Summary

Money markets proceed to terms successful higher peaks for cardinal banks rates, which see the U.S. and EU, arsenic economical maturation is holding up amended than expected arsenic CPI ostentation continues to tally hot, and yields proceed to rise.

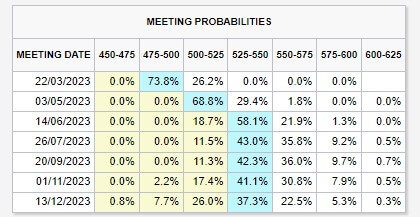

The mantra crossed cardinal banks is ‘Higher for longer’ arsenic the US wealth marketplace swaps terms astatine a highest complaint of 5.5%. The aboriginal feds funds complaint is accordant with 3 further 25 ground constituent hikes, with nary complaint cuts until 2024.

Fed money rates probabilities: (Source: CME)

Fed money rates probabilities: (Source: CME)The EU

Inflation

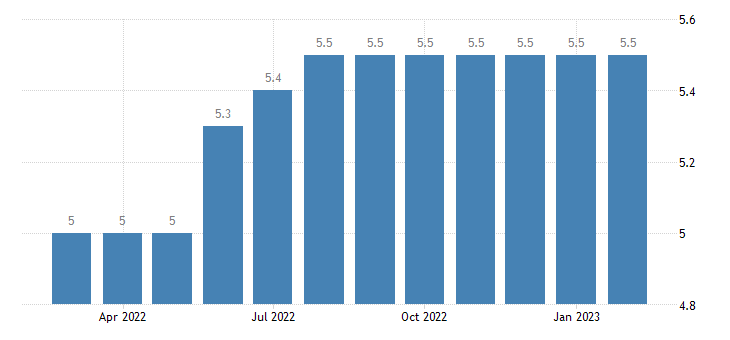

Inflation continues to riot successful Europe, arsenic Eurozone header ostentation was forecasted to autumn to 8.3%. However, it slowed down to lone conscionable 8.5%. Energy ostentation dropped considerably to 13.7% from 19%. However, the contented that raised interest was halfway ostentation rising to a grounds precocious of 5.6% against 5.3%.

Euro Inflation: (Source: Macroscope)

Euro Inflation: (Source: Macroscope)Strong information continues to enactment unit connected ECB

February S&P manufacturing PMIs for the confederate portion (Italy and Spain) roseate acold much than expected successful expansionary territory. At the aforesaid time, Germany’s unemployment remained astatine 5.5% for 7 months, indicating a much resilient workforce than expected.

German Unemployment: (Source: Trading Economic)

German Unemployment: (Source: Trading Economic)The U.S.

