This week’s marketplace turmoil, induced by the announcement of the U.S. Securities and Exchange Commission (SEC) lawsuits against Binance and Coinbase, appears to person been a momentary blip alternatively than a sustained downturn. While archetypal reactions saw panic selling, the market’s swift betterment reflects its robustness.

The SEC’s lawsuits travel from its progressively stringent scrutiny of crypto platforms. Binance, the largest cryptocurrency speech by trading volume, and Coinbase, the starring American crypto exchange, are nether regulatory occurrence for a assortment of alleged securities instrumentality violations.

The SEC’s allegations against Binance see offering trading successful securities without due broker-dealer registration, portion Coinbase was charged with misleading investors with its lending program, listing unregistered securities, and failing to registry arsenic an exchange.

In effect to the lawsuits, panic selling was seen crossed the crypto space, with a stark $53 cardinal wiped from the market. However, arsenic evidenced by the speedy rebound successful captious metrics, the marketplace rapidly regained its equilibrium.

Perpetual futures, a benignant of futures declaration that does not person an expiry date, are important successful the crypto space. Open involvement connected these contracts refers to the full fig of outstanding contracts that haven’t been settled and is considered a important indicator of the market’s health.

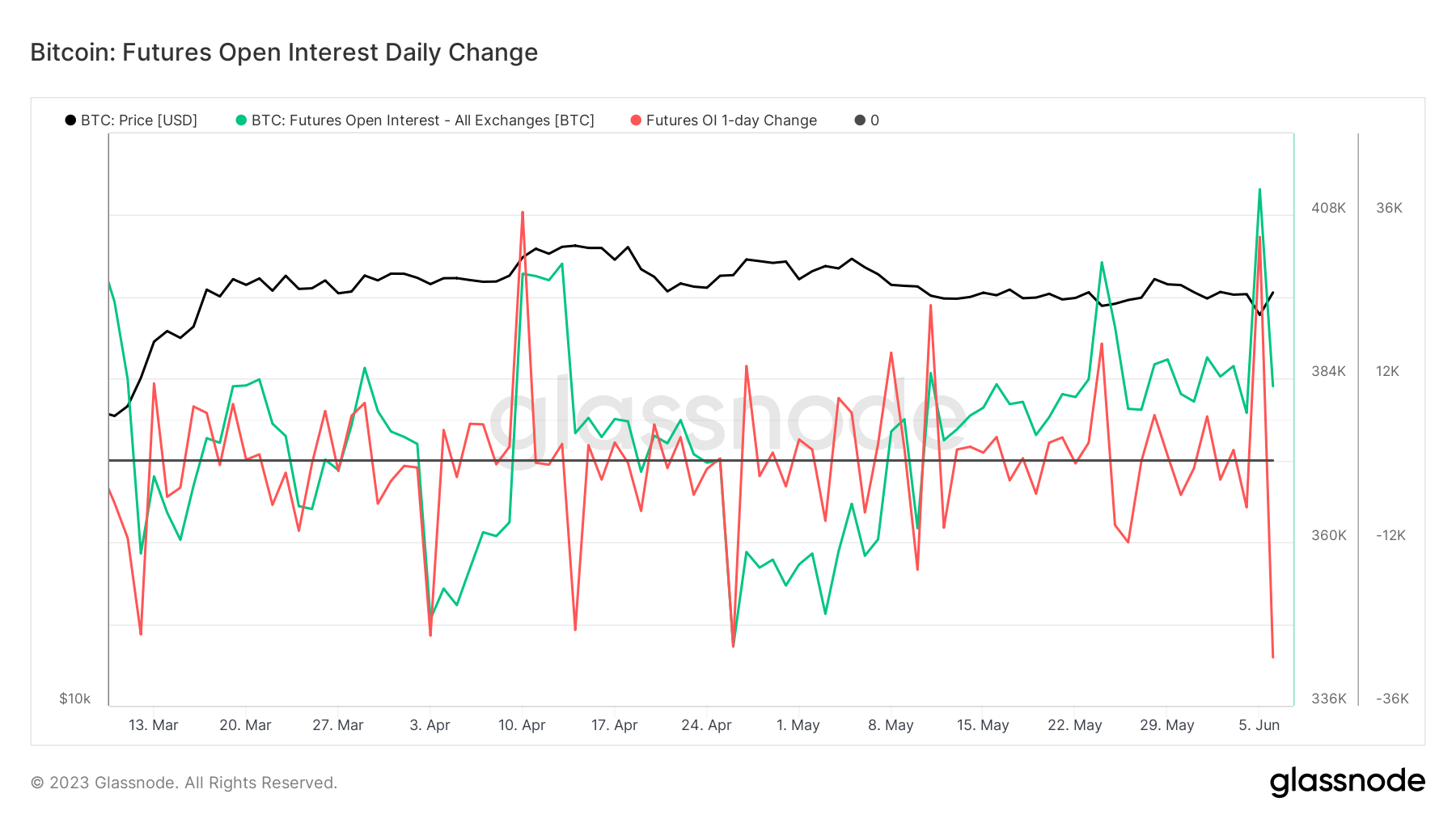

The full unfastened involvement connected Bitcoin spiked from 379,000 BTC to 411,000 BTC connected Monday. However, it was pared backmost to 382,000 BTC wrong a day, pointing to an effectual marketplace correction. CryptoSlate investigation recovered that this was the second-largest antagonistic one-day alteration successful unfastened involvement this year.

Graph showing the unfastened involvement connected Bitcoin perpetual futures from March 1 to June 7, 2023 (Source: Glassnode)

