Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin dipped marginally aft reaching a caller highest supra $97,000 connected May 2. It retreated to conscionable beneath $94,000, a 3% to 4% diminution from its caller high. Although short-term terms movements are keeping traders nervous, longer-term on-chain information is opening to grounds signs that whitethorn power what happens next.

Index Reading Indicates A Potential Early Bull Market

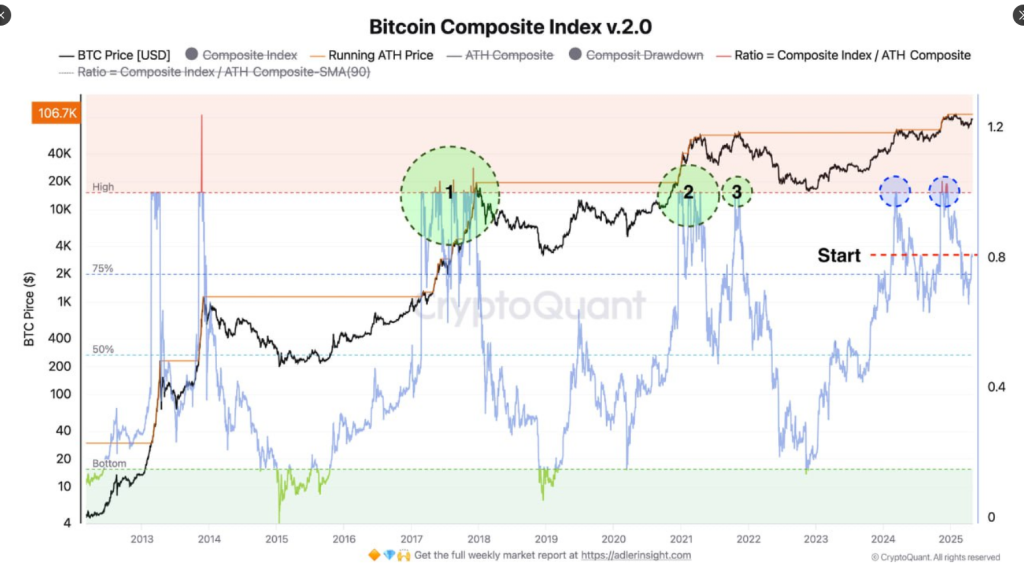

One gauge, which is referred to arsenic the Bitcoin Composite Index v2.0, is present lasting astatine a speechmaking of 0.8. The scale mixes terms enactment with blockchain enactment and attempts to measurement wherever Bitcoin could beryllium going. For expert Constantin Kogan, a reading connected this standard has antecedently appeared up of immoderate monolithic terms rallies, specified arsenic successful 2017 and 2021.

Kogan described however if this fig rises to 1.0 and holds, Bitcoin whitethorn statesman to accelerate importantly faster. The scale isn’t rather determination now—but it’s heading successful the close direction. One of the astir important components of the index, the “Running ATH Price,” has begun trending upward too. This suggests that further buyers are entering the marketplace and religion whitethorn beryllium connected the rise.

📈 The upward momentum successful Bitcoin is conscionable starting to build, with on-chain metrics similar the Bitcoin Composite Index signaling the opening of a bull market. The scale has already reached 0.8 (80%). Here are 3 imaginable scenarios:

🚀 Bullish: BTC could surge to… pic.twitter.com/8bZ4vmr2CH

— Constantin Kogan (@constkogan) May 4, 2025

Price Target May Hit $175K If Momentum Continues

If Bitcoin maintains its momentum and drives the Composite Index to much than 1.0, analysts foretell the terms to emergence sharply. The people scope fixed is betwixt $150,000 and $175,000. That’s if bullish momentum accelerates and past trends are repeated.

But if the scale remains wedged betwixt 0.8 and 1.0, Bitcoin whitethorn stall for a bit. That means a range-bound market, ranging from $90,000 to $110,000. Kogan besides highlighted a third, little probable route—if the scale falls beneath 0.75. Then Bitcoin whitethorn close backmost to $70,000 to $85,000.

Supply Data Shows Where Buyers Stepped In

The 2nd portion of the puzzle is from the UTXO Realized Price Distribution chart, besides referred to arsenic the URPD chart. Provided by expert Checkmate, it plots wherever the holders of Bitcoin past transferred their coins. This provides a consciousness of who purchased when—and astatine what price.

A immense conception of buyers appears to person entered betwixt $93,000 and $98,000. That portion is presently behaving arsenic a important proviso zone. It’s the portion wherever investors person conscionable bought Bitcoin and whitethorn clasp connected oregon merchantability based connected what follows.

Market Awaits Clear Move From Current Zone

Bitcoin is squarely successful the mediate of that scope astatine astir $94,000. As Checkmate points out, the adjacent determination volition beryllium connected whether terms breaks retired powerfully oregon gets rejected. A beardown breakout, evidenced by a almighty regular candle, could crook caller proviso into nett and propel prices higher. But if the terms can’t emergence done this area, it could make a little precocious and pull further selling pressure.

For the moment, Bitcoin sits successful hold mode. Traders and analysts are monitoring some the Composite Index and proviso figures to find whether the existent lull becomes the adjacent limb up—or a further measurement down.

Featured representation from Gemini Imagen, illustration from TradingView

5 months ago

5 months ago

English (US)

English (US)