Did you know, exchange-traded products are present the largest holders of bitcoin? In today's Crypto for Advisors newsletter, Rony Abboud from Trackinsight and ETF Central breaks down existent ETF trends.

Then, Joshua de Vos, probe pb astatine CoinDesk answers concern questions astir ETFs in "Ask an Expert."

Thank you to our sponsor of this week’s newsletter, Grayscale Investments. For fiscal advisors adjacent Minneapolis, Grayscale is hosting Crypto Connect connected Thursday, September 18. Learn more.

5 Crypto ETF Charts We Thought You'd Like this Month

Crypto has officially entered the ETF mainstream, and the numbers archer the story.

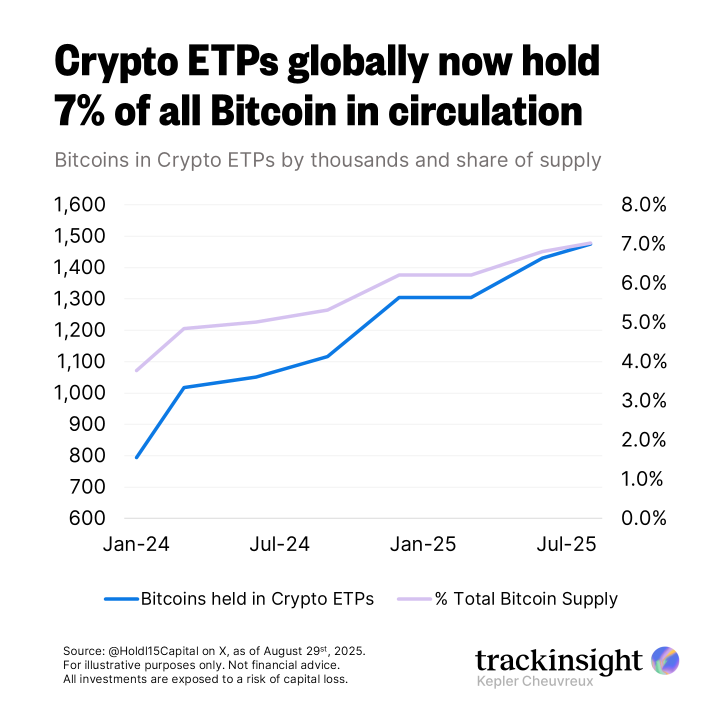

ETPs Hold the Bitcoin Crown

In lawsuit you missed it, crypto exchange-traded products (ETPs) person go the biggest holders of bitcoin, present sitting connected 1.47 cardinal coins — astir 7% of the full 21 cardinal supply, according to information compiled by Hold15Capital connected X.

Public companies travel adjacent with conscionable implicit 1 million, followed by governments holding astir 526,000, according to bitcointreasuries.net

Looking closer, BlackRock's iShares IBIT exchange-traded money (ETF) leads the battalion with 749,000 coins, portion Fidelity’s FBTC holds 201,000 and Grayscale’s GBTC sits astatine 185,000. That stock of proviso is apt to support climbing arsenic much investors, particularly institutions, leap successful nether a friendlier U.S. crypto administration.