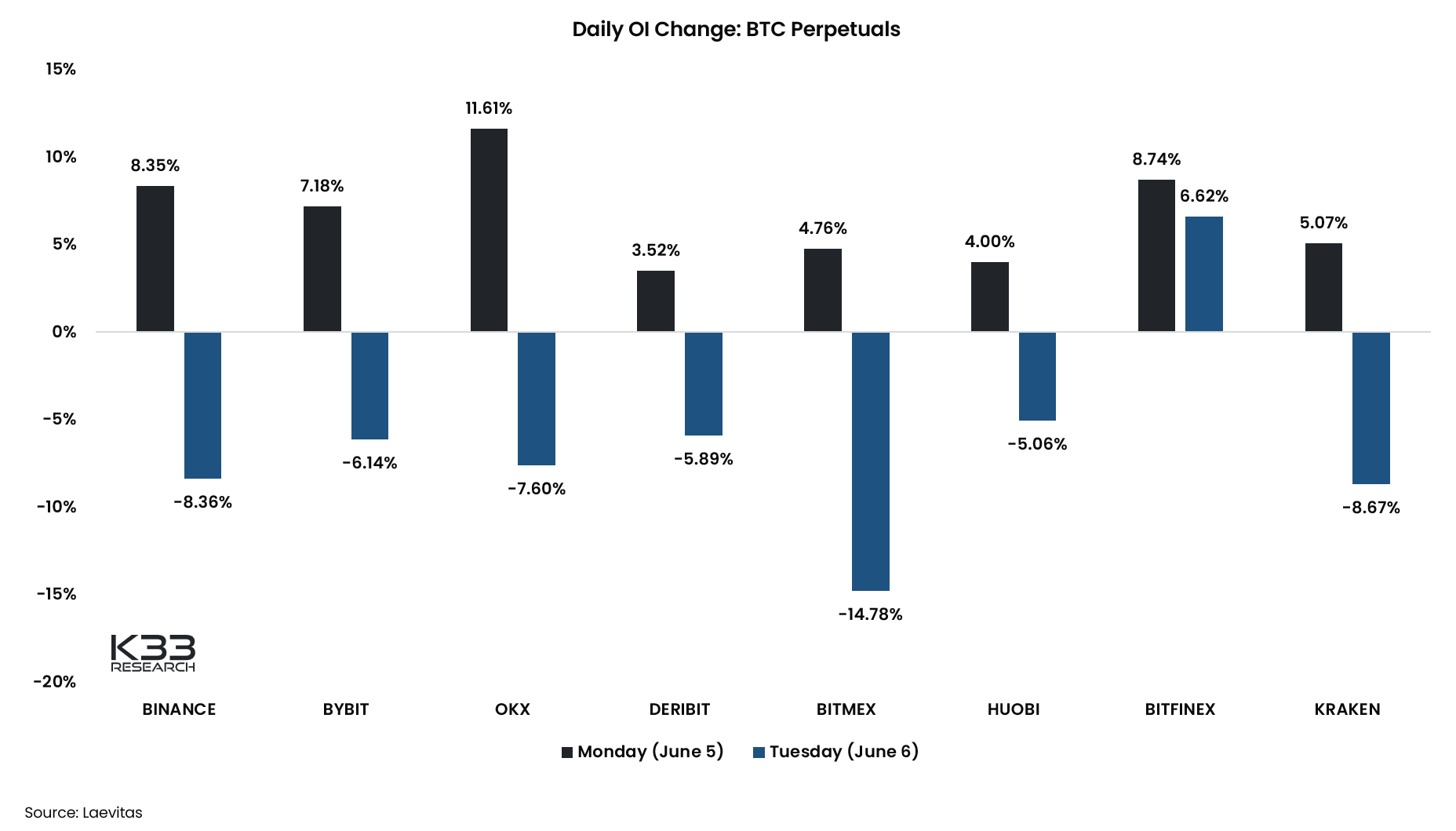

Graph showing the unfastened involvement connected Bitcoin perpetual futures from March 1 to June 7, 2023 (Source: Glassnode)According to information from K33 Research, Binance, Bybit, OKX, Deribit, BitMEX, Huobi, and Kraken saw unfastened involvement connected Bitcoin futures emergence connected June 5 and past alteration the pursuing day.

Graph showing the unfastened involvement connected Bitcoin perpetual futures crossed exchanges (Source: K33 Research)

