By Omkar Godbole (All times ET unless indicated otherwise)

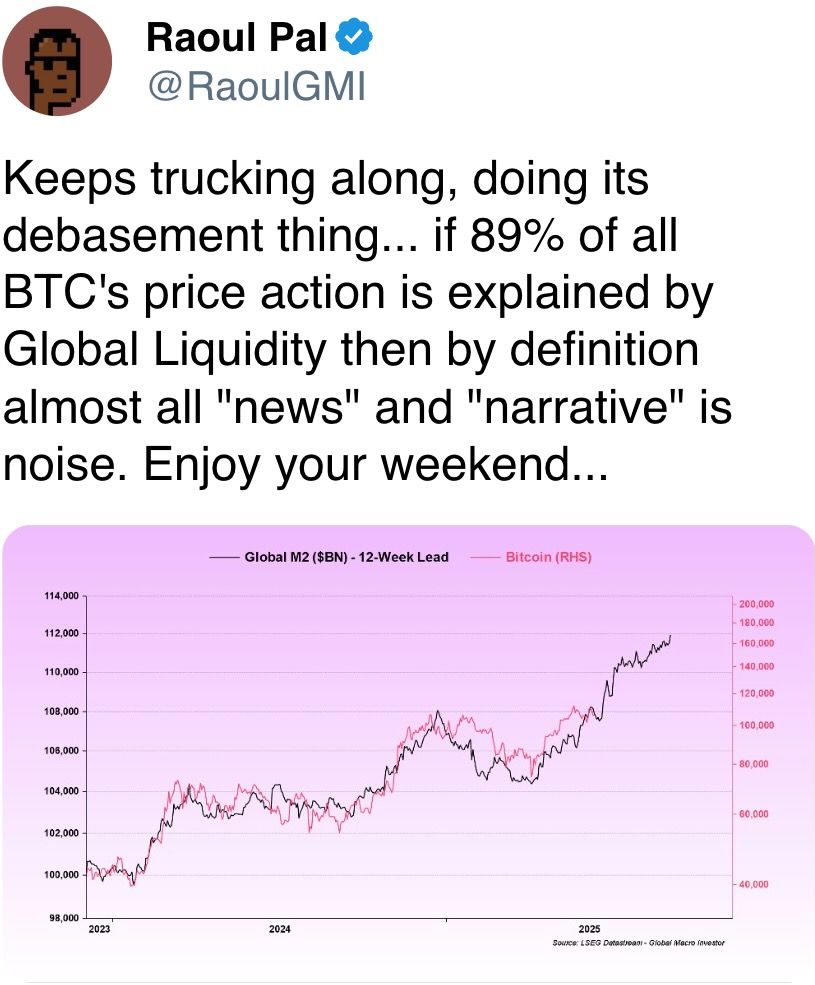

Bitcoin's BTC continued choppy trading adjacent January's highs of astir $110,000 has some observers drafting parallels with 2021, erstwhile the bull marketplace ended with duplicate peaks person to $70,000. Not everyone agrees.

"The marketplace dynamics betwixt 2021 and contiguous are wholly different," Jeff Anderson, caput of Asia astatine STS Digital, told CoinDesk. "BTC is evolving into a treasury asset, truthful it is precise hard to extrapolate illustration patterns onto an plus undergoing monolithic structural changes."

The terms enactment implicit the play was "encouraging," Anderson said, noting bitcoin's stableness astatine astir $105,000 adjacent arsenic Iran and Israel traded blows. As the aged saying goes: If a market does not fall too overmuch on bad news, it indicates large players are astir apt going long.

According to Singapore-based QCP Capital, BTC's resilient terms is underpinned by continued organization adoption.

"The marketplace seems to person rediscovered its footing, peculiarly aft BTC held supra the cardinal intelligence threshold of $100K contempt the archetypal shock," QCP said. "Crucially, Friday’s humble 3% pullback paled successful examination to April past year, erstwhile BTC fell much than 8% amid akin Iran-Israel turmoil."

