By Omkar Godbole (All times ET unless indicated otherwise)

Since Friday, cryptocurrencies, particularly bitcoin BTC, person demonstrated resilience successful the look of the Iran-Israel hostilities. But they besides haven't rallied connected what mightiness beryllium considered affirmative news.

The 2 largest tokens, bitcoin and ether ETH, person traded successful a constrictive scope successful the past 24 hours. Even the best-performing of the apical 100 tokens, bitcoin currency BCH, added conscionable 4%.

Behind the scenes, though, institutions are continuing to clasp crypto. On Monday, concern banking elephantine JPMorgan filed an exertion for a crypto-focused platform, JPMD, to connection trading, exchange, transportation and outgo services and issuance of integer assets.

Strategy, for its part, said it bought implicit 10,100 BTC worthy $1.05 cardinal past week, 1 of the biggest acquisitions of the year. And some bitcoin and ether spot ETFs registered inflows.

On regulatory front, the GENIUS stablecoin measure and the bipartisan CLARITY Act are progressing done Congress.

Perhaps markets are disquieted the U.S. volition participate what mightiness go a prolonged struggle successful the Middle East. Hours aft Axios reported the Trump squad was mulling a diplomatic solution to the clash implicit Iran's atomic program, President Trump said connected Truth Social that helium has not reached retired to Iran for "Peace Talks" successful immoderate way, signifier oregon form.

Wednesday's Federal Reserve complaint determination presents different crushed for bulls to tread cautiously. While the cardinal slope is expected to clasp rates steady, its commentary connected the interest-rate trajectory could determination markets.

According to XBTO, superior flows person go selective and hazard averse.

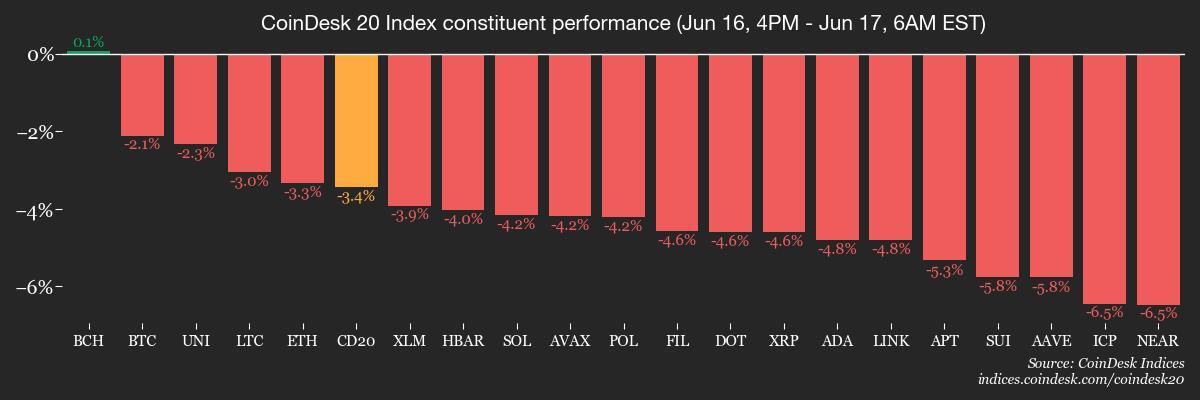

"The Market Factor, a proxy for the broader beingness of liquid crypto assets, fell by 4.06%," XBTO told CoinDesk successful an email. "This confirms that portion the majors held steady, the wider handbasket of altcoins experienced a overmuch much important sell-off. The move's debased Z-score of +0.11 suggests a controlled de-risking alternatively than a statistically important panic event, indicating that superior is consolidating, not fleeing the plus people entirely,"

Valentin Fournier, pb probe expert astatine BRN, said the marketplace is witnessing a structural displacement successful leadership, with corporations and institutions dominating demand.

"With request remaining beardown and merchantability unit weak, we support a high-conviction presumption that prices volition grind higher successful 2025," BRN said. "While momentum is paused, the asymmetry successful risk/reward favors staying invested, particularly if retail re-engages. We clasp our vulnerability dependable and expect BTC to pb until retail returns oregon ETH regains organization inflows," BRN said.

In different news, traders should enactment that speculation Ripple volition pain 10% of its XRP proviso is misleading. The disorder apt results from RealFi burning its ain token connected the XRP Ledger, not XRP.

