Hi. I’m Andy Baehr with the CoinDesk Indices team. Question: Bitcoin is stuck successful a range. Is that a atrocious happening oregon a bully thing?

Even casual BTC watchers volition person noted the 10 percent transmission that has held for much than a month. As of today, successful fact, it has been 40 days since we entered the ~$101K - ~$111K range, with nary catalyst forcing a breakout done either boundary. Good oregon atrocious thing?

The macro muddle supports range-trading. Our anchor bitcoin macro origin remains expectations for aboriginal existent involvement rates--nominal rates minus inflation. Recent cross-currents make an unclear picture: ostentation expectations from surveys person been elevated (though caller releases look little concerning), portion hopes for Fed alleviation were dim until the marketplace began pricing successful 2 2025 cuts much assertively. Too muddled for a breakout. Bitcoin is doing what it should.

For the store-of-value thesis, range-trading is really fine. As bitcoin accumulates much days of "not unexpected" behavior, it supports the communicative of comparative independency from different hazard assets and improved stability. (The S&P 500 has besides kept an 8% scope done the aforesaid 39 days, truthful bitcoin isn't unsocial successful this holding pattern, though caller quality flows mightiness person knocked a younger bitcoin disconnected the track.)

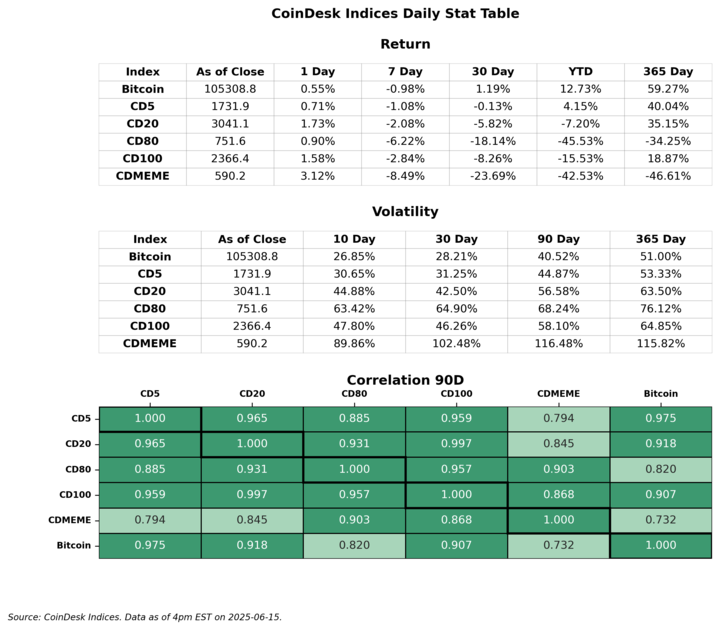

But traders are getting restless. Bitcoin's basement-level thirty-day realized volatility beneath 30% crimps opportunity. Implied vols are besides down arsenic enactment buyers turn fatigued and sellers drawback output much confidently. Like immoderate market, a scope that holds excessively agelong creates complacency—making the eventual exit much "exciting" than it would different be.

