Ethereum is approaching a pivotal infinitesimal arsenic it pushes to reclaim the $2,600 level, aiming to interruption escaped from weeks of sideways action. After trading wrong a choky scope since aboriginal May, ETH is present investigating the precocious bound of its consolidation zone, a determination that could people the commencement of a caller bullish signifier for the world’s second-largest cryptocurrency.

Market participants are intimately watching this level, arsenic a palmy breakout supra $2,600 would apt pull momentum buyers and corroborate renewed spot crossed the altcoin sector. However, the breakout is acold from guaranteed. If bulls neglect to prolong this move, Ethereum could look renewed selling pressure, with terms perchance revisiting little enactment zones.

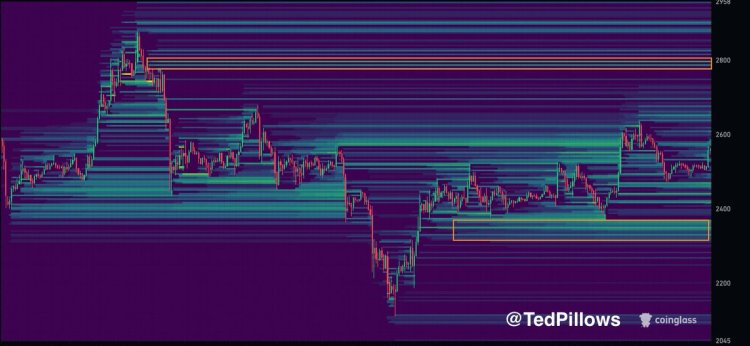

According to Coinglass data, liquidity clusters are intelligibly defined astatine $2,800 and $2,350. These levels volition apt enactment arsenic magnets successful the coming days, depending connected however Ethereum responds to existent resistance. A cleanable interruption toward $2,800 would corroborate bullish intent and broader altcoin surges, portion a rejection could reenforce bearish sentiment.

Ethereum’s Next Move Could Ignite Altseason

Altcoins stay astir 50% beneath their all-time highs, but bullish momentum is softly building. Ethereum, the person of the altcoin market, has been consolidating successful a well-defined scope betwixt $2,400 and $2,700 since aboriginal May. This prolonged sideways enactment has kept overmuch of the altcoin assemblage successful a authorities of indecision. Now, traders and analysts agree: Ethereum indispensable interruption retired to pb the adjacent large move.

Market expert Ted Pillows identifies 2 cardinal liquidity levels for ETH: $2,800 connected the upside and $2,350 connected the downside. These zones correspond the astir apt destinations for terms successful the abbreviated term, depending connected which broadside of the scope breaks first. If Ethereum pushes supra $2,800 with strength, it would apt trigger renewed hazard appetite and a broad-based altcoin rally. On the different hand, a breakdown beneath $2,350 could pb to deeper corrections crossed the board.

Ethereum liquidity vigor representation | Source: Ted Pillows connected X

Ethereum liquidity vigor representation | Source: Ted Pillows connected XSo far, bulls person defended the $2,500 level well, and increasing unfastened involvement suggests that investors are positioning for an expansion. A decisive breakout successful either absorption volition resoluteness weeks of consolidation and find the short-term trend. Until then, Ethereum remains the gatekeeper of altcoin momentum—its adjacent determination could specify the way for the full market.

ETH Tests Resistance Amid Range-Bound Structure

Ethereum is presently trading astatine $2,563, hovering conscionable beneath the $2,600 mark, a level that has acted arsenic short-term absorption passim June and aboriginal July. As shown successful the 12-hour chart, ETH has been trapped successful a horizontal consolidation operation betwixt $2,400 and $2,700, with aggregate failed attempts to interruption either broadside convincingly.

ETH consolidates wrong scope | Source: ETHUSDT illustration connected TradingView

ETH consolidates wrong scope | Source: ETHUSDT illustration connected TradingViewThe terms remains supra the 50, 100, and 200 elemental moving averages (SMAs), which is simply a affirmative awesome for bulls. The 100 SMA astatine $2,532 and the 200 SMA astatine $2,206 person offered beardown dynamic enactment during caller pullbacks, reinforcing the existent uptrend structure.

Volume remains moderate, suggesting that marketplace participants are waiting for a wide breakout earlier entering with conviction. A decisive adjacent supra $2,600 would unfastened the doorway for a determination toward $2,800, wherever ample liquidity clusters person been identified by Coinglass.

However, nonaccomplishment to support this short-term momentum could propulsion ETH backmost toward the $2,400 enactment zone. Bulls person defended this level respective times, and a interruption beneath it would apt invalidate the bullish setup and summation the hazard of a deeper correction.

Featured representation from Dall-E, illustration from TradingView

5 months ago

5 months ago

English (US)

English (US)