European integer plus manager CoinShares applied for a Solana spot ETF with the U.S. SEC, days aft 7 issuers, including 21Shares and Bitwise, updated applications. OKX speech has officially launched afloat compliant centralized cryptocurrency exchanges successful Germany and Poland. Stay alert!

What to Watch

- Crypto

- June 18: At astir 9:28 p.m. IoTeX L1 v2.2.0 hard fork volition activate astatine artifact 36,893,881. The fork volition halve artifact clip to 2.5s and motorboat System Staking v3.

- June 18: Shares of Purpose Investments' "Purpose XRP ETF" are expected to commencement trading on the Toronto Stock Exchange. The ETF volition connection Canadian dollar–hedged, Canadian dollar unhedged and U.S. dollar units nether the tickers XRPP, XRPP.B and XRPP.U, respectively.

- June 20: Proof-of-stake blockchain BlackCoin (BLK) activates SegWit connected mainnet, improving information and performance. Mandatory upgrade to node and wallet v26.2.0 required.

- Macro

- Day 3 of 3: G7 2025 Summit (Kananaskis, Alberta, Canada)

- June 17, 8:30 a.m.: The U.S. Census Bureau releases May retail income data.

- Retail Sales MoM Est. -0.7% vs. Prev. 0.1%

- Retail Sales YoY Prev. 5.2%

- June 17, 10 a.m.: National Association of Home Builders (NAHB) releases U.S. lodging marketplace information for June.

- NAHB Housing Market Index Est. 36 vs. Prev. 34

- June 17: The U.S. Senate volition ballot connected the last transition of the Guiding and Establishing National Innovation for US Stablecoins measure (GENIUS Act).

- June 18, 2 a.m.: U.K.'s Office for National Statistics releases May user terms ostentation data.

- Core Inflation Rate MoM Est. 0.2% vs. Prev. 1.4%

- Core Inflation Rate YoY Est. 3.6% vs. Prev. 3.8%

- Inflation Rate MoM Est. Est. 0.2% vs. Prev. 1.2%

- Inflation Rate YoY Est. 3.4% vs. Prev. 3.5%

- June 18, 5 a.m.: EUROSTAT releases (final) May eurozone user terms ostentation data.

- Core Inflation Rate YoY Est. 2.3% vs. Prev. 2.7%

- Inflation Rate MoM Est. 0% vs. Prev. 0.6%

- Inflation Rate YoY Est. 1.9% vs. Prev. 2.2%

- June 18, 8:30 a.m.: U.S. Department of Labor releases unemployment security information for the week ended June 14.

- Initial Jobless Claims Est. 245K vs. Prev. 248K

- June 18, 2 p.m.: Federal Reserve announces its interest-rate decision. Rates expected to beryllium held astatine 4.25%-4.50%. Chair Jerome Powell’s property league follows astatine 2:30 p.m.

- June 18, 5:30 p.m.: Brazil’s cardinal bank, Banco Central bash Brasil, announces its interest-rate decision.

- Selic Rate Est. 14.75% vs. Prev. 14.75%

- Earnings (Estimates based connected FactSet data)

- June 23 (TBC): HIVE Digital Technologies (HIVE), post-market, $-0.12

Token Events

- Governance votes & calls

- Compound DAO is acceptable to ballot connected a connection to create the Compound Foundation, a non-profit to thrust protocol maturation and strategy. It calls for an 18-month program and requests $9 cardinal successful COMP, with voting acceptable to statesman successful a time and extremity June 20.

- Arbitrum DAO is voting connected a connection to motorboat DRIP, an $80M incentives program targeting circumstantial DeFi activity. Managed by a foundation-led committee, DRIP would reward users straight and let the DAO to unopen it down via vote. Voting ends June 20.

- ApeCoin DAO is voting connected whether to sunset the decentralized autonomous organization and motorboat ApeCo, a caller entity established by Yuga Labs with a ngo to “supercharge the APE ecosystem.” Voting ends June 24.

- Polkadot Community is voting on launching a non-custodial Polkadot branded outgo card to “to span the spread betwixt integer assets successful the Polkadot ecosystem and mundane spending.” Voting ends July 9.

- June 17, 12 p.m.: Lido to hist its 29th Node Operator Community Call.

- June 18, 10 a.m.: Filecoin to big a league connected unlocking Filecoin’s blistery retention era.

- June 19, 9 a.m.: TON to big a Builders Call: Payments Edition.