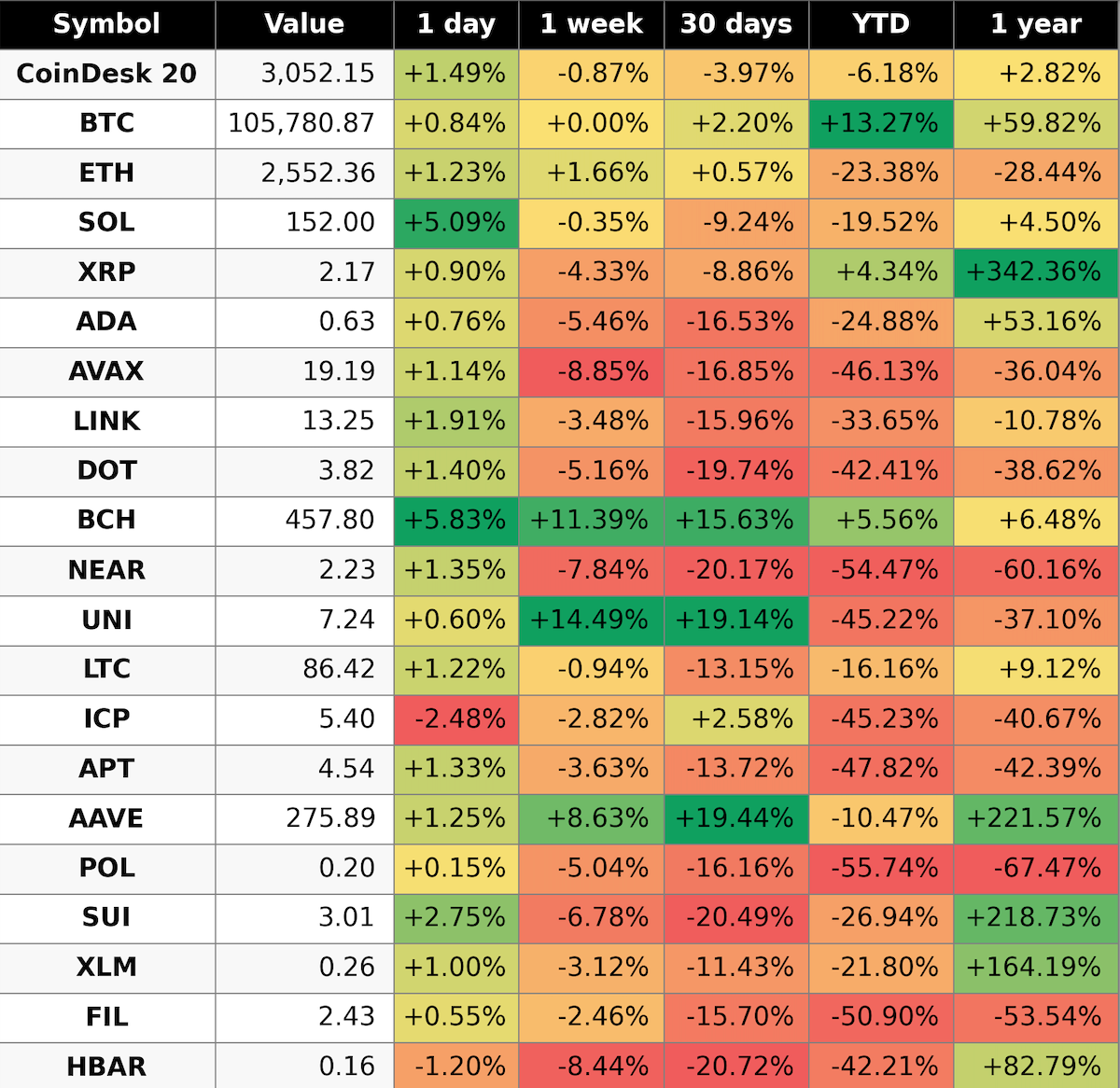

The stalled temper is hurting breadth. Without bitcoin providing leadership, different integer assets are wilting. The CoinDesk 20 Index has trailed bitcoin by astir 5% implicit the past month, arsenic the deficiency of sentiment has stalled the late-April rally, adjacent successful ETH, which had bounced strongly.

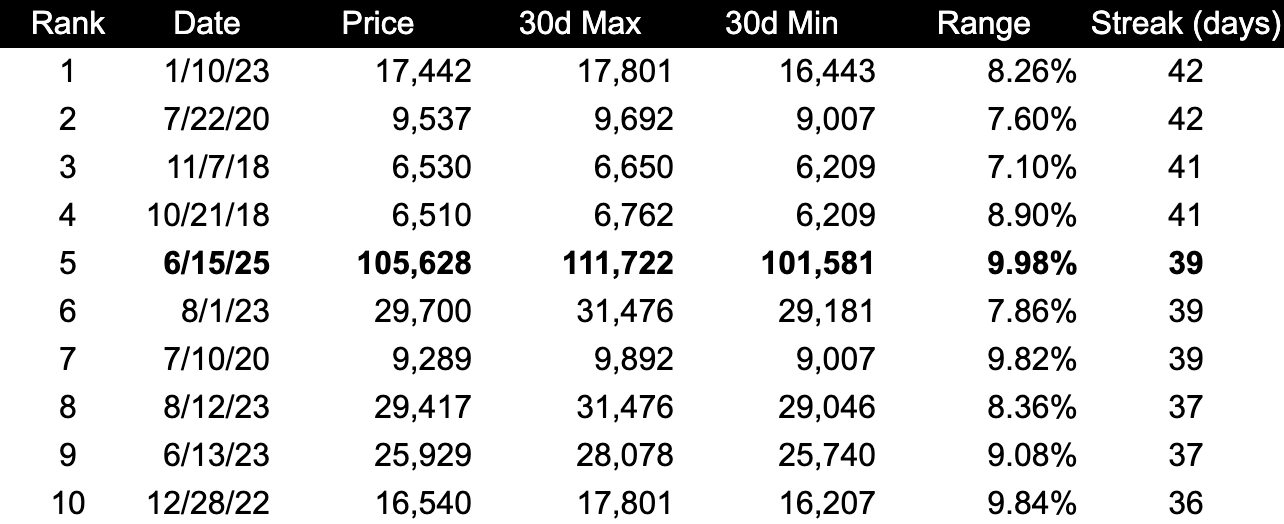

How does this comparison historically? With immoderate genuinely unattractive vibe coding (I instrumentality the blame), we studied bitcoin's longest streaks of holding 10% ranges. The existent 40-day agelong isn't the longest—that was 42 days—but it's close. Similar streaks occurred successful 2018, 2020, and 2023. Given bitcoin's evolved ownership operation (ETFs, MSTR) and much accessible spot and derivatives markets, would a 50-day streak astonishment anyone? Not sure.

4 months ago

4 months ago

English (US)

English (US)