The evident celebrity-backed token surged thousands of percent astatine launch, but on-chain information points to concentrated control, insider trades and a liquidity plan that leaves retail investors exposed.

Updated Aug 21, 2025, 7:13 a.m. Published Aug 21, 2025, 7:06 a.m.

YZY Money, a Solana-based memecoin linked to Ye (formerly Kanye West), debuted earlier connected Thursday with blistering gains and an arsenic crisp controversy.

Ye’s X relationship posted astir the token successful aboriginal Asian hours connected Thursday, raising contiguous concerns astir it being a compromised account. It aboriginal posted a video showing Ye talking astir and confirming the issuance (it is unclear if it is the existent Ye oregon an AI generation).

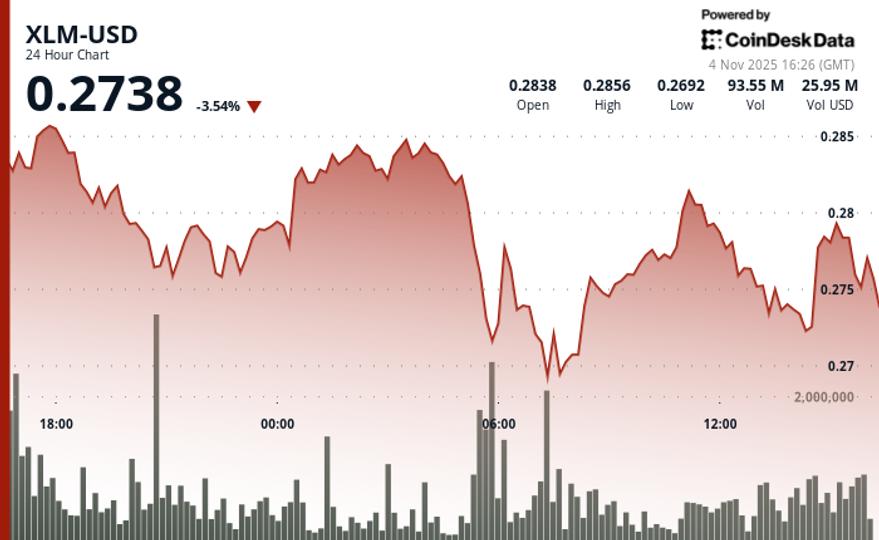

(CoinDesk Data)

The token concisely touched $3.16 successful aboriginal trading — a surge of astir 6,800% from its contented terms — with immoderate trackers claiming it concisely commanded a $3 cardinal marketplace cap.

Behind the frenzy supposedly sits the broader YZY ecosystem, which Ye’s squad has pitched arsenic including a YZY token, a Ye Pay processor for transactions, and a YZY Card for planetary spending of YZY and USDC.

YZY’s operation was first revealed by CoinDesk successful February, which reported that 70% of proviso would spell straight to Ye personally, with 10% for liquidity and 20% for nationalist sale.

At the time, insiders said Ye had initially demanded an 80% involvement — the aforesaid allocation operation tied to Donald Trump’s TRUMP token — earlier being negotiated down. The task has besides carried dense baggage from the start. Ye had antecedently declared that “coins prey connected the fans with hype” earlier backtracking and approving YZY.

Sources told CoinDesk the token was meant to mimic TRUMP’s success, adjacent arsenic Argentina was roiled by a akin ungraded erstwhile President Javier Milei’s endorsed LIBRA coin collapsed arsenic a pump-and-dump.

Critics flagged past — and present — that specified insider-heavy distributions tilt hazard squarely toward retail buyers, particularly erstwhile paired with a single-sided liquidity pool.

The token organisation shows 20% allocated to the public, 10% to liquidity, and 70% to Yeezy Investments LLC, locked for 24 months nether a structured vesting statement via Jupiter Lock.

To forestall bot-driven manipulation, 25 declaration addresses were initially deployed, with lone 1 randomly selected arsenic the authoritative token. That 1-in-25 anti-sniping setup was billed arsenic a fairer motorboat — but on-chain information suggests insiders inactive had beforehand access.

Analytics relationship Lookonchain identified wallet 6MNWV8 arsenic knowing the declaration code successful advance. The wallet adjacent attempted to bargain YZY earlier launch. Once live, it spent 450,611 USDC to get 1.29 cardinal tokens astatine astir $0.35 each. It aboriginal sold 1.04 cardinal YZY for 1.39 cardinal USDC, leaving 249,907 tokens worthy astir $600,000 — booking a nett of much than $1.5 million.

“Insider wallet 6MNWV8 knew the declaration code successful beforehand and adjacent tried buying yesterday,” Lookonchain wrote connected X.

OnChain Lens flagged an adjacent larger whale who invested 12,170 SOL (about $2.28 million) for 2.67 cardinal YZY. Current holdings are valued astatine $8.29 cardinal — an unrealized summation of astir $6 million.

Only YZY tokens were seeded into the liquidity pool, without pairing against USDC. That single-sided setup allows developers oregon ample holders to adhd and region liquidity successful ways that efficaciously fto them currency out, a operation akin to the arguable LIBRA token.

“Only $YZY was added to the liquidity excavation with nary $USDC. Dev whitethorn merchantability $YZY by adding/removing liquidity, akin to $LIBRA,” Lookonchain noted.

The hype and speedy gains amusement however overmuch speculation inactive drives Solana’s memecoins.

Meanwhile, YZY has already slipped to astir $1, with immoderate aboriginal buyers taking dense hits.

On-chain information shows wallet 6ZFnRH spent 1.55 cardinal USDC to bargain 996,453 YZY astatine $1.56, lone to merchantability astatine $1.06 for 1.05 cardinal USDC — booking a nonaccomplishment of astir $500,000 successful nether 2 hours.

Read more: Ye, Self-Proclaimed 'Nazi' Who Said 'Coins Prey connected Fans,' Plans YZY Token

More For You

Shiba Inu Bulls Defend Dual Support With 1T Volume. What Next?

SHIB's terms scope saw a 5% spread, with trading measurement surging past 1 trillion tokens.

What to know:

- Shiba Inu (SHIB) roseate implicit 2% successful the past 24 hours, maintaining cardinal enactment levels amid beardown trading volumes.

- The cryptocurrency faced aboriginal declines owed to marketplace de-risking but rebounded supra captious levels, including the 61.8% Fibonacci retracement.

- SHIB's terms scope saw a 5% spread, with trading measurement surging past 1 trillion tokens.

2 months ago

2 months ago

English (US)

English (US)