The marketplace composure is evident from Volmex's 30-day implied volatility scale (BVIV), which has declined to an annualized 42.7%, reversing Friday's spike to 46.12%.

Meanwhile, the dispersed betwixt ether and bitcoin implied volatilities continues to widen, a motion that ether options are becoming costlier comparative to bitcoin connected Deribit. The comparative richness of ether options presents a bully accidental for ether holders to make further output by penning oregon selling options, according to Anderson.

Hong Kong-listed institution Meme Strategy's stock terms surged implicit 20% aft the institution announced the acquisition of 2,440 Solana (SOL) tokens for astir HK$2.9 cardinal ($370,000). Corporate adoption of cryptocurrencies is rapidly moving beyond bitcoin and into different coins, specified arsenic ether ETH, sol SOL, and XRP XRP. However, past week, shares successful Nasdaq-listed SharpLink dropped sharply aft the institution disclosed that it had bought ether.

The outlook for the broader altcoin marketplace does not look truthful rosy arsenic ample unlocks loom.

"In the adjacent 7 days, tokens with ample one-time unlocks (over $5 million) see FTN, ZK, ARB, S, ID, APE, MELANIA, LISTA, and ZKJ. Tokens with ample regular linear unlocks (over $1 cardinal per day) see SOL, WLD, TIA, DOGE, TAO, AVAX, SUI, DOT, IP, MORPHO, ETHFI, and JTO," newsletter work LondonCryptoClub said.

