By Omkar Godbole (All times ET unless indicated otherwise)

The crypto marketplace is looking to regain poise, with bitcoin bouncing supra $81,000 up of tomorrow's U.S. ostentation report. Broadly speaking, the betterment from overnight lows is led by layer-1 and layer-2 coins, with gaming tokens besides rising.

The rebound comes amid indications of "peak fear" connected Wall Street, a dynamic typically observed astatine marketplace bottoms.

Interestingly, the dispersed betwixt one- and six-month futures tied to the VIX, Wall Street’s alleged fearfulness gauge, crossed supra zero connected Monday, signaling a uncommon affirmative speechmaking and reflecting expectations for greater volatility successful the short-term than six months out. Volmex's Bitcoin volatility scale shows a akin inversion, though that is much communal successful the crypto market.

"Is the worst down us? It’s intolerable to say," noted Ilan Solot, elder planetary marketplace strategist astatine Marex Solutions, successful an email to CoinDesk. "However, the risk-reward for entering agelong positions successful U.S. stocks is improving. The VIX scale for volatility is present importantly inverted, meaning near-term contracts are priced higher than semipermanent ones. This is an important motion of stress, but it tin besides bespeak extremes successful sentiment."

Meanwhile, bullish positioning successful the yen appears stretched, suggesting the haven currency's rally whitethorn soon suffer steam, perchance providing alleviation to hazard assets successful the process.

The Truflation U.S. Inflation Index, which offers a daily, real-time measurement of ostentation based connected information from implicit 30 sources and 13 cardinal terms points, has dropped to 1.35%, extending a diminution from February's precocious of implicit 2%. This inclination hints astatine the advancement connected ostentation the Federal Reserve is looking for earlier considering complaint cuts.

On Wednesday, the Bureau of Labor Statistics is expected to amusement a month-over-month summation of 0.3% for February. This would beryllium a notable deceleration from January's concerning 0.5%. A brushed speechmaking could validate traders' expectations for accelerated complaint cuts starting successful June, perchance starring to renewed risk-on sentiment. However, it’s important to enactment that Chairman Jerome Powell has indicated the Fed is waiting for clarity connected President Trump’s policies earlier making its adjacent move, suggesting that brushed CPI information unsocial mightiness not beryllium enough.

On the different hand, a hotter-than-expected CPI people could derail betterment prospects, perchance mounting the signifier for a deeper descent successful bitcoin and the broader crypto market. Some analysts adjacent foretell bitcoin could driblet to $74,000.

"A bearish signifier persists connected the regular timeframes, indicating a strengthening sell-off aft failing to clasp supra the 200-day moving average. The script of a pullback to the $70,000 to $74,000 scope inactive looks astir probable," said Alex Kuptsikevich, elder marketplace expert astatine FxPro, successful an email to CoinDesk. Stay alert!

What to Watch

Crypto:

March 11, 9:00 a.m.: Horizen (ZEN) mainnet web upgrade to mentation ZEN 5.0.6 astatine artifact tallness 1,730,680.

March 11, 10:00 a.m.: U.S. House Financial Services Committee hearing astir a national model for stablecoins and a CBDC. Livestream link.

March 11: The Bitcoin Policy Institute and Senator Cynthia Lummis co-host the invitation-only one-day "Bitcoin for America" lawsuit successful Washington.

March 12: Hemi (HEMI), an L2 blockchain that operates connected some Bitcoin and Ethereum, has its mainnet launch.

March 15: Athene Network (ATH) mainnet launch.

March 15: Reploy volition adjacent its V1 RAI staking programme to caller users arsenic it transitions to a afloat automated revenue-sharing protocol.

March 17.: CME Group launches solana (SOL) futures.

March 18: Zano (ZANO) hard fork web upgrade which activates “ETH Signature enactment for off-chain signing and plus operations.”

March 20: Pascal hard fork web upgrade goes unrecorded connected the BNB Smart Chain (BSC) mainnet.

Macro

March 11, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases January concern accumulation data.

Industrial Production MoM Est. 0.4% vs. Prev. -0.3%

Industrial Production YoY Est. 2.2% vs. Prev. 1.6%

March 11, 10:00 a.m.: The U.S. Department of Labor releases January’s JOLTs study (job openings, hires, and separations).

Job Openings Est. 7.75M vs. Prev. 7.6M

Job Quits Prev. 3.197M

March 12, 4:45 a.m.: European Central Bank President Christine Lagarde gives a speech astatine the 25th “ECB and Its Watchers” league successful Frankfurt.

March 12, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) merchandise February user terms ostentation data.

Inflation Rate MoM Est. 1.3% vs. Prev. 0.16%

Inflation Rate YoY Est. 5% vs. Prev. 4.56%

March 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases February user terms ostentation data.

Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.4%

Core Inflation Rate YoY Est. 3.2% vs. Prev. 3.3%

Inflation Rate MoM Est. 0.3% vs. Prev. 0.5%

Inflation Rate YoY Est. 2.9% vs. Prev. 3%

March 12, 9:45 a.m.: The Bank of Canada announces its interest complaint decision followed by a property league (livestream link) 45 minutes later.

Policy Interest Rate Est. 2.75% vs. Prev. 3%

March 12, 12:00 p.m.: Russia's Federal State Statistics Service merchandise February user terms ostentation data.

Inflation Rate MoM Est. 0.8% vs. Prev. 1.2%

Inflation Rate YoY Est. 10.1% vs. Prev. 9.9%

Earnings (Estimates based connected FactSet data)

March 17 (TBC): Bit Digital (BTBT), $-0.05

March 18 (TBC): TeraWulf (WULF), $-0.04

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.39

Token Events

Governance votes & calls

GMX DAO is voting connected the decentralization and automation of the interest organisation process for the GMX ecosystem to guarantee “real-time, trustless, and verifiable interest allocations.”

Frax DAO is discussing upgrading the protocol by renaming FXS to FRAX, making it the state token connected Fraxtal, implementing the Frax North Star hard fork, and introducing a process emanation program with gradually decreasing emissions and different enhancements.

Uniswap DAO is discussing continuing treasury delegation to support governance stableness and clasp progressive delegates, including a renewed model and operation expiration and allocation mechanisms.

March 13, 10 a.m.: Mantra to host a Community Connect telephone with its CEO and Co-Founder to sermon assorted large updates.

Unlocks

March 12: Aptos (APT) to unlock 1.93% of circulating proviso worthy $63.33 million.

March 15: Sei (SEI) to unlock 1.19% of its circulating proviso worthy $10.65 million.

March 16: Arbitrum (ARB) to unlock 2.1% of its circulating proviso worthy $30.76 million.

March 18: Fasttoken (FTN) to unlock 4.66% of its circulating proviso worthy $80 million.

March 21: Immutable (IMX) to unlock 1.39% of circulating proviso worthy $12.29 million.

Token Listings

March 11: Bybit to delist Bancor (BNT), Paxos Gold (PAXG), and Threshold.

March 11: Cookie DAO (COOKIE) to beryllium listed connected Coinbase.

March 11: PancakeSwap is retiring its crypto options product.

March 11: Mystery (MERY) was listed connected the Crypto.com app.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 2 of 2: MoneyLIVE Summit (London)

Day 2 of 3: AIBC Africa (Cape Town)

Day 1 of 2: VanEck Southern California Blockchain Conference 2025 (Los Angeles)

March 13-14: Web3 Amsterdam ‘25

March 16, 6:00 p.m.: Solana AI Summit (San Jose, Calif.)

March 18-20: Digital Asset Summit 2025 (New York)

March 18-20: Fintech Americas Miami 2025

March 19-20: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

March 28: Solana APEX (Cape Town)

Token Talk

By Shaurya Malwa

Grok Coin, a token inspired by, but not officially affiliated with, xAI’s Grok AI, was launched connected Base utilizing trading mechanisms from Bankr and Clanker.

The token’s AI-controlled wallet reportedly amassed implicit $200K successful fees successful the hours aft going live.

It was further amplified by the authoritative Base relationship connected X, which posted, “icymi, @grok launched a token connected Base,” and framing it arsenic a futuristic measurement wherever “AI is owning wallets, making markets, and generating revenue.” This gave the content of an endorsement from Base’s leadership.

The station prompted Base developers similar Kawz, the laminitis of Time.fun, to explicit vexation implicit the deficiency of designation for their ain projects.

Calling the GrokCoin station unfair and selective, Kawz noted they'd spent months gathering an app connected Base without a azygous tweet from @base.

Derivatives Positioning

ETH CME futures ground has dropped to an annualized 5%, the lowest since July.

BTC's ground has stabilized betwixt 5% and 10% successful a affirmative motion for the market.

BTC options amusement a akin anticipation signifier to gold, portion ETH and different cryptocurrencies are akin to the anticipation patterns of equities investors, information tracked by BloFin Academy show.

BTC and ETH hazard reversals amusement bias for protective puts retired to the May extremity expiry.

The $100K onslaught telephone is present the astir fashionable BTC enactment connected Deribit, arsenic opposed to the $120K telephone a fewer weeks ago.