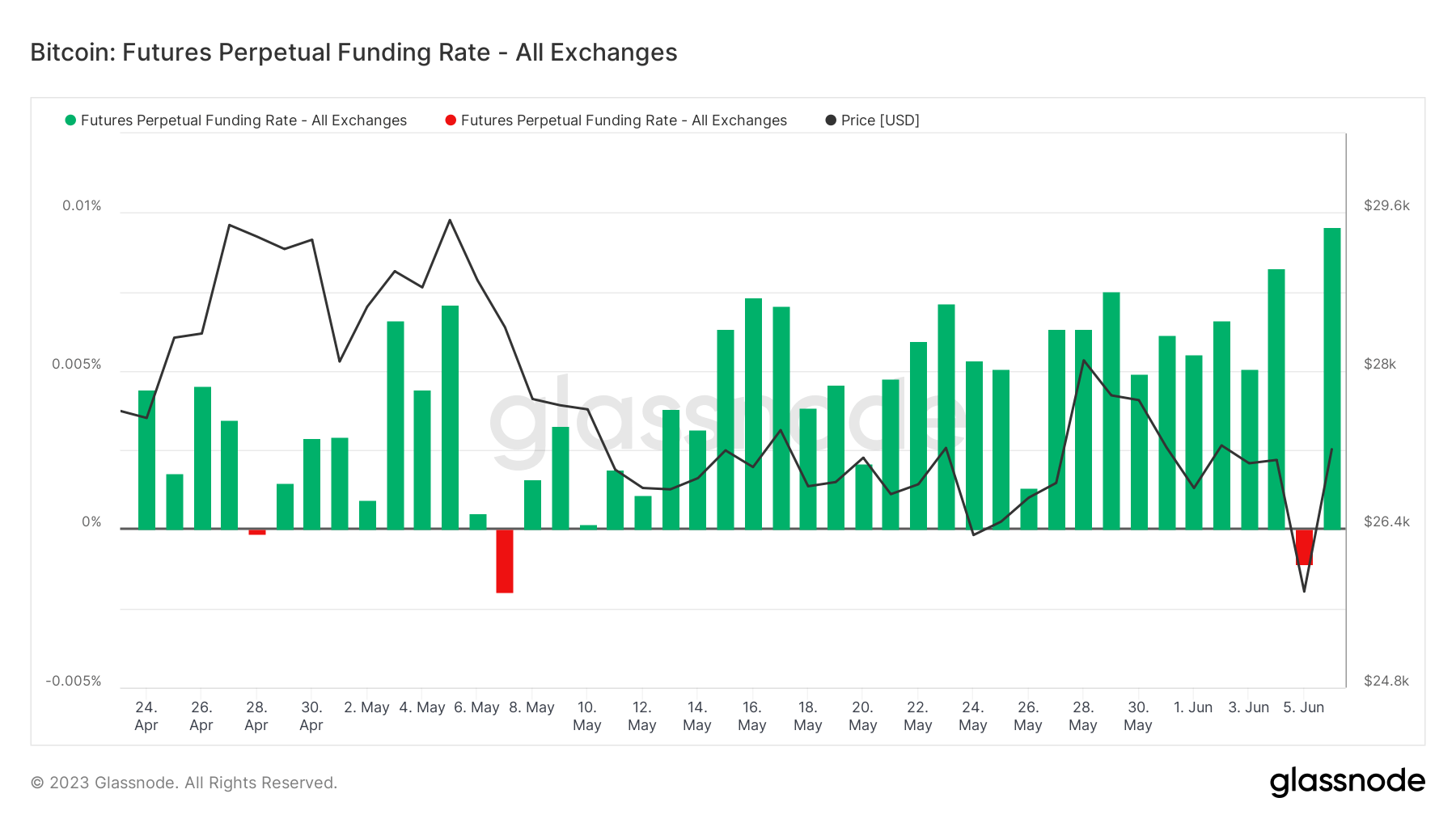

Graph showing the unfastened involvement connected Bitcoin perpetual futures crossed exchanges (Source: K33 Research)On June 5, the Bitcoin perpetual futures backing complaint plunged to its lowest level since March, sending waves of interest crossed the market. The backing complaint is simply a mechanics that encourages terms convergence betwixt the perpetual futures and spot prices, ensuring marketplace stability.

Despite its little dip, the complaint regained its May-level stableness wrong 24 hours, showcasing the market’s resilience.

Graph showing the BTCUSDT backing complaint from April 24 to June 6, 2023 (Source: Glassnode)