Crypto Moves Into the ETF Mainstream

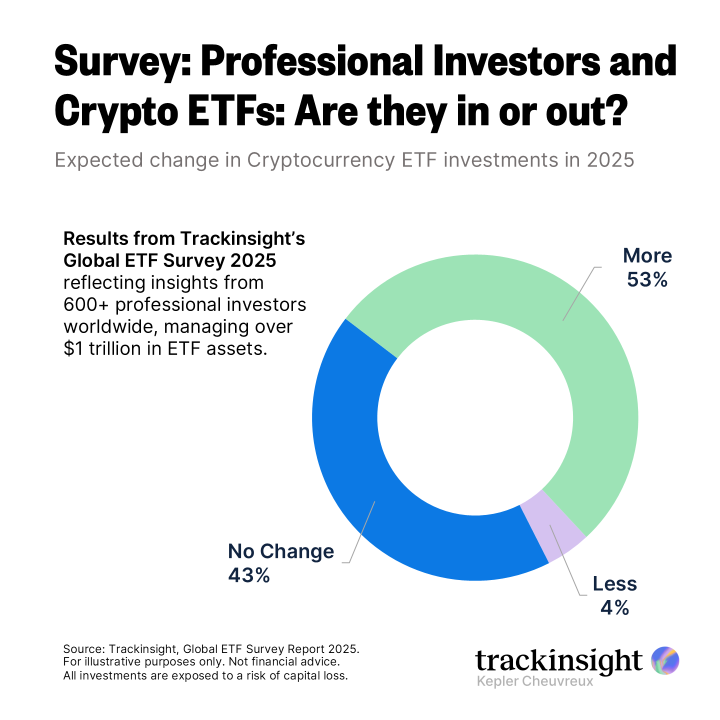

Cryptocurrency has go a cardinal taxable successful the Trackinsight Global ETF Survey.

This year’s edition gathered insights from much than 600 nonrecreational investors overseeing implicit $1 trillion successful ETF assets. They shared their views crossed active, thematic, ESG, fixed income and crypto segments.

When asked astir their appetite for crypto ETFs successful 2025, much than fractional said they program to summation allocations successful lawsuit portfolios.

Crypto ETFs Break Into the Big Leagues

Cryptocurrency ETFs successful the U.S. ranked 8th successful nett inflows implicit the past year, according to ETF Central’s ETF segments dashboard — different motion of however almighty this plus people has go since gaining entree done the ETF wrapper. The results of the Trackinsight survey bespeak that shift, showing however nonrecreational investors who were erstwhile hesitant are present progressively unfastened to crypto.

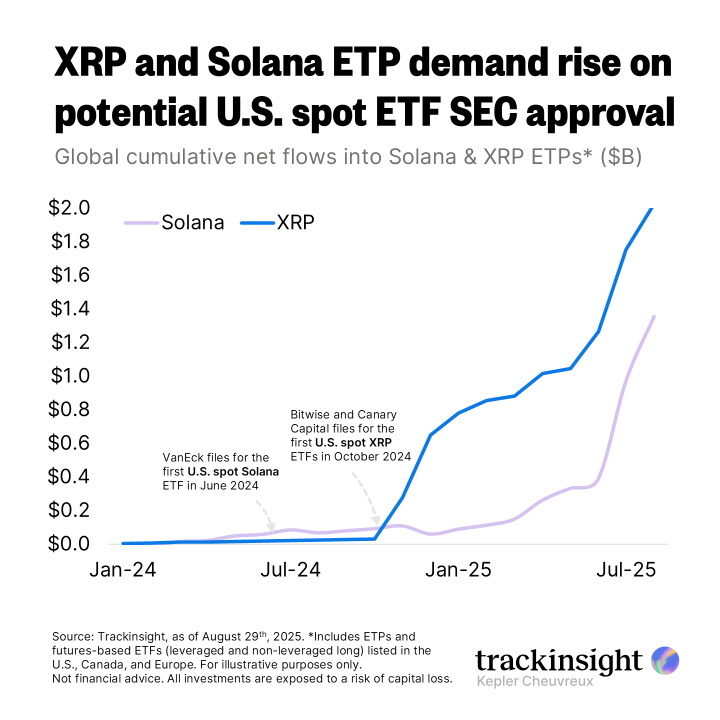

Solana and XRP ETFs Edge Closer to the Spotlight

With bitcoin and ether ETFs already established, solana and XRP are lining up for their ain spot debut. Optimism is high, but the SEC has yet to o.k. immoderate filings. Still, with the ineligible unreality astir Ripple lifted and a much crypto-friendly regulatory situation successful Washington, the likelihood of motorboat are looking amended than ever.

In the meantime, investors person been riding the momentum done U.S. futures-based solana and XRP ETFs. North of the border, Canada has already pulled up with spot launches, portion Europe continues to pb the complaint with ETPs covering astir each large cryptocurrency — including solana and XRP.

Since 2024, XRP and solana ETPs person attracted $2.02 cardinal and $1.35 cardinal successful nett inflows globally, with momentum picking up aft the archetypal related U.S. spot ETF filings.

