MakerDAO, the governance token down the 5th astir fashionable stablecoin DAI, is contemplating an increase successful its United States Treasury enslaved investments to $1.25 cardinal from its erstwhile allocation of $500 million.

According to a connection released March 6, the determination would let MakerDAO to capitalize connected the existent output environment.

Under the caller plan, the existing $500 cardinal allocation – consisting of $400 cardinal successful Treasury bonds and $100 cardinal successful firm bonds – would importantly summation by $750 million.

MakerDAO intends to execute this by implementing a six-month U.S. Treasury ladder strategy, which would impact bi-weekly roll-overs.

The latest connection comes connected the heels of respective high-profile moves by MakerDAO, including a caller initiative that would licence MKR token holders to get DAI.

MakerDAO is reviewing a connection to widen its existing US treasury enslaved investments from $500 cardinal to $1.25 billion. pic.twitter.com/DZj72oTJvP

— Maker (@MakerDAO) March 7, 2023

In June 2022, MakerDAO made announcement of a $500 cardinal allocation to Treasury funds. This time, the rationale down the determination has been explicitly stated arsenic follows:

“ [to] instrumentality vantage of the existent output environment, and make further gross connected Maker’s PSM Assets, successful a flexible, liquid, mode that tin accommodate worldly adjustments and upgrades arsenic whitethorn beryllium required nether prevailing, applicable Maker RWA related policies.”

MakerDAO movements

In different news, MakerDAO — 44% of which is controlled by lone 3 wallets – precocious voted against a $100 cardinal borrowing connection by Cogent Bank, with 73% rejecting the bid.

Interestingly, MakerDAO antecedently approved a akin indebtedness to Huntingdon Valley Bank, suggesting a willingness to enactment with much accepted fiscal institutions connected the portion of the DAI governance token.

The stablecoin marketplace has besides seen a roar successful the aftermath of the FTX collapse. After FTX filed for bankruptcy connected November 11th, the stablecoin sector’s dominance successful the wide cryptocurrency marketplace capitalization rose to 18%, reaching an all-time high, a inclination that has continued.

Meanwhile, past month, MakerDAO allocated 5 cardinal DAI to found a ineligible defence money that would code ineligible defence matters not typically covered by accepted security policies, and besides introduced Spark Protocol, an Aave rival that volition utilize DAI for liquidity and motorboat a lending merchandise arsenic its archetypal service.

Additionally, it initiated conversations regarding a connection that would let DAI to get from MKR tokens, a determination that has prompted immoderate to wonderment whether this borders excessively overmuch into the aforesaid risky behaviour that led to the illness of UST, the stablecoin backed by Terra Luna.

Critics of Maker’s ‘Endgame’ tokenomics reason that it appears excessively akin to Terra’s Seigniorage Mechanism, a process that entails producing and eliminating tokens successful accordance with marketplace demand.

However, opponents of the program instantly criticized this mechanism, branding it a probable liquidity exit scam that permits users to depart from the ecosystem done DAI without disposing of their MKR tokens but inactive maintaining power implicit the protocol’s governance.

Hmm looks a batch similar backing $UST with its governance token $LUNA.