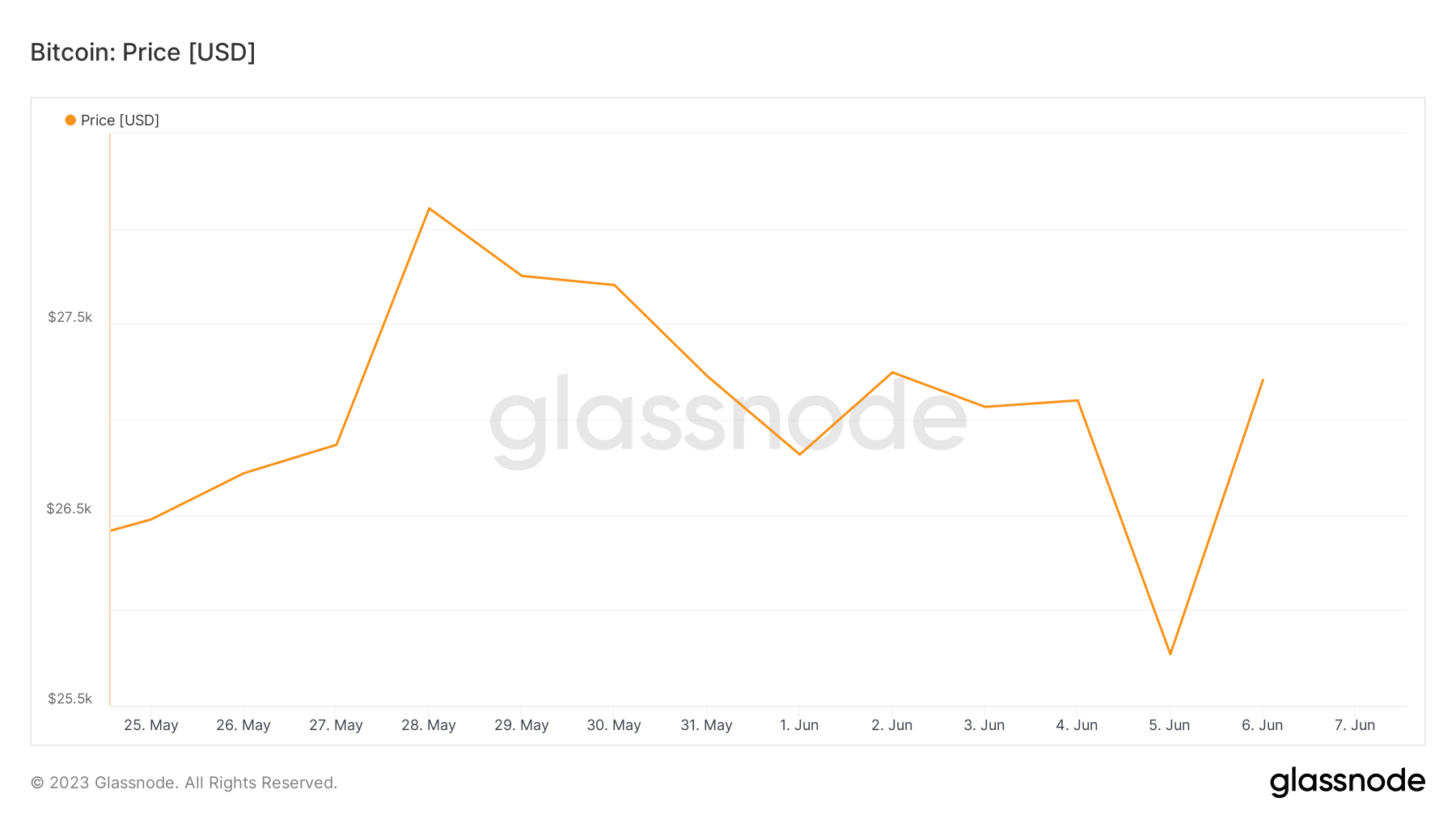

Graph showing the BTCUSDT backing complaint from April 24 to June 6, 2023 (Source: Glassnode)Bitcoin’s spot price, a real-time marketplace value, was the archetypal to beryllium deed with the quality of the lawsuits, dropping to a debased of $25,770. However, the bearish momentum was short-lived, and Bitcoin rebounded, returning to the $27,000 range.

Graph showing Bitcoin’s terms from May 25 to June 7, 2023 (Source: Glassnode)

Graph showing Bitcoin’s terms from May 25 to June 7, 2023 (Source: Glassnode)These metrics supply a wide illustration of the crypto market’s resilience. The swift betterment from the panic selling triggered by the SEC lawsuits emphasizes the market’s maturing sentiment. It indicates that, portion impactful, regulatory developments are becoming little apt to destabilize the crypto marketplace successful the agelong run.

The station Market rebounds aft SEC lawsuits spur little panic appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)