- Unlocks

- June 17: ApeCoin (APE) to unlock 1.95% of its circulating proviso worthy $10.37 million.

- June 18: Fasttoken (FTN) to unlock 4.65% of its circulating proviso worthy $88.80 million.

- June 18: Sonic (S) to unlock 1.68% of its circulating proviso worthy $16.12 million.

- June 30: Optimism (OP) to unlock 1.83% of its circulating proviso worthy $18.05 million.

- July 1: Sui (SUI) to unlock 1.3$ of its circulating proviso worthy $130.23 million.

- July 2: Ethena (ENA) to unlock 0.67% of its circulating proviso worthy $11.85 million.

- Token Launches

- June 17: Spark (SPK) to beryllium listed connected Binance, KuCoin, Bithumb, Bybit, Bitget, MEXC, and others.

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight.

- June 18-19: Canadian Blockchain Consortium’s 2nd Annual Policy Summit (Ottawa)

- June 18-19: SuperAI (Singapore)

- June 19-21: BTC Prague 2025

- June 24-26: Blockworks' Permissionless IV (New York)

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26: The Injective Summit (New York)

- June 26-27: Istanbul Blockchain Week

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

Token Talk

By Shaurya Malwa

- USELESS exploded onto the memecoin country with a 1,000% rally implicit the past week, contempt crypto markets holding reasonably dependable connected the Israel–Iran hostilities.

- Over $26 million successful 24-hour trading measurement shows feverish trader involvement adjacent though the coin’s website says it’s virtually useless: nary utility, nary roadmap and nary committedness of gains.

- Launched via Letsbonk.fun connected Solana, USELESS rode a question from $0.004 to highs adjacent $0.10, fueling retail FOMO and momentum mostly driven by societal media hype connected X.

- A whale dubbed “Bonk Guy," who goes by @theunipcs connected X, scooped up astir 2.8% of the full proviso (or 28 million tokens) for astir $382,000 successful caller weeks, contributing to the token's visibility.

- That involvement is present worthy astir $2.3 million successful unrealized profits.

- The frenzy is indicative of however satire and hype proceed to outweigh fundamentals successful an different level market, with its gag presumption not stopping traders from piling in, turning self-proclaimed zero-utility into superior superior swings.

Derivatives Positioning

- Annualized perpetual backing rates for astir large tokens proceed to hover beneath 10%. In different words, the marketplace is bullish but not overheated.

- One objection is HYPE. Funding rates for HYPE stay supra 40%, which whitethorn acceptable the signifier for a agelong compression should prices halt rising.

- TRX, BCH, SHIB, TAO and XRP person each seen increases successful unfastened interest.

- On the CME, annualized one-month ground successful BTC and ETH futures remains beneath 10%.

- On Deribit, ether options from July expiry amusement bullish bias portion bullishness successful BTC options is evident lone aft August.

Market Movements

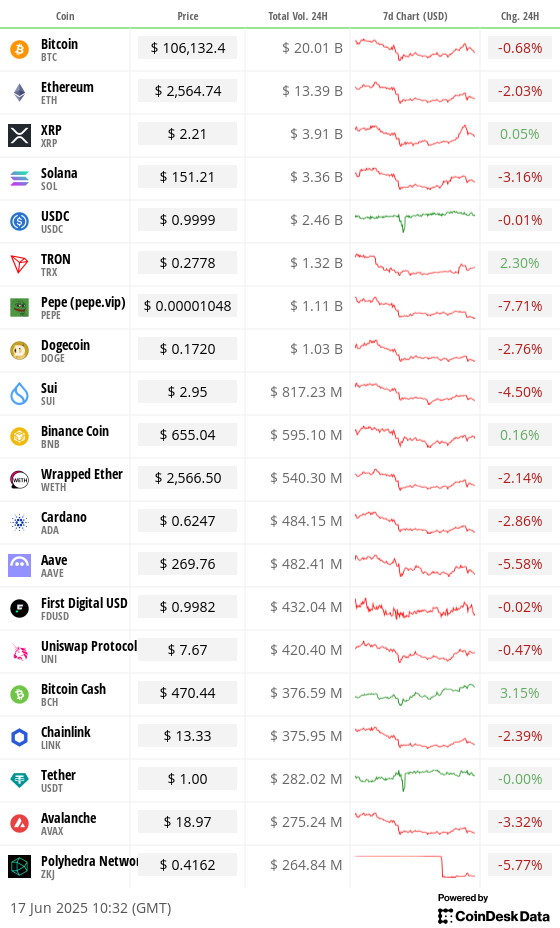

- BTC is up 1.17% from 4 p.m. ET Monday astatine $106,278.52 (24hrs: -0.67%)

