Caitlin Long, CEO of crypto slope Custodia, criticized the U.S. authorities for its handling of a monolithic crypto fraud that occurred months earlier the company’s collapse. She made her remarks successful a blog station aft disclosing grounds to instrumentality enforcement. Long’s station followed Custodia’s unsuccessful exertion to go a subordinate of the Federal Reserve System, which was denied by the Federal Reserve Board.

CEO of Custodia Criticizes U.S. Government for ‘Shooting a Messenger Who Warned of Crypto Debacle’

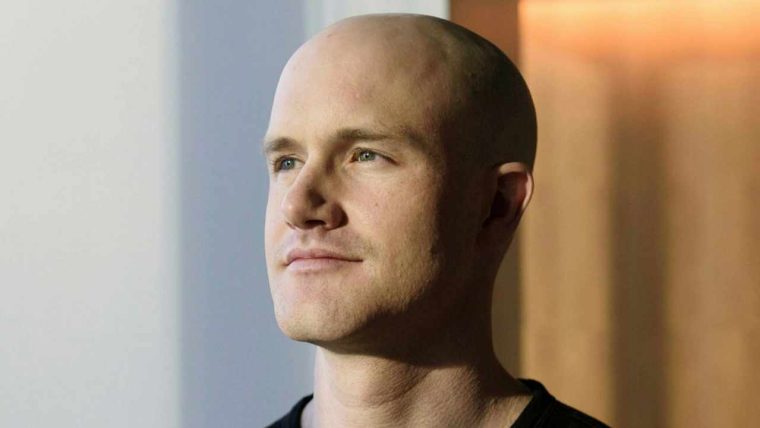

Executives of integer currency and blockchain companies are displeased with the U.S. government’s crackdowns and deficiency of regulatory clarity. Brian Armstrong, CEO of Coinbase, has called connected Congress to walk wide authorities connected cryptocurrencies, and Jesse Powell, CEO of Kraken, has echoed that message. On Feb. 17, Caitlin Long, CEO of Custodia, published a blog post explaining that she had fixed grounds to authorities astir a crypto fraud lawsuit months earlier the institution collapsed, leaving its millions of customers with losses.

In her blog station titled “Shame connected Washington, DC for Shooting a Messenger Who Warned of Crypto Debacle,” Long argues that the existent enforcement actions are a misguided crackdown connected the full industry. “Calls for a crackdown contiguous are coming from galore of the aforesaid policymakers who were charmed by the fraudsters,” Long wrote. It is good known that senior members of the U.S. Securities and Exchange Commission (SEC), the White House, and the Commodity Futures Trading Commission (CFTC) met with Sam Bankman-Fried (SBF) and high-ranking FTX officials.

The U.S. Federal Reserve Board precocious rejected the effort of Custodia Bank to go a subordinate of the Federal Reserve System.

The U.S. Federal Reserve Board precocious rejected the effort of Custodia Bank to go a subordinate of the Federal Reserve System.Additionally, an estimated one successful 3 members of Congress received a nonstop contribution from SBF and his interior circle. “In a 180-degree turn, [policymakers are] present throwing the babe retired with the bathwater,” Long wrote successful her blog post. The Custodia CEO besides mentioned that authorities officials likened her crypto bank’s operation to FTX’s misconduct and collapse, resulting successful an ambush connected the crypto manufacture by officials.

“Custodia Bank precocious recovered itself successful the crosshairs of Beltway Politics astatine their worst,” Long stressed. “Custodia was simultaneously attacked by the White House, the Federal Reserve Board of Governors, the Kansas City Fed, and Senator Dick Durbin (who conflated our non-leveraged, 100-percent liquid and solvent slope with FTX successful a Senate level speech, successful which helium attacked 2 companies tally by pistillate CEOs — Fidelity and Custodia — implicitly comparing america to a 29-year-old accused fraudster who is present wearing an ankle bracelet).”

The Custodia CEO added:

Custodia tried to go federally regulated – the precise effect bipartisan policymakers assertion to want. Yet Custodia has been denied and [is] present disparaged for daring to travel done the beforehand door.

After Long published her blog station astir the situation, Jesse Powell, CEO of Kraken, responded to her Twitter thread connected the subject. “I can’t archer you however infuriating it is to person pointed retired monolithic reddish flags and evidently amerciable enactment to regulators lone to person them disregard the issues for years,” Powell tweeted. “‘They’re offshore. It’s complicated. We’re looking astatine everybody.’ FOR YEARS. Then to beryllium utilized arsenic their example.”

The complaints from Long, Armstrong, and Powell travel aft the SEC’s enforcement enactment against Terraform Labs and CEO Do Kwon, 9 months aft the full Terra ecosystem collapsed. The U.S. securities regulator was criticized for being precocious to the game, and galore judge the SEC is simply throwing spaghetti astatine the partition to spot what volition stick.

Tags successful this story

Blog Post, Brian Armstrong, Broad Crackdowns, Caitlin Long, ceo, CFTC, Coinbase, collapse, Congress, Crackdown, crypto industry, Cryptocurrency, Custodia, do kwon, enforcement actions, Fraud, ftx, FTX collapse, Jesse Powell, Kraken, misconduct, offshore, overregulation, policymakers, red flags, regulatory clarity, Sam Bankman-Fried, sbf, SEC, securities regulator, spaghetti, terraform labs, Twitter, US government, White house

What is your sentiment connected the criticisms from Custodia’s CEO regarding the U.S. government’s handling of the caller enforcement actions successful the crypto manufacture and the reddish flags she pointed retired earlier a crypto company’s collapse? Share your thoughts connected this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)