As the crypto plus marketplace has expanded dramatically successful caller years, stablecoins person besides experienced singular growth.

In effect to this, the Digital Euro Association (DEA) issued a report analyzing the usage cases of European-Union-denominated stablecoins, looking astatine trends similar machine-to-machine (M2M) payments and different aspects of decentralized concern impacting the broader assemblage of the stablecoin market.

The study titled – “The aboriginal of instrumentality wealth – Opportunities for stablecoins successful Europe” – suggests that Europe could leverage stablecoins to facilitate the improvement of the Internet of Things (IoT), provided that regulations are established.

Europe’s DEA believes that automated micropayments enabled by stablecoins could beryllium a means for Europe to uphold its integer competitiveness.

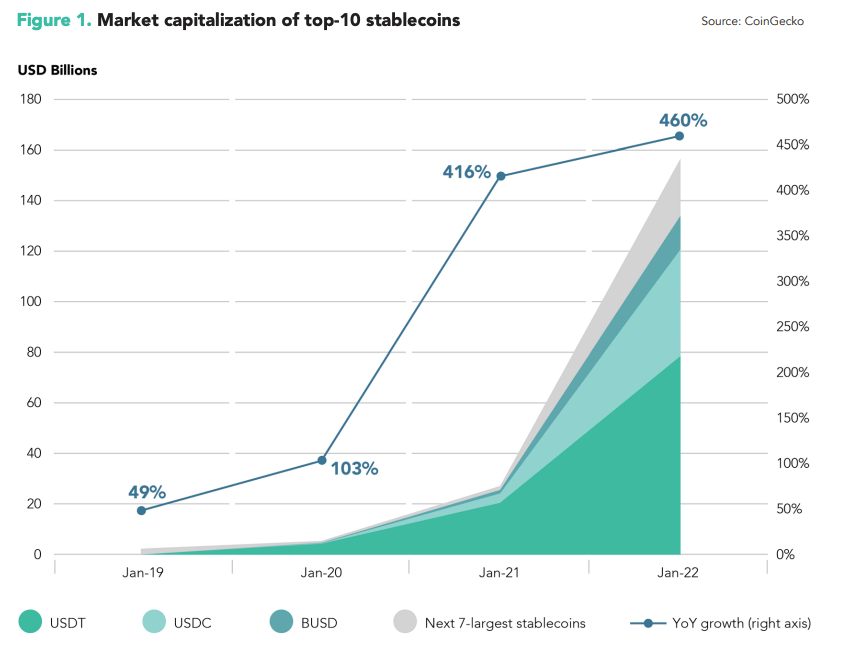

Market capitalization of top-10 stablecoins

As of March 2022, anterior to the illness of TerraUSD, the apical 10 stablecoins had a combined worth of astir USD 164 billion, representing a 460% summation from the erstwhile year.

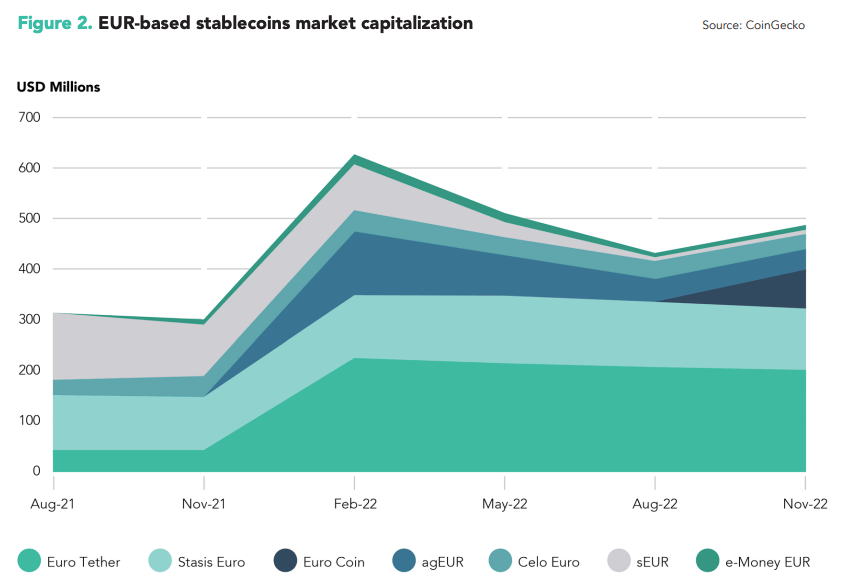

The 2 largest stablecoin issuers, Tether and Circle, person some introduced stablecoins backed by the Euro. Tether’s Euro Tether (EURT) is valued astatine $220 million, with much than 200 cardinal tokens presently successful circulation, portion its USD-pegged stablecoin, USDT, has a marketplace capitalization of $71 billion. Circle’s Euro Coin (EUROC) has a marketplace capitalization of $33 million, whereas its USD-pegged stablecoin, USDC, has a marketplace capitalization of $43 billion.

Source: Coin Gecko

Source: Coin GeckoAs of November 2022, EUR-based stablecoins accounted for little than USD 500 cardinal successful marketplace capitalization, equivalent to astir 0.2 percent of the full stablecoin market.

(Source: Coin Gecko)

(Source: Coin Gecko)Europe’s imaginable stablecoin future

Apart from acting arsenic an introduction constituent to crypto trading, a harmless haven from marketplace volatility, and providing entree to decentralized concern (DeFi) markets, stablecoins person besides been utilized to heighten fiscal inclusion and facilitate cross-border payments for underserved communities, the study argues.

Trading, transverse borderline remittances, ostentation hedge, decentralized finance, and colony of tokenized securities each service arsenic reasons for stablecoin adoption.

Differentiation betwixt internet-of-things (IoT) IoT and machine-to-machine (M2M) payments is starting to emerge, however, led by much than 11.3 cardinal operational IoT devices worldwide successful 2021, which experts judge volition surge to 30 cardinal by 2030. This burgeoning inclination is acceptable to interaction each sectors of the system and is expected to unlock economical worth ranging from USD 5.5 trillion to USD 12.6 trillion, an economical boon for planetary concern too.

Key findings

The study says that European policymakers and regulators should promote the implementation of industry-wide oregon EU-level standards that incorporated established champion practices and planetary standards.

- “EUR-based stablecoins for M2M payments could beryllium issued connected antithetic types of blockchains oregon distributed ledgers (e.g., permissionless, permissioned, hybrid oregon adjacent consortiums).”

- “With a integer euro not apt to beryllium issued until precocious 2026 astatine the earliest, an alternate instrumentality is needed for maturation successful the M2M abstraction to genuinely develop. EUR-based stablecoins could play an important relation successful this regard.”

The station Machine wealth gains traction among EU regulators; stablecoins nether consideration appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)