Market Movements:

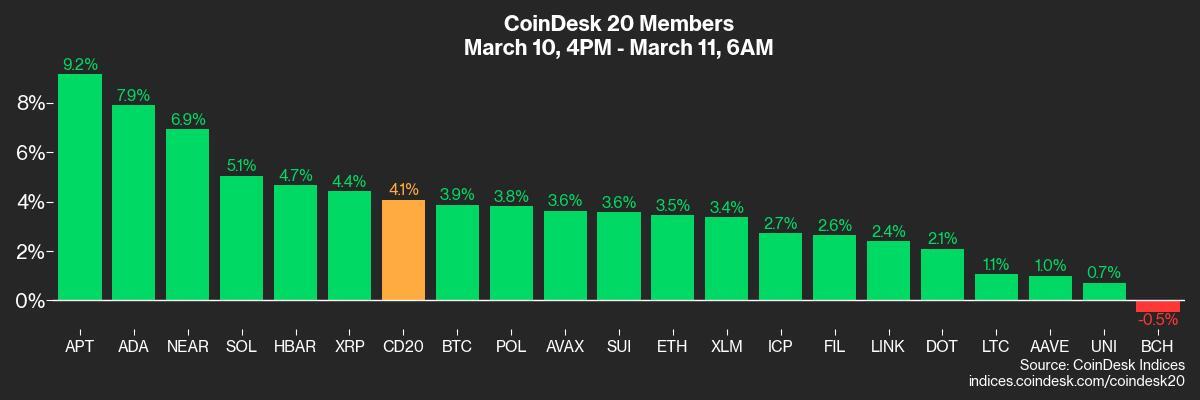

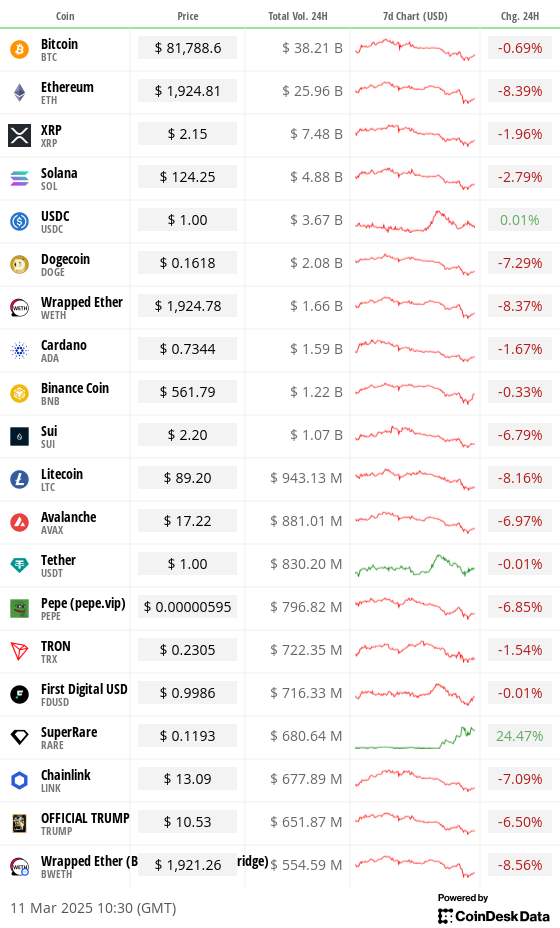

BTC is up 2.87% from 4 p.m. ET Monday astatine $81,425.03 (24hrs: -0.93%)

ETH is up 2.84% astatine $1,917.00 (24hrs: -8.65%)

CoinDesk 20 is up 3.05% astatine 2,531.70 (24hrs: -3.66%)

Ether CESR Composite Staking Rate is up 10 bps astatine 3.11%

BTC backing complaint is astatine 0.0001% (0.1% annualized) connected Binance

DXY is down 0.38% astatine 103.44

Gold is up 0.66% astatine $2,911.70/oz

Silver is up 1.12% astatine $32.49/oz

Nikkei 225 closed -0.64% astatine 36,793.11

Hang Seng closed unchanged astatine 23,782.14

FTSE is down 0.25% astatine 8,578.37

Euro Stoxx 50 is up 0.48% astatine 5,413.02

DJIA closed connected Monday -2.08% astatine 41,911.71

S&P 500 closed -2.7% astatine 5,614.56

Nasdaq closed -4% astatine 17,468.32

S&P/TSX Composite Index closed -1.53% astatine 24,380.71

S&P 40 Latin America closed -2.73% astatine 2,297.38

U.S. 10-year Treasury complaint is down 4 bps astatine 4.21%

E-mini S&P 500 futures are down 0.28% astatine 5636.50

E-mini Nasdaq-100 futures are down 0.41% astatine 19533.25

E-mini Dow Jones Industrial Average Index futures are down 0.21% astatine 42,036.00

Bitcoin Stats:

BTC Dominance: 61.95 (-0.24%)

Ethereum to bitcoin ratio: 0.02354 (-0.80%)

Hashrate (seven-day moving average): 814 EH/s

Hashprice (spot): $45.2

Total Fees: 5.3 BTC / $429,994

CME Futures Open Interest: 141,395 BTC

BTC priced successful gold: 28.2 oz

BTC vs golden marketplace cap: 8.01%

Technical Analysis

Bitcoin's RSI has carved retired a higher low, hinting astatine a bullish divergence, oregon affirmative displacement successful momentum.

