How does decentralized concern (DeFi) work? In today's Crypto for Advisors newsletter, Elisabeth Phizackerley and Ilan Solot and from Marex Solutions co-authored this portion astir the mechanics of a DeFi transaction utilizing Ethena, Pendle and Aave and however they each enactment unneurotic to make concern yields.

Then, DJ Windle breaks down the concepts and answers questions astir these investments successful "Ask an Expert."

Thank you to our sponsor of this week's newsletter, Grayscale. For fiscal advisors adjacent Minneapolis, Grayscale is hosting an exclusive event, Crypto Connect, connected Thursday, September 18. Learn more.

DeFi Yield Engines: Ethena, Pendle, Aave, and Hyperliquid

In accepted finance, advisers are utilized to products similar enslaved funds, wealth marketplace instruments, oregon structured notes that make output by recycling superior much efficiently. In decentralized concern (DeFi), a akin thought exists — but powered wholly by astute contracts, exploring however fiscal markets tin tally connected blockchain rails. There has been nary shortage of DeFi experiments implicit the past six years, since the assemblage kicked off; however, fewer person worked arsenic good arsenic the interplay betwixt Ethena, Pendle, and Aave. Together, these 3 protocols person built a self-reinforcing rhythm that channels much than $4 cardinal successful composable assets. As the abstraction develops, the interlinkages volition apt grow adjacent further, for example, by integrating elements of Hyperliquid and its caller layer-1, HyperEVM. First, immoderate definitions:

- Ethena: similar a wealth marketplace money generating output from futures.

- Pendle: similar a enslaved table splitting that output into “fixed” vs. “floating” portions.

- Aave: similar a slope offering loans against crypto-native collateral.

- Hyperliquid: similar immoderate crypto speech for futures and spot trading, but afloat on-chain.

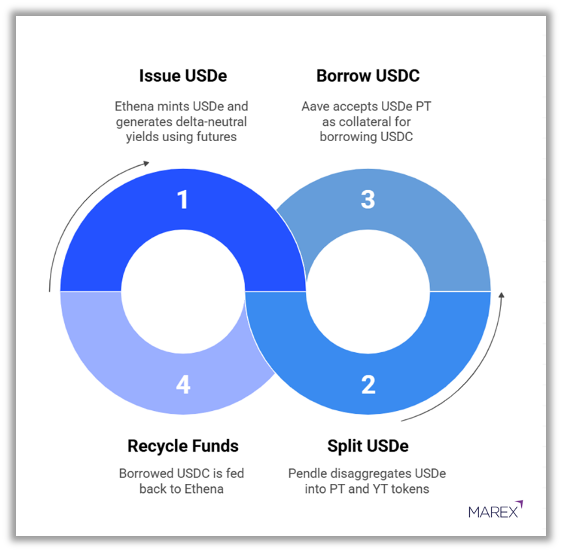

The archetypal USDe PT loop works astir similar this: It begins with Ethena, which issues USDe, a synthetic dollar backed by a operation of stablecoins and crypto. Ethena uses deposits to instrumentality delta-neutral strategies connected futures contracts to make yield, which gets paid to stakers of USDe. Staked USDe is earning astir 9% arsenic of precocious August.

Pendle past takes USDe and decomposes it into 2 parts: Principal Tokens (PTs) and Yield Tokens (YTs). YTs correspond the adaptable watercourse of output (and immoderate points accrued) from the underlying plus – USDe successful this case. While PTs correspond the underlying worth of USDe, which is sold by Pendle astatine a discount (like a T-bill) past redeemed one-to-one astatine maturity.

Then Aave closes the loop by allowing investors to get against their PT deposits. Since PTs person a predictable redemption structure, they enactment good arsenic collateral. So, depositors often get USDC (for example), and recycle it backmost into Ethena to mint caller USDe, which flows again into Pendle, reinforcing the loop.

In short, Ethena generates yield, Pendle packages it, and Aave leverages it. This operation present accounts for the bulk of Ethena’s deposits connected Aave and astir of Pendle's full worth locked (TVL), making it 1 of the astir influential output engines on-chain.

This flywheel didn’t lone enactment due to the fact that yields are attractive, but due to the fact that the protocols stock a communal foundation. All 3 are EVM-compatible, making integration easier. Each is designed to beryllium afloat on-chain and crypto-native, avoiding dependencies connected banks oregon off-chain assets. Additionally, they run successful the aforesaid DeFi “neighborhood,” with overlapping idiosyncratic bases and liquidity pools that accelerate adoption. What mightiness person different remained a niche experimentation has go a halfway gathering artifact of on-chain output strategies.

The earthy question present is whether a 4th protocol volition join, and Hyperliquid has a beardown lawsuit for doing so. Ethena uses Hyperliquid perps arsenic portion of its yield-generating strategy, and USDe is already embedded wrong some HyperCore and the HyperEVM. Pendle has $300 cardinal successful TVL tied to HyperEVM products, and its caller Boros funding-rate markets is simply a earthy acceptable for Hyperliquid perpetual futures. Aave’s narration with Hyperliquid is much tentative, but the emergence of HyperLend, a affable fork connected HyperEVM, points to a deeper integration ahead. As Hyperliquid expands, the strategy could germinate from a closed loop into a broader network. Liquidity would nary longer conscionable rhythm wrong 3 protocols but travel straight into perpetual futures markets, deepening superior ratio and reshaping however on-chain output strategies are built.

The Ethena-Pendle-Aave loop already shows however accelerated DeFi tin standard erstwhile protocols stock the aforesaid environment. Hyperliquids could propulsion this exemplary adjacent further.

- Ilan Solot, elder planetary markets strategist and co-head of integer assets, Marex Solutions

- Elisabeth Phizackerley, macro strategist analyst, Marex Solutions

Ask an Expert

Q. What does “composability” mean successful DeFi?

A. In accepted finance, products beryllium successful silos. In DeFi, composability means protocols plug into each different similar Lego blocks. Ethena creates yield, Pendle packages it, and Aave lends against it, each on-chain. This makes maturation accelerated but besides means risks tin dispersed quickly.

Q. What are Principal Tokens (PTs) and Yield Tokens (YTs)?

A. Pendle splits an plus into 2 parts. The Principal Token (PT) is similar buying a enslaved astatine a discount and redeeming it later. The Yield Token (YT) is akin to a coupon, providing an income stream. It’s simply a mode to abstracted main from output successful crypto form.

Q. What is simply a “delta-neutral strategy”?

A. Ethena uses this to support its synthetic dollar stable. By holding crypto and shorting futures simultaneously, gains and losses offset each other. The setup stays dollar-neutral portion inactive generating output akin to market-neutral hedge money strategies, but on-chain.

- DJ Windle, laminitis and portfolio manager, Windle Wealth

Keep Reading

- There are present 92 cryptocurrency-related ETF applications pending support with the U.S. Securities and Exchange Commission.

- Google Cloud is processing the Universal Ledger (GCUL), a caller Layer-1 blockchain designed for fiscal institutions.

- SEC Chair Paul Atkins has floated the imaginativeness for a unified “SuperApp Exchange” wherever investors could commercialized everything from tokenized stocks and bonds to cryptocurrencies and integer assets nether a azygous platform.

2 months ago

2 months ago

English (US)

English (US)