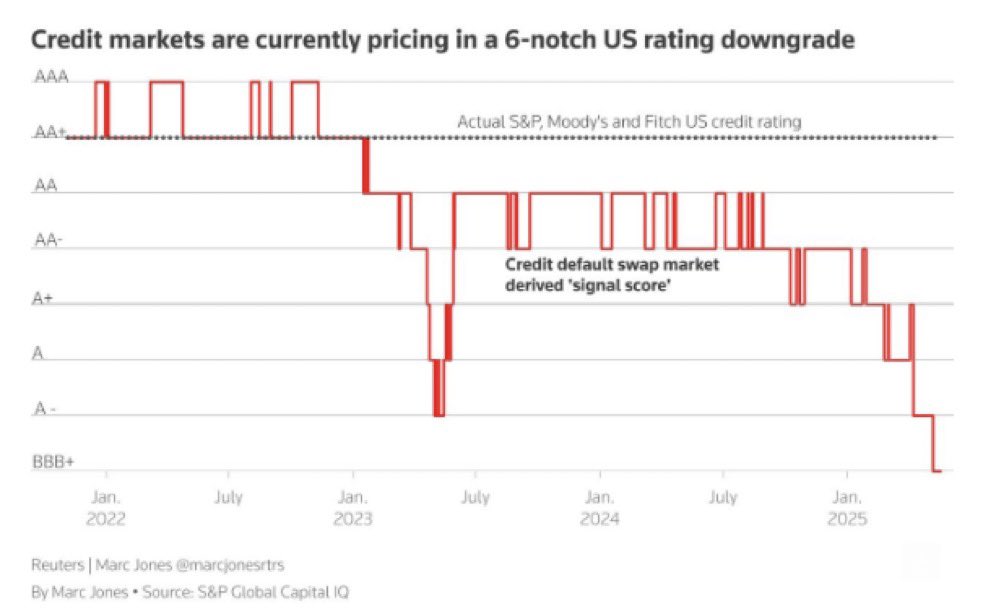

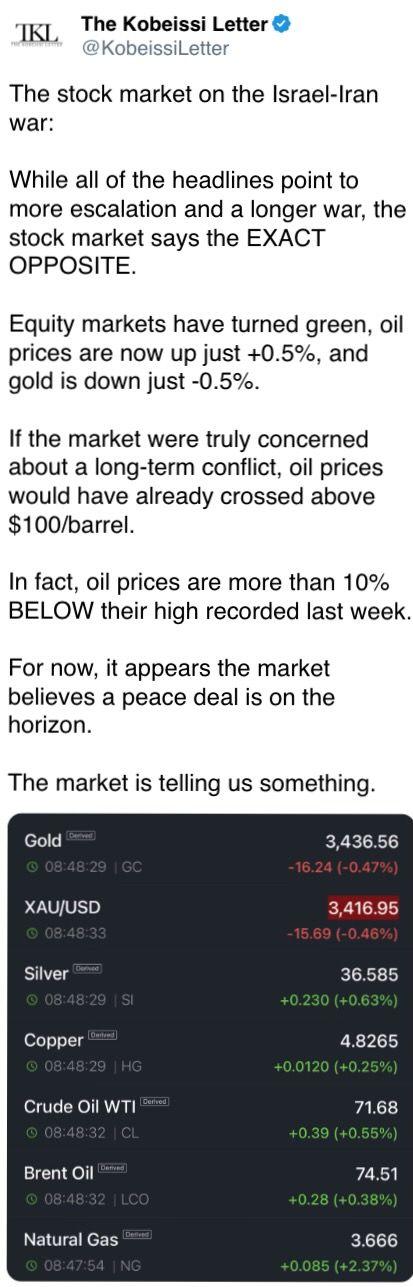

In accepted markets, futures tied to the S&P 500 signaled a dependable commencement to the week with gains arsenic lipid prices stabilized pursuing Friday's surge. According to Barchart.com, recognition markets are pricing successful a six-level recognition downgrade for the U.S., equating to a standing of BBB, conscionable a notch supra concern grade. Stay alert!

What to Watch

- Crypto

- June 16: 21Shares executes a 3-for-1 stock divided for the ARK 21Shares Bitcoin ETF (ARKB) connected NYSE Arca; ticker and NAV stay unchanged.

- June 16: Brazil’s B3 speech launches USD-settled ether (0.25 ETH) and solana (5 SOL) futures contracts, approved by Brazil’s securities regulator, the Comissão de Valores Mobiliários (CVM) and benchmarked to Nasdaq indices.

- June 18: At astir 9:28 p.m. IoTeX L1 v2.2.0 hard fork volition activate astatine artifact 36,893,881. It volition halve artifact clip to 2.5s and motorboat System Staking v3.

- June 20: Proof-of-stake blockchain BlackCoin (BLK) activates SegWit connected mainnet, improving information and performance; mandatory upgrade to node and wallet v26.2.0 required.

- Macro

- Day 2 of 3: G7 2025 Summit (Kananaskis, Alberta, Canada)

- June 16, 11 p.m.: Bank of Japan announces monetary argumentation decision.

- Key Rate Est. 0.5% vs. Prev. 0.5%

- June 17, 8:30 a.m.: The U.S. Census Bureau releases May retail income data.

- Retail Sales MoM Est. -0.7% vs. Prev. 0.1%

- Retail Sales YoY Prev. 5.2%

- June 17, 10 a.m.: National Association of Home Builders (NAHB) releases U.S. lodging marketplace information for June.

- NAHB Housing Market Index Est. 36 vs. Prev. 34

- June 17: The U.S. Senate volition ballot connected the last transition of the measure Guiding and Establishing National Innovation for US Stablecoins (the GENIUS Act of 2025).

- Earnings (Estimates based connected FactSet data)

- June 23 (TBC): HIVE Digital Technologies (HIVE), post-market, $-0.12

Token Events

- Governance votes & calls

- Compound DAO is acceptable to ballot connected a connection to create the Compound Foundation, a non-profit to thrust protocol maturation and strategy. It calls for an 18-month program and requests $9 cardinal successful COMP, with voting acceptable to statesman successful 1 day. Voting ends June 20.

- Arbitrum DAO is voting connected a connection to motorboat DRIP, an $80M incentives program targeting circumstantial DeFi activity. Managed by a foundation-led committee, DRIP would reward users straight and let the DAO to unopen it down via vote. Voting ends June 20.

