Ethereum is inactive struggling beneath $3,000 contempt the Bitcoin terms sitting adjacent to all-time highs. At the existent levels, Ethereum continues to look incredibly bearish, with sell-offs dominating the marketplace astatine this level. While piling shorts are pointing to a imaginable alleviation rally, determination is besides the anticipation that the terms volition clang backmost down from here. Crypto expert Weslad maps retired the ETH terms trajectory utilizing the ABCDE question structure, showing a imaginable clang beneath $2,000.

The Bullish Ethereum Scenario

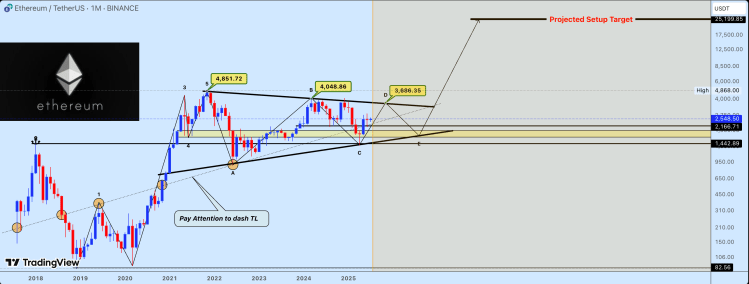

Weslad points to the 2021 Ethereum highest erstwhile the terms reached $4,851 arsenic the constituent erstwhile a large-scale symmetrical pennant had formed for the integer asset. Interestingly, this has continued for aggregate years already, and continues to play retired adjacent successful 2025, 4 years later. So far, the expert believes that the altcoin has been successful a long-term accumulation phase successful a defined corrective range.

Another important improvement is the enactment of an ABCDE question pattern. This signifier often predicts peaks and troughs, and depending connected wherever the plus is successful the pattern, it could constituent to a betterment oregon a crash. Presently, the crypto expert puts the Ethereum terms arsenic being determination successful a D wave, which is still bullish for the price.

“Currently, terms enactment is processing adjacent constituent D, approaching the precocious bound of the pennant, a important country that could specify the adjacent directional move,” the expert said. If this D question plays retired arsenic expected, past the Ethereum terms is expected to really surge from here. The apical of this signifier would enactment it supra $3,500 earlier the determination is completed.

On the precocious extremity of this is the enactment of an Inverse Head and Shoulders Pattern. This signifier has seen the $2,855 acting arsenic cardinal resistance, beating the Ethereum terms down aggregate times this year. However, if a sustained interruption is achieved supra this level, successful conjunction with a breakout from Wave D, past it is imaginable that the terms does rally to caller all-time highs supra $6,000.

Source: TradingView.com

Source: TradingView.comThe Bearish Scenario

While the enactment of the ABCDE question number points to immoderate bullishness for the Ethereum price, determination is inactive the anticipation that the terms could spell successful the other direction. For example, aft the D question is completed, comes the adjacent question successful the sequence, which is the E wave, and this is simply a bearish wave.

As the crypto expert explains, a temporary rejection astatine the neckline oregon pennant resistance would trigger an E question retracement. In this case, the Ethereum terms could spot an implicit 30% crash, putting it backmost toward the $1,400-$1,800 level, wherever determination is the astir support.

“Recent terms behaviour shows compressed volatility and accrued buying involvement connected dips, reinforcing the anticipation of an imminent directional breakout,” Weslad warned. “A decisive determination extracurricular this macro operation whitethorn people the opening of a caller signifier of semipermanent terms expansion.”

Featured representation from Dall.E, illustration from TradingView.com

5 months ago

5 months ago

English (US)

English (US)