By Francisco Rodrigues (All times ET unless indicated otherwise)

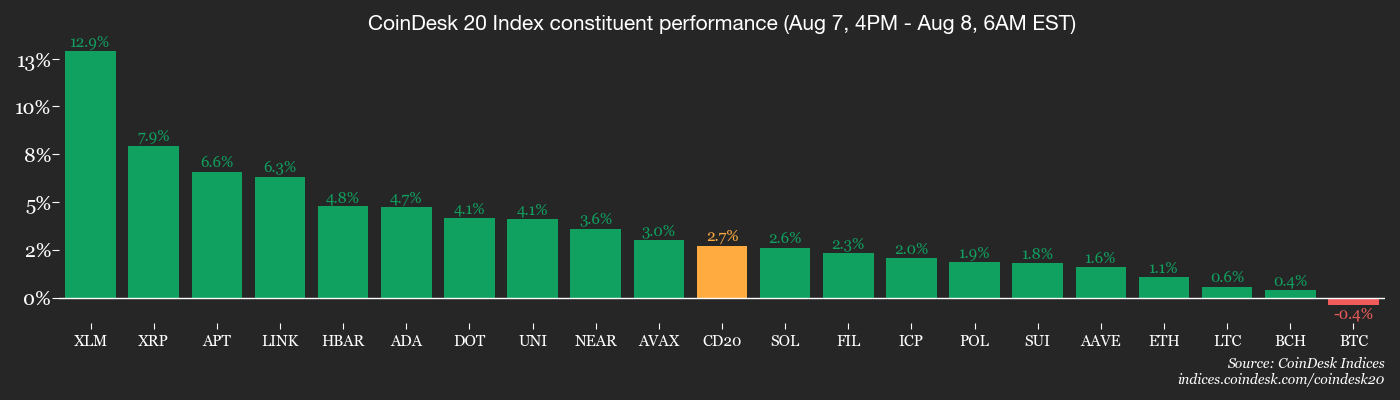

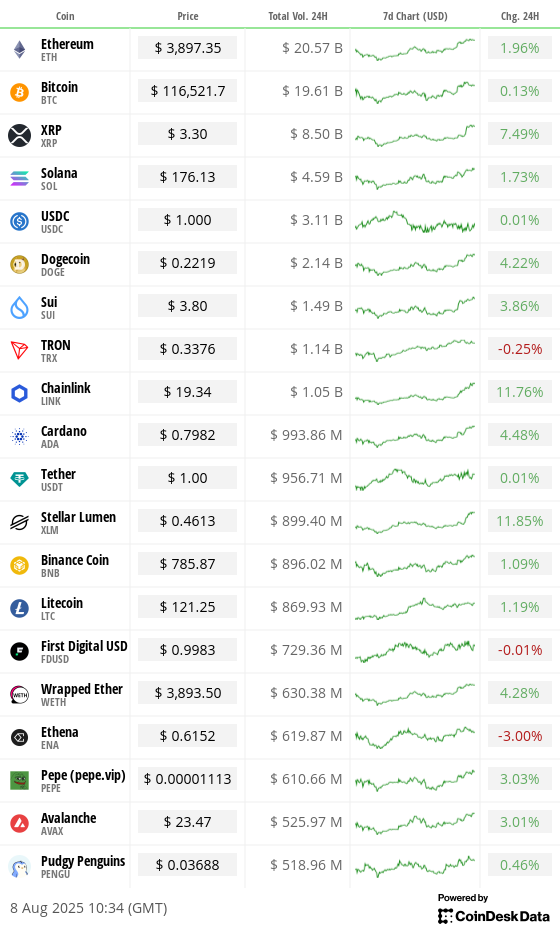

Crypto markets rallied successful the past 24 hours, with the CoinDesk 20 (CD20) scale rising 5.3% arsenic caller U.S. argumentation signals and regulatory clarity supported hazard appetite crossed the sector. Bitcoin (BTC) gained a comparatively muted 1.3% to $116,500.

The rally took disconnected aft President Donald Trump signed an enforcement bid opening 401(k) status plans to a broader scope of investments, including cryptocurrencies. The bid directs the Department of Labor and Securities and Exchange Commission to people caller guidance for status accounts.

