Bitcoin reached a caller all-time high of $122,838 connected July 14, but has since slipped into a signifier of consolidation astir the $118,000 level. The caller intermission successful upward momentum hasn’t dampened marketplace sentiment, which remains firmly bullish. According to Coinmarketcap’s Fear & Greed Index, Bitcoin is inactive presently sitting astatine a greed level of 68. This sentiment, combined with method investigation of the Logarithmic Growth Curve (LGC), shows that Bitcoin is inactive connected way for almighty upward moves.

Greed Returns To The Market, But Not Yet Overheated

Bitcoin’s terms enactment has spent the bulk of the past 48 hours holding supra $118,000 aft a question of profit-taking took spot conscionable aft it peaked astatine $122,838. However, on-chain information shows an absorbing overview of Bitcoin investors.

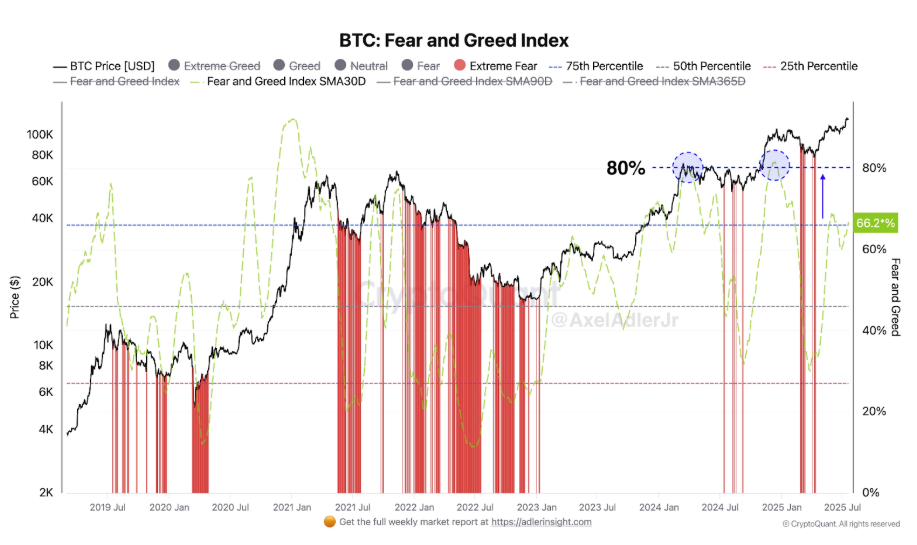

Particularly, crypto expert Axel Adler Jr. shared data from CryptoQuant showing that the 30-day moving mean of the Fear and Greed Index has climbed backmost into the optimism zone, present sitting astatine 66.2%. Although sentiment surrounding the starring cryptocurrency is presently successful greedy territory, this level is good beneath the 75% to 80% range, which coincided with caller terms highs successful March 2024 and December 2025

The existent 66% reading, portion successful the greenish level, suggests there’s inactive country for bullish sentiment to turn earlier the marketplace enters a euphoric blow-off phase. In essence, this metric shows that if Bitcoin continues to consolidate and propulsion higher without the sentiment entering into utmost greed levels betwixt 75% and 80%, it volition proceed connected a sustainable propulsion to caller heights.

Bitcoin Re-Enters Resistance Zone On Growth Curve

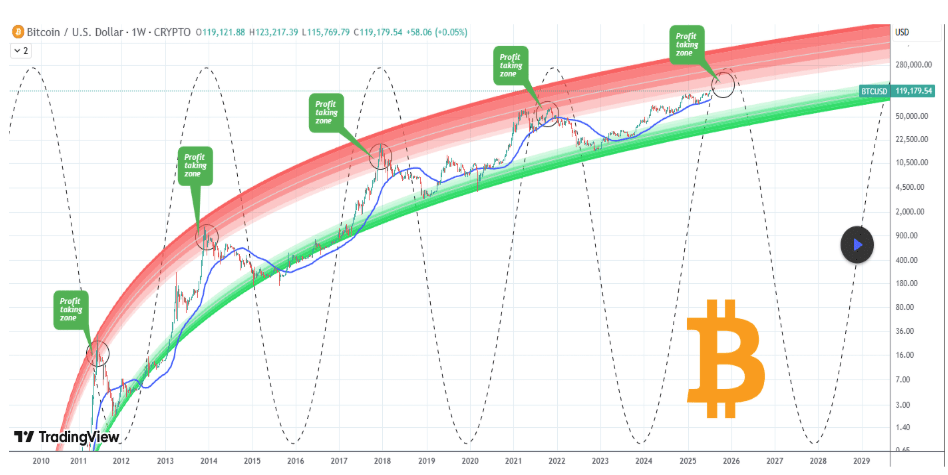

As mentioned earlier, Bitcoin’s interruption supra the $120,000 terms level and its consequent highest were followed by a question of profit-taking. The inclination saw Bitcoin’s terms close to $116,000 precise concisely earlier stabilizing astir $118,000. Interestingly, technical analysis of the play candlestick timeframe shows that Bitcoin re-entered the archetypal set of the Logarithmic Growth Curve (LGC) absorption portion arsenic it reached this terms peak.

This band, which is identified arsenic the airy pinkish portion successful the illustration below, has ever served arsenic the profit-taking country successful each of Bitcoin’s past bull markets. Interestingly, Bitcoin concisely tapped this country successful December 2024 and January 2025 earlier being rejected, successful a signifier akin to that of January 2021’s archetypal apical successful the erstwhile bull cycle.

Image From TradingView: TradingShot

Basically, this indicator implies that Bitcoin is present astatine the commencement of a last build-up phase. According to crypto expert TradingShot, who posted the investigation connected the TradingView platform, the eventual apical for this rhythm is going to beryllium betwixt October and November 2025. Depending connected the timing and spot of factors similar anticipated US complaint cuts successful September, Bitcoin’s highest could onshore anyplace betwixt $140,000 and $200,000.

At the clip of writing, Bitcoin is trading astatine $118,152.

Featured representation from Pexels, illustration from TradingView

3 months ago

3 months ago

English (US)

English (US)