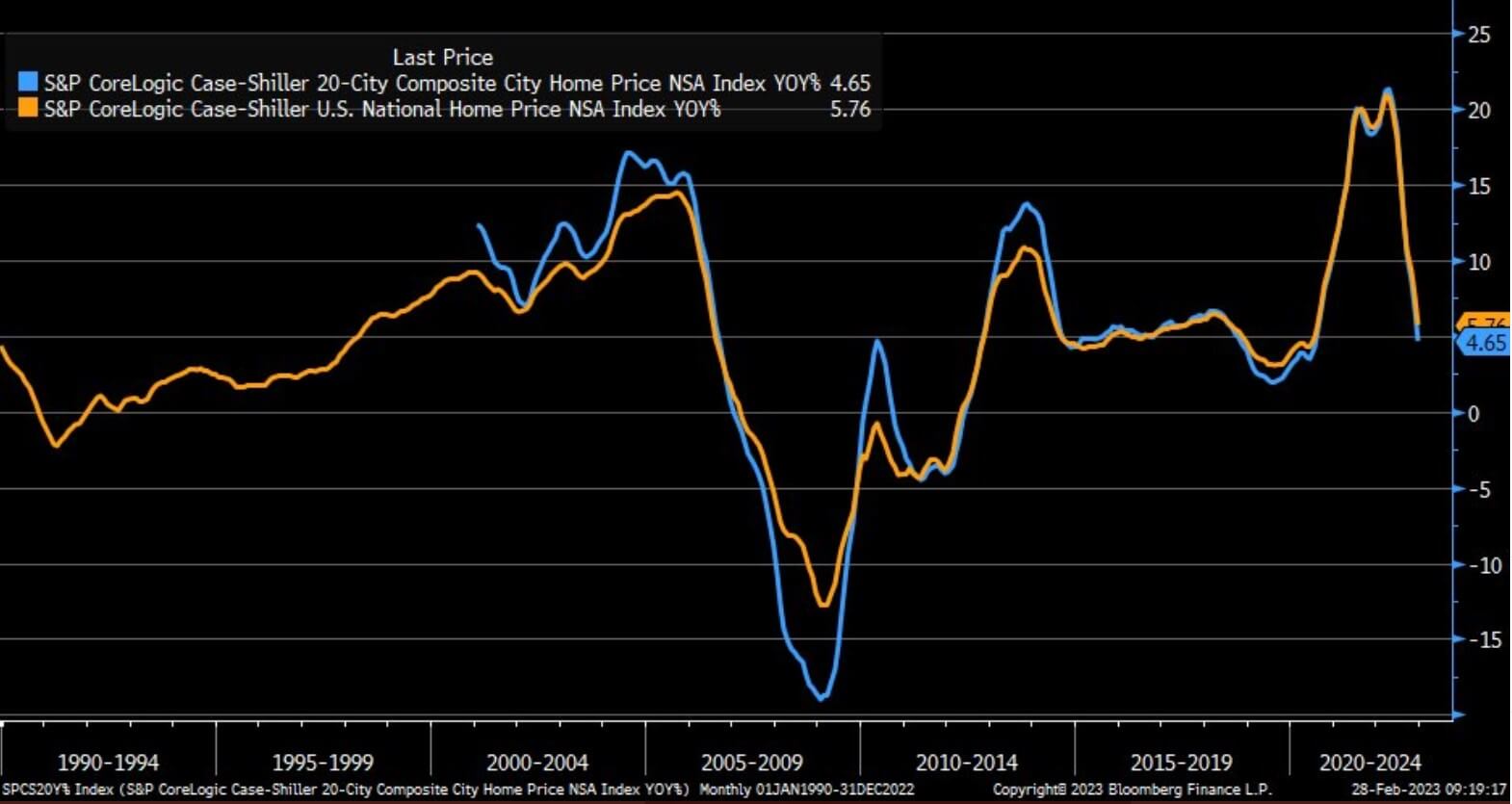

U.S. location terms declines accelerate

The S&P CoreLogic 20-city, location terms scale fell faster than expected, which saw the year-over-year terms maturation complaint down from 6.8% to 4.7%. This scale is simply a lagging indicator of prices connected a three-month mean going arsenic acold backmost arsenic Q3 2022.

While 30-year owe rates person topped 7% again, owe applications for location purchases fell arsenic overmuch arsenic 6% past week, pursuing an 18% drawdown the week prior.

S&P CoreLogic: (Source:Bloomberg)

S&P CoreLogic: (Source:Bloomberg)The U.S. system is inactive hot

ISM services got released successful March 3, which showed that the U.S. system is inactive highly strong. Services were amended than expected, little prices paid, stronger employment, and stronger caller orders.

All eyes connected FOMC

The adjacent FOMC meeting, which takes spot connected March 22, volition see an update of the Fed Dot Plot and an update connected the summary of economical projections, which volition person greater value than conscionable a 25 oregon 50bps rise by the fed.

The U.K.

Record nutrient inflation

Troubling times are up for the U.K. arsenic store terms ostentation accelerated by astir treble digits successful February, portion nutrient terms ostentation reached a grounds 17.1%, according to the British Retail Consortium.

