By Omkar Godbole (All times ET unless indicated otherwise)

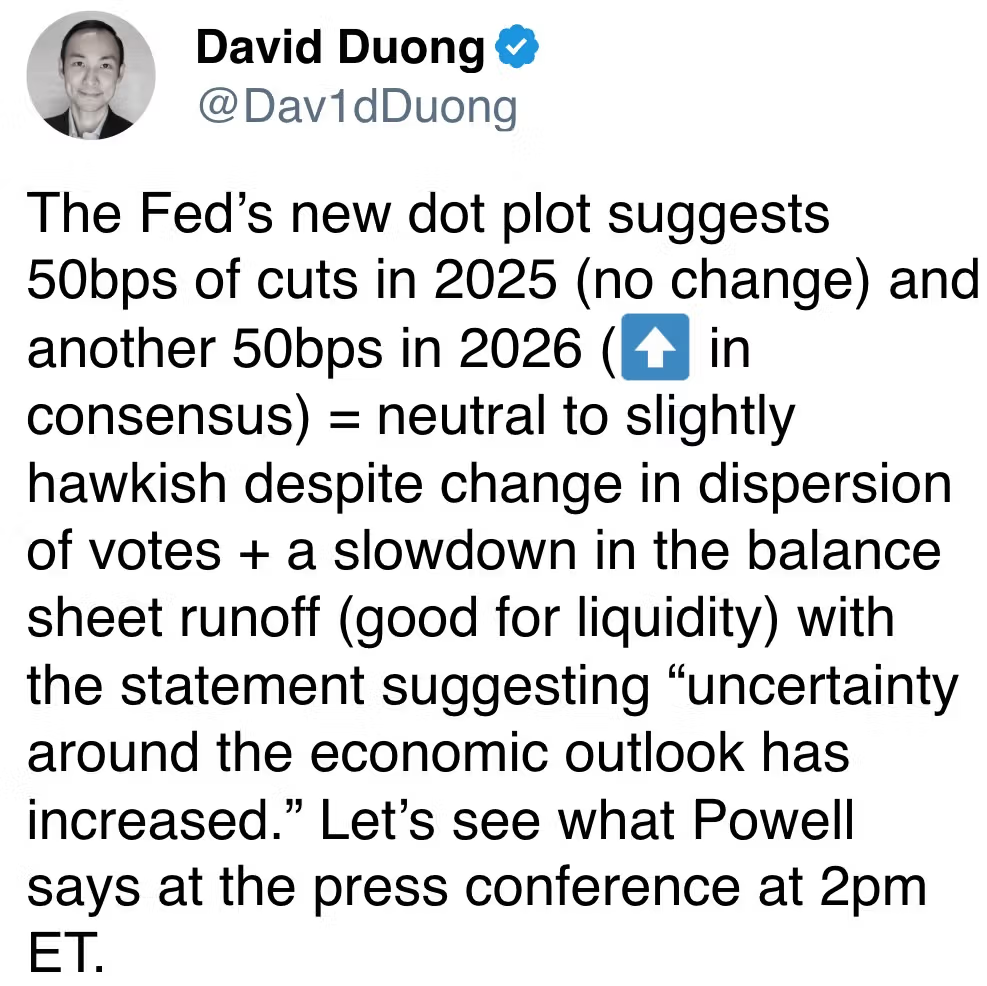

Bitcoin (BTC), ether (ETH) and the broader crypto marketplace are facing renewed pressure, reversing immoderate of gains made aft Federal Reserve Chairman Jerome Powell downplayed concerns astir tariff-driven ostentation .

President Donald Trump is reportedly scheduled to speak astatine Blockworks' Digital Asset Summit successful New York later, with traders keen to perceive however the medication plans to get BTC successful a budget-neutral manner. Don't get excessively excited, the likelihood of specified an announcement remains low.

Trump is much apt to reiterate his aspiration to marque America the "crypto superior of the world," and adjacent this whitethorn overwhelm markets.

On a much affirmative note, renewed involvement successful U.S.-listed spot ETFs supports marketplace strength. On Wednesday, bitcoin ETFs experienced a full nett inflow of $11.8 million, a 4th consecutive time of affirmative flows, according to Farside Investors. In contrast, ether spot ETFs recorded a nett outflow of $11.7 million, extending a streak of withdrawals to 11 consecutive days.

"Several catalysts proceed to enactment a bullish outlook," Blockhead Research Network said. "The U.S. authorities exploring budget-neutral ways to accumulate bitcoin could beryllium a game-changing origin for this cycle. Additionally, solana futures being added to the CME is simply a large bullish indicator for altcoins, perchance expanding organization vulnerability to SOL."

Speaking of on-chain flows, information from IntoTheBlock reveals that whales present clasp immoderate 62,000 much BTC than they did astatine the opening of the month, indicating a resurgence successful accumulation pursuing astir a twelvemonth of declining balances. XRP whales person besides been buying implicit the past 2 months.

For its part, the SUI token has remained resilient, looking to physique connected its Wednesday gains successful the aftermath of Canary Capital Group, an organization crypto trading and absorption firm, filing for a Sui exchange-traded money (ETF) with the SEC.

