Hive Digital’s fiscal Q1 2026 gross jumped 44.9% successful its mining conception and astir 60% successful its HPC unit.

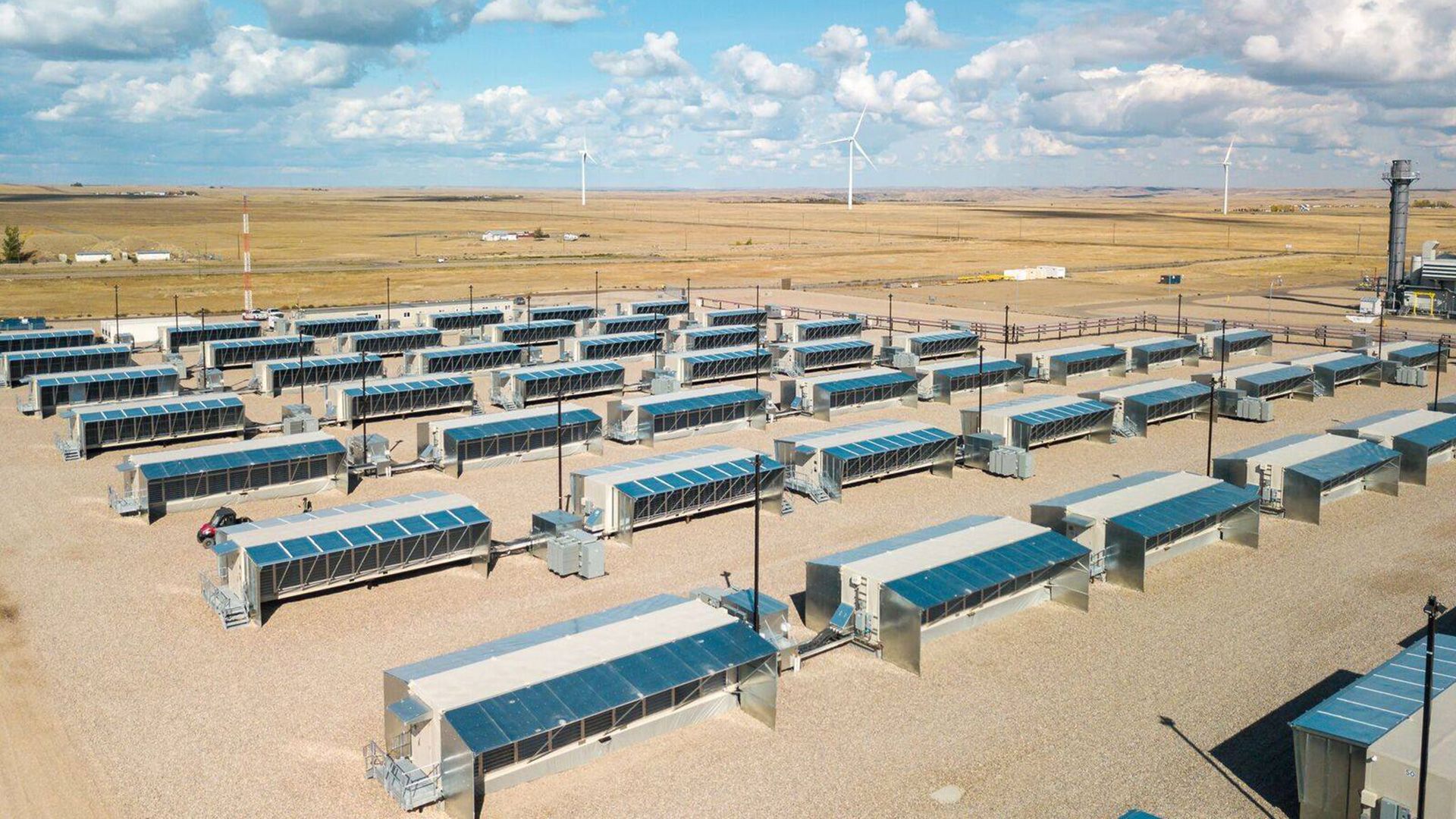

Hive Digital, a Bitcoin miner turned information halfway infrastructure provider, reported grounds gross and net successful its fiscal archetypal quarter, driven by beardown maturation successful high-performance computing (HPC) hosting services alongside its halfway mining business.

In its fiscal Q1 2026, Hive generated $45.6 cardinal successful full revenue. Digital currency mining contributed $40.8 million, up 44.9% from the erstwhile quarter, arsenic the institution mined 406 Bitcoin (BTC) — a 34% summation quarter-over-quarter. Bitcoin’s rising worth further supported the company’s performance.

Revenue from its HPC division, operating nether the Buzz HPC brand, roseate 59.8% sequentially to a grounds $4.8 million.

On an adjusted basis, net totaled $44.6 million.

Although mining remains Hive’s superior gross driver, the institution is progressively leveraging precocious AI chips to grow its HPC business. Executives Frank Holmes and Aydin Kilic told Cointelegraph that they purpose for the HPC conception to scope a $100 cardinal yearly tally complaint by adjacent year.

Company shares were down somewhat pursuing the net report, with HIVE past seen trading astir $2.20.

Hive isn’t the lone Bitcoin miner benefiting from the crypto bull market. Last week, CleanSpark reported grounds gross and profits, boosted by surging BTC prices.

Similarly, past period MARA Holdings posted a crisp gross increase, driven by higher Bitcoin valuations and expanded mining operations.

Related: Bitcoin miners and AI firms vie for inexpensive sustainable energy

Bitcoin mining industry’s AI pivot continues

Hive was among the archetypal Bitcoin miners to repurpose portion of its infrastructure for HPC and AI — a inclination that has lone accelerated crossed the industry.

Earlier this week, TeraWulf announced a $3.7 cardinal AI hosting agreement with Fluidstack, an AI infrastructure provider, with Google backing Fluidstack’s lease obligations. In return, Google received 41 cardinal TeraWulf shares arsenic portion of the deal.

Core Scientific is simply a salient illustration of a Bitcoin miner whose pivot to AI revived its struggling concern aft filing for Chapter 11 bankruptcy during the past crypto carnivore market. The institution was later acquired by CoreWeave successful a $9 cardinal deal.

Hut 8 has deployed implicit 1,000 Nvidia H100 GPUs arsenic portion of its enlargement into cloud-based AI computing. In its latest quarterly net report, the institution said it is moving to “commercialize AI information halfway opportunities.”

Related: Jack Dorsey’s Block targets 10-year lifecycle for Bitcoin mining rigs

2 months ago

2 months ago

English (US)

English (US)