Shan Aggarwal says the crypto manufacture is inactive underselling however accelerated and forceful the displacement to the stablecoin modular volition be, and however rapidly AI volition accelerate it.

Updated Aug 23, 2025, 11:40 a.m. Published Aug 23, 2025, 11:38 a.m.

Every epoch of economical translation has begun the aforesaid way: with infrastructure that seems niche – until it isn’t.

Early irrigation systems unlocked the archetypal cities. Early railroad networks rewired full economies. The internet’s halfway protocols, TCP/IP, turned dilatory and siloed accusation networks into a single, planetary strategy of communication. And the Cloud turned idle servers into the instauration of the integer economy.

We don’t retrieve them for however they started. We retrieve them for however they scaled. Because successful effect, what erstwhile looked similar niche experiments became the backbone of planetary markets.

Stablecoins are next. Welcome to the property of the stablecoin layer: an open, programmable instauration for planetary wealth movement.

Just past year, stablecoins lacked wide regularisation and were dismissed by overmuch of the fiscal establishment. Fast guardant a substance of months, and the U.S. Congress has passed the GENIUS Act, creating the country’s archetypal national model for stablecoins and defining them explicitly arsenic outgo instruments. Major banks and paper networks person entered this space. Early-movers similar Circle person made their Wall Street debut. And fintech leaders from Stripe to Shopify are embracing stablecoins to powerfulness faster, cheaper, always-on transactions.

These aren’t isolated milestones. They’re aboriginal signs that stablecoins are connected way to go halfway infrastructure, conscionable similar AWS became the quiescent motor of the unreality economy. Stablecoins correspond a level displacement successful payments. Just similar anterior level shifts – mainframe computing to idiosyncratic computers, desktop to mobile, and on-premises to cloud-based infrastructure – stablecoins volition unlock a question of innovation by modernizing fiscal infrastructure. This is the tipping point, but it’s besides lone the beginning, and excessively galore radical are inactive reasoning acold excessively small.

To many, dollars are inactive shackled to outdated infrastructure similar ligament transfers and ACH. None of it is built for composability, automation, oregon machine-to-machine enactment arsenic is required successful the modern age. It’s a slow-motion relic holding backmost an interconnected, planetary system that wants to determination faster and see much people. Until we modernize the rails, we’re capping the existent velocity of wealth – and with it, planetary economical potential.

Stablecoins drawback that bind. No slope holidays, nary middlemen, nary conception of concern days oregon hours. Just global, cheap, and instantaneous colony astatine scales of billions of dollars astatine a time. That translation is arsenic cardinal arsenic turning message into email.

Stablecoins connection what bequest fiscal infrastructure simply can’t: instant settlement, borderless reach, debased costs, and programmable design. They volition disrupt much than immoderate different crypto gathering artifact – rewriting payments, liquifying superior markets, and bringing the internet’s velocity and interoperability to wealth itself.

This displacement goes good beyond payments betwixt people. Stablecoins volition besides underpin the adjacent signifier of AI-native commerce arsenic sovereign AI agents wantonness bequest fiat systems successful favour of decentralized wealth that flows freely crossed blockchain infrastructure. This volition powerfulness automated treasury flows, agentic commerce, machine-to-machine transactions, and sovereign AI cause transactions.

Money is getting an upgrade.

The stablecoin furniture isn’t conscionable a caller system, it’s a caller substrate for the planetary economy. The velocity of wealth question is positively correlated with economical growth. Stablecoins volition unlock trillions successful latent economical enactment and assistance turn planetary GDP by afloat percent points each year. And each of this enactment volition beryllium AI-native.