“This determination efficaciously opens entree to bitcoin and different cryptocurrencies for status investors, unlocking a staggering $8.7 trillion successful assets nether management.,” James Butterfill, caput of probe astatine CoinShares, said successful an emailed statement.

Jake Ostrovskis, OTC trader astatine Wintermute, told CoinDesk that the interaction of the determination could not beryllium understated.

“Just a 2% allocation to Bitcoin and Ethereum would correspond 1.5x the full cumulative ETF inflows to date, portion a 3% allocation would much than treble the full market,” Ostrovskis said. “Critically, these would beryllium mostly price-insensitive buyers focused connected gathering allocation benchmarks alternatively than tactical trading.“

In practice, that means 401(k) funds would make “sustained, predictable request flows that could supply a structural bid for integer assets careless of short-term terms volatility,” Ostrovskis added.

While crypto has ne'er been formally banned from the status investments, erstwhile guidance powerfully discouraged fiduciaries from offering it.

Meanwhile, the Ethereum blockchain deed a caller grounds for mean regular transactions this week, according to information from Dune Analytics. The summation was underpinned by the SEC's clarification earlier this week that definite liquid staking models don’t represent securities nether the 1933 Securities Act, making it safer for institutions to connection staking services.

Ether's (ETH) terms surged 4.6% implicit the past 24 hours to adjacent $3,900.

While fireworks were going disconnected successful the crypto sector, TradFi was much subdued. The S&P 500 dropped successful Thursday’s session, and the Nasdaq closed 0.35% higher, furthering the attraction of megacaps successful the indexes. The 10 largest stocks present relationship for 76% of the full banal marketplace capitalization, information shared by Barchart shows.

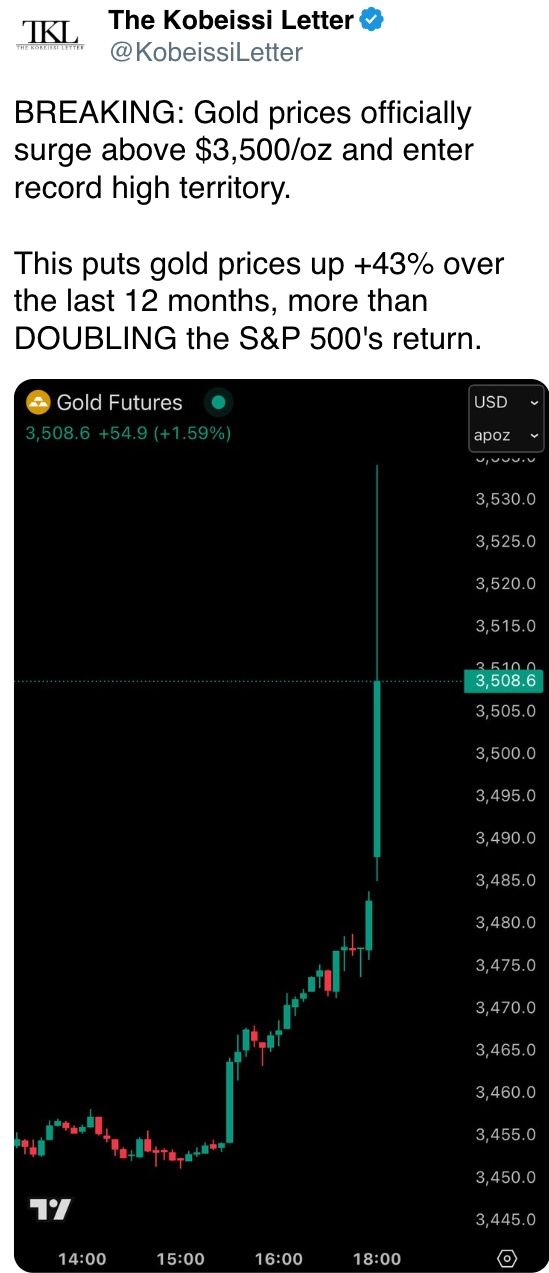

Gold roseate connected tariffs being imposed connected immoderate bullion bars. Looking ahead, investors are bracing for July’s ostentation report, owed adjacent week, which whitethorn power the likelihood of a dovish Fed interest-rate chopped successful September. Stay alert!

