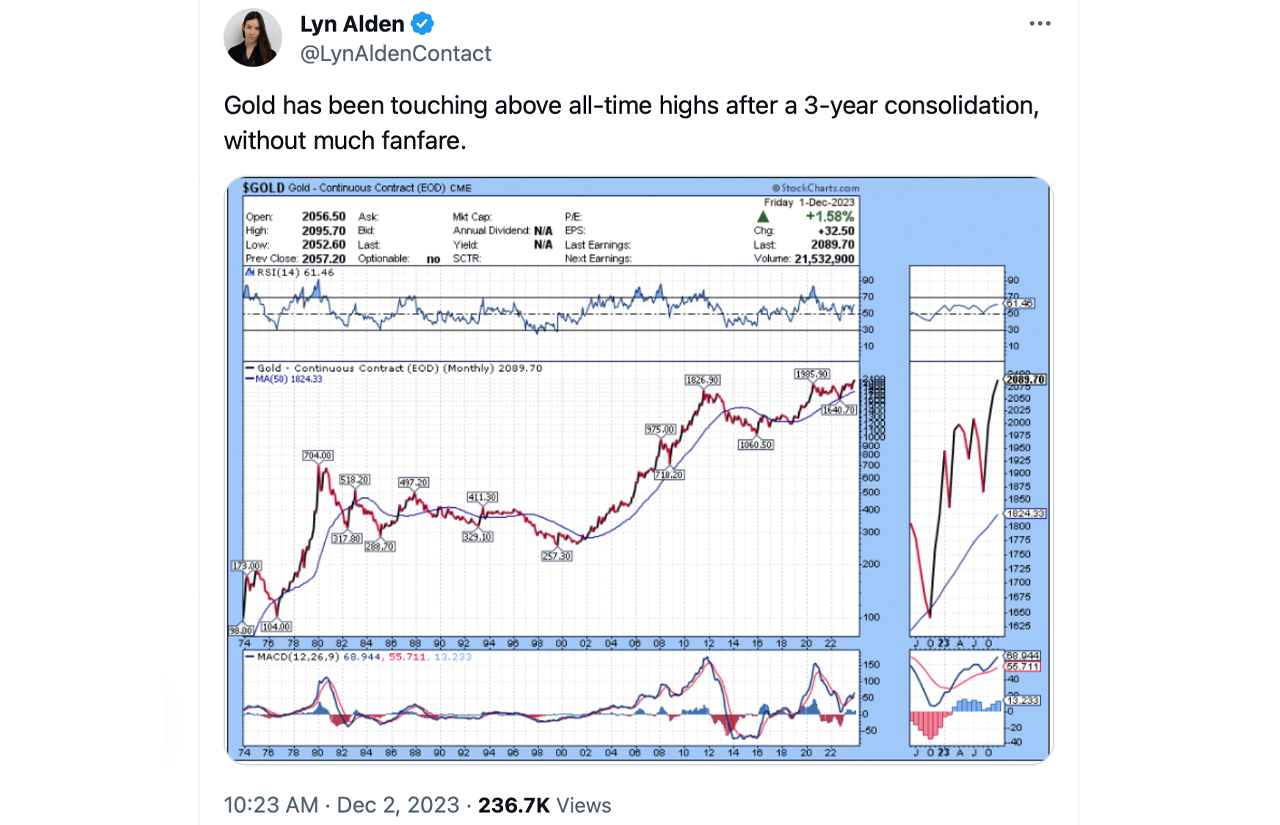

The terms of an ounce of axenic golden has approached its highest humanities level this weekend, reaching $2,071 per ounce. This highest astir matches its grounds 3 years agone connected August 7, 2020, erstwhile during the Covid-19 pandemic, spot golden prices soared to an unprecedented precocious of $2,072.50 per ounce.

Gold Flirts With Lifetime Price High Amid Economic Unrest

Amid U.S. equities ending Friday connected a affirmative enactment and a surge successful the crypto economy’s value, the outgo of a azygous ounce of golden is connected the verge of surpassing its humanities peak. Currently, golden is trading astatine $2,071.88 per ounce, conscionable a fractional 0.029% beneath its all-time precocious acceptable connected August 7, 2020.

During the tallness of the Covid-pandemic’s uncertainty and ensuing lockdowns successful 2020, concerns astir the economy’s aboriginal mounted. On August 7 of that year, golden reached its intraday zenith, hitting $2,072.50 per ounce.

Today, arsenic the planetary system grapples with ongoing uncertainty, golden prices are mirroring these concerns, drafting investors to this accepted safe-haven asset. While the strength of the Covid-19 situation has diminished, China is present grappling with a surge successful mysterious respiratory diseases, including mycoplasma pneumonia.

This alarming summation successful cases has led the World Health Organization (WHO) to petition much details astir the outbreak. Moreover, the ongoing planetary tensions, including the conflicts betwixt Russia and Ukraine and betwixt Israel and Hamas, person heightened planetary economical uncertainty, further enhancing the entreaty of golden arsenic a invaluable asset.

Furthermore, successful the U.S., the Federal Reserve’s strategy of expanding involvement rates to tackle ostentation has resulted successful higher involvement rates and marketplace volatility, thereby heightening fears of a recession. Moreover, output curve metrics, peculiarly the examination betwixt the 10-year and 3-month Treasury rates, a traditionally close forecaster of recessions, suggest a important likelihood of a recession occurring wrong the adjacent year.

A operation of unpredictable events, geopolitical unrest, and planetary economical slowdowns person propelled golden prices to their existent levels. This surge is besides supported by significant demand for golden from cardinal banks globally. While golden has seen a 1.73% increase successful the past 24 hours, metallic has not reached its humanities highest and has lone experienced a humble 0.65% rise during the aforesaid period.

Presently, silver’s terms is markedly little than its April 25, 2011, precocious of $49 per ounce. To surpass its erstwhile peak, metallic would request to witnesser a 92% increase. Technical expert Gary Wagner opines that the “rally successful golden and metallic is acold from over.” Wagner acknowledges that the contiguous economical conditions volition favour some metals, but helium predicts that “it is golden that volition proceed to summation worth astatine a overmuch greater gait than silver.”

What bash you deliberation astir gold’s terms rise? Share your thoughts and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)