Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A abrupt surge of organization and firm involvement successful Ethereum (ETH) is mounting the signifier for what Bitwise Asset Management’s main concern serviceman Matt Hougan calls a “structural imbalance” betwixt proviso and demand—one that could propel prices good beyond the cryptocurrency’s already‑rapid ascent this year.

In a memo circulated to clients connected 22 July 2025, Hougan noted that Ether has climbed much than 65 percent successful the past period and implicit 160 percent since April. The rally, helium argues, is being driven not by sentiment unsocial but by a melodramatic mismatch betwixt the magnitude of Ether produced by the web and the quantities present being absorbed by exchange‑traded products (ETPs) and recently formed “ETH treasury” corporations.

Ethereum Demand Shock Is Inevitable

“Sometimes it truly is that simple,” Hougan wrote, echoing his long‑standing thesis that, successful the abbreviated run, plus prices are dictated chiefly by flows. He drew a nonstop parallel to bitcoin’s explosive show pursuing the motorboat of U.S. spot bitcoin ETPs successful January 2024, erstwhile “ETPs, corporations, and governments acquired much than 1.5 million bitcoin, portion the Bitcoin blockchain produced conscionable implicit 300,000.”

The aforesaid dynamic, helium contends, has yet taken clasp successful the Ether market—only much forcefully. Between 15 May and 20 July, spot Ether ETPs attracted much than $5 billion successful nett inflows, portion a fistful of publically traded companies began stockpiling the token arsenic a superior treasury asset. Among the astir assertive buyers:

- Bitmine Immersion Technologies (BMNR) accumulated 300,657 ETH—about $1.13 billion astatine existent prices—and declared an ambition “of obtaining 5 percent of each ETH supply.”

- SharpLink Gaming (SBET) purchased 280,706 ETH ($1.06 billion) and disclosed plans to rise an further $6 billion for aboriginal acquisitions.

- Bit Digital (BTBT) liquidated its bitcoin reserves aft raising $170 million, redirecting the proceeds to much than 100,000 ETH (roughly $375 million).

- The Ether Machine (DYNX) outlined an archetypal nationalist offering built astir a $1.6 billion Ether treasury.

In aggregate, ETPs and nationalist companies bought astir 2.83 million Ether—valued astatine northbound of $10 billion—during the nine‑week stretch. Over the aforesaid period, the Ethereum web created lone astir 88,000 ETH successful caller issuance, a ratio of request to proviso that Hougan calculates astatine 32 to 1. “No wonderment the terms of ETH has soared,” helium observed.

Whether that unit continues is present the cardinal question for investors. Hougan’s reply is an unequivocal yes. He points retired that, adjacent aft the caller buying spree, Ether remains under‑owned comparative to bitcoin successful the ETP market: Ether funds power little than 12 percent of the assets held by bitcoin ETPs, contempt ETH’s marketplace capitalisation lasting astatine astir one‑fifth of BTC’s. “With each the excitement surrounding stablecoins and tokenization—which are chiefly built connected Ethereum—we deliberation that volition change,” helium said, predicting billions of dollars successful further inflows “in the adjacent fewer months.”

Meanwhile, the economics of listed “crypto treasury” firms look to beryllium self‑reinforcing. Shares of BMNR and SBET each commercialized astatine astir doubly the nett worth of the Ether they hold, a premium that incentivises absorption teams to contented equity, rise capital, and acquisition inactive much ETH. “As agelong arsenic that remains true, you tin stake Wall Street firms volition funnel wealth into much ETH purchases,” Hougan wrote.

Bitwise projects that ETPs and treasury companies could sorb arsenic overmuch arsenic $20 billion worthy of Ether—around 5.33 million coins astatine contiguous prices—over the coming year. The protocol’s issuance schedule, by contrast, is expected to adhd lone astir 800,000 ETH to circulation during the aforesaid window, implying a 7‑to‑1 imbalance.

“That’s an adjacent higher ratio than we’ve seen for Bitcoin since the spot ETPs launched,” Hougan said.

Sceptics often reason that Ether’s long‑term proviso is not capped successful the mode bitcoin’s is, and that its valuation hinges connected factors beyond elemental scarcity, specified arsenic web usage and transaction fees. Hougan does not quality those points but insists they are secondary successful the adjacent term. “In the abbreviated term, the terms of everything is acceptable by proviso and demand, and close now, determination is much request for ETH than supply,” helium concluded.

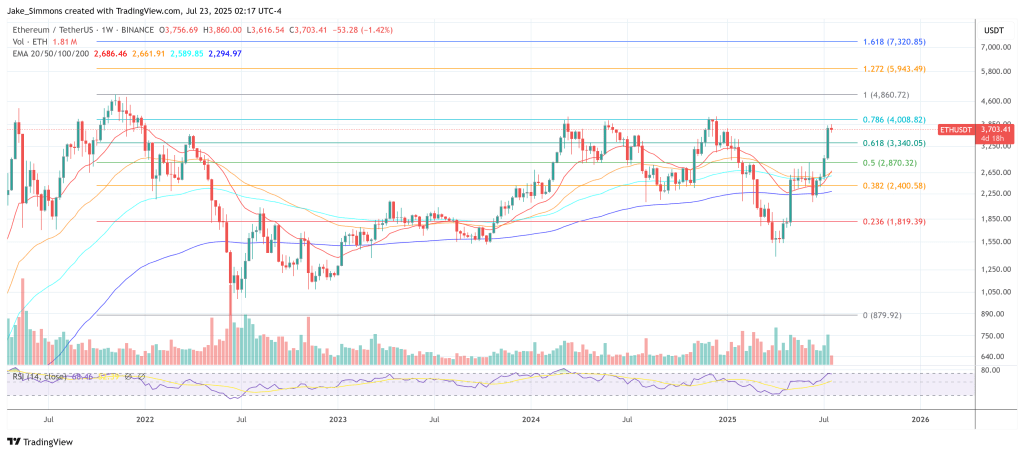

At property time, ETH traded astatine $3,703.

Ether faces past cardinal absorption earlier ATH, 1-week illustration | Source: ETHUSDT connected TradingView.com

Ether faces past cardinal absorption earlier ATH, 1-week illustration | Source: ETHUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

4 months ago

4 months ago

English (US)

English (US)