What to Watch

- Crypto

- Aug. 15: Record day for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who conscionable pre-distribution requirements.

- Aug. 18: Coinbase Derivatives volition launch nano SOL and nano XRP U.S. perpetual-style futures.

- Macro

- Aug. 8: Federal Reserve Governor Adriana D. Kugler's resignation becomes effective, creating an aboriginal vacancy connected the Board of Governors that allows President Trump to nominate a successor.

- Aug 8: President Trump’s deadline for Russia to perpetrate to a ceasefire and bid woody successful Ukraine, with intensified U.S. sanctions and secondary tariffs connected countries purchasing Russian vigor if the deadline is not met.

- Aug. 8: U.S. President Donald Trump hosts Armenian Prime Minister Nikol Pashinyan and Azerbaijani President Ilham Aliyev astatine the White House to motion a peace agreement. The U.S. volition besides motion bilateral economical agreements to beforehand commercialized and determination stability.

- Aug. 8, 7 p.m.: Colombia’s National Administrative Department of Statistics releases July user terms ostentation data..

- Inflation Rate MoM Est. 0.19% vs. Prev. 0.1%

- Inflation Rate YoY Est. 4.81% vs. Prev. 4.82%

- Aug. 12, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases July user terms ostentation data.

- Inflation Rate MoM Prev. 0.24%

- Inflation Rate YoY Prev. 5.35%

- Aug. 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases July user terms ostentation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

- Core Inflation Rate YoY Est. 3% vs. Prev. 2.9%

- Inflation Rate MoM Est. 0.2% vs. Prev. 0.3%

- Inflation Rate YoY Est. 2.8% vs. Prev. 2.7%

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- BendDAO is voting connected a plan to stabilize BEND by burning 50% of treasury tokens, restarting lender rewards, and launching monthly buybacks utilizing 20% of protocol revenue. Voting ends Aug. 10.

- 1inch DAO is voting connected a $1.88 cardinal assistance to money its information successful 9 planetary crypto events done precocious 2025. The connection aims to boost developer engagement, turn organization ties and grow adoption crossed ecosystems similar Ethereum and Solana. Voting ends Aug. 10.

- Aug. 8, 11:30 a.m.: Axie Infinity to host a municipality hall connected Discord.

- Unlocks

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating proviso worthy $12.66 million.

- Aug. 12: Aptos (APT) to unlock 1.73% of its circulating proviso worthy $52.59 million.

- Aug. 15: Avalanche (AVAX) to unlock 0.39% of its circulating proviso worthy $39.25 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating proviso worthy $16.19 million.

- Aug. 15: Sei (SEI) to unlock 0.96% of its circulating proviso worthy $17.21 million

- Aug. 16: Arbitrum (ARB) to unlock 1.8% of its circulating proviso worthy $39.21 million.

- Aug. 18: Fasttoken (FTN) to unlock 4.64% of its circulating proviso worthy $91.6 million.

- Token Launches

- Aug. 8: Pudgy Penguins (PENGU) to beryllium listed connected Arkham Exchange.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done Aug. 31.

- Day 3 of 5: Rare EVO (Las Vegas)

- Day 2 of 2: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

- Aug. 11: Paraguay Blockchain Summit 2025 (Asuncion)

- Aug. 11-13: AIBB 2025 (Istanbul)

- Aug. 11-17: Ethereum NYC (New York)

- Aug. 13-14: CryptoWinter ‘25 (Queenstown, New Zealand)

Token Talk

By Shaurya Malwa

- Ethereum’s seven-day mean regular transactions deed a grounds 1.74 cardinal arsenic staked ETH levels climbed to an all-time high.

- Over 36 cardinal ETH, astir 30% of full supply, is present locked successful staking contracts, according to Dune Analytics.

- The summation followed the SEC’s clarification that definite liquid staking activities and staking receipt tokens aren’t securities nether the 1933 Act if they conscionable strict assumptions.

