The U.S. Securities and Exchange’s (SEC) lawsuit against Binance wiped disconnected implicit $200 cardinal wrong 1 hr from crypto traders who held positions connected the market.

Following the news, CryptoSlate’s information showed that the full marketplace headdress of integer assets declined 2.87% to $1.12 trillion.

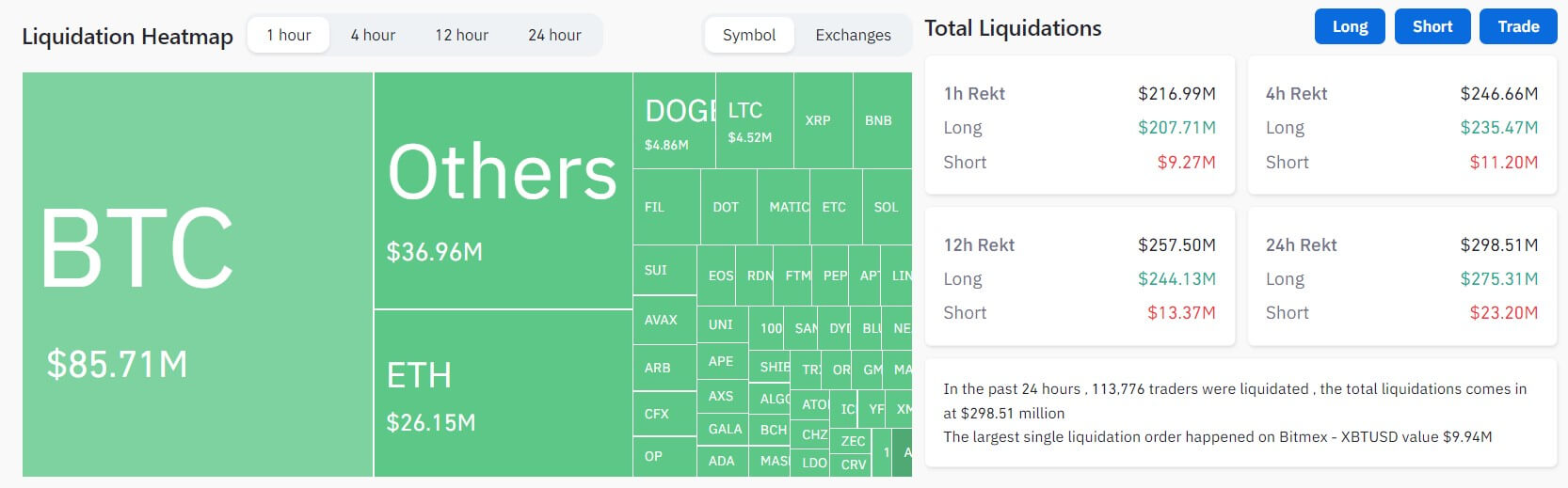

Nearly $300M successful the past 24 hours

The crypto marketplace saw $298.51 cardinal liquidated successful the past 24 hours, with much than 110,000 traders affected.

Data from Coinglass showed that agelong traders mislaid $275.31 million, with Bitcoin and Ethereum accounting for $130.46 cardinal of these losses.

Source: Coinglass

Source: CoinglassMeanwhile, abbreviated traders experienced $23.2 cardinal successful liquidations. The apical 2 integer assets were liable for astir 49.5% of these losses.

Other assets specified arsenic BNB, Chainlink, XRP, Litecoin, and Solana experienced little than $2 cardinal successful liquidations, respectively.

Across exchanges, astir of the liquidations occurred connected OKX, Binance, and ByBit. These 3 exchanges accounted for 75% of the wide liquidations, with 92% being agelong positions. Other exchanges similar Huobi, Deribit, and Bitmex besides recorded a sizeable magnitude of the full liquidations.

The astir important liquidation occurred connected Bitmex – XBTUSD, valued astatine $9.94 million.

Red market

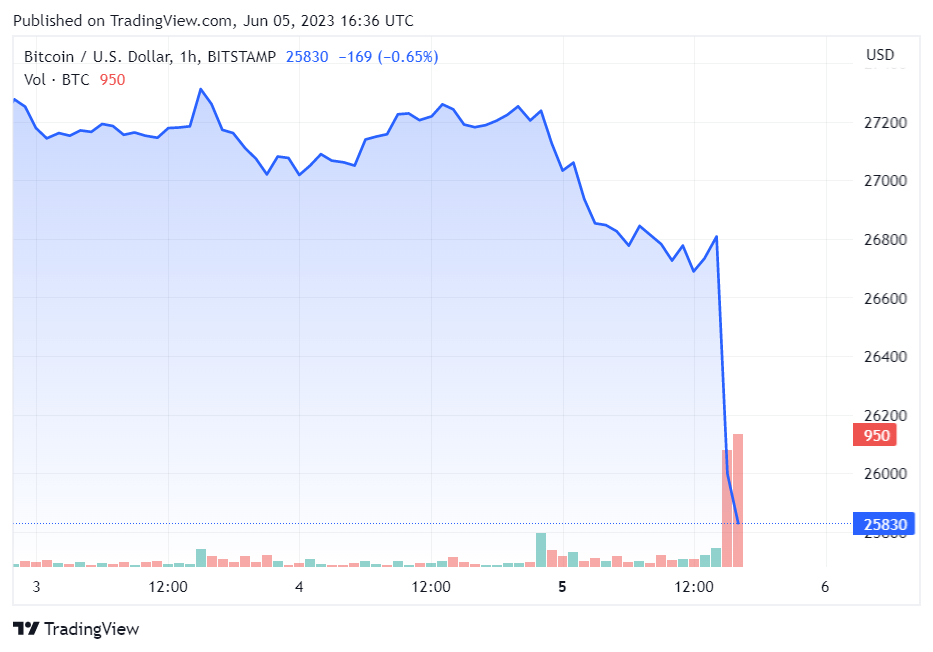

Bitcoin dipped from implicit $27,000 to beneath $26,000 wrong 1 hr and was trading astatine $25,859 arsenic of 16:36 UTC

The terms of Bitcoin is down wide by astir 5% implicit the past 24 hours.

Source: Tradingview

Source: TradingviewBinance-related BNB saw the highest loss, plunging by astir 10% to $281, portion Ethereum (ETH) fell 3%. Other apical integer assets similar XRP, Cardano (ADA), Dogecoin (DOGE), and others besides reported important losses during the reporting period.

The station Liquidations surpass $200M successful 1 hr aft SEC’s Binance lawsuit appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)