This is an investigation station by CoinDesk expert and Chartered Market Technician Omkar Godbole.

As we attack the last 4th of 2025, the pursuing cardinal charts supply invaluable insights to assistance crypto traders navigate the evolving marketplace landscape.

Bullish seasonality

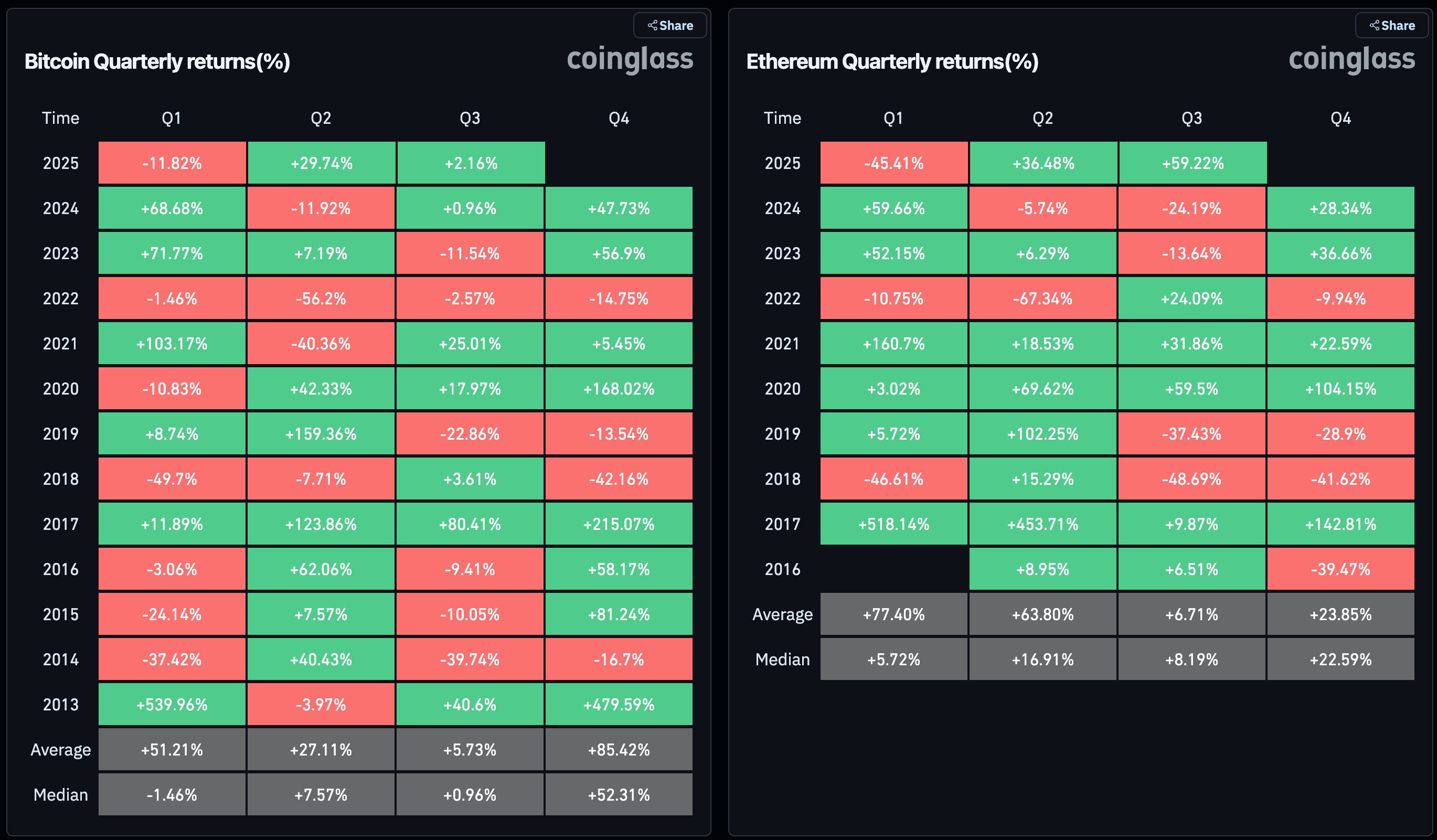

Seasonal trends suggest a bullish Q4 outlook for some bitcoin (BTC) and ether (ETH), the apical 2 cryptocurrencies by marketplace capitalization.