- The ruling reduced ineligible overhang, opening the doorway for greater organization participation.

- The inclination is besides backed by yield-seeking holders and increasing treasury allocations from publically listed firms, tightening liquid supply.

- Public companies present power $11.77 cardinal successful ETH, led by BitMine Immersion Technologies ($3.2 billion), SharpLink Gaming ($2 billion), and The Ether Machine ($1.3 billion).

- Vitalik Buterin said treasuries are “good and valuable” for Ethereum but warned that excessive leverage could spark cascading liquidations.

- ETH has rallied 163% from April lows with much than 500,000 ETH ($1.8 billion) staked successful the archetypal fractional of June unsocial — a gait CryptoQuant’s Onchainschool said reflects “rising assurance and a continued driblet successful liquid supply.”

Derivatives Positioning

- Total BTC futures unfastened involvement sits astatine $80.65 billion, level connected the time aft a mild pullback earlier this week.

- CME remains ascendant with a 20% share, underscoring dependable organization exposure. Binance and OKX flows were mixed, with OKX OI up 3.95% successful the past 24 hours contempt heavier intraday swings.

- ETH liquidations led the marketplace implicit the past 24 hours astatine $188.7 million, dwarfing BTC’s $52.6 cardinal and XRP’s $29 million.

- The largest liquidation was a $34.28 cardinal ETH-USDT agelong presumption connected HTX, reflecting concentrated leverage successful ETH perps up of terms swings.

- Liquidation information skews heavy to the abbreviated side, with $319 cardinal successful shorts wiped versus $91 cardinal successful longs, suggesting that the caller upside caught positioning disconnected defender and whitethorn person forced momentum-driven covering crossed majors.

- BTC unfastened involvement organisation shows CME’s ground holding steadfast astatine 2.61%, suggesting sustained transportation request from TradFi desks, portion Binance’s ground is muted astatine 0.61%, indicating little assertive directional leverage from offshore traders.

- ETH backing rates stay elevated astatine oregon adjacent exchange-imposed caps, signaling persistent agelong bias contempt the dense wipeout of shorts. This operation — precocious backing positive caller OI — suggests traders are rotating backmost into directional plays alternatively than afloat deleveraging.

Market Movements

- BTC is down 0.43% from 4 p.m. ET Thursday astatine $116,701.75 (24hrs: +0.22%)

- ETH is up 0.68% astatine $3,900.02 (24hrs: +2.08%)

- CoinDesk 20 is up 2.2% astatine 4,046.33 (24hrs: +3.94%)

- Ether CESR Composite Staking Rate is unchanged astatine 2.9%

- BTC backing complaint is astatine 0.004% (4.4052% annualized) connected Binance

- DXY is down 0.16% astatine 98.24

- Gold futures are up 1.12% astatine $3,492.50

- Silver futures are up 0.80% astatine $38.60

- Nikkei 225 closed up 1.85% astatine 41,820.48

- Hang Seng closed down 0.89% astatine 24,858.82

- FTSE is unchanged astatine 9,095.08

- Euro Stoxx 50 is up 0.13% astatine 5,339.07

- DJIA closed connected Thursday down 0.51% astatine 43,968.64

- S&P 500 closed unchanged astatine 6,340.00

- Nasdaq Composite closed up 0.35% astatine 21,242.70

- S&P/TSX Composite closed down 0.57% astatine 27,761.27

- S&P 40 Latin America closed up 2.03% astatine 2,666.61

- U.S. 10-Year Treasury complaint is up 0.6 bps astatine 4.25%

- E-mini S&P 500 futures are up 0.26% astatine 6,383.25

- E-mini Nasdaq-100 futures are up 0.28% astatine 23,562.75

- E-mini Dow Jones Industrial Average Index are up 0.17% astatine 44,155.00

Bitcoin Stats

- BTC Dominance: 60.82% (-0.31%)

- Ether to bitcoin ratio: 0.03343 (0.42%)

- Hashrate (seven-day moving average): 966 EH/s

- Hashprice (spot): $57.95

- Total Fees: 5.2 BTC / $602,389

- CME Futures Open Interest: 137,710 BTC

- BTC priced successful gold: 34.4 oz

- BTC vs golden marketplace cap: 9.73%

Technical Analysis

- The ETH/SOL ratio is investigating a cardinal play absorption (~22.4); a confirmed breakout could trigger beardown continuation with ether rising toward the 34-36 SOL range.

