New comments from Solmate’s Marco Santori and 2 wide followed analysts enactment the absorption connected SOL's $238 pivot and what would corroborate higher prices.

Marco Santori's comments

In an X thread, Santori, a erstwhile Kraken CLO, introduced Solmate, calling it “brand caller Solana infrastructure” for the UAE and saying helium volition beryllium CEO. He said it is aligned with the Solana Foundation, backed by UAE investors with enactment from Ark Invest, and plans bare-metal validators successful Abu Dhabi successful concern with RockawayX. He framed integer plus treasuries arsenic “capital accumulation machines” and closed, “I’m each successful connected it.”

Comments from analysts connected SOL's terms action

Analyst Rekt Capital said SOL has breached a semipermanent downtrend and is present retesting astir $238 —f ormerly large monthly absorption —a s enactment connected the play chart. He sees a palmy retest arsenic confirmation that the aged ceiling has flipped to a floor, which would support the way unfastened for attempts astatine caller all-time highs.

Trader KALEO said “$1,000+ sol isn’t a meme,” presenting four-figure prices arsenic plausible; helium did not specify timing successful the post.

CoinDesk Research's method analysis

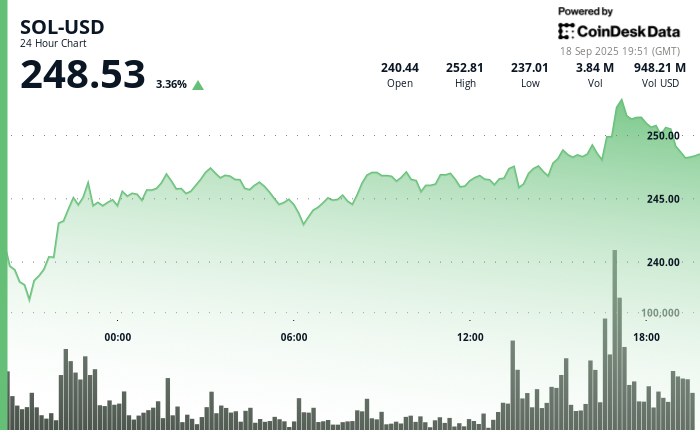

Time window. The investigation covers Sept. 17, 2025, 19:00 UTC to Sept. 18, 2025, 18:00 UTC.

What happened. During that window, SOL moved from $233.78 to $250.59 (about +7.2%), swinging astir $19.72 successful total. That tells america buyers were mostly successful power during this period.

Where buyers showed up. Around 22:00 UTC connected Sept. 17, 2025, terms pushed supra ~$245 connected overmuch heavier trading (~2.32M units). “Heavier trading” means much coins changed hands than usual.

When terms climbs connected bigger-than-normal activity, it’s a motion request is beardown capable to flooded sellers. After that push, ~$245 started acting similar a level (support) — traders were consenting to bargain dips there.

Where sellers pushed back. At 17:00 UTC connected Sept. 18, 2025, terms stalled adjacent ~$253.44 connected precise precocious trading (~2.88M units). That shows ~$253 is simply a ceiling (resistance) — galore traders chose to merchantability oregon instrumentality nett there, absorbing bargain orders.

How the model ended. Between 17:56 UTC and 18:55 UTC connected Sept. 18, 2025, terms eased from $251.55 to $250.40. That small, orderly slice aft a beardown tally is emblematic cool-off oregon consolidation — the marketplace catching its enactment alternatively than reversing trend.

Levels to watch:

- Floors (support): ~$245 first, ~$238 if ~$245 breaks. Support = areas wherever buyers person precocious stepped in.

- Ceilings (resistance): ~$252–$253 first, past ~$255–$260 if terms gets done ~$253. Resistance = areas wherever sellers person precocious pushed back.

Bottom line. Buyers defended ~$245; sellers capped ~$253. A daily/4-hour adjacent supra ~$253 (UTC) would apt invitation a propulsion toward ~$255–$260. A driblet beneath ~$245 would apt bring a cheque of $242–$243, past ~$238.

Analysis of Latest SOL-USD CoinDesk Data Charts

24-hour illustration (ending Sept. 18, 19:51 UTC): Range $237.01–$252.81; coiling supra ~$245 with a ceiling ~$252–$253. Hold ~$245 and a propulsion done ~$253 would apt people ~$255–$260; suffer ~$245 and the way is $242–$243, past ~$238.

One-month illustration (ending Sept. 18, 19:52 UTC): Uptrend of higher highs/lows (roughly $179.71 → $250.50). $238 is the pivot: supra it keeps the breakout lawsuit clean; beneath it suggests a intermission toward the debased $230s earlier different effort higher.

1 month ago

1 month ago

English (US)

English (US)