Ethereum is undergoing its archetypal notable pullback aft an explosive rally that took the terms from $2,500 to $3,800 successful little than 3 weeks. Despite this cooldown, bulls stay successful control, with ETH holding steadfast supra the $3,600 level—a cardinal enactment portion present acting arsenic the basal for imaginable consolidation. The marketplace appears to beryllium digesting caller gains, with signs that Ethereum’s spot could beryllium acold from over.

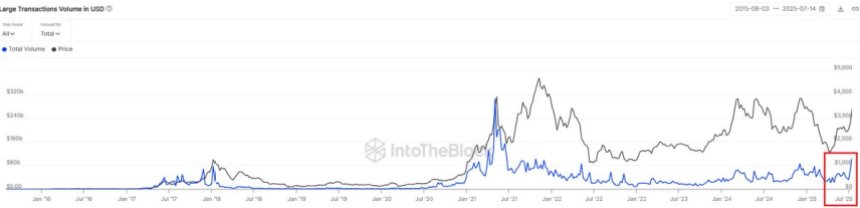

On-chain information from Sentora adds to the bullish outlook. Last week, Ethereum saw the highest play measurement of ample transactions since 2021. This surge successful big-money enactment signals rising involvement from organization players and ample investors, adjacent amid short-term volatility.

With ineligible clarity successful the US improving and Ethereum fundamentals strengthening, the existent intermission whitethorn beryllium mounting the signifier for different limb higher. Whether this consolidation lasts days oregon weeks, the elevated on-chain enactment suggests Ethereum’s ecosystem is heating up again, with large players positioning for the adjacent move.

Institutions Rotate From BTC Into Ethereum

Sentora data confirms a large displacement underway: big-money Ethereum is back. Last week, on-chain transfers implicit $100,000 totaled much than $100 billion—the highest play measurement since 2021. This spike successful high-value transfers reflects renewed organization interest, reinforcing Ethereum’s relation arsenic the starring altcoin amid evolving marketplace dynamics.

Ethereum ample transaction measurement successful USD | Source: Sentora connected X

Ethereum ample transaction measurement successful USD | Source: Sentora connected XThe timing of this surge is critical. Ethereum’s terms has rallied aggressively from $2,500 to $3,800 successful a substance of weeks, and organization superior appears to beryllium rotating from Bitcoin into ETH. While Bitcoin remains successful a choky consolidation scope conscionable beneath its all-time high, Ethereum’s upside momentum and on-chain spot suggest it whitethorn present beryllium starring the charge. This rotation has sparked discussions astir the opening of “Ethereum season,” a signifier seen successful erstwhile marketplace cycles erstwhile ETH outperforms BTC and superior begins to travel into the broader altcoin market.

Some analysts judge this could people the aboriginal stages of a long-awaited altseason. Historically, Ethereum leads specified phases, acting arsenic the gateway for investors to research high-beta assets crossed the crypto ecosystem. If ETH maintains existent spot and breaks supra the $4,000 level, it could trigger a broader marketplace expansion.

ETH Price Holds Above Key Support After Parabolic Rally

Ethereum is undergoing its archetypal meaningful pullback since opening a almighty surge from the $2,500 portion successful aboriginal July. After reaching a section precocious of $3,801, ETH is present trading astir $3,662, down astir 2.7% connected the day. Despite the insignificant correction, the wide operation remains bullish. The existent terms sits supra the $3,600 zone, a level that present acts arsenic cardinal short-term support.

ETH finds absorption astir $3,850 level | Source: ETHUSDT illustration connected TradingView

ETH finds absorption astir $3,850 level | Source: ETHUSDT illustration connected TradingViewVolume has somewhat decreased during this pullback, suggesting that selling unit remains comparatively controlled. ETH is inactive trading good supra its 50-day, 100-day, and 200-day moving averages, reinforcing the spot of the uptrend. The adjacent large absorption lies astir $3,800–$3,850, which aligns with erstwhile peaks seen successful aboriginal 2024.

A palmy consolidation supra $3,600 could supply the instauration for a caller limb higher toward the $4,000 mark. However, nonaccomplishment to clasp this enactment level mightiness trigger a retest of the $3,450–$3,500 area, followed by stronger enactment astir $3,000 and the $2,850 breakout zone.

Featured representation from Dall-E, illustration from TradingView

4 months ago

4 months ago

English (US)

English (US)