Bitcoin (BTC) and the broader crypto marketplace are witnessing beardown request for bullish leveraged plays, a motion the marketplace is overheated. While marketplace makers' hedging is apt to support BTC supported astatine astir $100,000, the heightened enactment raises the hazard of pullbacks for different cryptocurrencies.

Bitcoin, the starring cryptocurrency by marketplace value, tapped a grounds precocious supra $103,000 aboriginal Thursday, pursuing President-elect Donald Trump's determination to name pro-crypto Paul Atkins arsenic president for the Securities and Exchange Commission (SEC).

The breakout sent traders chasing the terms rally, pushing backing rates for perpetual futures skywards, a motion of increasing request for and overcrowding successful agelong positions. In this scenario, a flimsy pullback tin effect successful ample liquidations (forced selling by exchanges owed to borderline shortages) and accrued downside volatility.

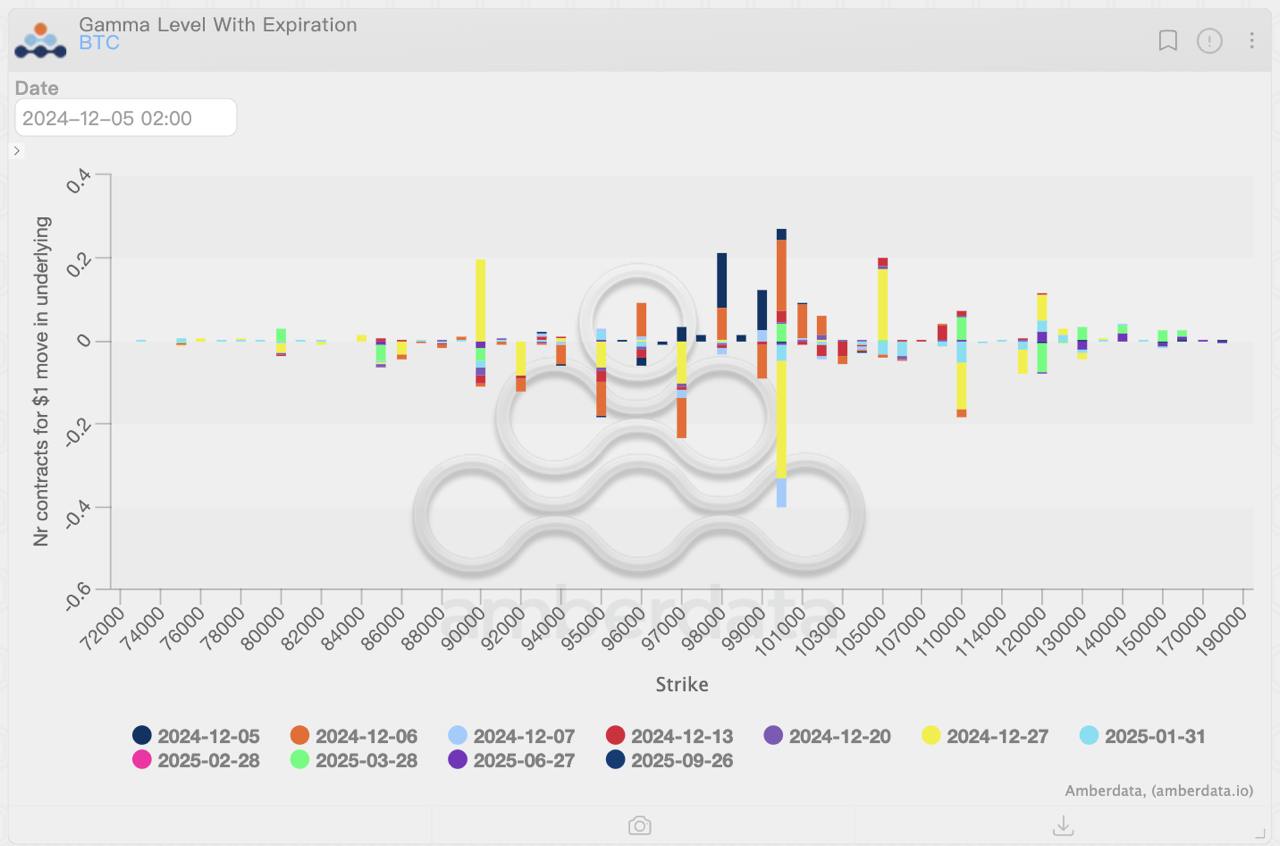

Support whitethorn travel from the options market, according to Griffin Ardern, caput of options trading and probe astatine crypto fiscal level BloFin. When options prices emergence faster than that of the underlying plus — that is, erstwhile the alleged gamma imbalance is affirmative — marketplace makers thin to merchantability their holdings to support their nett vulnerability neutral. They bargain erstwhile it's negative, acting arsenic a contrarian unit and limiting terms swings.

"BTC tin beryllium unchangeable astatine astir $100,000 successful the short-term, helped by the hedging enactment of marketplace makers," Ardern told CoinDesk. "This enactment from the options marketplace whitethorn offset the interaction of deleveraging to a definite extent."

The annualized backing complaint for bitcoin surged to astir 100%, surpassing rates for purely speculative tokens similar DOGE, information from VeloData show. Other coins, specified arsenic XRP, CRO and XMR, besides boast backing rates successful excess of 100%.

"That EOD [volume weighted mean price] suggests Saylor blew different fewer billion, and the [BTC] backing rates marque maine deliberation this last determination was purely lever-driven," said Felix Hartmann, laminitis and managing spouse of Hartmann Capital, referring to Michael Saylor, enforcement president of MicroStrategy, the largest publically traded holder of bitcoin. "Wouldn’t beryllium shocked astatine a bully aged 20-30% bull marketplace correction here. 80s are just game."

Hartmann stressed the request for further request implicit and supra MSTR's purchases to support the bull tally going, a presumption echoed by respective observers connected societal media. They suggested that either the marketplace continues to rally, justifying the costs associated with holding bullish bets, oregon turns little successful a crisp correction.

Even with marketplace makers' activity, bitcoin terms volatility could instrumentality toward the extremity of the year.

"The positive gamma astatine $105,000 successful options expiring connected Dec. 27 could bring capable gravity, but aft the expiry, it volition disappear, boosting terms uncertainty," Ardern told CoinDesk.

Options are derivative contracts, offering the purchaser the close but not the work to bargain oregon merchantability the underlying plus astatine a preset terms astatine a aboriginal date. A telephone oregon a bullish stake gives the close to buy, portion a enactment confers the close to sell.

11 months ago

11 months ago

English (US)

English (US)