Since 2013, Bitcoin (BTC) has delivered an mean instrumentality of 85% successful the last quarter, according to information from Coinglass, making Q4 historically the strongest play for bulls.

November stands retired arsenic the astir bullish month, with an mean summation of 46%, followed by October, which typically sees a 21% increase.

Ether (ETH) besides tends to execute good successful the past 3 months of the year, though its strongest humanities returns person been successful the archetypal 4th since inception.

BTC's 50-week SMA support

Bitcoin's terms has dropped by 5% this week, consistent with the bearish method signals and looks acceptable to widen losses to precocious August lows adjacent $107,300. If bulls neglect to support that, the absorption volition displacement to the 200-day elemental moving mean astatine $104,200.

The ongoing terms decline, combined with bitcoin's humanities signifier of peaking astir 16 to 18 months aft a halving event, whitethorn scare bulls.

However, specified concerns whitethorn beryllium premature arsenic agelong arsenic prices stay supra the 50-week elemental moving mean (SMA). This moving mean has consistently acted arsenic a enactment level, marking the extremity of corrective terms pullbacks during the existent bull tally that began successful aboriginal 2023.

Traders, therefore, should intimately ticker the 50-week SMA, which is presently positioned astir $98,900, arsenic a cardinal level for broader marketplace direction.

XRP/BTC compression

XRP, often called the "U.S. authorities coin" by firms similar Arca, has surged 32% this year. However, contempt this beardown rally, the payments-focused cryptocurrency remains confined wrong a prolonged sideways trading scope against Bitcoin (XRP/BTC), showing constricted comparative strength.

The XRP/BTC brace has been confined wrong a constrictive trading scope since aboriginal 2021, resulting successful implicit 4 years of low-volatility compression.

Recent terms enactment adjacent the precocious bound of this transmission suggests that bulls are gradually gaining control. A breakout from specified a prolonged consolidation could trigger a almighty rally successful XRP comparative to BTC, arsenic the accumulated vigor from this compression is released.

Now, let’s crook to charts that telephone for caution.

Breakout successful Defiance Daily Target 2x Short MSTR ETF (SMST)

The leveraged anti-Strategy ETF (SMST), which seeks to present regular concern results that are -200%, oregon minus 2x, the regular percent alteration successful bitcoin-holder Strategy's (MSTR) stock price, is flashing bullish signals.

The ETF’s terms climbed to a five-month precocious of $35.65, forming what appears to beryllium an inverse head-and-shoulders pattern, characterized by a salient trough (the head) flanked by 2 smaller, astir adjacent troughs (the shoulders).

This signifier often signals a imaginable bullish reversal, suggesting the ETF whitethorn beryllium gearing up for a important upward move.

In different words, it's flashing a bearish awesome for some BTC and Strategy, which is the largest publically listed BTC holder with a coin stash of 639,835 BTC.

Dollar Index's treble bottom

Last week, I discussed the dollar's post-Fed complaint chopped resilience arsenic a imaginable headwind for hazard assets, including cryptocurrencies.

The dollar scale has since gained ground, establishing a treble bottommost astatine astir 96.30. It's a motion that bulls person successfully established the way of slightest absorption connected the higher side.

A continued determination beyond 100.26, the precocious of the interim betterment betwixt the duplicate bottoms astir 96.30, would corroborate the alleged treble bottommost breakout, opening the doorway for a determination to 104.00.

Watch retired for the signifier nonaccomplishment beneath 96.00, arsenic that could pb to accrued risk-taking successful fiscal markets.

NVDA topping?

Nvidia (NVDA), the world's largest listed institution by marketplace value, and a bellwether for hazard assets, continues to flirt with the precocious extremity of the broadening transmission identified by June 2024 and November 2024 highs and lows deed successful August 2024 and April 2025.

The rally has stalled astatine the precocious trendline since precocious July successful a motion of bullish exhaustion. Should it diminution from here, it could awesome the onset of a risk-off play successful planetary markets, including cryptocurrencies.

1 month ago

1 month ago

English (US)

English (US)