- ETH is up 0.84% astatine $2,567.65 (24hrs: -2.06%)

- CoinDesk 20 is unchanged astatine 3,086.55 (24hrs: +0.81%)

- Ether CESR Composite Staking Rate is up 9 bps astatine 2.97%

- BTC backing complaint is astatine 0.0042% (4.6308% annualized) connected Binance

- DXY is up 0.21% astatine 98.20

- Gold futures are down 0.49% astatine $3,400.40

- Silver futures are up 0.35% astatine $36.58

- Nikkei 225 closed up 0.59% astatine 38,536.74

- Hang Seng closed down 0.34% astatine 23,980.30

- FTSE is down 0.51% astatine 8,829.82

- Euro Stoxx 50 is down 1.24% astatine 5,273.24

- DJIA closed connected Monday up 0.75% astatine 42,515.09

- S&P 500 closed up 0.94% astatine 6,033.11

- Nasdaq Composite closed up 1.52% astatine 19,701.21

- S&P/TSX Composite closed up 0.24% astatine 26,568.61

- S&P 40 Latin America closed up 1.32% astatine 2,642.67

- U.S. 10-Year Treasury complaint is down 2 bps astatine 4.434%

- E-mini S&P 500 futures are down 0.60% astatine 5,999.25

- E-mini Nasdaq-100 futures are down 0.61% astatine 21,807.25

- E-mini Dow Jones Industrial Average Index are down 0.64% astatine 42,264.00

Bitcoin Stats

- BTC Dominance: 64.8 (-0.12%)

- Ethereum to bitcoin ratio: 0.02415 (1.43%)

