While marketplace attraction is focused connected the statement implicit the U.S. indebtedness ceiling, imaginable implications for crypto markets person garnered little discussion.

The Treasury General Account (TGA), the superior operational relationship of the U.S. Treasury, has been playing a important relation successful offsetting Federal Reserve’s quantitative tightening policy.

Historically, the TGA’s superior intent has been to assistance the national authorities successful managing its payments efficiently. However, successful the discourse of the looming indebtedness ceiling crisis, the relationship has been gradually drained to guarantee the continuous servicing of authorities bills.

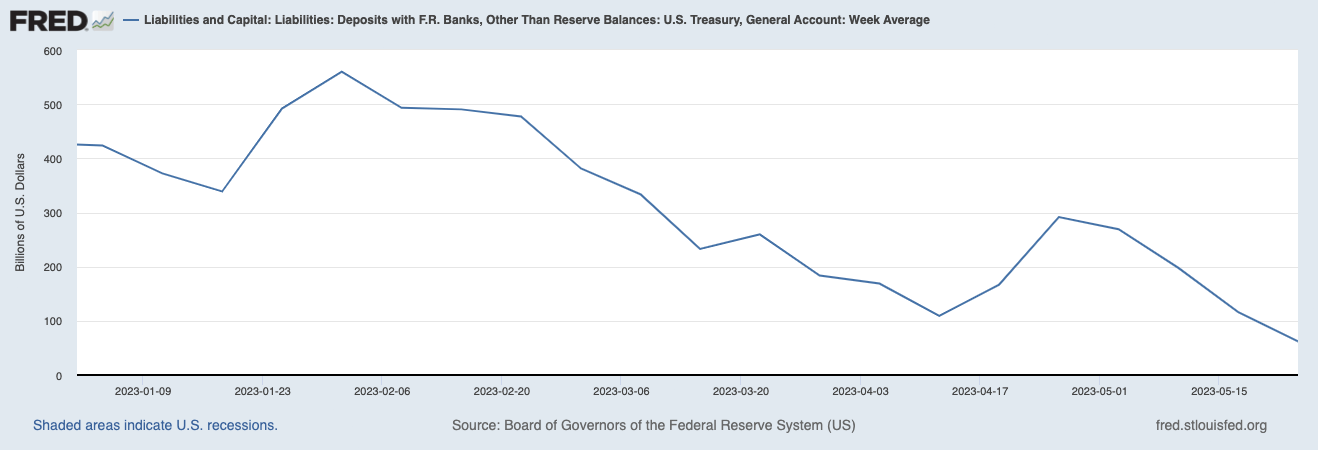

The TGA equilibrium has dwindled from astir $1.8 trillion successful June 2020 to $61.9 cardinal successful May 2023 — a 96% decrease. Since the opening of the year, the TGA equilibrium dropped by implicit 85%.

Graph showing the equilibrium of the U.S. Treasury’s General Account from January 2020 to May 2023 (Source: Federal Reserve)

Graph showing the equilibrium of the U.S. Treasury’s General Account from January 2020 to May 2023 (Source: Federal Reserve)The Federal Reserve’s quantitative tightening policies person aimed astatine reducing the magnitude of wealth successful circulation, exerting upward unit connected involvement rates to curb borrowing activity. However, the TGA’s draining has offset these tightening measures, efficaciously injecting liquidity into the marketplace and somewhat counteracting the tightening effects.

Once the indebtedness ceiling is raised, the Treasury has signaled its volition to bolster the TGA equilibrium to its people of $500 billion. To execute this, it would person to rise astir $440 billion. The superior method for gathering these funds would beryllium issuing Treasury Bills (T-bills), which would inevitably siphon further liquidity from the market.

According to data presented by the Treasury Department, the mean worth of T-bills issued per period implicit the past 3 years has hovered astir $220 billion. This suggests that to rise the indispensable $440 billion, the Treasury would request to ramp up T-bill issuance implicit 2 months, fixed the accustomed issuance volumes.

However, this estimation could beryllium taxable to fluctuation arsenic the nonstop timeline would beryllium connected assorted factors, including marketplace request and economical conditions. Goldman Sachs believes the Treasury could contented up to $700 cardinal successful T-bills wrong six to 8 weeks of a indebtedness deal. Overall, Goldman expects the Treasury to proviso the marketplace with implicit $1 trillion worthy of T-bills connected a nett ground this year.

This accrued T-bill issuance could treble the quantitative tightening effect, posing a important menace to the fiscal and crypto markets. As the wealth proviso shrinks, a liquidity crunch could ensue, perchance starring to falling plus prices crossed the board. Analysts astatine Bank of America said this could person an equivalent interaction connected the system arsenic a 25 ground points complaint hike.