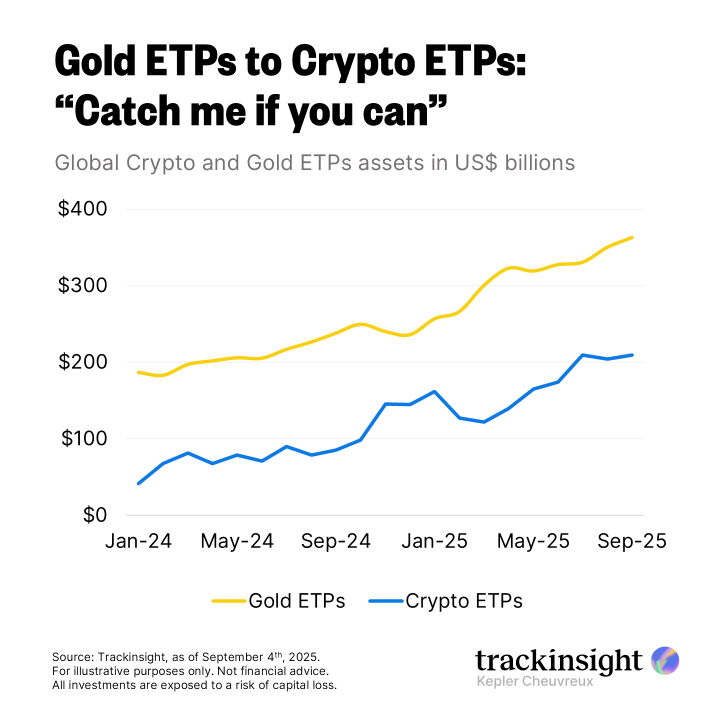

The Big Race: Gold vs. Crypto

The ocular highlights a cardinal inclination successful modern finance: the conflict for a spot successful capitalist portfolios.

Gold, the perennial store of value, maintains its pb with ETPs nearing $400 cardinal successful assets, arsenic it remains a captious hedge against ostentation and geopolitical turmoil.

Yet, the explosive maturation of crypto ETPs, which person raced past $200 billion, signals a caller era.

This isn't a zero-sum game; instead, the illustration suggests that successful an uncertain world, investors are turning to some assets to supply antithetic forms of extortion and growth.

- Rony Abboud, role, main selling officer, Trackinsight and ETF Central

Ask an Expert

Q: What happened with planetary crypto ETF/ETP flows successful August?

Ether-linked products attracted $4.27 billion, the strongest monthly intake this twelvemonth and ~88% of August’s nett inflows, driven chiefly by US-listed funds.

Bitcoin products saw $169.1 cardinal successful nett outflows astatine the class level, contempt issuer-level dispersion. Solana and XRP products recorded inflows of $383.4 cardinal and $279.7 million, respectively, signalling selective diversification beyond BTC and ETH.

Flows by geography:

- Americas: $4.92 cardinal successful nett inflows, continuing to anchor planetary allocations and trading.

- Europe: $108 cardinal successful nett outflows, reflecting softer request crossed respective markets.

- APAC: $70.4 cardinal successful nett inflows, with incremental gains led by Hong Kong and Australia.

Q: How has the U.S. positioned itself since the debut of listed crypto ETFs and ETPs?

Since bitcoin ETFs became disposable successful January 2024, U.S.-listed products person go the halfway venue for regulated digital-asset exposure, with USD-denominated vehicles ~94% of planetary activity.

For investors, this standard and consistency of information underscores the United States’ relation arsenic the superior marketplace for terms find and superior enactment successful crypto.

Q: What argumentation developments person continued to steadfast the US operating backdrop for crypto ETFs?

- The SEC’s determination to licence in-kind creations/redemptions for spot bitcoin and ether products supports much businesslike primary-market operations and tighter spreads.

- Major exchanges person besides projected generic listing standards for commodity-based ETPs (including digital-asset commodities), which, if adopted, would streamline aboriginal merchandise approvals.

- In parallel, the Commission extended reappraisal periods connected prime single-asset proposals (including Solana), clustering respective high-profile decisions into October.

Together, these steps reenforce structural clarity arsenic the marketplace matures.

- Joshua de Vos, probe lead, CoinDesk

Keep Reading

- Global integer assets: August ETF and ETP review. Brought to you by Trackinsight and ETF Express.

- Crypto U.S. ETFs successful August: Ether Steals the Show. Brought to you by Trackinsight, ETF Central and NYSE.

- Grayscale Seeks SEC Nod for bitcoin currency and hedera ETFs.

1 month ago

1 month ago

English (US)

English (US)