- RSI shows beardown momentum (70+) with nary bearish divergence, supporting the breakout potential.

- Unless rejected, the setup favors ETH outperformance vs. SOL connected confirmation.

Crypto Equities

- Strategy (MSTR): closed connected Thursday astatine $402.01 (+4.85%), -0.25% astatine $401 successful pre-market

- Coinbase Global (COIN): closed astatine $310.79 (+2.38%), +0.86% astatine $313.45

- Circle (CRCL): closed astatine $152.93 (-5.43%), +1.12% astatine $154.64

- Galaxy Digital (GLXY): closed astatine $28.09 (+2.74%), +1.35% astatine $28.47

- MARA Holdings (MARA): closed astatine $15.95 (+0.38%), -0.13% astatine $15.93

- Riot Platforms (RIOT): closed astatine $11.58 (-0.69%), +0.35% astatine $11.62

- Core Scientific (CORZ): closed astatine $14.35 (+1.7%), +0.84% astatine $14.47

- CleanSpark (CLSK): closed astatine $10.72 (-2.55%), unchanged successful pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $25.37 (-1.4%)

- Semler Scientific (SMLR): closed astatine $37.54 (+5.27%), unchanged successful pre-market

- Exodus Movement (EXOD): closed astatine $31.34 (+6.74%)

- SharpLink Gaming (SBET): closed astatine $23.36 (+5.51%), +2.57% astatine $23.96

ETF Flows

Spot BTC ETFs

- Daily nett flows: $277.4 million

- Cumulative nett flows: $54 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: $222.3 million

