By Omkar Godbole (All times ET unless indicated otherwise)

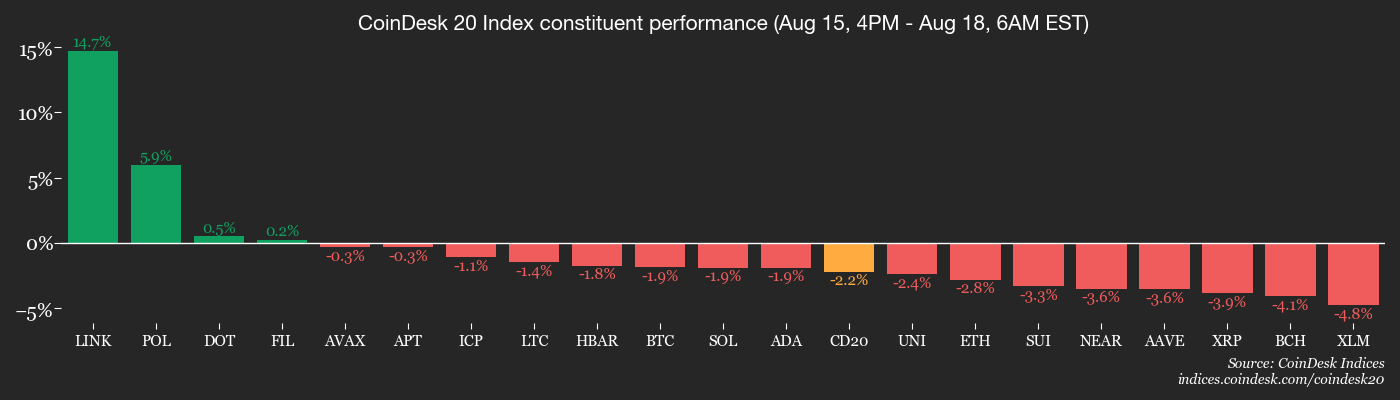

There's a enactment of caution seeping into crypto markets, with bitcoin (BTC) sliding nether $115,000 and ether (ETH) falling to $4,220 up of Fed Chairman Jerome Powell's code astatine the Jackson Hole Symposium aboriginal this week. The CoinDesk 20 Index, a measurement of the biggest tokens, has dropped much than 4.5% successful the past 24 hours.

Bitcoin's driblet took the largest cryptocurrency to beneath it's 50-day elemental moving mean (SMA) and marks rather a retrenchment from the grounds precocious of $124,000 it registered past week. In ether's case, on-chain information indicates a hazard of monolithic liquidations astatine $4,170.

"More than $400m successful agelong positions were liquidated overnight arsenic BTC slid from 118k to 115k and ETH from 4,500 to 4,300," QCP Capital said successful a marketplace update. "This extends past week’s 5 % pullback amid implicit $1bn of DeFi liquidations and profit‑taking. Funding rates person turned antagonistic and hazard reversals favour puts, suggesting cautious positioning up of Jackson Hole."

Notably, ether losses travel aft the second-largest cryptocurrency faced a record validator exit queue, with 855,158 tokens worthy implicit $3.5 cardinal looking to leave. Furthermore, past week, BlackRock's ether ETF (ETHA) registered a grounds trading measurement of 364.25 cardinal shares, according to information root TradingView. The money besides registered grounds inflows of $2.32 billion.

"Spot Bitcoin and Ethereum ETFs clocked a record-breaking US$40 cardinal successful play trading volume, with Ethereum contributing US$17 billion, and US$2.85 cardinal of that successful nett inflows. This isn’t conscionable short-term momentum; we’re seeing the infrastructure solidify astir crypto successful existent time," Mena Theodorou, a co-founder of crypto speech Coinstash, said.

Speaking of the broader market, the bitcoin-to-altcoin liquidations ratio continued to slide, reaching its lowest constituent since aboriginal 2024, according to information root CryptoQuant. (See Chart of the Day.) The driblet shows altcoins person been experiencing much speculative enactment comparative to bitcoin, a dynamic often observed astatine marketplace tops.

Monero attacker Qubic's assemblage overwhelmingly voted successful favour of targeting the Dogecoin web implicit ZCash. DOGE dropped implicit 4%, disappointing bulls positioned for a rally pursuing past week's aureate crossover.

In accepted markets, golden rose, European stocks dropped and U.S. banal scale futures were muted arsenic traders awaited a cardinal gathering betwixt European leaders and President Donald Trump implicit Ukraine's future. Stay alert!