Traders who trust connected charts whitethorn consciousness tempted to effort retired longs arsenic prices are adjacent to the cardinal enactment of the March 2024 precocious of $73,757, offering an charismatic risk-reward.

That, successful turn, mightiness spot the betterment stitchery pace.

Crypto Equities

Strategy (MSTR): closed connected Monday astatine $239.27 (-16.68%), up 4.57% astatine $250.20 successful pre-market

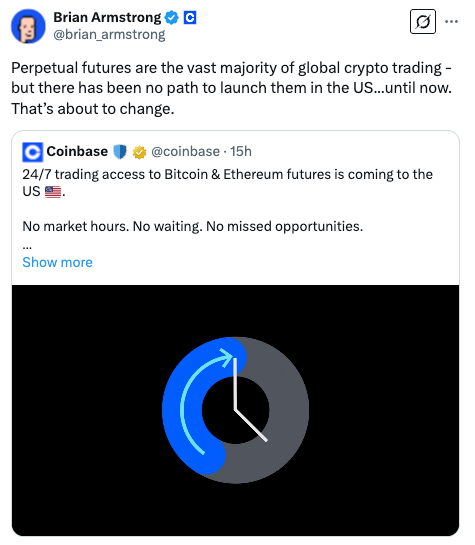

Coinbase Global (COIN): closed astatine $179.23 (-17.58%), up 4.09% astatine $186.55

Galaxy Digital Holdings (GLXY): closed astatine C$17.46 (-7.32%)

MARA Holdings (MARA): closed astatine $13.41 (-16.29%), up 1.34% astatine $13.59

Riot Platforms (RIOT): closed astatine $7.56 (-9.68%), up 2.51% astatine $7.75

Core Scientific (CORZ): closed astatine $8.01 (+2.96%), up 3.62% astatine $8.30

CleanSpark (CLSK): closed astatine $7.98 (-9.63%), up 1.5% astatine $8.10

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $14.48 (-11.27%), up 3.04% astatine $14.92

Semler Scientific (SMLR): closed astatine $32.74 (-11.97%), unchanged successful pre-market

Exodus Movement (EXOD): closed astatine $24.60 (-16.33%), down 5.65% astatine $23.21

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$278.4 million

Cumulative nett flows: $35.93 billion

Total BTC holdings ~ 1,122 million.

Spot ETH ETFs

Daily nett flow: -$34 million

Cumulative nett flows: $2.69 billion

Total ETH holdings ~ 3.579 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The illustration shows the dispersed betwixt yields connected the 10-year U.S. and Japanese authorities bonds.

The spread has narrowed sharply, diving beneath a five-year-long uptrend line.

The narrowing of the output dispersed favors spot successful the yen, seen arsenic an anti-risk, haven currency.

While You Were Sleeping

Global Markets Steady After Slowdown Fears Hit Wall Street (Financial Times): Stocks steadied globally arsenic investors reassessed recession concerns pursuing crisp Wall Street losses, portion European defence and infrastructure shares continued to summation connected expectations of accrued authorities spending.

Bitcoin and Nasdaq Could Stabilize arsenic Bull Positioning successful Yen Appears Stretched (CoinDesk): Overstretched bullish bets connected the yen could trigger a reversal, offering alleviation to hazard assets, though the currency’s broader uptrend remains supported by a narrowing U.S.-Japan enslaved output gap.

Latest Draft of U.S. Stablecoin Bill Aims to Split Power Between State and Federal Authorities (CoinDesk): States tin oversee stablecoin issuers with a marketplace headdress nether $10 billion, portion larger issuers whitethorn stay nether authorities supervision if they conscionable definite criteria.

Dormant Ether Whale Moves $13M successful ETH to Kraken (CoinDesk): A wallet that has held ether since the cryptocurrency’s inception moved 7,000 ETH to Kraken aft 5 months of inactivity arsenic the terms deed its lowest level since October 2023.

Citi Downgrades U.S. Stocks, Raises China arsenic America First Fades (Bloomberg): Citigroup downgraded U.S. equities to neutral, citing expectations for "more antagonistic US information prints," portion upgrading China to overweight owed to charismatic valuations and authorities enactment for the tech sector.

Ukraine Hits Moscow With Largest Drone Attack Hours Before Talks (The Wall Street Journal): Ahead of a high-level U.S.-Ukraine gathering successful Saudi Arabia, Kyiv carried retired its largest drone onslaught connected the Russian capital, escalating tensions arsenic discussions connected imaginable bid efforts loom.

In the Ether

5 months ago

5 months ago

English (US)

English (US)