- Cumulative nett flows: $9.37 billion

- Total ETH holdings ~5.6 million

Source: Farside Investors

Overnight Flows

Chart of the Day

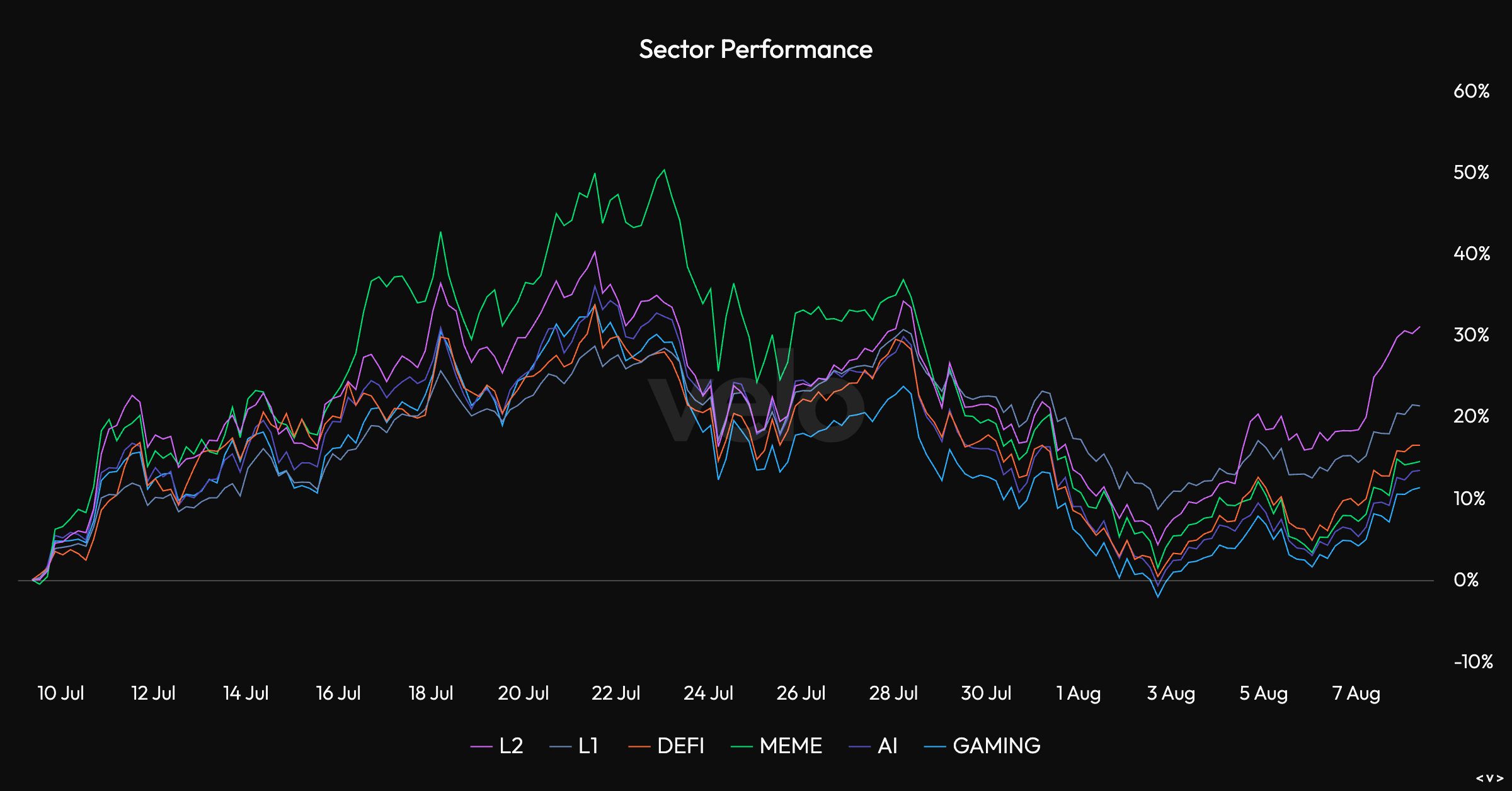

- The memecoin sector's outperformance of the wider cryptocurrency marketplace was short-lived, showing that portion its heightened volatility could contiguous opportunities, marketplace timing is critical.

- Meanwhile, layer-2 tokens person outperformed successful the past month, arsenic Velo information shows.

- The worst-performing assemblage passim the play were gaming-related tokens, which consistently underperformed.

While You Were Sleeping

- Ethereum Transactions Hit Record High arsenic Staking, SEC Clarity Fuel ETH Rally (CoinDesk): The SEC’s softer stance connected liquid staking is spurring organization ETH accumulation, with astir 30% of proviso present locked successful staking contracts and firm treasuries holding much than $11 cardinal worthy of ether.

- Crypto’s $25 Billion Spree Sparks Unease Even Among Insiders (Bloomberg): Several money managers warned that if altcoin-focused treasury firms’ valuations autumn beneath their crypto holdings’ value, forced selling could follow, deepening losses and perchance ending the existent crypto bull cycle.

- XRP Surges 12% arsenic Traders Bet connected Big Price Swings with 'Straddle' Strategy (CoinDesk): Traders are placing ample Deribit agelong straddles — buying calls and puts with identical strikes and expiries, risking lone the premiums paid for perchance unlimited upside oregon sizable gains if prices plunge.

- Binance Teams Up With BBVA to Let Customers Keep Assets Off Exchange (Financial Times): After a monolithic U.S. fine, Binance is giving traders the enactment of storing collateral successful U.S. Treasuries astatine BBVA, highlighting accepted banks’ deeper propulsion into crypto markets.

- Israeli Security Cabinet Approves Gaza Control Plan (The Wall Street Journal): Prime Minister Benjamin Netanyahu’s connection — seizing each of Gaza, past handing it to Arab conjugation forces for day-to-day governance portion keeping an Israeli-controlled perimeter — is drafting wide home and planetary pushback.

- Trump Tariffs connected Russia’s Oil Buyers Bring Economic, Political Risks (Reuters): The U.S. president’s secondary tariffs, starting with India, could hazard raising substance prices, straining relations with China and India and hurting Republicans’ midterm predetermination prospects with perchance nary gain.

In the Ether

2 weeks ago

2 weeks ago

English (US)

English (US)