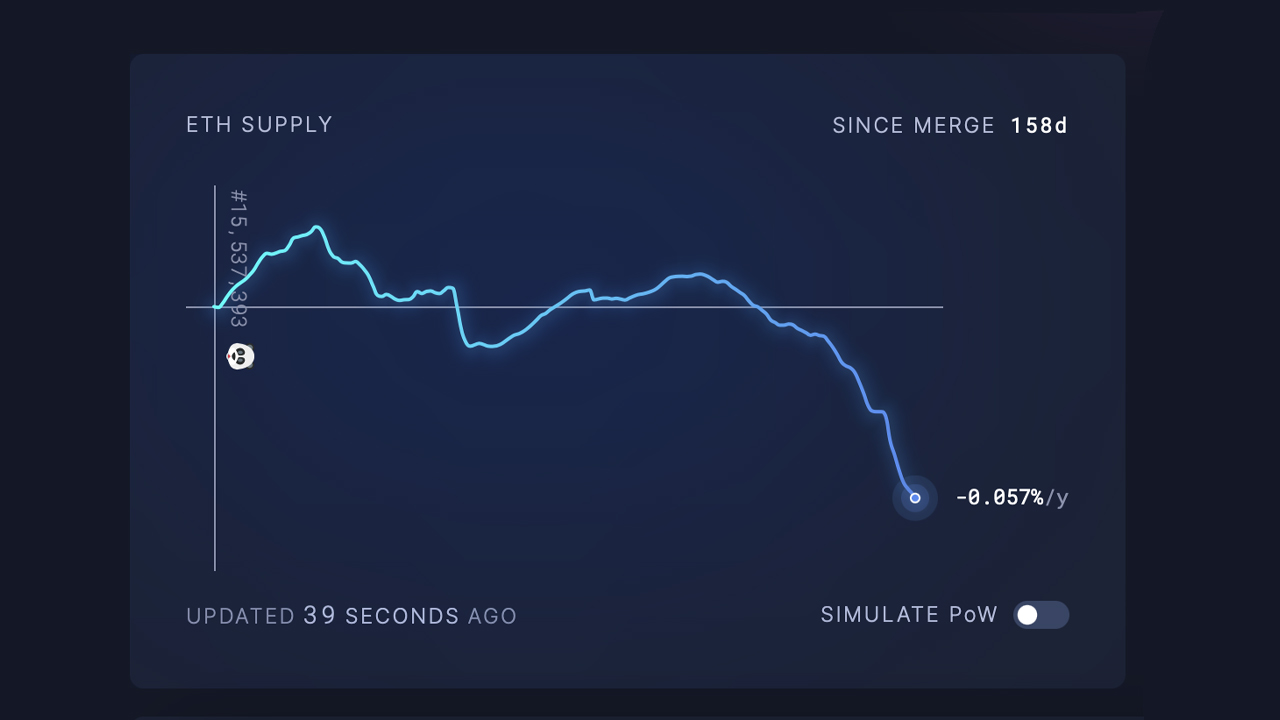

After the modulation from proof-of-work (PoW) to proof-of-stake (PoS), Ethereum’s yearly issuance complaint has been reduced to antagonistic 0.057%, according to statistic 158 days aft The Merge. The metrics bespeak that much ethereum tokens person been removed than issued, and if the concatenation were inactive nether PoW consensus, 1,823,678 ether would person been minted to date.

Ethereum’s Negative Annual Issuance and Unlocked Ether successful March Could Shift Equilibrium

Statistics from the analytics website ultrasound.money amusement that the Ethereum web is deflationary these days. More than 1.023 cardinal ether is removed from circulation annually, according to metrics pursuing the London hard fork’s implementation of EIP-1559. Since the modulation from proof-of-work (PoW) to proof-of-stake (PoS) known arsenic The Merge, the existent yearly issuance complaint is antagonistic 0.057% oregon -29,797 ether.

Data from the analytics website ultrasound.money shows Ethereum’s issuance complaint is presently -0.057% per annum connected Feb. 20, 2023.

Data from the analytics website ultrasound.money shows Ethereum’s issuance complaint is presently -0.057% per annum connected Feb. 20, 2023.The information shows that much ethereum (ETH) is presently being removed from circulation than is being issued. If Ethereum were inactive utilizing PoW, the issuance complaint would summation by astir 3.49% annually. As of 10:30 a.m. (ET) connected Feb. 20, 2023, information indicates that 1,823,678 ethereum tokens would person been added to the fig of coins successful circulation nether PoW consensus. As of 10:55 a.m. (ET) connected the aforesaid day, astir 120,491,331 ethereum (ETH) tokens are successful circulation.

At that aforesaid time, 16,763,815 ether is locked into the Beacon concatenation contract, and erstwhile the Shanghai update occurs successful March, galore of those coins could beryllium released from their locked state. The locked ether represents $28.61 cardinal of the second-largest cryptocurrency’s $205.77 cardinal marketplace valuation, oregon 13.91% of the circulating proviso and marketplace value. According to statistic from ultrasound.money, Ethereum’s existent yearly issuance rewards are 4.1%, and the pain complaint for non-stakers is 1.8% per year.

Tags successful this story

Altcoins, Annual Issuance Rate, Beacon Chain, Blockchain, Burn Rate, Change, circulating supply, crypto assets, Cryptocurrency, Cryptography, Decentralized, deflation, deflationary, EIP-1559, ETH issuance rate, Ethereum, future, inflation, inflation rate, issuance, issuance rate, Locked Ether, London Hard Fork, Market Valuation, merge, metrics, Non-Stakers, PoS, PoW, Proof of Work, Proof-of-Stake, Rewards, Shanghai Update, Smart Contracts, The Merge, Tokens, Ultra Sound Money, ultrasound money

What bash you deliberation the aboriginal holds for Ethereum’s issuance complaint and circulating proviso arsenic the web continues to modulation to proof-of-stake and instrumentality updates similar the upcoming Shanghai update? Share your thoughts successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Editorial photograph credit: ultrasound.money

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)