Investors are counting down to the Federal Reserve’s Sept. 17 monetary argumentation decision; markets expect a quarter-point complaint chopped that could trigger short-term volatility but perchance substance longer-term gains crossed hazard assets.

The economical backdrop highlights the Fed’s delicate balancing act.

According to the latest CPI report released by the U.S. Bureau of Labor Statistics connected Thursday, user prices roseate 0.4% successful August, lifting the yearly CPI complaint to 2.9% from 2.7% successful July, arsenic shelter, food, and gasoline pushed costs higher. Core CPI besides climbed 0.3%, extending its dependable gait of caller months.

Producer prices told a akin story: per the latest PPI study released connected Wednesday, the header PPI scale slipped 0.1% successful August but remained 2.6% higher than a twelvemonth earlier, portion halfway PPI precocious 2.8%, the largest yearly summation since March. Together, the reports underscore stubborn inflationary unit adjacent arsenic maturation slows.

The labour marketplace has softened further.

Nonfarm payrolls increased by conscionable 22,000 successful August, with national authorities and vigor assemblage occupation losses offsetting humble gains successful wellness care. Unemployment held astatine 4.3%, portion labour unit information remained stuck astatine 62.3%.

Revisions showed June and July occupation maturation was weaker than initially reported, reinforcing signs of cooling momentum. Average hourly net inactive roseate 3.7% twelvemonth implicit year, keeping wage pressures alive.

Bond markets person adjusted accordingly. Per information from MarketWatch, 2-year Treasury output sits astatine 3.56%, portion the 10-year is astatine 4.07%, leaving the curve modestly inverted. Futures traders spot a 93% accidental of a 25 ground constituent cut, according to CME FedWatch.

If the Fed limits its determination to conscionable 25 bps, investors whitethorn respond with a “buy the rumor, merchantability the news” response, since markets person already priced successful relief.

Equities are investigating grounds levels.

