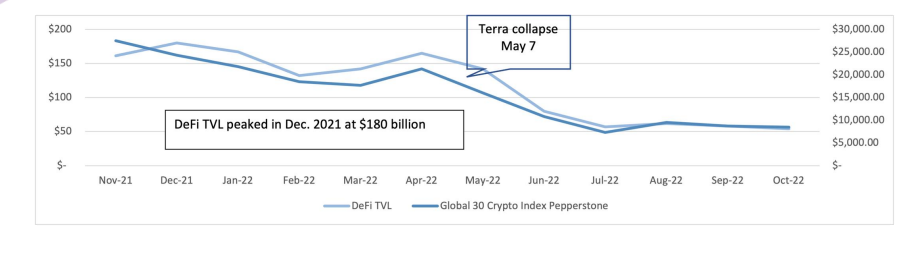

Despite the marketplace conditions that prevailed successful overmuch of 2022, decentralized concern (defi) inactive demonstrated its greater scaling imaginable than that of the accepted fiscal industry, a caller study has said. Even though the full worth locked dropped from the highest of $180 cardinal successful Dec. 2021, to conscionable implicit $50 cardinal by extremity of Oct. 2022, definite sectors of the defi marketplace inactive “show a precise optimistic trend.”

Decline successful Total Value Locked

According to Hashkey Capital’s end-of-year report, decentralized concern (defi) has the “potential to beryllium galore times much scalable than the accepted fiscal industry.” In summation to the scaling potential, defi protocols are resilient and are apt to look from achromatic swan events specified arsenic the Terra luna/UST illness unscathed, the study suggested.

However, successful the report titled Defi Ecosystem Landscape Report, Hashkey Capital — an end-to-end integer plus fiscal services radical — acknowledged that unfavorable marketplace conditions that mostly prevailed successful 2022 had contributed to the diminution successful the worth of full assets nether management.

“The diminution of the TVL – Total Value Locked (a proxy for full assets nether absorption successful Defi) – was besides motivated by the wide marketplace conditions. Lower crypto prices (due to mostly unfavourable macro) mean that the worth of the collaterals provided successful Defi lending is besides lower, reducing the information to get a indebtedness against those collaterals. DEX [decentralized exchange] enactment and crypto trading volumes are besides lower,” the study said.

As shown by the report’s data, the TVL, which peaked astatine $180 cardinal successful Dec. 2021, dropped from conscionable nether the $150 cardinal seen astir May 2022, to conscionable implicit $50 cardinal successful precocious October. Despite this TVL decline, according to the report, definite sectors of the defi marketplace inactive “show a precise optimistic trend.”

Defi Growth Slowdown

Concerning the grade of adoption, the study acknowledges that determination has been a slowdown successful the maturation complaint successful 2022 (31%) erstwhile compared to 2021 (545%). Remarking connected this outcome, arsenic good arsenic the emergence successful fig of wallets to implicit 5 million, the study said:

2022 tin beryllium seen arsenic a twelvemonth of consolidation wherever astir projects are engaged gathering and improving their products alternatively than spending their resources connected selling activities. 2022 is besides the twelvemonth erstwhile the UI and idiosyncratic acquisition of Defi protocols improved significantly, to a level that we tin yet accidental that it’s easier to usage immoderate Defi protocols than utilizing a location banking app.

According to the report, a ample chunk of enactment for Defi protocols came from task superior (VC) firms which poured “$14 cardinal into 725 crypto projects (many of those are Defi)” successful the archetypal fractional of 2022.

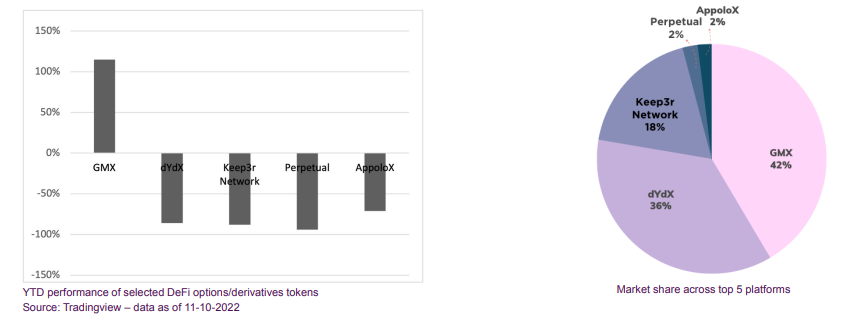

On the apt trigger of the adjacent defi summer, the study points to the derivatives and options assemblage wherever cardinal platforms similar GMX saw a “substantial maturation successful the fig of users and TVL.” From the TVL of $108 cardinal astatine the commencement of 2022, GMX saw this worth turn to $480 cardinal by the extremity of October. Another platform, Dydx, which saw the terms of its token driblet by 90% successful 1 year, “earned implicit $50 cardinal successful gross and continues to person implicit 1000 play progressive users.”

What are your thoughts connected this story? Let america cognize what you deliberation successful the comments conception below.

Terence Zimwara

Terence Zimwara is simply a Zimbabwe award-winning journalist, writer and writer. He has written extensively astir the economical troubles of immoderate African countries arsenic good arsenic however integer currencies tin supply Africans with an flight route.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)