- Hashrate (seven-day moving average): 929 EH/s

- Hashprice (spot): $53.71

- Total Fees: 4.92 BTC / $528,060

- CME Futures Open Interest: 154,415

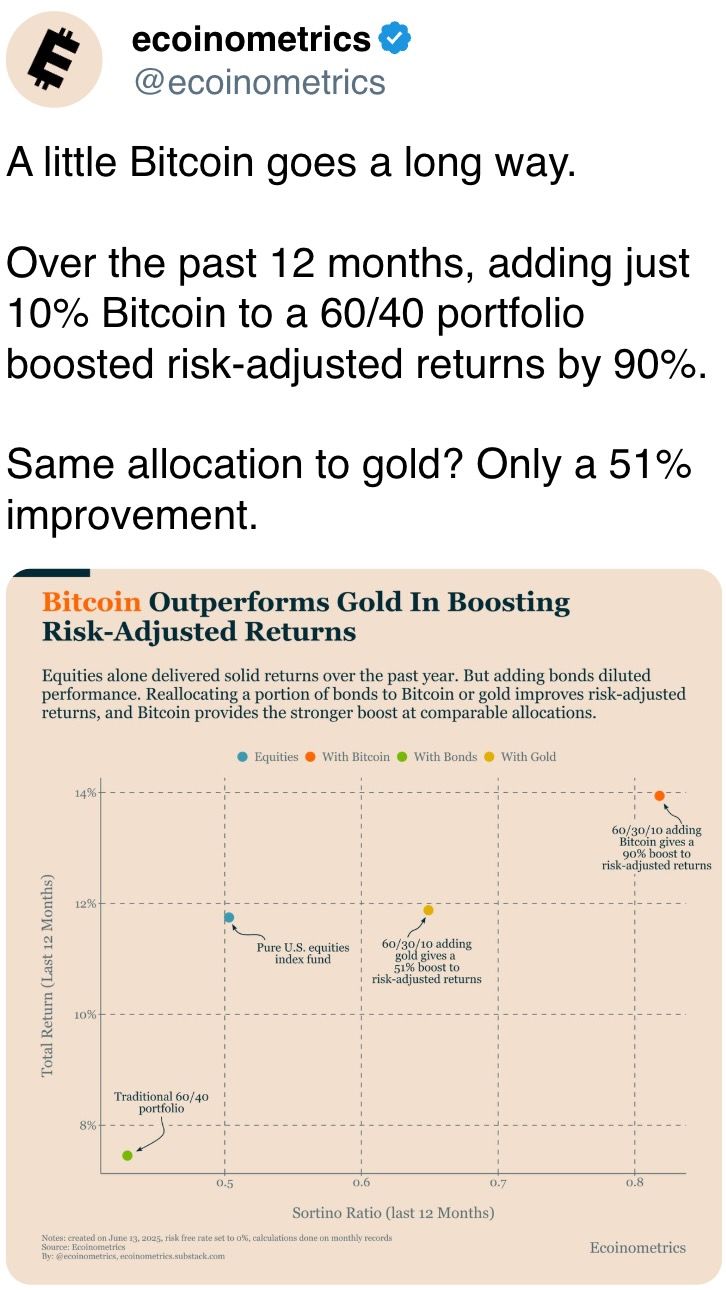

- BTC priced successful gold: 31.1 oz

- BTC vs golden marketplace cap: 8.80%

Technical Analysis

- Bitcoin's 50-day elemental moving mean (SMA) has emerged arsenic beardown enactment for the largest cryptocurrency, restricting downside moves astatine slightest doubly this month.

- A imaginable interruption beneath the mean could invitation stronger selling pressure, yielding deeper losses.

Crypto Equities

- Strategy (MSTR): closed connected Monday astatine $382.25 (-0.16%), pre-market down 2.09% astatine $374.28

- Coinbase Global (COIN): closed astatine $261.57 (+7.77%), pre-market down 1.85% astatine $256.73

- Circle (CRCL): closed astatine $151.06 (+13.1%), up 6.06% pre-market astatine $160.30

- Galaxy Digital Holdings (GLXY): closed astatine C$26.33 (+2.93%)

- MARA Holdings (MARA): closed astatine $15.32 (+1.86%), pre-market down 1.76% astatine $15.05

- Riot Platforms (RIOT): closed astatine $10.17 (+4.63%), pre-market down 2.26% astatine $9.94

- Core Scientific (CORZ): closed astatine $12.08 (+1.6%), pre-market down 1.08% astatine $11.95

- CleanSpark (CLSK): closed astatine $9.62 (+3.44%), pre-market down 2.29% astatine $9.40

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $19.7 (+4.45%)

- Semler Scientific (SMLR): closed astatine $30.52 (+3.18%)

- Exodus Movement (EXOD): closed astatine $32.76 (+4.43%), pre-market down 0.18% astatine $32.7