What to Watch

- Crypto

- Aug. 18: Coinbase Derivatives volition launch nano SOL and nano XRP U.S. perpetual-style futures.

- Aug. 20: Qubic (QUBIC), the fastest blockchain ever recorded, volition acquisition its archetypal yearly halving event arsenic portion of a controlled emanation model. Although gross emissions stay fixed astatine 1 trillion QUBIC tokens per week, the adaptive pain complaint volition summation substantially — burning immoderate 28.75 trillion tokens and reducing nett effectual emissions to astir 21.25 trillion tokens.

- Macro

- Aug. 18, 1 p.m. ET: President Donald Trump volition greet Ukrainian President Volodymyr Zelensky astatine the White House, followed by a bilateral meeting. European leaders volition articulation for a multilateral gathering including Zelensky starting astatine 3 p.m.

- Aug. 18, 6 p.m.: The Central Reserve Bank of El Salvador releases July shaper terms ostentation data.

- PPI YoY Prev. 1.29%

- Aug. 19, 8:30 a.m.: Statistics Canada releases July user terms ostentation data.

- Core Inflation Rate MoM Est. 0.4% vs. Prev. 0.1%

- Core Inflation Rate YoY Prev. 2.7%

- Inflation Rate MoM Est. 0.4% vs. Prev. 0.1%

- Inflation Rate YoY Prev. 1.9%

- Aug. 19, 2:10 p.m.: Fed Vice Chair for Supervision Michelle W. Bowman volition talk connected “Fostering New Technology successful the Banking System” astatine the Wyoming Blockchain Symposium 2025. Watch live.

- Aug. 19, 4 p.m.: The Central Bank of Uruguay announces its monetary argumentation decision.

- Monetary Policy Rate Prev. 9%

- Aug. 20, 11 a.m.: Fed Governor Christopher J. Waller volition talk connected “Payments” astatine the Wyoming Blockchain Symposium 2025. Watch live.

- Aug. 20, 2 p.m.: The Fed volition merchandise the FOMC minutes from the July 29-30 meeting.

- Earnings (Estimates based connected FactSet data)

- Aug. 18: Bitdeer Technologies Group (BTDR), pre-market, -$0.12

Token Events

- Governance votes & calls

- SoSoValue DAO is voting to allocate 5 cardinal SOSO tokens for a Researcher Ecosystem Fund aimed astatine boosting top-tier crypto probe done competitions and incentives, improving contented quality, transparency and SOSO’s utility. Voting ends Aug. 18.

- Uniswap DAO is voting to allocate $540,000 successful UNI over six months to arsenic galore arsenic 15 apical delegates, with up to $6,000 a period based connected voting activity, assemblage engagement, connection authorship and holding 1,000+ UNI. Voting ends Aug. 18

- Aavegotchi DAO is voting connected a Bitcoin Ben’s Crypto Club Las Vegas sponsorship: a $1,000/month firm rank (logo connected sponsor wall, squad access, newsletter feature, 1 branded meetup/month) oregon a $5,000, 90-day Graffiti Wall mural with promo. Voting ends Aug. 23.

- Unlocks

- Aug. 18: Fasttoken (FTN) to unlock 4.64% of its circulating proviso worthy $91.6 million.

- Aug. 20: LayerZero (ZRO) to unlock 8.53% of its circulating proviso worthy $57.59 million.

- Aug. 20: Kaito (KAITO) to unlock 8.82% of its circulating proviso worthy $27.55 million.

- Token Launches

- OPENPAD TOKEN (OPAD) lists connected KuCoin

- Backroom (ROOM) lists connected LBank

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done Aug. 31.

- Day 2 of 5: Crypto 2025 (Santa Barbara, California)

- Day 1 of 4: Wyoming Blockchain Symposium 2025 (Jackson Hole, Wyoming)

- Aug. 21-22: Coinfest Asia 2025 (Bali, Indonesia)

- Aug. 25-26: WebX 2025 (Tokyo)

Token Talk

By Shaurya Malwa

- Solana's on-chain liquidations exceeded wipeouts astatine centralized exchanges during the play slump, with $37.4 cardinal of SOL flushed connected the blockchain versus $20.9 cardinal connected CEXs. Drift and Hyperliquid carried astir of the flow, showing however overmuch perp enactment has migrated on-chain.

- Hyperliquid OI successful SOL deed a grounds $1.2 cardinal adjacent arsenic Binance volumes slipped. Total OI is backmost adjacent $5 billion, with whales split: 59 wallets long, 70 short. One standout, “White Whale,” holds a $79 cardinal 20x leveraged agelong present sitting $1.22 cardinal successful the red.

