In today’s Crypto for Advisors, Gregory Mall, main concern serviceman from Lionsoul Global, writes astir bitcoin’s existent rally, and however it historically has and could perchance interaction altcoins.

Then, Kevin Tam looks astatine crypto trends, 13-F filings and organization adoption successful Ask an Expert.

Bitcoin's Breakout — Is the Altcoin Rally Next?

On May 22, bitcoin (BTC) marked a historical moment, reaching a caller all-time high, concisely surpassing the levels seen earlier this year. While prices person since consolidated, BTC remains wrong striking region of its all-time precocious — a feat achieved contempt lingering macro uncertainties, debased trading volumes, and wide marketplace skepticism.

Meanwhile, astir altcoins stay acold from their respective all-time highs. As of aboriginal June, Ethereum (ETH) is inactive astir 20% beneath its November 2021 peak, and Solana (SOL) sits much than 30% beneath its erstwhile highs. This divergence highlights what immoderate marketplace observers are calling the "most hated rally"—a quiet, low-participation surge successful bitcoin that caught galore disconnected guard.

What Drove the BTC Rally?

Three cardinal factors contributed to the caller BTC breakout:

Central Bank Optimism: Futures markets suggest that complaint cuts from the Federal Reserve are apt successful the 2nd fractional of 2025, with the eurozone adjacent further ahead—now connected its seventh consecutive complaint cut. This easing backdrop has revived hazard appetite crossed assets, peculiarly among organization allocators. With tariff fears successful the rearview mirror, the wide inflationary outlook has importantly improved successful caller weeks.

Institutional Inflows: Spot bitcoin ETFs, approved earlier this year, proceed to sorb flows. While regular volumes person tapered from launch-week highs, nett inflows person remained consistently positive, peculiarly from fee-sensitive RIA and backstage wealthiness channels. Year to date, cumulative inflows transcend $16 billion, with May signaling the largest inflow this year. At the aforesaid time, MicroStrategy and different companies person continued to heap firm treasury assets into bitcoin.

Easing Political Risks: Fading tariff tensions and improving planetary commercialized sentiment helped stabilize broader markets, allowing hazard assets similar bitcoin to resume their upward trend.

Despite these tailwinds, the rally occurred connected comparatively bladed volumes.

BTC Dominance Rising — But History Rhymes

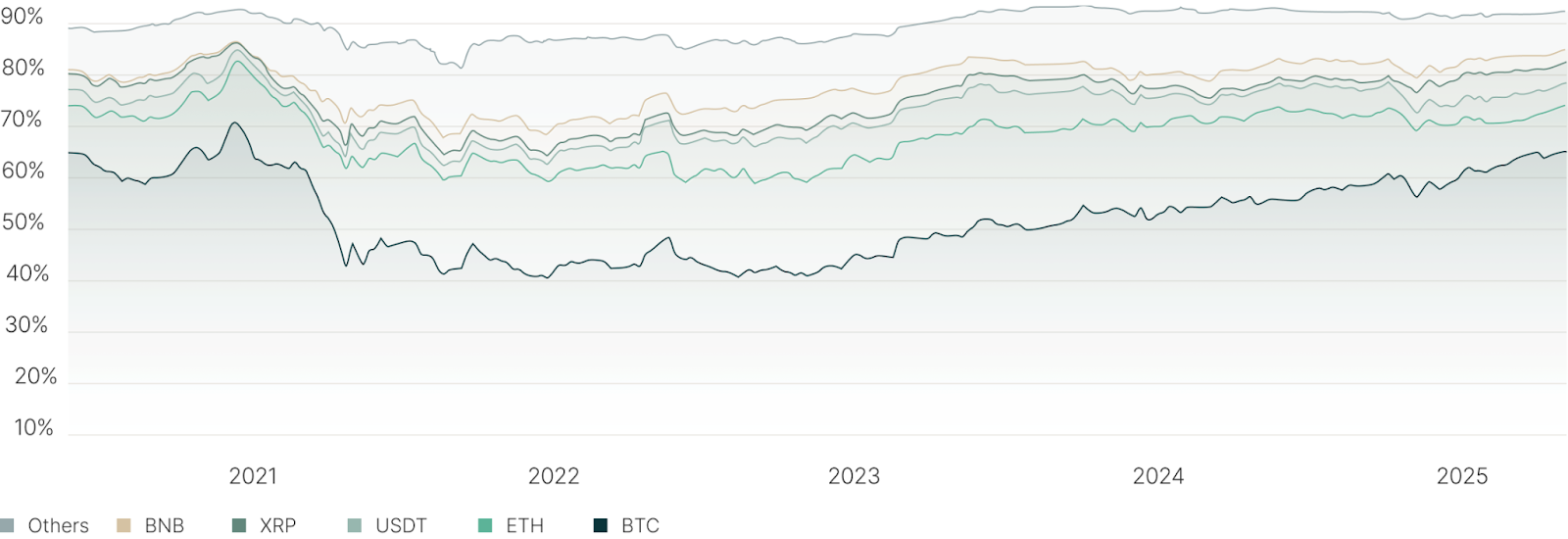

Bitcoin dominance — the percent of full crypto marketplace headdress made up by BTC — has present climbed supra 54%, up from astir 38% successful precocious 2022. Historically, BTC dominance peaks earlier altcoins statesman to outperform. During the 2017 and 2021 cycles, altcoin rallies lagged the BTC all-time highs by 2 to six months.