- ApeCoin DAO is voting connected whether to sunset the decentralized autonomous enactment and motorboat ApeCo, a caller entity established by Yuga Labs with a ngo to “supercharge the APE ecosystem.” Voting ends June 24.

- June 17, 12 p.m.: Lido to hist its 29th Node Operator Community Call.

- Unlocks

- June 16: Arbitrum (ARB) to unlock 1.91% of its circulating proviso worthy $31.45 million.

- June 17: ZKsync (ZK) to unlock 20.91% of its circulating proviso worthy $39.55 million.

- June 17: ApeCoin (APE) to unlock 1.95% of its circulating proviso worthy $10.73 million.

- June 18: Fasttoken (FTN) to unlock 4.65% of its circulating proviso worthy $16.81 million.

- June 30: Optimism (OP) to unlock 1.83% of its circulating proviso worthy $19.08 million.

- July 1: Sui (SUI) to unlock 1.3$ of its circulating proviso worthy $136.39 million.

- Token Launches

- June 16: Advised deadline to unstake stMATIC arsenic portion of Lido connected Polygon’s sunsetting process ends

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight.

- June 16: The Future of Finance Digital Money Event 2025 (London)

- June 18-19: Canadian Blockchain Consortium’s 2nd Annual Policy Summit (Ottawa)

- June 18-19: SuperAI (Singapore)

- June 19-21: BTC Prague 2025

- June 24-26: Blockworks' Permissionless IV (New York)

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26: The Injective Summit (New York)

- June 26-27: Istanbul Blockchain Week

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

Token Talk

By Oliver Knight

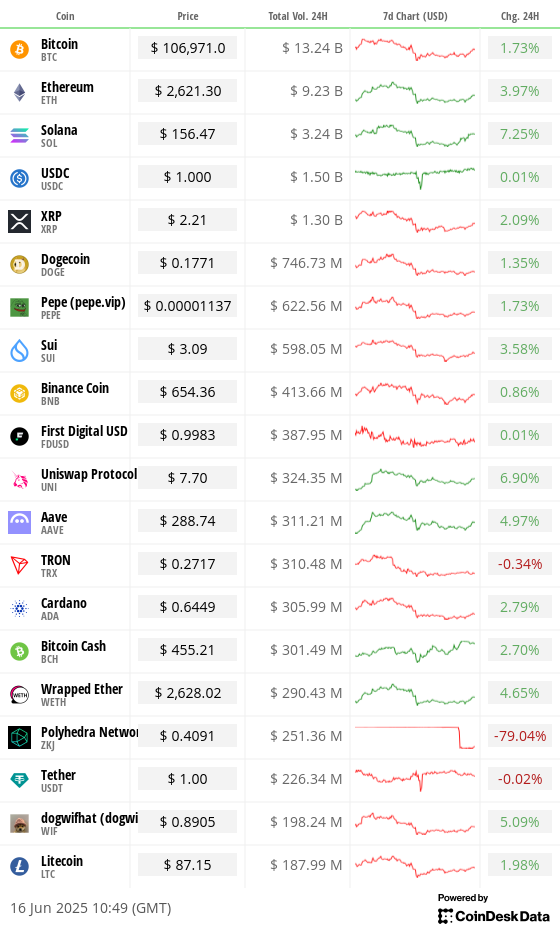

- The motorboat of AI blockchain Polyhedra's ZKJ token was steeped successful contention implicit the play aft the token mislaid 80% of its worth soon aft going live.

- The token was rolled retired connected the Binance Alpha platform, with the speech saying that it "experienced important terms volatilities" that was owed to ample holders removing on-chain liquidity to spark a liquidation cascade.

- More than $100 cardinal worthy of ZKJ derivative positions were liquidated pursuing the sell-off, including six idiosyncratic traders who mislaid much than $1 cardinal each, according to Coinglass data.

- Polyhedra said successful a tweet that the fundamentals of the task remains beardown and that it is "closely reviewing the situation."

- ZKJ presently trades astatine $0.40 aft debuting astatine the $2.00 mark, according to CoinMarketCap.

