Disclosure: The writer of this communicative owns shares successful MicroStrategy (MSTR).

Since Donald Trump won the U.S. predetermination connected Nov. 5, bitcoin (BTC) has soared from $67,000 to astir $100,000. This has coincided with a immense emergence successful bitcoin's full commercialized measurement which has present surpassed $100 billion.

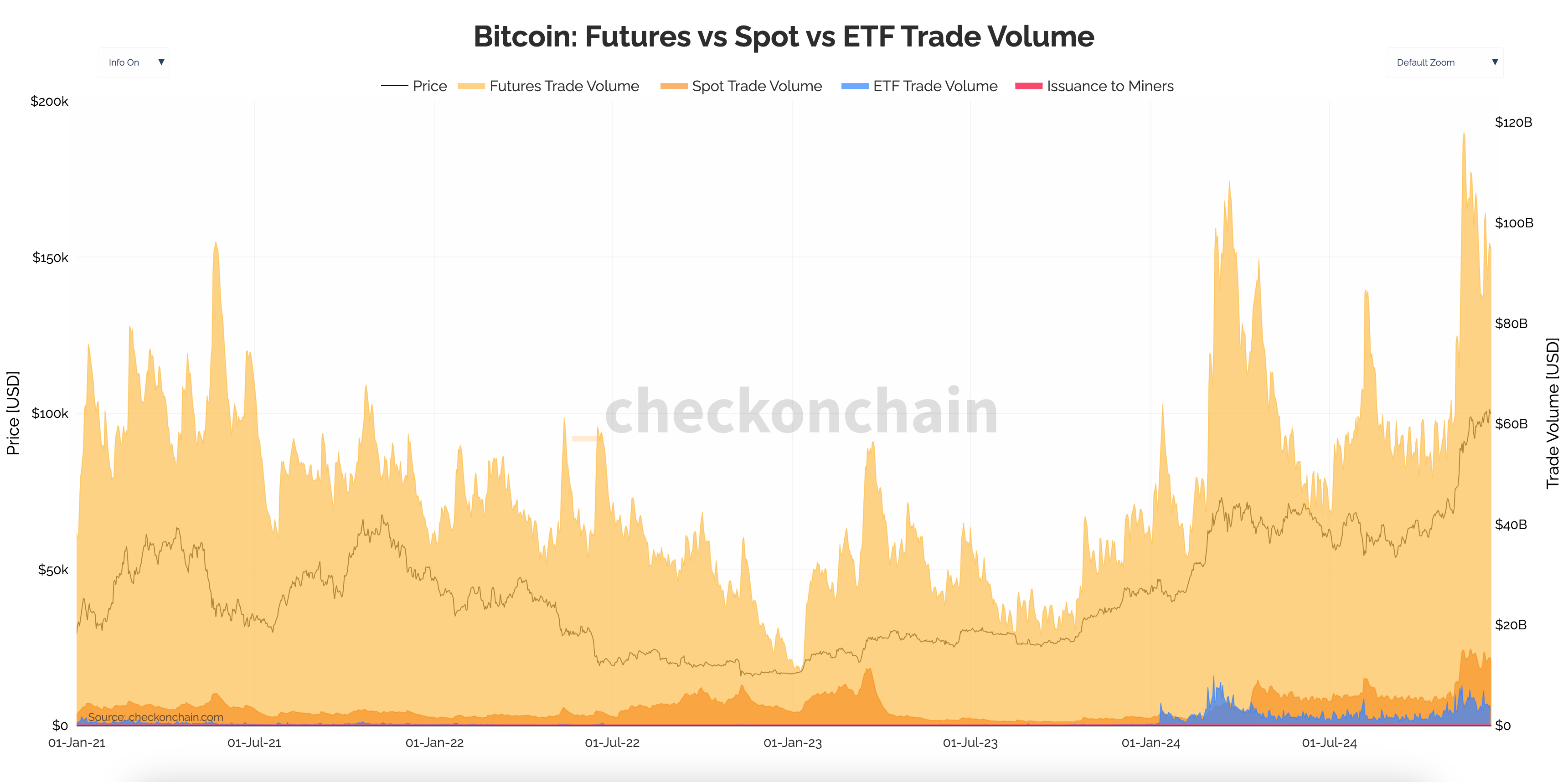

According to checkonchain data, bitcoin futures trading measurement deed an all-time precocious of astir $120 cardinal connected Nov. 17, astir doubling since the U.S. election. However, since past futures commercialized measurement has plateaued and steadied astir $100 billion.

The aforesaid tin beryllium seen with spot commercialized measurement which has besides doubled from astir $6 cardinal to $12 billion. While the spot listed U.S. exchange-traded funds (ETF) commercialized measurement has besides picked up reaching $4 cardinal a day.

Bitcoin remains successful a cardinal trading scope of $100,000, going supra and beneath the cardinal intelligence country connected aggregate occasions. A batch of this has to bash with the tremendous merchantability unit coming from long-term holders (LTH) oregon investors who person held bitcoin for longer than 155 days.

Since September, LTHs person sold 843,113 BTC. In the aforesaid play short-term holders (STHs), those who person held bitcoin for little than 155 days, person accumulated 1,081,633 BTC. This works retired to astir 9,960 BTC sold by LTHs and STHs accumulating 12,432 BTC per day.

To amusement the quality of trading volumes betwixt agelong and short-term holders, we comparison them to different large players successful the industry, specified arsenic the self-described bitcoin improvement institution MicroStrategy (MSTR). MicroStrategy holds 423,650 bitcoin oregon conscionable implicit 2% of the full supply. In addition, U.S. ETFs present clasp implicit 1 cardinal bitcoin.

Since September, MicroStrategy has accumulated 197,250 BTC, which works retired to astir 2,168 BTC per day. While, the U.S ETFs person accumulated astir 205,000 BTC, which works retired to 2,253 BTC per day. The U.S. ETF BTC equilibrium has grown from 916,000 BTC to 1.12 cardinal BTC.

In bid for bitcoin to conclusively interruption higher of $100,000 we volition request to spot LTHs dial down connected offloading their tokens oregon person bigger cohorts participate the abstraction and prime up the buys.

9 months ago

9 months ago

English (US)

English (US)