“We judge the Trust’s astir 1 cardinal investors merit this just playing tract arsenic rapidly arsenic possible,” Grayscale’s lawyers wrote to the regulator.

1587 Total views

28 Total shares

Grayscale has told the Securities and Exchange Commission it has nary ineligible reasoning near to artifact the conversion of the plus manager’s flagship Bitcoin (BTC) money to a spot exchange-traded money (ETF).

On Sept. 5, Grayscale’s lawyers sent a missive to the SEC requesting the brace conscionable to sermon the adjacent steps pursuing the regulator’s tribunal nonaccomplishment regarding the conversion of the Grayscale Bitcoin Trust (GBTC).

“Now that the Court of Appeals has spoken, determination is nary disposable rationale that would separate a Bitcoin futures ETP from a spot Bitcoin ETP nether the ineligible investigation antecedently adopted by the Commission successful rejecting spot Bitcoin ETPs.”Grayscale added it believes the SEC should reason determination are “no grounds" for treating the GBTC otherwise from Bitcoin futures ETFs whose filings “the Commission has antecedently approved.”

On Aug. 29, a United States Appeals Court ruled against the SEC’s denial of Grayscale’s exertion to person its GBTC to a spot Bitcoin ETF.

Screenshot of the missive sent to the SEC by Grayscale’s retained instrumentality steadfast Davis Polk. Source: Grayscale

Screenshot of the missive sent to the SEC by Grayscale’s retained instrumentality steadfast Davis Polk. Source: GrayscaleGrayscale said if determination was immoderate different crushed for rejecting the conversion too the Exchange Act’s request that rules beryllium “designed to forestall fraudulent and manipulative acts and practices,” it would person already been made apparent.

“We are assured that it would person surfaced by present successful 1 of the 15 Commission orders that rejected spot Bitcoin filings adjacent aft Bitcoin futures ETPs began trading,” Grayscale wrote.

Grayscale added its money conversion exertion has been pending for astir 3 times longer than the magnitude of clip stipulated by the SEC’s rules.

Joseph A. Hall — who besides penned Grayscale’s missive successful July urging the SEC to o.k. each pending ETF applications unneurotic — concluded his latest missive by saying:

“We judge the Trust’s astir 1 cardinal investors merit this just playing tract arsenic rapidly arsenic possible.”Related: Grayscale wins the tribunal battle, but what does this mean for a spot Bitcoin ETF?

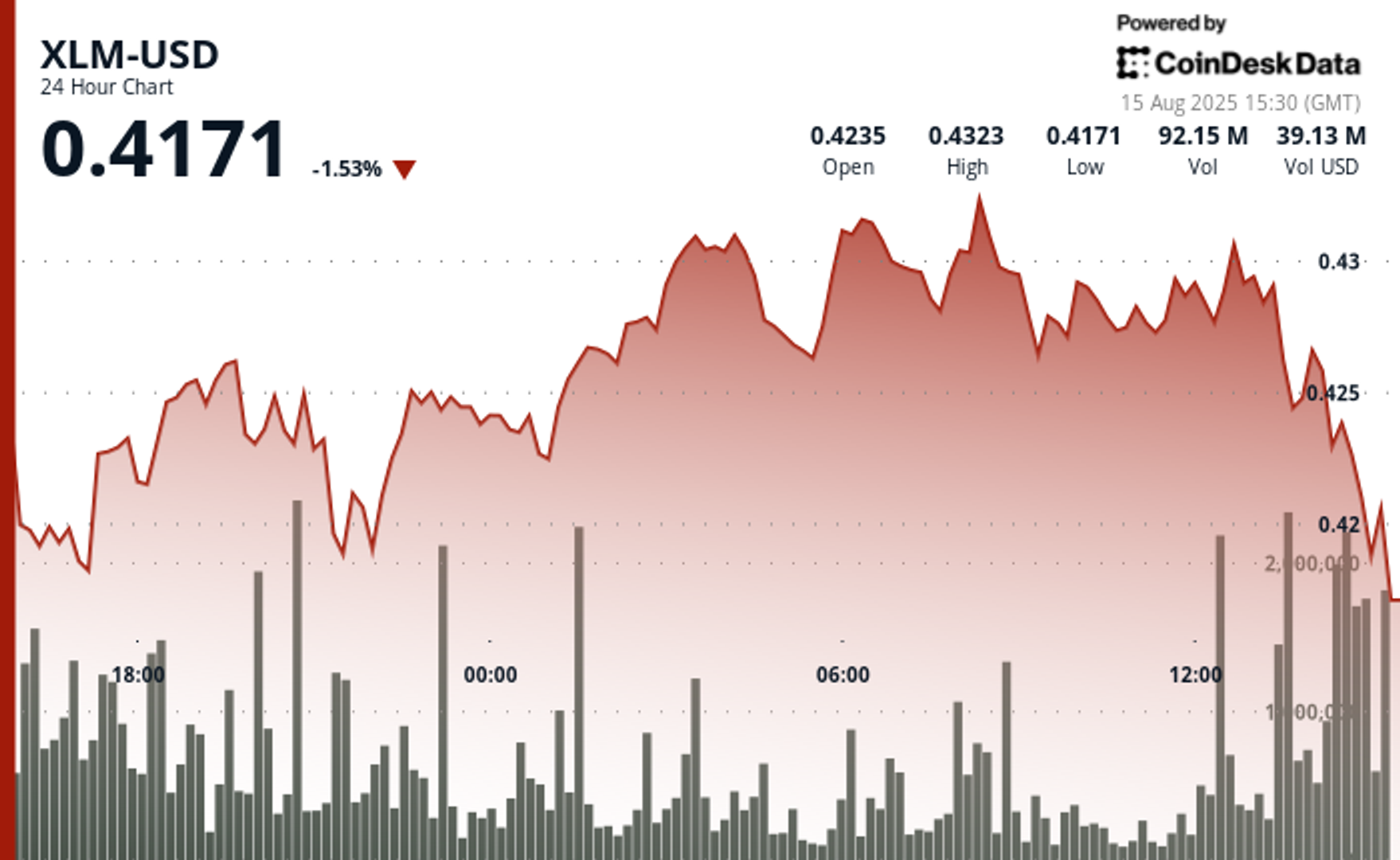

Since the Aug. 29 tribunal ruling, the GBTC discount — the percent showing however acold disconnected an ETF is trading supra oregon beneath its nett plus worth — has fallen to 19.9%.

GBTC’s discount was nearing antagonistic 50% during the carnivore rhythm bottommost pursuing the FTX illness successful December 2022.

Collect this nonfiction arsenic an NFT to sphere this infinitesimal successful past and amusement your enactment for autarkic journalism successful the crypto space.

1 year ago

1 year ago

English (US)

English (US)