Derivatives Positioning

- BTC, ETH perpetual backing rates person stabilized supra zero implicit the weekend, signaling renewed assurance successful bullish terms prospects.

- Annualized ground successful the BTC CME futures remains locked successful the 5%-10% range.

- On Deribit, short-term and near-term puts traded astatine a premium to calls, signaling contiguous downside fears.

- BTC front-end (short-term) implied volatilities stay beneath 40, portion the S&P 500 VIX hovers adjacent 20, some hinting astatine marketplace calm contempt the volatile concern successful the Middle East.

Market Movements

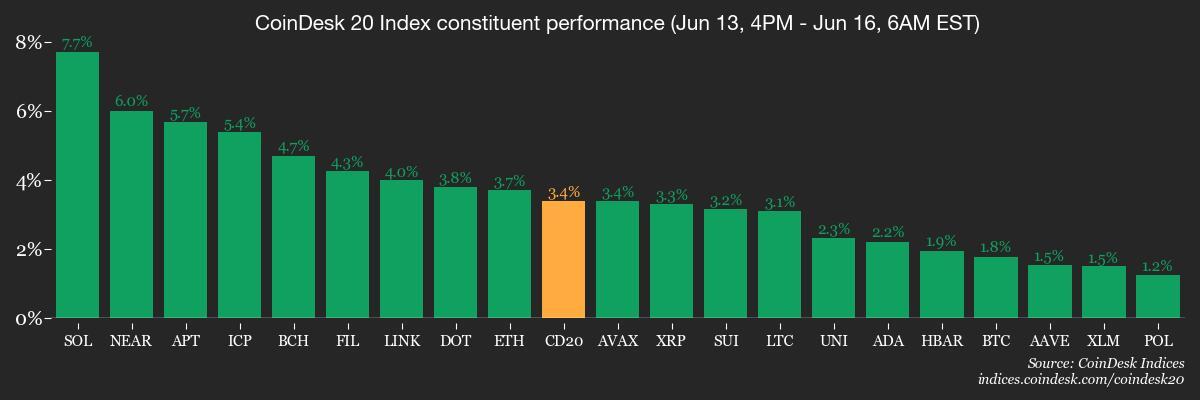

- BTC is up 2.12% from 4 p.m. ET Friday astatine $106,800 (24hrs: 1.56%)

- ETH is 4.75% astatine $2,612.88 (24hrs: 3.62%)

- CoinDesk 20 is up 3.5% astatine 3,116.85 (24hrs: +3.5%)

- Ether CESR Composite Staking Rate is down 22 bps astatine 2.87%

- BTC backing complaint is astatine 0.0055% (6.0367% annualized) connected Binance

- DXY is down 0.21% astatine 97.98

- Gold futures are down 0.46% astatine $3,437.00

- Silver futures are up 0.37% astatine $36.49

- Nikkei 225 closed up 1.26% astatine 38,311.33

- Hang Seng closed up 0.70% astatine 24,060.99

- FTSE is up 0.40% astatine 8,886.23

- Euro Stoxx 50 is up 0.46% astatine 5,314.97

- DJIA closed connected Friday down 1.79% astatine 42,197.79

- S&P 500 closed down 1.13% astatine 5,976.97

- Nasdaq Composite closed down 1.30% astatine 19,406.83

- S&P/TSX Composite closed down 0.42% astatine 26,504.35

- S&P 40 Latin America closed up NA NA

- U.S. 10-Year Treasury complaint is up NA NA

- E-mini S&P 500 futures are up 0.48% astatine 6,007.75

- E-mini Nasdaq-100 futures are up 0.55% astatine 21,762.50

- E-mini Dow Jones Industrial Average Index are up 0.41% astatine 42,381.00

Bitcoin Stats

- BTC Dominance: 64.6 (-0.18%)

- Ethereum to bitcoin ratio: 0.02454 (1.70%)

- Hashrate (seven-day moving average): 928 EH/s

- Hashprice (spot): $53.55

- Total Fees: 2.63 BTC / $277,146

- CME Futures Open Interest: 150,970

- BTC priced successful gold: 30.9 oz

- BTC vs golden marketplace cap: 8.76%

Technical Analysis

- A caller greenish ceramic appeared connected bitcoin's three-line interruption chart connected June 9, signaling bullish momentum is inactive intact.