Did @stablekwon secretly infiltrate @MakerDAO? https://t.co/3u6NzOMkPK

— Arthur Hayes (@CryptoHayes) February 24, 2023

Maker doubles down connected move

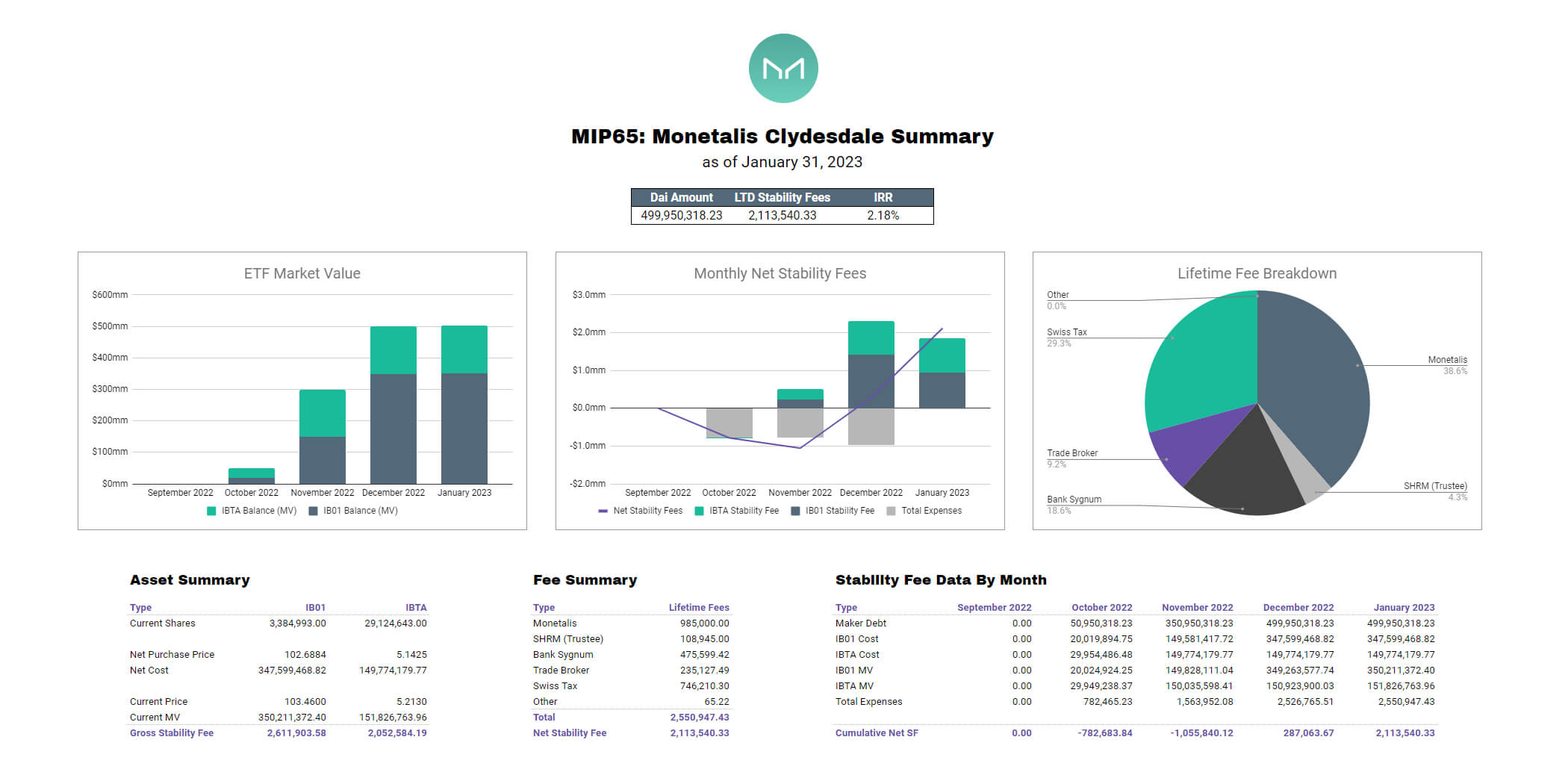

In a tweet, MakerDAO said that by the extremity of January 2023, “MIP65’s $500 cardinal short-term enslaved concern strategy has provided ~$2.1 cardinal successful beingness fees to MakerDAO.”