- Ecosystem fees are backmost supra $1 cardinal a time arsenic Jupiter, Jito and Kamino spot caller inflows. Stablecoins connected Solana person crossed $12 billion, with astir fractional of caller superior migrating successful from Ethereum.

- A Shiba inu (SHIB) whale shifted 3 trillion SHIB (~$38 million) disconnected Coinbase Institutional into acold retention connected Aug. 15, signaling condemnation implicit trading. The wallet had nary anterior history.

- The determination coincided with SHIB’s pain complaint jumping astir 2,000% successful 24 hours, with 4.7 cardinal tokens destroyed. Supply compression remains a cardinal communicative for the community.

- Developers are prepping cross-chain enlargement to Base and Solana utilizing Chainlink CCIP alongside a caller dev hub and DEX to deepen liquidity. Price enactment is dependable adjacent $0.000013, with technicals pointing to a dilatory grind higher.

Derivatives Positioning

- Bitcoin’s terms diminution since Friday is marked by a dependable summation successful futures unfastened involvement (OI), which has surged to 720,000 BTC, the astir since Aug. 2.

- At the aforesaid time, affirmative backing rates are fading, indicating that bearish abbreviated positions are gaining momentum successful the market.

- The aforesaid tin beryllium said for the ether market, wherever unfastened involvement has accrued to 14.34 cardinal ETH, besides the highest since Aug. 2.

- OI successful LINK, which has bucked the broader marketplace weakness, reached a grounds precocious 68.13 cardinal LINK, alongside annualized backing rates of astir 10%. The operation points to capitalist involvement successful chasing terms gains.

- On the CME, unfastened involvement successful Solana futures hovers astatine a grounds precocious of implicit 4.6 cardinal SOL. However, the annualized three-month premium has declined sharply to 15% from 35% past week. The premium for BTC and ETH remains locked adjacent 10%.

- Open involvement successful CME bitcoin futures remains good beneath July highs, pointing to debased information from organization traders. The OI present has continued to people little highs since December, diverging bearishly from the caller highs successful the spot price.

- On Deribit, hazard reversals retired to November expiry showed a bias for enactment options arsenic the spot terms driblet spurred request for downside protection. In ETH's case, bearishness was pronounced astatine the short-end.

- Block flows featured a elephantine abbreviated strangle, involving penning of $4.4K puts and $4.7K calls. The trader collected a premium of $680,000, betting connected a rangeplay betwixt $4,040 and $5,020.

- In BTC's case, a trader picked up the Sept. 25 expiry enactment enactment astatine $110,000, anticipating a terms sell-off.

Market Movements

- BTC is down 1.84% from 4 p.m. ET Friday astatine $115,205.89 (24hrs: -2.73%)

- ETH is down 2.75% astatine $4,305.90 (24hrs: -5.77%)

- CoinDesk 20 is down 1.93% astatine 4,057.54 (24hrs: -4.56%)

- Ether CESR Composite Staking Rate is down 8 bps astatine 2.85%

- BTC backing complaint is astatine 0.0018% (1.9392% annualized) connected Binance

- DXY is up 0.14% astatine 97.99

- Gold futures are up 0.43% astatine $3,397.00

- Silver futures are up 0.65% astatine $38.22

- Nikkei 225 closed up 0.77% astatine 43,714.31

- Hang Seng closed down 0.37% astatine 25,176.85

- FTSE is unchanged astatine 9,132.66

- Euro Stoxx 50 is down 0.46% astatine 5,423.34

- DJIA closed connected Friday unchanged astatine 44,946.12

- S&P 500 closed down 0.29% astatine 6,449.80

- Nasdaq Composite closed down 0.4% astatine 21,622.98

- S&P/TSX Composite closed unchanged astatine 27,905.49

- S&P 40 Latin America closed up 1.23% astatine 2,686.10

- U.S. 10-Year Treasury complaint is down 3.3 bps astatine 4.295%

- E-mini S&P 500 futures are down 0.19% astatine 6,459.50

- E-mini Nasdaq-100 futures are down 0.2% astatine 23,756.25

- E-mini Dow Jones Industrial Average Index are down 0.11% astatine 44,992.00

Bitcoin Stats

- BTC Dominance: 59.7% (+0.48%)

- Ether-bitcoin ratio: 0.03698 (-2.92%)

- Hashrate (seven-day moving average): 957 EH/s

- Hashprice (spot): $56.04

- Total fees: 2.54 BTC / $299,765

- CME Futures Open Interest: 141,755 BTC

- BTC priced successful gold: 34.3 oz.