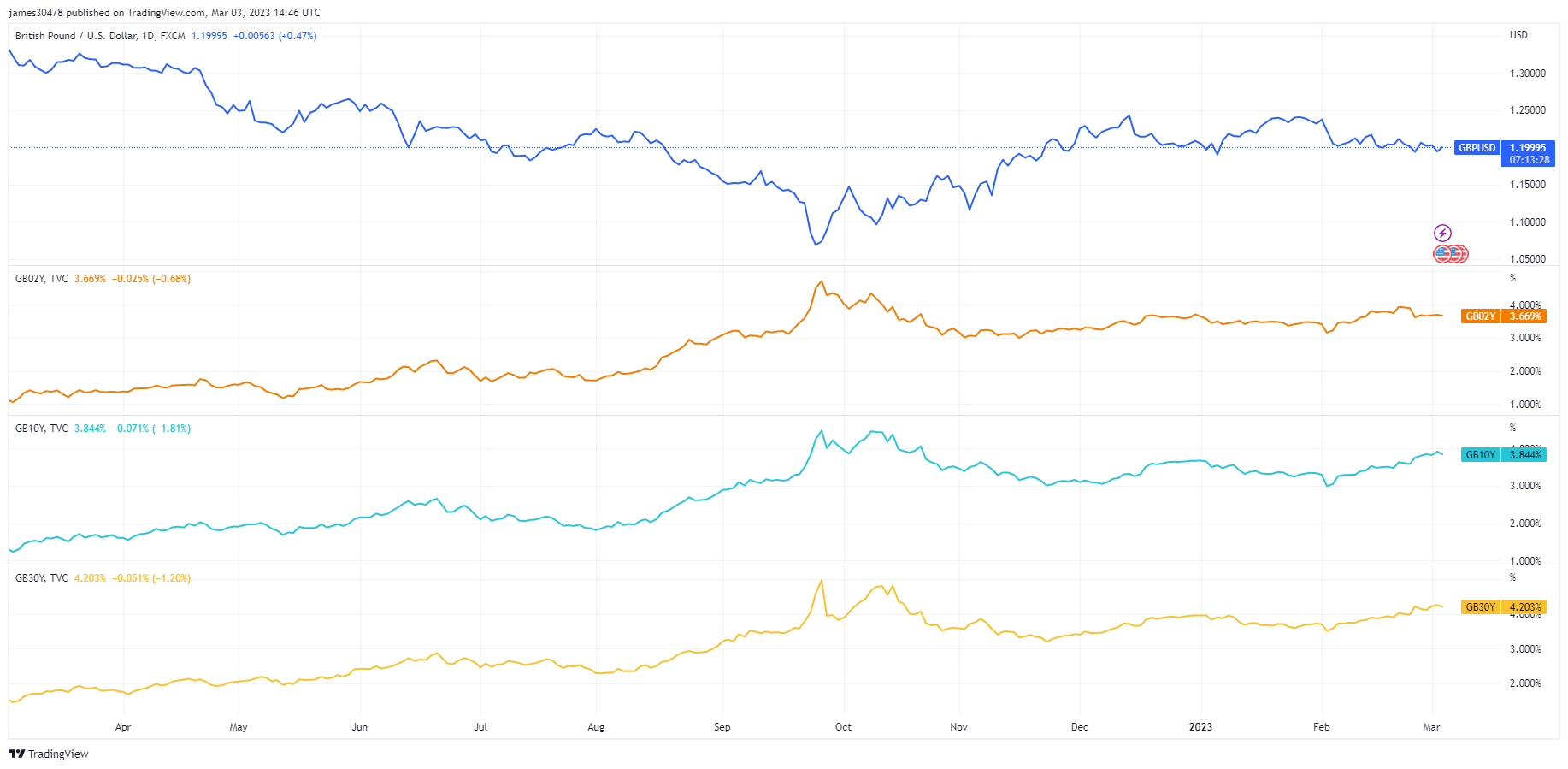

BOE caught betwixt a stone and a hard place

Yields up, GBP down arsenic the BOE struggles successful galore antithetic ways. Unlike the Fed and ECB, who person devised a hawkish program for 2023, the BOE continues to flip-flop with nary wide direction. The lb astatine $1.199 approaches a year-to-date debased portion the output curve continues to steepen.

GBPUSD: (Source Trading View)

GBPUSD: (Source Trading View)The station MacroSlate: Inflation, involvement complaint hikes proceed to wreak havoc crossed the US, EU and UK appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)