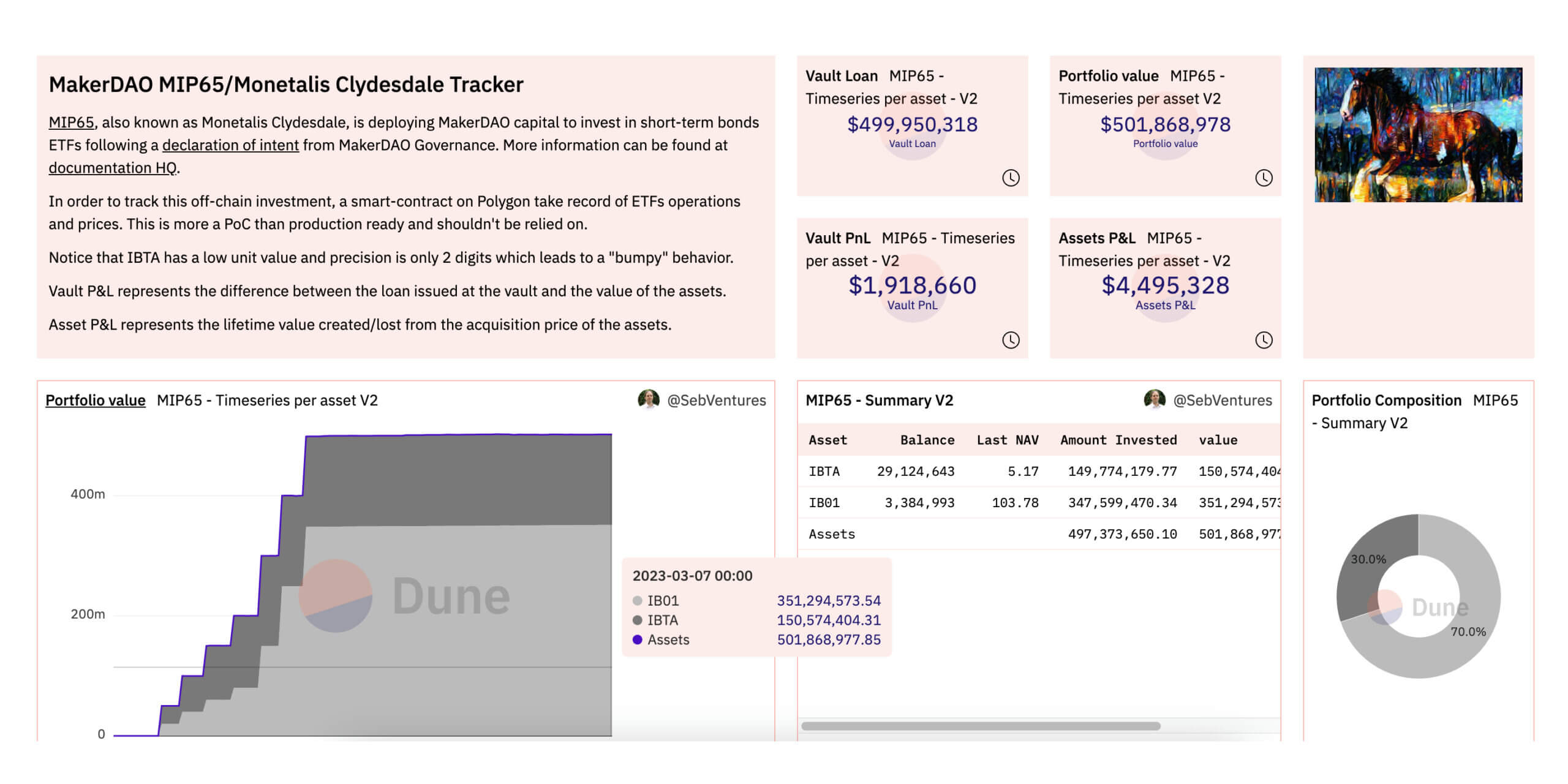

(Source: Dune Analytics)

(Source: Dune Analytics)This concern strategy presently represents much than 50% of MakerDAO’s annualized revenues, the Dao added.

As of today, MIP65’s existent portfolio is composed of:

• ~$351.4 cardinal of IB01: iShares $ Treasury Bond 0-1 yr UCITS ETF

• ~$150.6 cardinal of IBTA: iShares $ Treasury Bond 1-3 yr UCITS ETF

(Source: Dune Analytics)

(Source: Dune Analytics)

The station MakerDAO faces disapproval implicit tokenomics program amidst high-stakes US treasury concern strategy appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)