On-chain information shows the Ethereum Exchange Reserve has plunged by much than 1 cardinal ETH implicit the past month. What does this mean for the asset?

Ethereum Exchange Reserve Has Seen A Sharp Decline

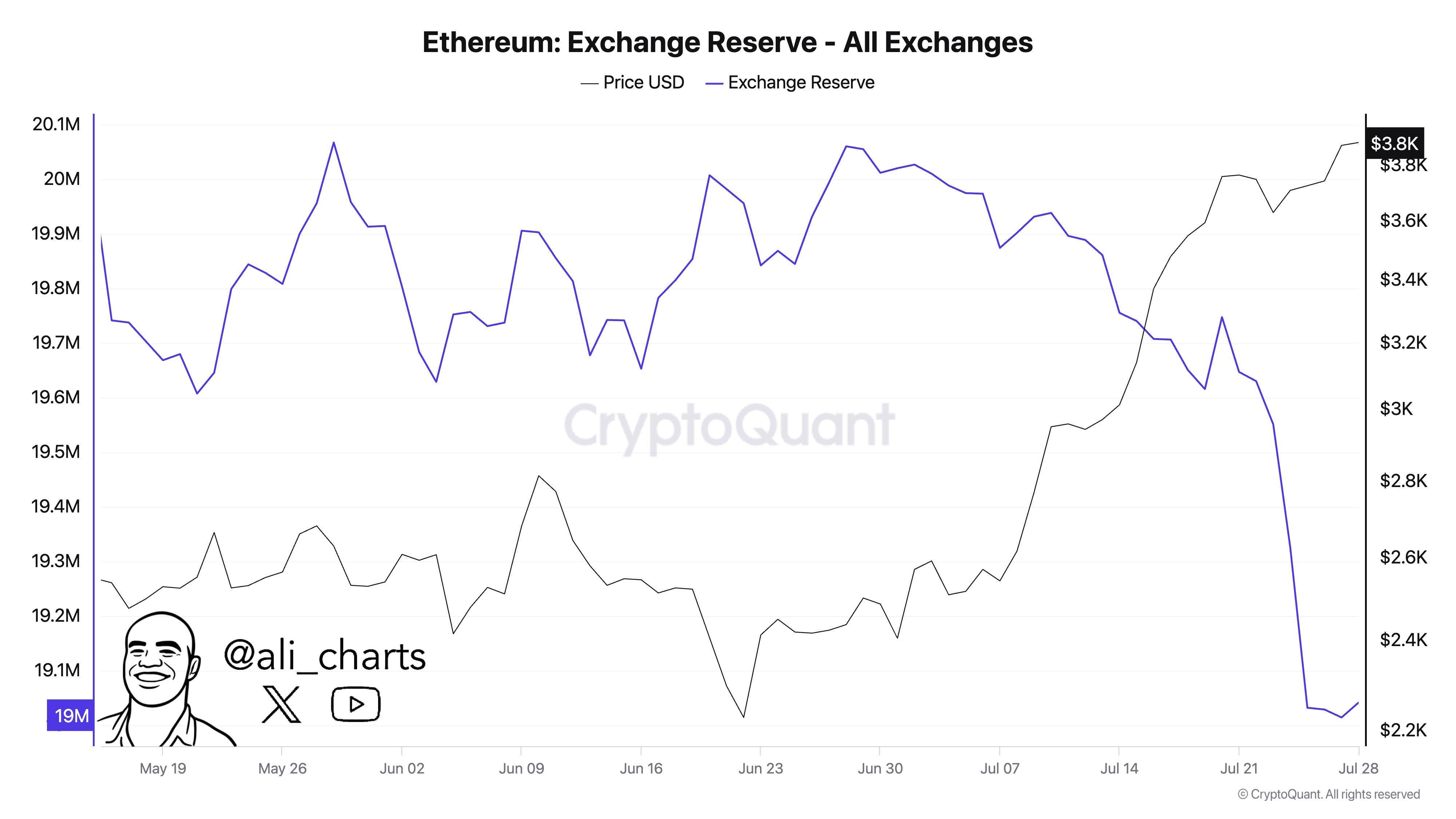

In a caller post connected X, expert Ali Martinez has talked astir the latest inclination successful the Exchange Reserve of Ethereum. The “Exchange Reserve” present refers to an on-chain indicator that keeps way of the full magnitude of ETH that’s sitting successful the wallets associated with centralized exchanges.

When the worth of this metric goes down, it means the investors are withdrawing a nett fig of coins from these platforms. Generally, holders instrumentality their coins to self-custodial wallets erstwhile they program to clasp into the agelong term, truthful specified a inclination tin beryllium a bullish motion for the cryptocurrency.

On the different hand, the indicator’s worth observing a diminution suggests the inflows into exchanges outweigh the outflows. As 1 of the main reasons wherefore investors usage exchanges is for selling-related purposes, this benignant of inclination could beryllium bearish for the asset’s price.

Now, present is the illustration shared by the expert that shows however the Exchange Reserve for Ethereum has changed during the past fewer months:

The worth of the metric appears to person plummeted precocious | Source: @ali_charts connected X

The worth of the metric appears to person plummeted precocious | Source: @ali_charts connected XAs displayed successful the supra graph, the Ethereum Exchange Reserve has seen a crisp driblet recently, implying the investors person withdrawn a ample magnitude of the asset.

More specifically, the holder person taken retired much than 1 cardinal tokens of the cryptocurrency (worth astir $3.8 cardinal astatine the existent price) from the exchanges implicit the past month.