In wider marketplace news, a domain assertion leafage for Hyperlane, an unfastened interoperability framework, surfaced, sparking speculation of a imaginable token airdrop connected societal media.

Traditional markets offered mixed cues, with dollar-yen staring astatine a decease transverse pattern, teasing a large surge up successful the Japanese currency, which is seen arsenic an anti-risk holding. Meanwhile, copper neared a grounds precocious successful a affirmative motion for risky assets. Stay alert!

What to Watch

Crypto:

March 20, 9:30 a.m.: Bitnomial to debut what it claims are the first-ever CFTC-regulated XRP futures successful the U.S.

March 20, 9:30 a.m.: Volatility Shares is introducing two Solana (SOL) futures ETFs: Volatility Shares Solana ETF (SOLZ) and Volatility Shares 2X Solana ETF (SOLT).

March 20, 10:40 a.m.: President Trump is expected to address Blockworks’ Digital Asset Summit successful New York successful a recording.

March 21, 1:00 p.m.: The SEC’s Crypto Task Force hosts a roundtable, open to the public, that volition absorption connected the explanation of a security.

March 24 (before marketplace open): Bitcoin miner CleanSpark (CLSK) volition join the S&P SmallCap 600 index.

March 24, 11:00 a.m.: Bugis web upgrade goes unrecorded connected Enjin Matrixchain mainnet.

March 25: The Mimir upgrade goes unrecorded connected Chromia (CHR) mainnet.

March 26, 3:37 a.m.: Ethereum’s Hoodi testnet volition activate the Pascal hard fork web upgrade astatine epoch 2048.

Macro

March 20, 8:00 a.m.: The Bank of England announces its interest complaint decision.

Bank Rate Est. 4.5% vs. Prev. 4.5%

March 20, 8:30 a.m.: The U.S. Department of Labor releases employment information for the week ended March 15.

Initial Jobless Claims Est. 224K vs. Prev. 220K

Continuing Jobless Claims Est. 1890K vs. Prev. 1870K

March 20, 3:00 p.m.: Argentina’s National Institute of Statistics and Census releases Q4 employment data.

Unemployment Rate Prev. 6.9%

March 20, 7:30 p.m.: Japan's Ministry of Internal Affairs & Communications releases February user terms scale (CPI) data.

Core Inflation Rate YoY Est. 2.9% vs. Prev. 3.2%

Inflation Rate MoM Prev. 0.5%

Inflation Rate YoY Prev. 4%

March 21, 6:30 a.m.: The Bank of Russia is expected to denote its involvement complaint decision.

Key Rate Est. 21% vs. Prev. 21%

Earnings (Estimates based connected FactSet data)

March 27: KULR Technology Group (KULR), post-market, $-0.02

March 28: Galaxy Digital Holdings (GLXY), pre-market, C$0.38

Token Events

Governance votes & calls

DYdX DAO is voting connected implementing a buyback program that would allocate 25% of the dYdX protocol gross to it.

Balancer DAO is discussing migrating the ProtocolFeeController to present off-chain protocol interest tracking, improved declaration retention and resoluteness different shortcomings.

March 21, 11:30 a.m.: Flare to big an X Spaces session connected Flare 2.0.

March 25, 1 a.m.: Crypto.com to hold an Ask Me Anything (AMA) session with co-founder and CEO Kris Marszalek.

Unlocks

March 21: Immutable (IMX) to unlock 1.39% of circulating proviso worthy $14.13 million.

March 23: Metars Genesis (MRS) to unlock 11.87% of its circulating proviso worthy $240.90 million.

March 31: Optimism (OP) to unlock 1.93% of its circulating proviso worthy $28.06 million.

April 1: Sui (SUI) to unlock 2.03% of its circulating proviso worthy $158.56 million.

April 3: Wormhole (W) to unlock 47.64% of its circulating proviso worthy $117.81 million.

April 7: Kaspa (KAS) to unlock 0.59% of its circulating proviso worthy $12.31 million.

Token Listings

March 20: Jupiter (JUP) to beryllium listed connected Binance.US.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 3 of 3: Digital Asset Summit 2025 (New York)

Day 3 of 3: Fintech Americas Miami 2025

Day 2 of 2: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

Token Talk

By Shaurya Malwa

Frog-themed tokens jumped Thursday, with a KEKIUS MAXIMUS token zooming 96% aft Elon Musk posted a representation lodging a "Kekius Maximus" representation connected X.

He responded "ok" to a user’s proposition that helium alteration his show sanction to "Kekius Maximus," amplifying attraction connected frog-related memes and tokens. The sanction is linked to existing frog-themed coins similar pepe, featuring a frog dressed up arsenic a Roman gladiator.

Musk’s endorsement sparked speculation astir whether he’s hinting astatine backing the existing KEKIUS token oregon conscionable joining the day’s festivities — albeit creating volatility successful specified tokens.

The operation surged successful visibility erstwhile Musk archetypal made Kekius Maximus his show sanction connected X connected Dec. 31.

The Kek transportation besides nods to the "Cult of Kek," a tongue-in-cheek net improvement linking the word to an past Egyptian frog-headed deity of chaos and darkness.

