The crypto rally took a intermission connected Tuesday with bitcoin (BTC) rapidly pulling backmost from grounds highs supra $126,000 arsenic analysts pointed to signs of crypto rally overheating, astatine slightest successful the abbreviated run.

BTC plunged beneath $122,000, erasing the past 3 days of gains and trading 2.4% little successful the 24 hours. The selloff rippled crossed the crypto market, with XRP (XRP), dogecoin (DOGE), Cardano (ADA) and Avalanche (AVAX) down 5%-7% during the period.

If the terms enactment successful bitcoin appears familiar, that's due to the fact that it is. Despite a 31% summation year-to-date, bitcoin has fixed bulls precise small accidental to bask successful their wins. Each grounds precocious has seemingly been met with a speedy and viscous sell-off. Consider the archetypal tally to $109,000 conscionable up of the Trump inauguration successful January. That reversed little to $100,000 successful hours and to $75,000 wrong 3 months.

July's archetypal determination supra $123,000 was met with astir a 10% diminution implicit the pursuing fewer days. And akin surge supra $120,000 successful mid-August presaged astir a 15% plunge successful ensuing days.

The declines this clip astir came aft bitcoin's near-vertical 16% pump disconnected the precocious September lows beneath $109,000.

Jean-David Péquignot, CCO of options marketplace Deribit, projected successful a Monday study that BTC could revisit the $118,000-$120,000 portion shaking retired traders who missed the lows and joined the rally late. If that pullback happens, helium said, would connection a buying accidental arsenic technicals and the macro situation aligns for BTC to tally higher supra $130,000 done the past 4th of the year.

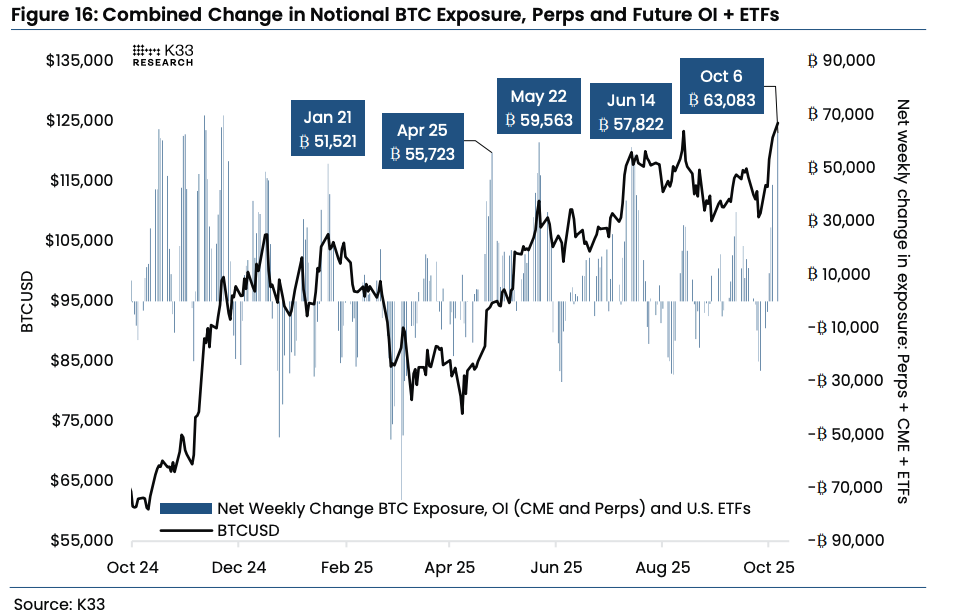

Derivatives marketplace and ETF inflows besides got overheated, said Vetle Lunde, caput of probe astatine K33. He noted that the past week marked the strongest BTC accumulation of the year, with a combined 63,083 BTC (worth astir $.7 7billion) added crossed U.S. ETFs, CME and perpetual futures, surpassing the May peak. The surge was driven by wide agelong positioning betting connected higher prices without a wide macro catalyst, laying the crushed for a pullback.

"Historically, akin bursts successful vulnerability person often coincided with section tops, and the existent setup suggests a temporarily overheated marketplace with elevated hazard of short-term consolidation," Lunde said.

Fed's Miran Says Neutral Rate Should Be 0.5%

Federal Reserve Governor Stephen Miran — a caller Trump appointee — said Tuesday his presumption of the neutral involvement complaint has shifted “from 1 extremity of the scope to the other,” during a treatment astatine the Managed Funds Association Policy Outlook 2025. He present believes the neutral complaint should basal astatine 0.5%. Miran pointed to tighter migration restrictions and evolving expectations astir the national shortage arsenic the main factors down his reassessment.

Miran’s comments suggest that semipermanent forces shaping the U.S. system are changing. A smaller labour excavation could bounds growth, portion rising fiscal pressures mightiness support the Fed’s balancing enactment betwixt ostentation and employment much complex. His remarks travel arsenic policymakers statement however overmuch country the cardinal slope has to chopped rates without reigniting terms pressures.

Fed officials conscionable astatine the extremity of this period to determine astir a imaginable further complaint cut, however, without captious information coming from the authorities arsenic the shutdown continues.

Miran besides noted that economical maturation successful the archetypal fractional of the twelvemonth was weaker than anticipated, weighed down by uncertainty implicit commercialized and taxation policy. But Miran struck a much affirmative code for the months ahead, saying overmuch of that uncertainty has present cleared. “With clearer argumentation signals, I expect a steadier gait of growth,” helium said.

Crypto stocks suffer

The wide pullback successful crypto prices is hitting the related stocks, led by a 7% diminution successful Strategy (MSTR) and a 4% nonaccomplishment for Coinbase (COIN). Ether (ETH) treasury companies Bitmine Immersion (BMNR) and Sharplink Gaming (SBET) are down 3% and 7%, respectively.

BItcoin miners are mostly successful the red, led by MARA Holdings falling 4% and Riot Platforms (RIOT) 3%. Hut 8 (HUT) is little by 2%.

3 hours ago

3 hours ago

English (US)

English (US)