Ethereum has erstwhile again taken halfway signifier successful the crypto marketplace aft surging to a caller all-time precocious supra the $4,900 level connected Sunday. The rally, which pushed ETH into uncharted territory, highlighted the spot of bulls aft weeks of dependable organization accumulation and marketplace momentum. However, the terms did not clasp these highs for long. Ethereum has since retraced, dropping backmost to the $4,600 region, wherever bulls are present attempting to found enactment earlier the adjacent determination higher.

This pullback has sparked statement among analysts. Some presumption the retracement arsenic a motion of a imaginable section top, cautioning that ETH whitethorn necessitate a play of consolidation earlier different breakout attempt. Others, however, stay firmly bullish, pointing to beardown fundamentals and increasing organization involvement arsenic signals that Ethereum’s rally is acold from over.

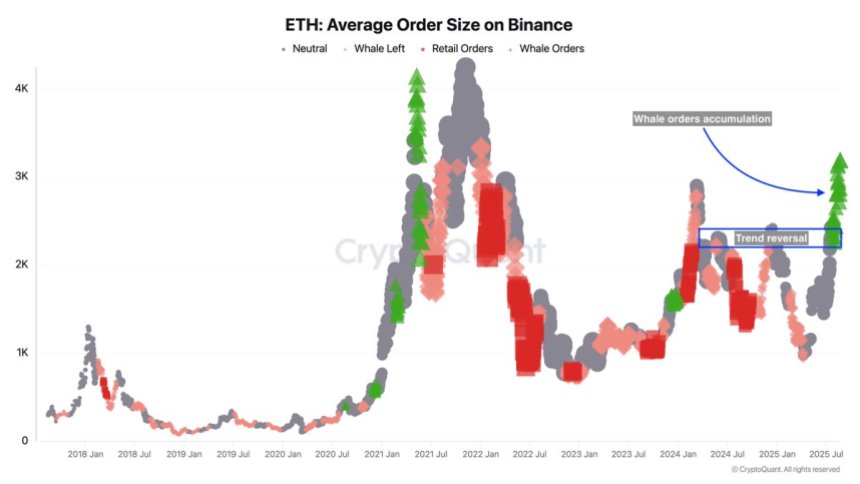

Adding value to the bullish case, cardinal on-chain information reveals that Binance whales proceed to presumption themselves heavy successful Ethereum. Large spot and futures orders attributed to these players person been flowing consistently, peculiarly aft ETH confirmed its affirmative trend. This dependable accumulation suggests assurance successful Ethereum’s semipermanent trajectory, adjacent arsenic short-term volatility continues to signifier the market’s direction.

Binance Whales Accumulate Ethereum

According to apical expert Darkfost, Ethereum’s Average Order Size connected Binance chart provides wide penetration into the behaviour of antithetic cohorts, distinguishing betwixt retail investors and whales. Since July, a important displacement has taken place: whale enactment connected Binance has surged. This reflects a increasing inclination of large-scale accumulation, with whale-sized spot and futures orders continuing to travel into the marketplace arsenic ETH edges person to the $5,000 mark.

Ethereum Average Order Size connected Binance | Source: Darkfost

Ethereum Average Order Size connected Binance | Source: DarkfostWhat makes this inclination peculiarly noteworthy is the timing of whale participation. Unlike retail investors, who often effort to bargain aboriginal and thrust imaginable upside, whales thin to similar entering erstwhile a bullish inclination has been confirmed.

Darkfost highlights that this signifier is evident now, arsenic whale orders began accelerating lone aft Ethereum reversed its earlier downtrend and regained beardown bullish momentum. This validates the thought that ample players question reduced hazard and clearer confirmation earlier allocating superior astatine scale.

With some retail and organization participants aligning, the coming weeks could beryllium decisive successful determining whether ETH firmly breaks into caller terms discovery. If whales proceed to bargain astatine this pace, Ethereum’s rally could widen acold beyond its 2021 highs.

Testing Critical Support Level

Ethereum (ETH) is presently trading astir $4,598 aft a crisp retracement from its caller all-time precocious adjacent $4,900. On the 4-hour chart, the operation shows that ETH is inactive maintaining a bullish trend, though momentum has cooled aft past week’s explosive rally.

ETH retraces to cardinal request aft reaching ATH | Source: ETHUSDT illustration connected TradingView

ETH retraces to cardinal request aft reaching ATH | Source: ETHUSDT illustration connected TradingViewThe 50 SMA ($4,455) and 100 SMA ($4,435) are present converging conscionable beneath existent terms levels, acting arsenic contiguous dynamic support. This clump strengthens the bullish outlook arsenic agelong arsenic ETH tin stay supra it. A deeper driblet toward the 200 SMA ($4,068) would awesome a broader correction signifier and perchance widen the consolidation earlier different propulsion higher.

The caller pullback shows that sellers are progressive adjacent the $4,900–$5,000 region, which present forms a captious resistance. A breakout supra this level would unfastened the way to uncharted territory and apt accelerate momentum, with targets perchance stretching toward $5,200 and beyond.

On the downside, nonaccomplishment to clasp the $4,450–$4,400 enactment country could displacement sentiment bearish successful the abbreviated term, with traders eyeing $4,200 arsenic the adjacent cardinal request zone.

Featured representation from Dall-E, illustration from TradingView

3 months ago

3 months ago

English (US)

English (US)