The implications of this determination widen good into the future. T-bills, typically maturing successful 1 twelvemonth oregon less, would not lone sorb a important magnitude of liquidity upon issuance but besides necktie up those funds for the duration of the bill’s term. This means the interaction connected marketplace liquidity could beryllium felt up to a twelvemonth pursuing the accrued issuance, assuming the Treasury chiefly uses one-year T-bills to refill the TGA.

The crypto marketplace could acquisition a pronounced downturn arsenic investors’ hazard tolerance diminishes successful effect to tighter monetary conditions.

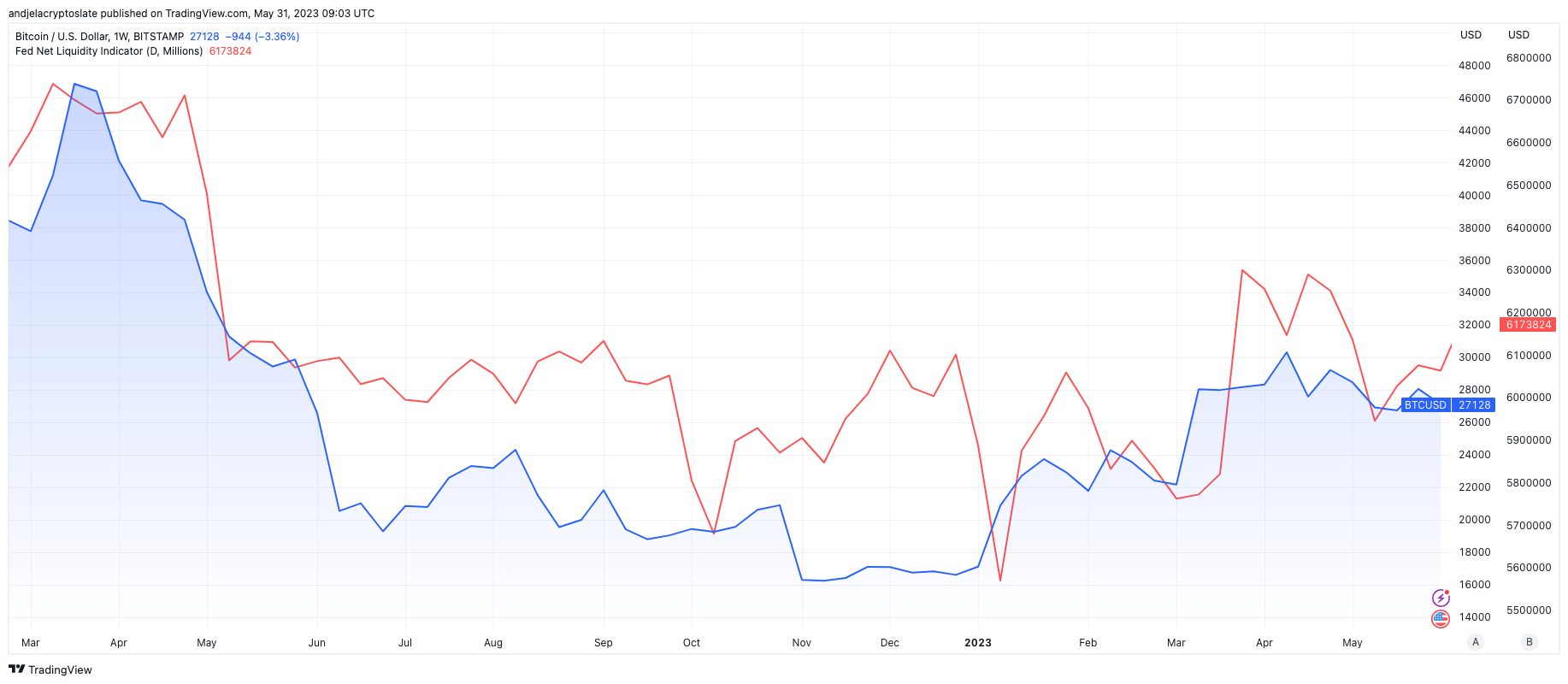

Since 2022, Bitcoin has shown an accrued correlation to nett liquidity. A CryptoSlate report from April 22 this twelvemonth recovered that an summation successful the wide magnitude of wealth disposable successful the marketplace correlated to a emergence successful Bitcoin’s price.