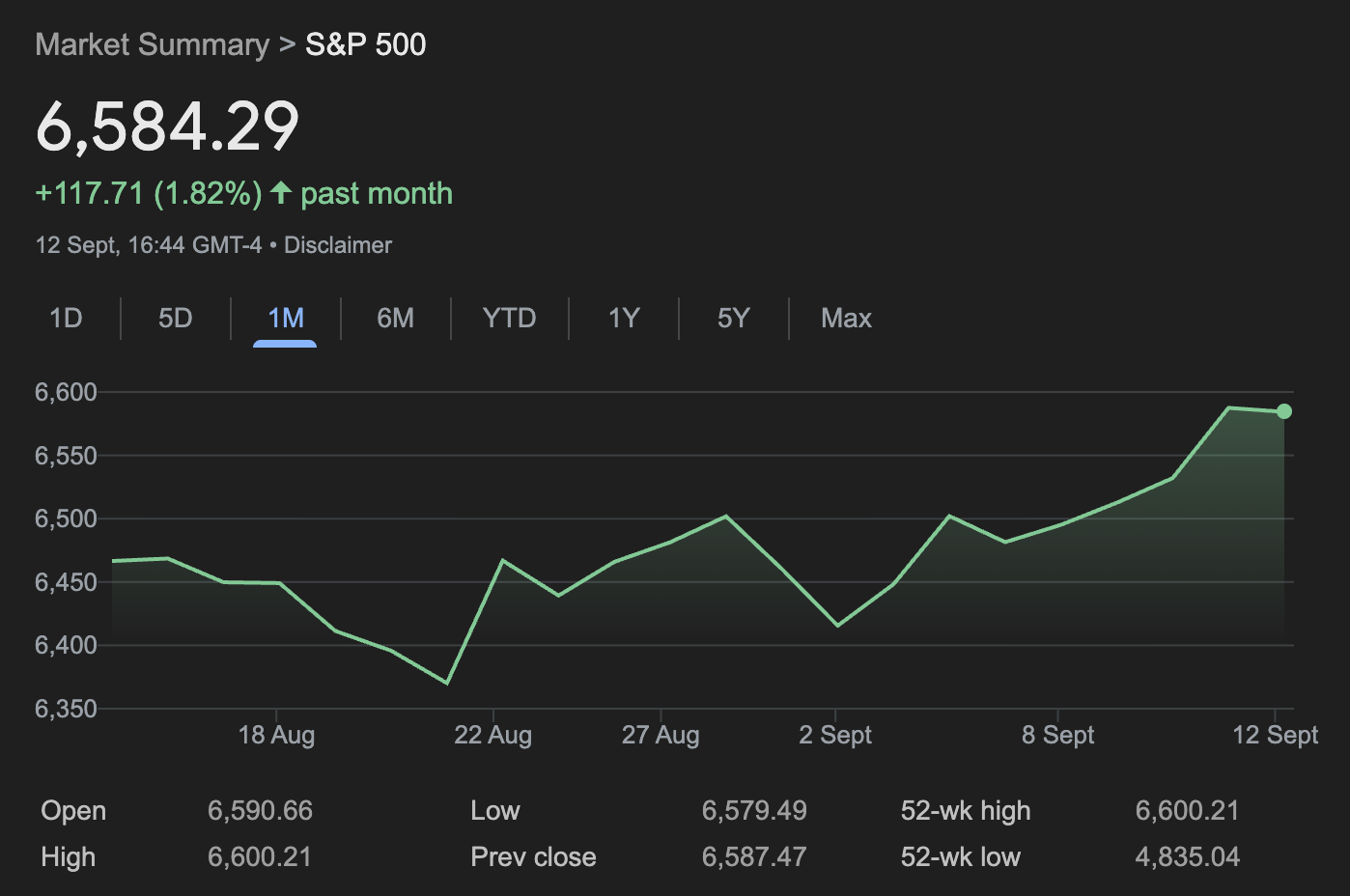

The S&P 500 closed Friday astatine 6,584 aft rising 1.6% for the week, its champion since aboriginal August. The index’s one-month illustration shows a beardown rebound from its late-August pullback, underscoring bullish sentiment heading into Fed week.

The Nasdaq Composite besides notched 5 consecutive grounds highs, ending astatine 22,141, powered by gains successful megacap tech stocks, portion the Dow slipped beneath 46,000 but inactive booked a play advance.

Crypto and commodities person rallied alongside.

Bitcoin is trading astatine $115,234, beneath its Aug. 14 all-time precocious adjacent $124,000 but inactive firmly higher successful 2025, with the planetary crypto marketplace headdress present $4.14 trillion.

Gold has surged to $3,643 per ounce, adjacent grounds highs, with its one-month illustration showing a dependable upward trajectory arsenic investors terms successful little existent yields and question ostentation hedges.

Historical precedent supports the cautious optimism.

Analysis from the Kobeissi Letter — reported successful an X thread posted Saturday — citing Carson Research, shows that successful 20 of 20 anterior cases since 1980 wherever the Fed chopped rates wrong 2% of S&P 500 all-time highs, the scale was higher 1 twelvemonth later, averaging gains of astir 14%.

The shorter word is little predictable: successful 11 of those 22 instances, stocks fell successful the period pursuing the cut. Kobeissi argues this clip could travel a akin signifier — archetypal turbulence followed by longer-term gains arsenic complaint alleviation amplifies the momentum down assets similar equities, bitcoin and gold.

The broader setup explains wherefore traders are watching the Sept. 17 announcement closely.

Cutting rates portion ostentation edges higher and stocks hover astatine records risks denting credibility, yet staying connected clasp could spook markets that person already priced successful easing. Either way, the Fed’s connection connected growth, inflation, and its argumentation outlook volition apt signifier the trajectory of markets for months to come.

1 month ago

1 month ago

English (US)

English (US)