Source: TradingView

If past holds, the rotation from bitcoin into altcoins whitethorn already beryllium underway. ether's caller outperformance — posting an 81% rally since its April lows — is simply a motion that sentiment is starting to spill implicit from bitcoin to the altcoin market.

Altcoin Season Ahead?

While the word "altseason" is often thrown astir carelessly, determination are immoderate existent indicators worthy watching:

Institutional Broadening: Allocators who entered BTC via ETFs are present evaluating broader exposure. Equal-weight oregon astute beta indexes that connection diversified vulnerability to Layer 1s, DeFi, and infrastructure tokens are gaining traction.

L1 Innovation and Narrative Cycles: Layer 1 ecosystems similar Solana, Avalanche, and Near proceed to make existent throughput improvements, which are progressively applicable arsenic idiosyncratic request for on-chain enactment returns.

DeFi Resurgence: As of aboriginal June 2025, the full worth locked successful DeFi protocols has surpassed $117 billion, marking a important betterment from the April slump. According to DeFiLlama, the full worth locked crossed each DeFi pools has accrued by 31% since its April lows.

Risk Rotation: In accepted markets, arsenic the bull marketplace matures, investors rotate from ample caps to small/mid caps. Crypto is nary different. Bitcoin whitethorn beryllium the starting point, but not the end.

A Word of Caution

Although determination are important diversification benefits associated with crypto investing, it is besides just to accidental that crypto is inactive behaving mostly arsenic a risk-on plus class. As highlighted by the latest OECD report, the planetary economical scenery is becoming progressively fragile. Heightened commercialized restrictions, tighter recognition conditions, declining concern and user confidence, and persistent argumentation uncertainty are each weighing connected maturation prospects and expanding the risks of a sell-off of speculative assets that includes crypto.

Key Takeaways for Advisors

Expect Rotation: If anterior cycles are a guide, altcoins whitethorn lag BTC but thin to rally with a delay. Advisors should see this erstwhile rebalancing portfolios.

Diversification Matters: Equal-weight crypto baskets oregon thematic exposures (e.g., Layer 1s, DeFi) whitethorn assistance seizure upside without betting connected a azygous asset.

Stay Objective: While terms enactment often drives lawsuit interest, fundamentals — from web enactment to developer momentum — should stay the northbound prima for allocation decisions.

Bitcoin's caller all-time precocious is surely a milestone. However, it whitethorn besides beryllium a signal: the adjacent signifier of the rhythm could beryllium to the broader crypto plus class. Advisors who recognize the timing and mechanics of marketplace rotations are champion positioned to usher clients done the adjacent leg.

Legal Disclaimer: Information presented, displayed, oregon different provided is for acquisition purposes lone and should not beryllium construed arsenic investment, legal, oregon taxation advice, oregon an connection to merchantability oregon a solicitation of an connection to bargain immoderate interests successful a money oregon different concern product. Access to the products and services of Lionsoul Global Advisors is taxable to eligibility requirements and the definitive presumption of documents betwixt imaginable clients and Lionsoul Global Advisors, arsenic they whitethorn beryllium amended from clip to time.

- Gregory Mall, Chief Investment Officer, Lionsoul Global

Ask an Expert

Q: One twelvemonth into the trend, however are Canadian banks and pension funds approaching bitcoin?

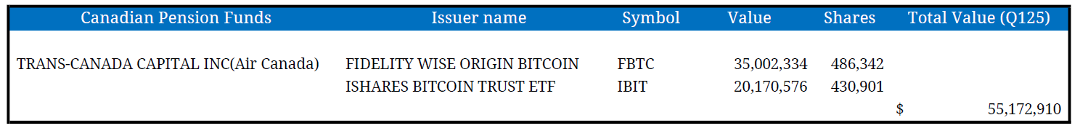

A: This caller quarters 13F filing uncover that Montreal based Trans-Canada Capital has made notable investments successful integer assets. They negociate the pension assets for Air Canada, arsenic 1 of the largest firm pensions plans Canada. The pension money added $55 cardinal successful spot bitcoin ETF.