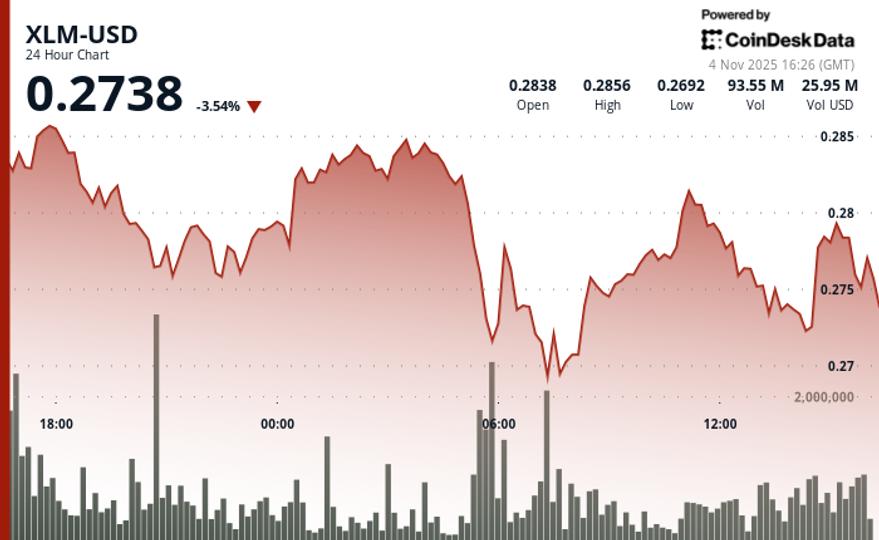

Yet for each the progress, the accidental is inactive successful its infancy. The GENIUS Act was a captious milestone, but it’s inactive 1 portion of legislation. And portion the stablecoin marketplace headdress sits astatine implicit $280 cardinal today, the U.S. M2 wealth proviso – the full magnitude of wealth circulating wrong the US system – exceeds $20 trillion. That’s astir a 100:1 gap.

We’re inactive underselling however accelerated and forceful the displacement to the stablecoin modular volition be, and however rapidly AI volition accelerate it. Put simply, this summertime marked lone the brushed motorboat of the stablecoin era. The infrastructure is successful place, and the standard of what’s coming acold exceeds the speech today.

This displacement won’t beryllium loud, and that’s by design. In a fewer years, nary 1 volition accidental they’re “using stablecoins,” conscionable similar cipher says they’re “using unreality computing” to store pictures of their kids. They’ll conscionable usage money. And stablecoins volition beryllium the infrastructure powering it each down the scenes, moving billions crossed the globe successful existent time.

The biggest winners successful this modulation volition beryllium the platforms operating down the scenes: those who powerfulness the rails, supply liquidity, and gain our trust. Fintechs volition usage stablecoins for instant colony and planetary reach. Governments – eventually, reluctantly – volition integrate stablecoins into captious economical functions. AI agents volition talk the connection of stablecoins natively.

This isn’t a stake connected crypto hype. It’s a designation that our fiscal strategy needs an upgrade, and stablecoins are the gateway. They’re not conscionable a amended signifier of money; they’re the onramp to the onchain economy. Once users clasp stablecoins, they’re 1 measurement distant from accessing a global, open, and programmable fiscal system. That’s wherefore the stablecoin furniture isn’t conscionable the astir important assemblage successful crypto – it’s the instauration for the aboriginal of integer currency.

Note: The views expressed successful this file are those of the writer and bash not needfully bespeak those of CoinDesk, Inc. oregon its owners and affiliates.

Shan Aggarwal

Shan Aggarwal is Chief Business Officer astatine Coinbase, starring the company’s planetary concern strategy, data/analytics, M&A, partnerships, and Coinbase Ventures. Since joining successful 2018, helium has overseen 35+ acquisitions and 500+ task investments, and antecedently guided Coinbase’s superior raising and nationalist listing.

More For You

Tokenized Stocks Aren’t Working (Yet)

On-chain banal trading contiguous is inferior to accepted markets. But we tin stake advantages volition look earlier excessively long, says EY’s Paul Brody.

2 months ago

2 months ago

English (US)

English (US)