The terms of Ethereum's ether (<a href="https://indices.coindesk.com/indices/etx" target="_blank">ETH</a>) broke supra the $4,000 people connected Friday for the archetypal clip since March.

The second-largest cryptocurrency is up 2.4% successful the past 24 hours and 8.4% successful the past 7 days, outperforming bitcoin (<a href="https://indices.coindesk.com/indices/xbx" target="_blank">BTC</a>) successful some timeframes. The determination comes arsenic spot ether exchange-traded funds saw <a href="https://www.coindesk.com/markets/2024/12/06/u-s-ether-etfs-post-record-inflows-bitcoin-etfs-add-most-in-almost-a-month" target="_blank">record inflows</a> connected Thursday.

As of writing, ether is trading for $4,033, conscionable 2% distant from mounting a caller 2024 high. It's besides a specified 20% distant from its all-time precocious of $4,868. The ETH/BTC ratio, which has been getting hammered since September 2022, has reached 0.04 again — a level that marked a little apical for ether successful narration to bitcoin connected Nov. 10.

The Coinbase premium connected ether besides continues to grow — meaning that ether is trading for a higher terms connected the speech than connected the astir liquid crypto exchange, Binance. Coinbase premiums are mostly seen arsenic a motion of request among U.S. organization investors arsenic good arsenic retail participants. TradingView information shows a flimsy summation successful ether's terms connected Coinbase comparative to Binance, suggesting the marketplace is driven by enactment from the U.S,., which coincided with the U.S. marketplace opening astir an hr ago.

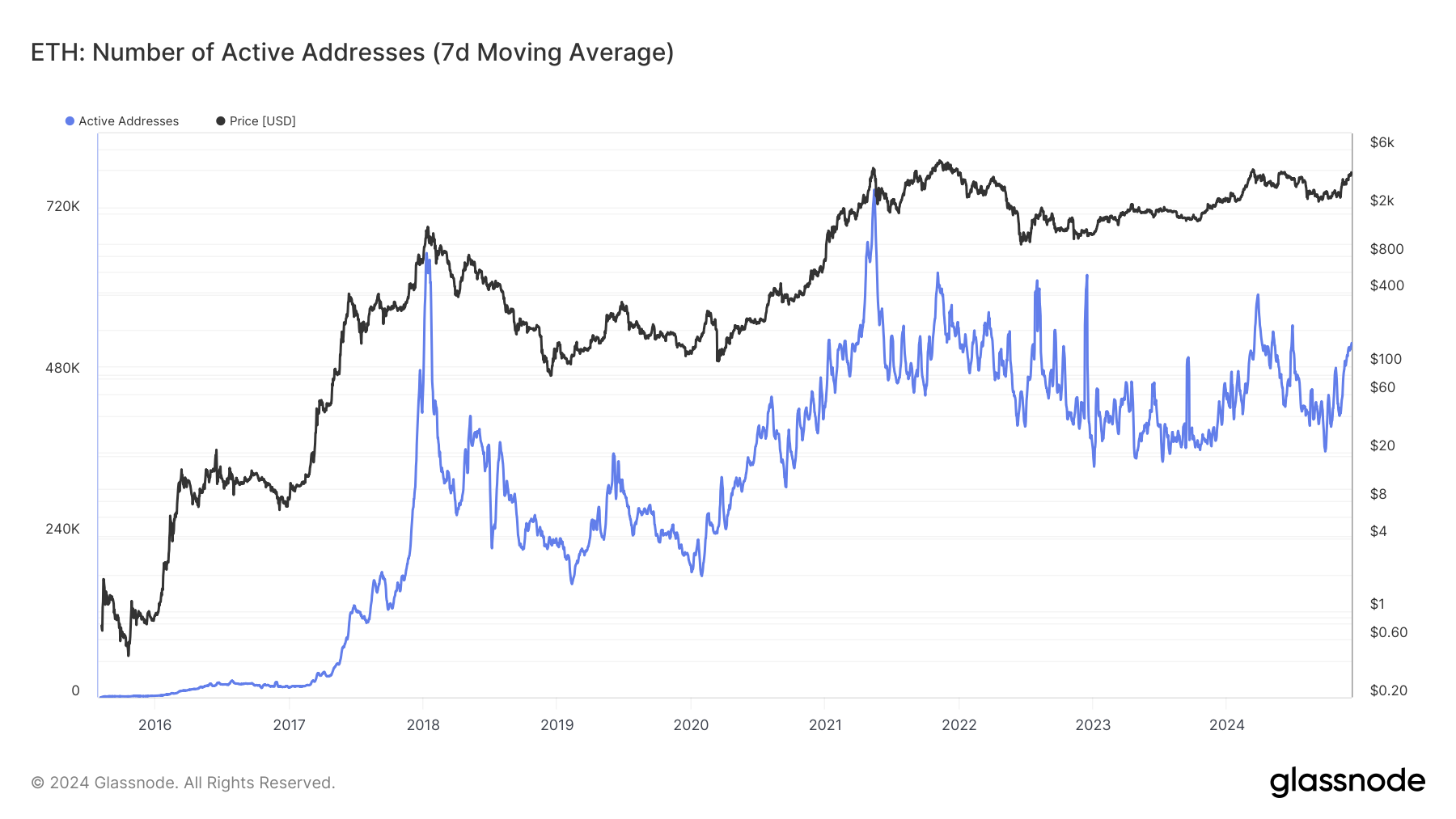

That's not all. Glassnode information shows that progressive addresses connected Ethereum person changeable up connected a 7-day moving mean from 368,000 to 523,000 from Sept. 24 to Dec. 5, indicating an enlargement of on-chain activity, which successful crook ends up benefitting ether by constraining its the token’s proviso done the "burn" mechanism.

Meanwhile, the <a href="https://indices.coindesk.com/indices" target="_blank">CoinDesk 20</a> — an scale of the apical 20 cryptocurrencies by marketplace capitalization excluding memecoins, stablecoins and speech coins — is down 1.4%, with its worst performers consisting of stellar (<a href="https://www.coindesk.com/price/stellar" target="_blank">XLM</a>) and litecoin (<a href="https://indices.coindesk.com/indices/ltx" target="_blank">LTC</a>), which person dropped 3.1% and 5% respectively successful the past 24 hours. Uniswap (<a href="https://indices.coindesk.com/indices/unx" target="_blank">UNI</a>) and render token (<a href="https://www.coindesk.com/price/render-token" target="_blank">RDNR</a>), however, are up 11.7% and 6.4% successful the aforesaid play of time.

11 months ago

11 months ago

English (US)

English (US)