ETF Flows

Spot BTC ETFs

- Daily nett flows: $408.6 million

- Cumulative nett flows: $46 billion

- Total BTC holdings ~1.22 million

Spot ETH ETFs

- Daily nett flows: $21.4 million

- Cumulative nett flows: $3.89 billion

- Total ETH holdings ~3.96 million

Source: Farside Investors

Overnight Flows

Chart of the Day

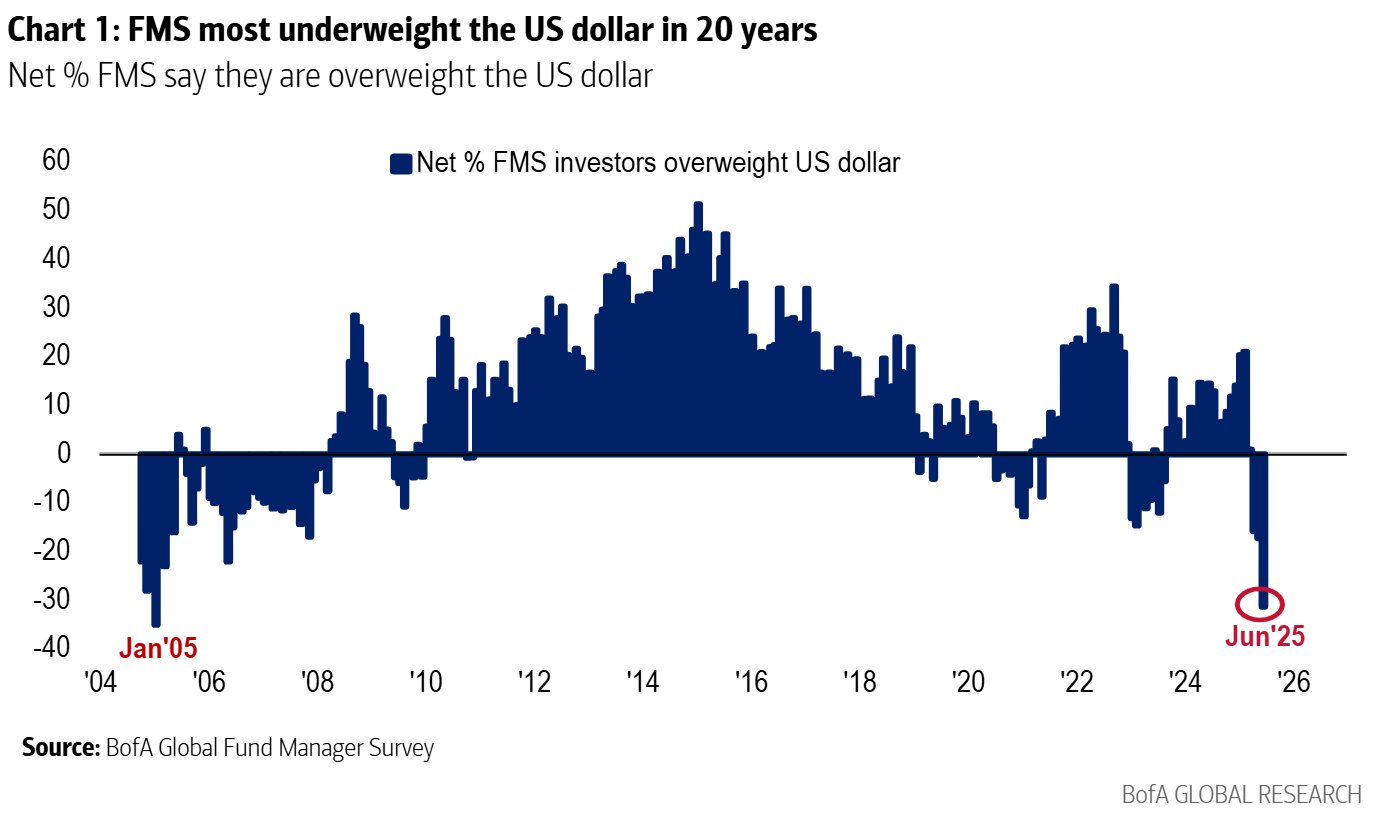

- The illustration shows money managers are astir underweight connected the U.S. dollar successful 2 decades.

- The utmost bearish positioning successful the dollar alongside elevated Treasury yields points to capitalist concerns astir U.S. fiscal sustainability.

- That said, utmost bearish moods often people interim bottoms.

While You Were Sleeping

- ARK Invest Offloads Over $50M successful Circle Shares arsenic Stock Extends Rally (CoinDesk): Cathie Wood's steadfast sold the shares, dispersed crossed 3 of its ETFs, arsenic the terms rallied 13% aft it bought $373 cardinal worthy of the banal earlier this month.

- Polymarket Odds connected U.S. Military Action Against Iran Slide arsenic Trump Team Proposes Tehran Talks (CoinDesk): Odds connected the decentralized betting level fell to 46% aft Axios reported that the U.S. whitethorn inquire envoy Steve Witkoff to conscionable Iranian Foreign Minister Abbas Araghchi this week.

- Deribit Sees Strong Demand From Institutions, Volume connected Its Block RFQ Tool Reaches $23B successful Four Months (CoinDesk): The crypto derivatives exchange's Block Request-for-Quote (RFQ) instrumentality present accounts for 27.5% of artifact trades, signaling beardown organization request for executing ample crypto derivatives transactions without impacting nationalist bid books.

- Central Banks Plan to Boost Gold Reserves and Trim Dollar Holdings (Financial Times): Nearly each cardinal banks surveyed by the World Gold Council accidental they expect to rise golden reserves wrong a year, portion 75% foresee cutting dollar holdings by 2030.

- Bank of Japan to Slow Cuts to Government Bond Purchases From April Next Year arsenic Growth Risks Loom (CNBC): The slope volition dilatory its enslaved acquisition cuts from April 2026, reflecting interest astir draining liquidity excessively quickly. A argumentation reappraisal is acceptable for June 2026.

- Citi Calls Time connected Gold’s Rally connected Slumping Demand, Fed Cuts (Bloomberg): Citi sees golden sinking beneath $2,700 by precocious 2026 arsenic concern request wanes amid expected Fed complaint cuts, U.S. fiscal stimulus, and easing of Trump’s tariffs.

In the Ether

4 months ago

4 months ago

English (US)

English (US)