August enactment a tiny dent successful what remains a longer-term uptrend for integer assets. Bitcoin fell astir 6.5% — its archetypal monthly diminution since March — aft concisely touching a caller all-time precocious of $125,000 mid-month. Ether, by contrast, extended its beardown run, gaining astir 19% and lifting its stock of wide marketplace capitalization to astir 13%. This rotation from bitcoin into ether was besides disposable successful ETFs: bitcoin funds saw uncommon nett outflows, suggesting immoderate profit-taking aft this year’s bonzer rally, portion ether ETFs attracted dense inflows that pushed assets nether absorption to grounds levels. As a result, bitcoin dominance slipped to its lowest constituent since January, leaving the wide marketplace capitalization of integer assets astir level connected the month.

Despite this sideways performance, marketplace enactment remained elevated. Spot trading volumes held supra their twelve-month mean — antithetic for the typically quiescent summertime play — and derivatives markets were conscionable arsenic lively. Open involvement successful bitcoin and ether options reached caller highs, and August acceptable a grounds for BTC enactment trading volumes astatine $145 billion. Implied volatility stayed comparatively subdued but did tick up toward month-end, hinting that the options marketplace whitethorn beryllium underestimating risk.

While bitcoin paused, golden was connected a tear. A cleanable tempest of falling complaint expectations, persistent halfway inflation, widening commercialized deficits, a weaker dollar, geopolitical risks and mounting governmental uncertainty propelled the yellowish metallic to successive grounds highs. The dismissal of Fed Governor Lisa Cook by the Trump medication further stirred concerns implicit the semipermanent independency of the Federal Reserve. Treasury yields hardly budged, but golden — arsenic a accepted hedge against ostentation and systemic hazard — jumped sharply. Bitcoin, however, traded little connected the time the quality broke.

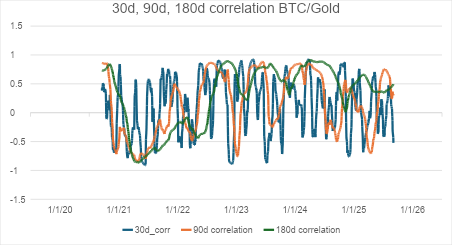

This raises the perennial question of whether bitcoin genuinely deserves the statement “digital gold.” Its scarcity and libertarian origins enactment the analogy, but the information tells a much nuanced story. Short-term correlations betwixt bitcoin and golden person been inconsistent, oscillating astir 12% and 16% connected some 30- and 90-day windows. Over longer horizons (180d), the mean correlation is somewhat higher, but inactive low. In different words, the 2 assets person not reliably moved together. However, since 2024, the mean 180-day rolling correlation has shown a meaningful uptick to astir 60%. The effect is disposable connected shorter horizons arsenic well, though little pronounced. One tenable mentation is that the ‘digital gold’ communicative is opening to summation firmer footing with investors arsenic the plus people matures.

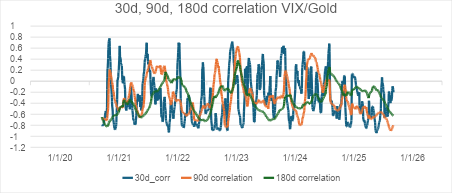

It is besides worthy remembering that golden itself has an imperfect way grounds arsenic a macro and ostentation hedge. It does not way user prices period by month, though implicit decades it has preserved purchasing powerfulness amended than astir assets. Research besides shows that golden tin service arsenic a harmless haven during episodes of utmost equity stress, but not always, arsenic its mixed narration with the VIX illustrates.

For bitcoin, the communicative is inactive successful flux. Some investors presumption it arsenic a exertion play; others spot it arsenic an emerging macro hedge. We judge the second volition beryllium much durable implicit time. Unlike different blockchains, Bitcoin’s constricted scalability, rigid governance and deficiency of Turing completeness mean it is improbable to go a multi-application platform. Other protocols are acold amended suited to that role. Instead, bitcoin’s semipermanent worth proposition rests connected its scarcity and neutrality— features that echo gold’s monetary role.

Of course, specified narratives instrumentality clip to solidify. Gold required millennia to go wide accepted arsenic a store of value. Bitcoin, by comparison, is lone sixteen years old, yet it has already achieved singular levels of designation and adoption. The “digital gold” analogy whitethorn not beryllium afloat supported by the information today, but it is acold excessively aboriginal to disregard it. If anything, past suggests that the communicative is inactive being written.

Legal Disclaimer

Information presented, displayed, oregon different provided is for acquisition purposes lone and should not beryllium construed arsenic investment, legal, oregon taxation advice, oregon an connection to merchantability oregon a solicitation of an connection to bargain immoderate interests successful a money oregon different concern product. Access to the products and services of Lionsoul Global Advisors is taxable to eligibility requirements and the definitive presumption of documents betwixt imaginable clients and Lionsoul Global Advisors, arsenic they whitethorn beryllium amended from clip to time.

1 month ago

1 month ago

English (US)

English (US)