- In different words, the way of slightest absorption is to the higher broadside contempt tensions successful the Middle East.

Crypto Equities

- Strategy (MSTR): closed connected Friday astatine $382.87 (+0.82%), pre-market up 1.6% astatine $389

- Coinbase Global (COIN): closed astatine $242.71 (+0.69%), pre-market up 2.7% astatine $249.27

- Circle (CRCL): closed astatine $133.56 (+25.36%), pre-market up 8.7% astatine $145.50

- Galaxy Digital Holdings (GLXY): closed astatine C$25.58 (-3.25%)

- MARA Holdings (MARA): closed astatine $15.04 (-4.93%), pre-market up 1.66% astatine $15.29

- Riot Platforms (RIOT): closed astatine $9.72 (-4.8%), pre-market up 1.85% astatine $9.90

- Core Scientific (CORZ): closed astatine $11.89 (-2.06%), pre-market up 2.87% astatine $12.23

- CleanSpark (CLSK): closed astatine $9.3 (-4.22%), pre-market up 2.37% astatine $9.52

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $18.86 (-3.82%)

- Semler Scientific (SMLR): closed astatine $29.58 (-3.77%), pre-market up 3.28% astatine $30.55

- Exodus Movement (EXOD): closed astatine $31.37 (-0.79%)

ETF Flows

Spot BTC ETFs

- Daily nett flow: $301.7 million

- Cumulative nett flows: $45.59 billion

- Total BTC holdings ~ 1.21 million

Spot ETH ETFs

- Daily nett flow: -$2.1 million

- Cumulative nett flows: $3.87 billion

- Total ETH holdings ~ 3.96 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The illustration shows the sovereign awesome people derived from the recognition default swap markets.

- It shows the markets are expecting large standing agencies to downgrade the U.S. sovereign standing to BBB successful the coming months.

While You Were Sleeping

- Metaplanet Overtakes Coinbase With 10K BTC, Becomes No. 9 Bitcoin Holder (CoinDesk): The steadfast bought 1,112 BTC for $117.2 million, raising its full stash to $947 cardinal astatine an mean outgo of $94,697 per bitcoin.

- Bitcoin Price Volatility Signal Goes Off – Is a Surge Ahead? (CoinDesk): A narrowing Bollinger set spread is expected to widen arsenic the MACD flips positive, signaling a imaginable instrumentality of volatility that has historically preceded beardown terms rallies.

- Vietnam Passes Landmark Law Recognizing Crypto Assets (CoinDesk): Vietnam’s Digital Technology Industry Law distinguishes crypto from different integer assets by its usage of encryption to validate instauration and transfers. It takes effect Jan. 1, 2026.

- Israel Takes Control of Iran’s Skies—a Feat That Still Eludes Russia successful Ukraine (The Wall Street Journal): After knocking retired aerial defenses successful occidental Iran, Israel has shifted to utilizing older F-15 and F-16 jets and inexpensive guided bombs to prolong its aerial run much efficiently.

- Oil Options Attract Bulls successful Heavy Trade arsenic Mideast Risks Expand (Bloomberg): Thousands of Brent crude $80–$100 calls traded aboriginal Monday arsenic volatility surged, with traders bracing for escalation and imaginable proviso shocks if Iran disrupts flows done the Strait of Hormuz.

- China’s Factories Slow, Consumers Unexpectedly Perk Up (Reuters): Although China’s concern output grew conscionable 5.8% successful May, its slowest gait successful six months, retail income jumped 6.4% connected subsidies and an aboriginal commencement to the "618" buying festival.

In the Ether

4 months ago

4 months ago

English (US)

English (US)