During the past week, crypto assets accrued successful worth by 9.62%, rising from $1.10 trillion to the existent $1.21 trillion. Apart from the listed stablecoins, the apical 20 crypto assets by marketplace capitalization each experienced gains this week, arsenic $110 cardinal was injected into the crypto economy.

Crypto Market Surges, Rally Led by Pepe, Stacks, Bitcoin Cash

At the clip of writing, the crypto system stands astatine $1.21 trillion, pursuing a 9.62% summation this week. Metrics bespeak that bitcoin (BTC) gained 18.1%, portion ethereum (ETH) roseate by 12.5%.

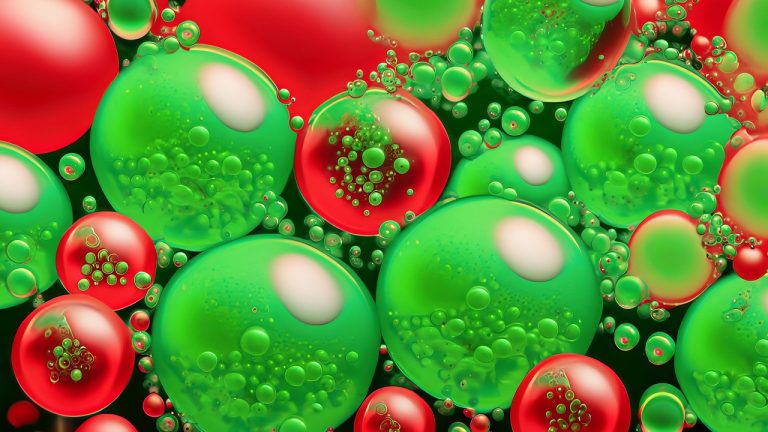

However, galore different integer assets experienced importantly larger gains, arsenic evident from cryptobubbles.net’s weekly data. According to the data, BCH, XRD, PEPE, WOO, ZIL, and VET each recorded double-digit gains.

The meme coin pepe (PEPE) experienced a important 65% summation this week, portion bitcoin currency (BCH) jumped implicit 38%. Pepe led the battalion successful presumption of gains, portion stacks (STX) roseate by much than 41% implicit the past 7 days.

Conflux (CFX) saw a leap of 40.4%, and kaspa (KAS) gained 26% during the aforesaid period. On the different hand, integer currencies specified arsenic bittorrent (BTT), kucoin (KCS), terra luna classical (LUNC), and quant (QNT) faced losses ranging from 2.2% to 7.9% this week.

Friday’s leaders successful presumption of 24-hour stats see FTT, which is up much than 14%; VET, up implicit 11%; BSV, up much than 8%; LEO, besides up much than 8%; ZIL, up 7.6%; and BCH, up much than 6%.

Although, today’s 24-hour losses are led by PEPE and STX. PEPE shed 5.5%, portion STX mislaid 9.8% during the past day. Bitcoin dominance remains precocious astatine 48.2%, and ETH’s marketplace dominance stands astatine 18.6%, according to coingecko.com’s current data.

The crypto rally is believed to beryllium driven by organization involvement and the engagement of large accepted concern (tradfi) giants. In the past week and a half, several spot bitcoin exchange-traded funds (ETFs) were filed, and a crypto exchange backed by Charles Schwab, Citadel Securities, and Fidelity Digital Assets was precocious launched.

However, contempt the alleged organization interest, the planetary commercialized measurement of the crypto system has been low, and a fewer crypto businesses are inactive exhibiting signs of fiscal weakness.

What are your predictions for the aboriginal of the crypto market? Which integer assets bash you deliberation volition proceed to outperform others successful the coming weeks? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)