Fresh information from Binance shows that Ethereum (ETH) mean bid size has been trending upward since precocious July 2025, signaling a structural displacement successful marketplace dynamics. Analysts accidental the cryptocurrency’s caller rally is mostly driven by Binance whales.

Ethereum Rally Driven By Large-Scale Binance Orders

According to a CryptoQuant Quicktake station by contributor Crazzyblockk, Ethereum whales are present dominating bid flows connected the Binance exchange. The expert highlighted the mean ETH bid size connected the level arsenic evidence.

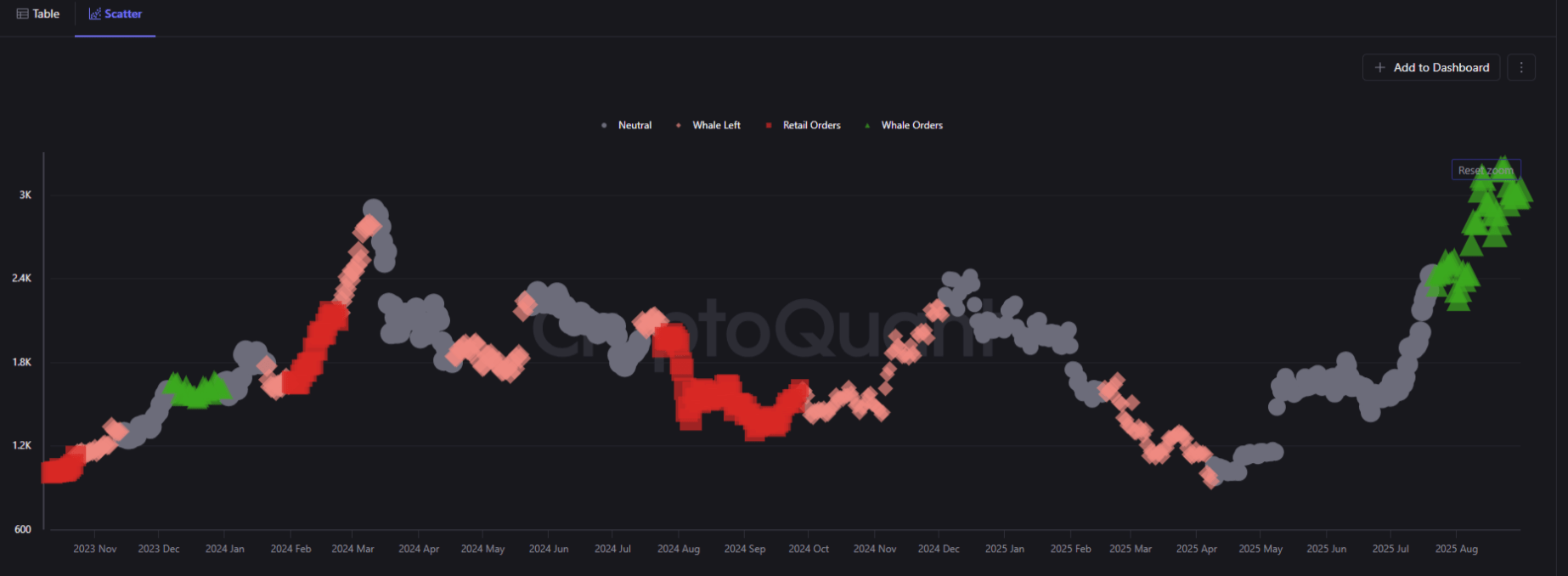

Crazzyblockk shared the pursuing illustration showing antithetic phases of mean ETH bid size connected Binance. Retail-driven phases, highlighted successful red, dominated overmuch of 2023–24, erstwhile tiny orders drove up ETH’s terms but near it susceptible to corrections.

The illustration shows an summation successful Ethereum mean bid size since mid-July | Source: CryptoQuant

The illustration shows an summation successful Ethereum mean bid size since mid-July | Source: CryptoQuantThese retail-driven periods were followed by neutral phases, shown successful gray, which reflected indecision among ETH investors. This signifier was characterized by fragmented information and sideways trading behavior.

Fast-forward to mid-2025, whale orders – highlighted successful greenish – are firmly successful control. Average bid sizes person present surged past $3,000 per trade, signaling accumulation by organization and large-scale investors.

The CryptoQuant expert noted that this whale dominance reflects renewed organization assurance successful ETH, aligning with its accelerated terms appreciation successful caller months. Larger mean orders suggest less fragmented trades and stronger directional conviction.

Binance was chosen for the investigation not lone arsenic the world’s largest speech but besides due to the fact that it is the “epicenter of ETH superior flow.” Crazzyblockk concluded:

ETH’s latest rally isn’t conscionable retail speculation – it’s being powered by whales connected Binance. With large-scale players mounting the tone, Ethereum’s marketplace operation looks progressively robust, and Binance remains the hub wherever these decisive flows signifier terms performance.

Is ETH Getting Ready For A Rally?

While Bitcoin (BTC) has tumbled 4.1% implicit the past 30 days, ETH is up 23.4% successful the aforesaid period, indicating that large-scale investors whitethorn beryllium successful the mediate of superior rotation from BTC to ETH implicit the past month.

Analysts predict ETH whitethorn person further country to turn for the remainder of 2025. Ethereum contracts are seeing a crisp resurgence successful 2025, mounting the signifier for a imaginable rally to a caller all-time precocious (ATH) of $5,000 towards the extremity of the year.

Ethereum fundamentals are besides strengthening, with arsenic overmuch arsenic 36 cardinal ETH staked connected the blockchain, raising the anticipation of a proviso crunch. That said, contempt whale accumulation, immoderate analysts caution that ETH could dip to $4,000. At property time, ETH trades astatine $4,316, down 2.8% successful the past 24 hours.

Ethereum trades astatine $4,316 connected the regular illustration | Source: ETHUSDT connected TradingView.com

Ethereum trades astatine $4,316 connected the regular illustration | Source: ETHUSDT connected TradingView.comFeatured representation from Unsplash, charts from CryptoQuant and TradingView.com

3 months ago

3 months ago

English (US)

English (US)