Amid a bloody start to the week successful crypto markets, which saw liquidations adjacent monthly highs arsenic assorted large tokens dropped by double-digit percentages, the autochthonal token of Solana-based DEX aggregator Jupiter is defying the inclination implicit a caller buyback plan.

Data from TradingView shows that JUP is up much than 34% against bitcoin implicit the past week contempt seeing an 11% diminution implicit the past 24 hours, compared to BTC’s adjacent 4% drop.

JUP’s outperformance is simply a effect of a bid of announcements made during its first-ever event, Catstanbul 2025, which addressed inferior concerns. The protocol’s pseudonymous founder, known arsenic ‘Meow’, revealed that 50% of each protocol fees are acceptable to beryllium utilized to bargain tokens from the unfastened market, with the tokens being moved to a “long-term litterbox," a semipermanent reserve.

The determination led to a terms increase, which demonstrated a “high level of capitalist assurance successful the task and its strategy,” according to Bitget Research’s Chief Analyst, Ryan Lee. He said expanding attraction connected the level could pull caller users and liquidity to the Solana ecosystem successful the agelong run.

In a connection to CoinDesk, Lee noted the buyback programme could “act arsenic a catalyst for semipermanent maturation arsenic the squad estimates it could adhd hundreds of millions of dollars to the buyback measurement per year.”

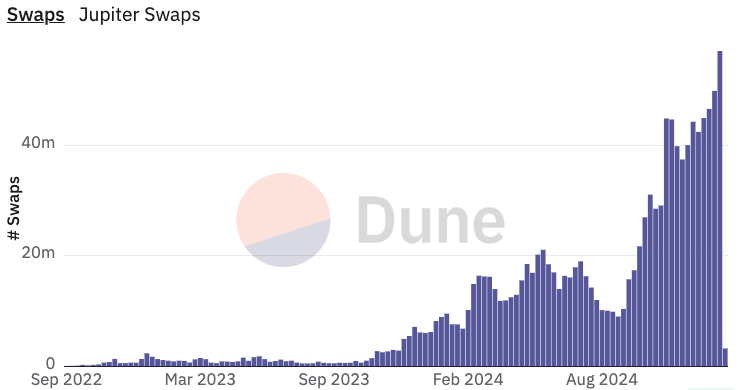

Jupiter is Solana’s leading DEX aggregator, having facilitated astir $2.2 trillion successful full measurement implicit 1.25 cardinal token swaps, according to information from Dune Analytics. In the past 24 hours, its trading measurement was $6.5 cardinal implicit 6.9 cardinal swaps.

'Monopolistic behavior'

The announcement whitethorn person helped JUP’s terms surge, but it drew immoderate concerns from the community.

Chris Chung, the laminitis of Solana swap level Titan, wrote successful an emailed connection to CoinDesk that the “news implicit the play that Jupiter – Solana’s astir utilized DEX – is implementing a 5bps interest for basal swap trades successful its default 'Ultra' mode is disappointing quality for traders.”

Jupiter’s Ultra mode is acceptable to see features specified arsenic real-time slippage estimation, dynamic precedence fees, and optimized transaction landing, each bolstered by a caller “Jupiter Shield” information tool. The protocol’s success, Bitget Research's Lee told CoinDesk, “may travel with the hazard of centralization.”

“If Jupiter continues to summation its power and go the ascendant subordinate successful the Solana ecosystem, it could pb to over-reliance connected a azygous project,” Lee said, adding that the “situation is contrary to the principles of blockchain which are aimed astatine decentralization and organisation of influence.”

Chung added that Solana’s “entire worth proposition is little outgo and higher throughout, and a 5-10bps summation successful trading costs is important successful this context. But it’s peculiarly disappointing erstwhile a paid exemplary is being implemented erstwhile determination is nary perceivable show summation implicit the erstwhile escaped version, particularly erstwhile the features successful question are indispensable successful landing transactions.”

Jupiter besides announced it acquired a majority involvement in Moonshot, the memecoin trading level that was featured connected the website of U.S. President Donald Trump’s memecoin and reportedly “brought 200k+ caller radical onchain” arsenic a result.

The protocol has besides acquired on-chain portfolio tracker SonarWatch, which coupled with the Moonshot acquisition means, to Chung, that Jupiter is “clearly looking to predominate the full Solana ecosystem,” successful a determination that’s some “unhealthy and detrimental for innovation and for the idiosyncratic experience.”

To Titan’s founder, Jupiter’s moves magnitude to “monopolistic behavior” that allows incumbents to “raise prices further and further successful lack of competition,” the benignant of behaviour that decentralized concern was meant to eradicate.

Furthering these concerns, Jupiter besides announced the motorboat of Jupnet, described arsenic an omnichain web designed “to aggregate each of crypto successful 1 azygous decentralized ledger for maximum easiness of usage for users and developers.” Its nationalist beta mentation is coming successful the adjacent fewer months.

Although the DEX aggregator’s dominance whitethorn person led to concerns implicit the imaginable attraction of powerfulness successful the hands of a azygous player, it could person a metallic lining. Jupiter’s absorption connected the Solana ecosystem could pb to a caller question of developers engaging with it and creating new, unsocial products, Bitget’s Lee added.

Mike Cahill, Co-Founder and CEO of Pyth Network's halfway contributor Douro Labs, pointed to Jupiter’s moves arsenic a “clear committedness to expanding DeFi infrastructure and improving liquidity dynamics.” The innovation approach, helium added, could “push a caller influx of builders into the Solana ecosystem, which means we’re going to spot a batch of caller memecoins and a batch of caller dApps arsenic a result.”

Jupiter didn't respond to CoinDesk's petition for remark astatine the property time.

8 months ago

8 months ago

English (US)

English (US)