- BTC vs golden marketplace cap: 9.74%

Technical Analysis

- The illustration shows dollar index's (DXY) play terms enactment successful the candlesticks format.

- The DXY has failed to penetrate the erstwhile support-turned-resistance astatine 99.58.

- The repeated bull nonaccomplishment suggests that selling unit is rather beardown and the scale could endure a deeper decline.

Crypto Equities

- Strategy (MSTR): closed connected Friday astatine $366.32 (-1.78%), -2.03% astatine $358.90 successful pre-market

- Coinbase Global (COIN): closed astatine $317.55 (-2.26%), -1.78% astatine $311.90

- Circle (CRCL): closed astatine $149.26 (+7.2%), -1.03% astatine $147.72

- Galaxy Digital (GLXY): closed astatine $26.09 (-8.68%), -2.26% astatine $25.50

- Bullish (BLSH): closed astatine $69.54 (-6.82%), -4.23% astatine $66.60

- MARA Holdings (MARA): closed astatine $15.67 (-0.51%), -2.11% astatine $15.34

- Riot Platforms (RIOT): closed astatine $11.33 (-7.51%), -1.68% astatine $11.14

- Core Scientific (CORZ): closed astatine $14.13 (+2.13%), +0.28% astatine $14.17

- CleanSpark (CLSK): closed astatine $9.75 (-2.01%), -2.05% astatine $9.55

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $26.70 (-1%), -4.08% astatine $25.61

- Semler Scientific (SMLR): closed astatine $33.84 (-3.67%)

- Exodus Movement (EXOD): closed astatine $28.82 (+7.34%), unchanged successful pre-market

- SharpLink Gaming (SBET): closed astatine $19.85 (-15.5%), -4.23% astatine $19.01

ETF Flows

Spot BTC ETFs

- Daily nett flows: -$14.13 million

- Cumulative nett flows: $54.97 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: -$59.34 million

- Cumulative nett flows: $12.67 billion

- Total ETH holdings ~6.49 million

Source: Farside Investors

Chart of the Day

- The bitcoin-to-altcoin liquidations ratio peaked successful November and has declined sharply since July.

- It shows that an expanding fig of traders person been speculating successful the altcoin market, starring to the forced closure of positions connected adverse terms swings.

While You Were Sleeping

- Zelensky Brings Backup to the White House arsenic Trump Aligns More Closely With Putin (The New York Times): European leaders’ Washington sojourn aims to safeguard NATO cohesion and Ukraine’s sovereignty aft Trump dropped a ceasefire-first stance, fueling fears helium could unit Zelensky into concessions favoring Putin.

- Ether Market May Become More Exciting Below $4.2K. Here is Why. (CoinDesk): Large clusters of ETH longs astatine $4,170 and beneath enactment $236 cardinal astatine risk, with analysts informing cascading liquidations could snowball into arsenic overmuch arsenic $5 cardinal successful forced selling.

- Metaplanet Expands Bitcoin Treasury by 775 BTC, Assets Outweigh Debt 18-Fold (CoinDesk): The purchase, made astatine an mean terms of 17.72 cardinal yen ($120,500) per bitcoin, lifts the company’s full holdings to 18,888 BTC, worthy astir 284.1 cardinal yen ($1.95 billion).

- Japan’s First Yen-Denominated Stablecoin to Be Approved by the Financial Services Agency, JPC To Be Issued arsenic Early arsenic Autumn (Nikkei): JPYC, a Tokyo-based firm, volition registry arsenic a wealth transportation relation this period to contented a stablecoin pegged 1:1 to the yen and backed by slope deposits and Japanese authorities bonds.

- Bolivia’s Left successful Historic Defeat arsenic Presidential Vote Set for October Runoff (Reuters): Centrist Rodrigo Paz, blimpish Jorge “Tuto” Quiroga and leftist Eduardo del Castillo secured 32.18%, 26.94% and 3.16% of the vote, respectively. No campaigner cleared 40%, forcing an Oct. 19 runoff election.

- Trump Pressure Lights Fire Under Mexico’s ‘Powder Keg’ Ruling Party (Financial Times): Trump’s tariffs, slope sanctions and cartel allegations against elder officials are pressuring President Claudia Sheinbaum arsenic she navigates U.S. demands and protectionist policies inherited from erstwhile president López Obrador.

In the Ether

2 months ago

2 months ago

English (US)

English (US)