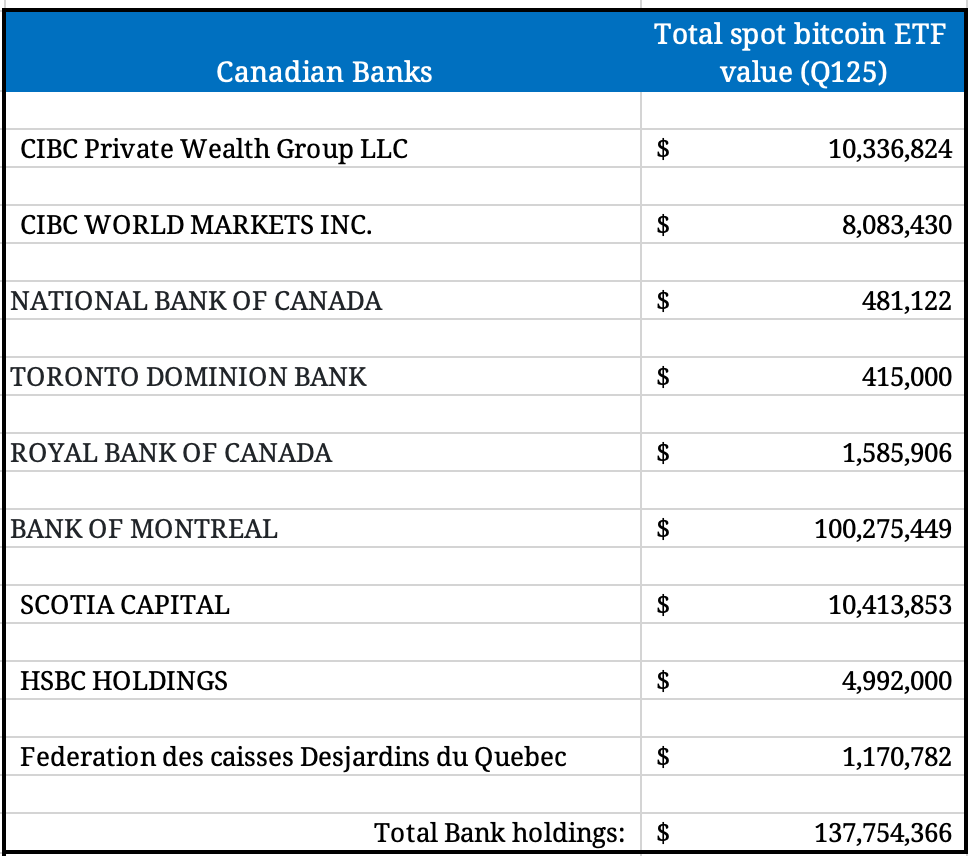

Institutional adoption of bitcoin has accelerated implicit the past year, driven by clearer regulatory guidance, the motorboat of spot ETFs and expanding designation of bitcoin arsenic a strategical asset. Schedule 1 banks successful Canada are holding much than $137 cardinal successful bitcoin speech traded funds, underscoring increasing organization request and semipermanent positioning.

Q: How mightiness organization accumulation impact bitcoin’s marketplace dynamic?

A: Last twelvemonth ETFs bought astir 500,000 bitcoin, portion the web produced 164,250 caller bitcoins done its impervious of enactment consensus. This means ETF request unsocial was 3 times higher than the recently minted supply. Additionally, nationalist and backstage corporations purchased 250,000 bitcoin. As governments see including bitcoin successful their strategical reserve, different entities are exploring adding bitcoin to their firm treasury.

Q: How volition the Financial Conduct Authority (FCA) greenlighting retail entree to crypto exchange-traded notes (ETNs) successful the UK accelerate the retail & organization adoption?

A: This marks an important infinitesimal for successful crypto products successful the retail marketplace arsenic plus people that reflects a broader displacement successful the UK’s regulatory stance toward integer assets. It is simply a implicit reversal from a 2020 determination erstwhile the FCA banned crypto speech trades notes. ETNs volition request to beryllium traded connected an FCA-approved concern exchanges. The UK is shifting its attack to crypto arsenic the authorities seeks to turn the system and enactment a integer assets industry. They are sending a beardown awesome to organization investors that the UK is positioning itself arsenic a rival subordinate successful the planetary crypto market.

Keep Reading

- The Digital Asset Month successful Review for May provides highlights and insights connected planetary crypto ETFs/ETPs. By Joshua de Vos of CoinDesk, successful concern with ETF Express and Trackinsight.

- Unlike galore U.S. States that are creating crypto affable laws, Connecticut says NO, with the caller measure HB702 that bans the authorities accepting oregon investing successful crypto.

- For the archetypal clip ever, the terms of bitcoin has stayed over $100,000 for 30-days, marking a caller milestone for the cryptocurrency.

4 months ago

4 months ago

English (US)

English (US)