Alongside this withdrawal spree, the ETH terms has enjoyed a bull rally beyond the $3,800 level, indicating that the accumulation question could beryllium a driving origin down it. The Exchange Reserve whitethorn beryllium to support an oculus connected now, arsenic wherever it heads adjacent could besides extremity up having an effect connected the asset.

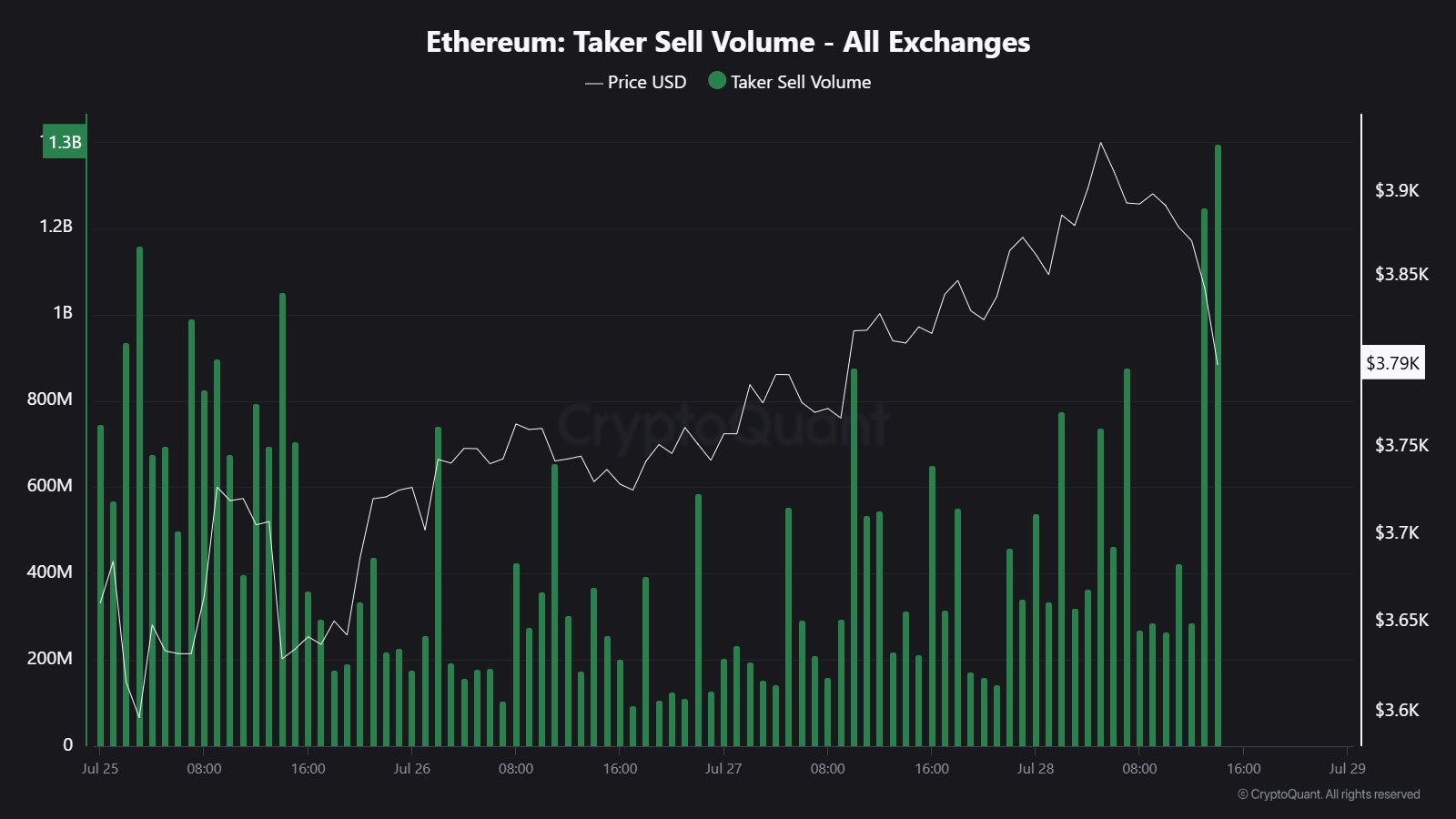

In immoderate different news, the Ethereum Taker Sell Volume has conscionable seen a crisp spike, arsenic CryptoQuant assemblage expert Maartunn has pointed retired successful an X post.

The inclination successful the ETH Taker Sell Volume implicit the past fewer days | Source: @JA_Maartun connected X

The inclination successful the ETH Taker Sell Volume implicit the past fewer days | Source: @JA_Maartun connected XThe Taker Sell Volume present refers to a metric that keeps way of the measurement of merchantability orders (in USD) that are being filed by traders successful Ethereum perpetual swaps. From the chart, it’s evident that this metric has conscionable observed 2 immense spikes. Across these, Taker Sell Volume has totaled astatine a whopping $2.68 billion.

Whether this reflects a displacement successful marketplace sentiment oregon conscionable short-term positioning remains to beryllium seen.

ETH Price

While altcoins similar XRP and Dogecoin person seen pullbacks during the past week, Ethereum has managed to bash comparatively good arsenic its terms is trading astir $3,800.

The terms of the coin has been connected the emergence during the past period | Source: ETHUSDT connected TradingView

The terms of the coin has been connected the emergence during the past period | Source: ETHUSDT connected TradingViewFeatured representation from Dall-E, CryptoQuant.com, illustration from TradingView.com

4 months ago

4 months ago

English (US)

English (US)