Graph showing the correlation betwixt Bitcoin and nett liquidity (Source: TradingView)

Graph showing the correlation betwixt Bitcoin and nett liquidity (Source: TradingView)Conversely, Bitcoin has besides exhibited an inverse correlation to the TGA balance. Since 2020, each summation successful the Treasury General Account correlated with a driblet successful Bitcoin’s price.

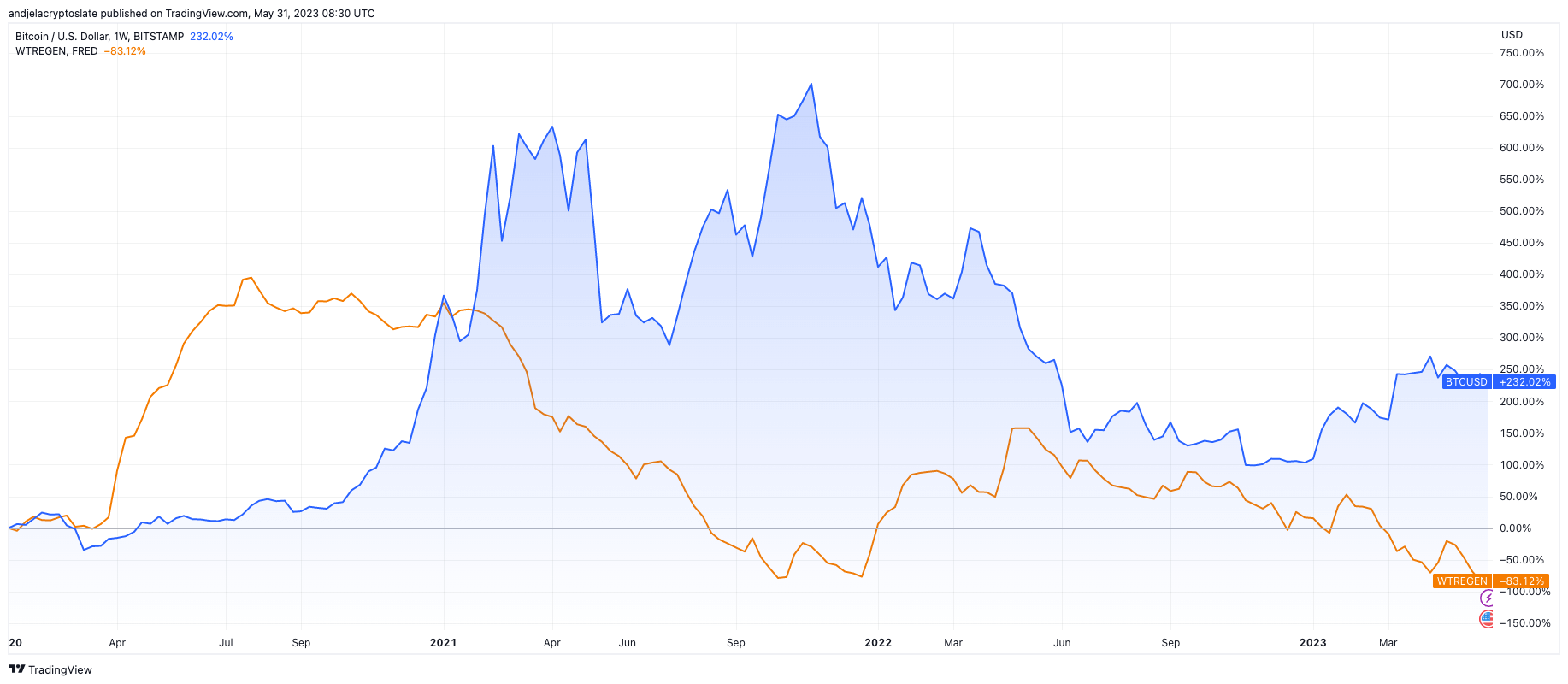

Graph showing the correlation betwixt TGA equilibrium and Bitcoin from 2020 to 2023 (Source: TradingView)

Graph showing the correlation betwixt TGA equilibrium and Bitcoin from 2020 to 2023 (Source: TradingView)In conclusion, portion the marketplace is absorbed successful the play of the U.S. indebtedness ceiling debate, the existent communicative lies successful the looming liquidity crisis. The Treasury’s imaginable T-bill issuance to replenish the TGA equilibrium could drastically tighten the market’s liquidity, prompting plus terms depreciation successful some fiscal and crypto markets. While it’s apt that Bitcoin would spot a rebound and defy the wide marketplace trend, the short-term effects connected the marketplace could beryllium severe.

The station Crypto markets brace for interaction arsenic US indebtedness ceiling statement threatens liquidity crunch appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)