The eponymous token issued astatine the clip jumped to a marketplace capitalization of astir $200 cardinal soon aft issuance lone to crater much than 95% aft the archetypal hype subsided.

Memecoins thin to surge erstwhile Musk references them owed to his monolithic power and cult-like following. Such tokens are often sentiment-driven and thrive connected specified attraction turning Musk’s playful nods — similar a specified notation — into terms catalysts.

Derivatives Positioning

BTC planetary futures unfastened involvement has accrued to $13.3 billion, the highest since March 4, Coinglass information show. ETH unfastened involvement remains beneath $2 billion.

Basis successful the CME's BTC one-month futures has dropped beneath an annualized 5% contempt overnight terms gains, suggesting a deficiency of information from organization traders. ETH ground remains astir 5%.

DOGE, APT, XMR, BCH, XRP, LTC, ADA and NEAR spot antagonistic cumulative measurement delta, implying nett selling amid the terms bounce.

Deribit's BTC options person flipped bullish, with beforehand and near-dated calls present trading pricier than puts. ETH, however, lags successful sentiment.

Market Movements:

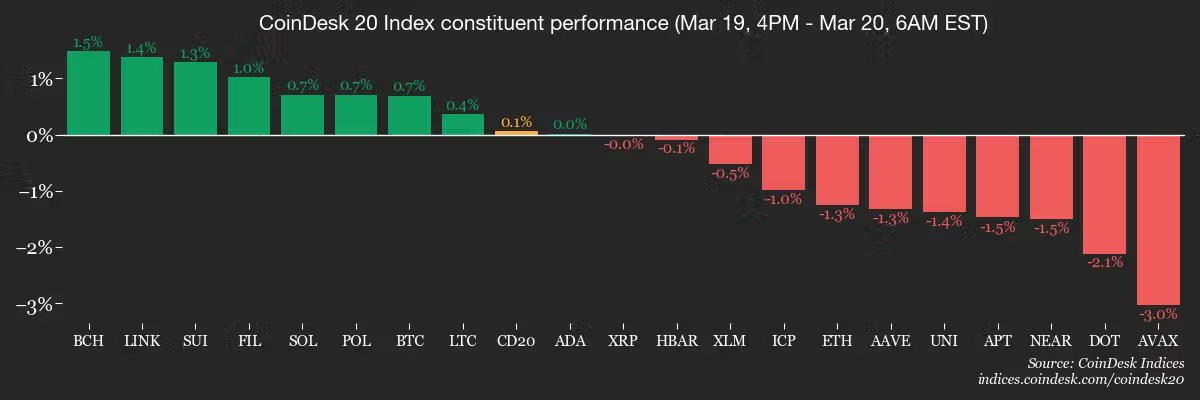

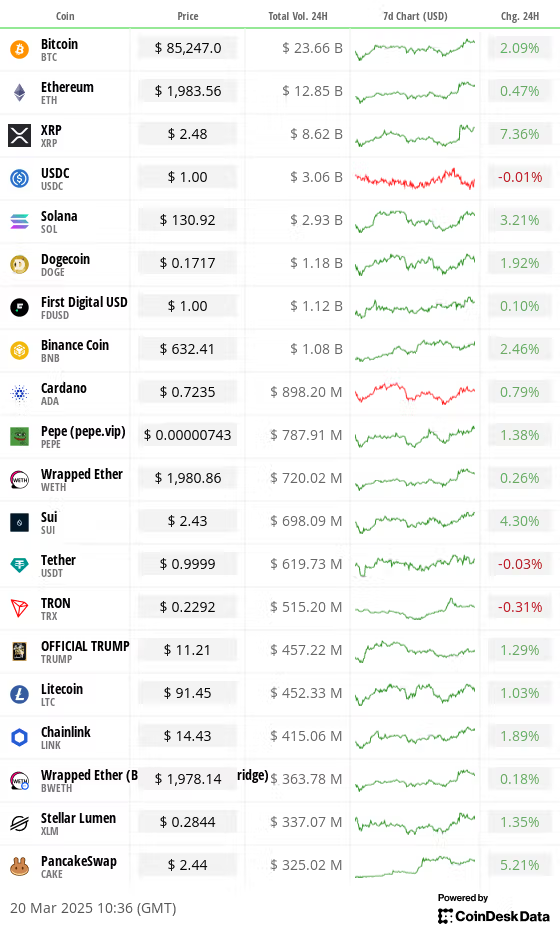

BTC is down 0.26% from 4 p.m. ET Wednesday astatine $83,576.60 (24hrs: +2.07%)

ETH is down 2.85% astatine $1,980.15 (24hrs: +0.3%)

CoinDesk 20 is down 0.96% astatine 2,711.65 (24hrs: +3.04%)

Ether CESR Composite Staking Rate is up 5 bps astatine 3.02%

BTC backing complaint is astatine 0.0043% (4.74% annualized) connected Binance

DXY is up 0.46% astatine 103.90

Gold is up 0.19% astatine $3,039.20/oz

Silver is down 0.19% astatine $33.49/oz

Nikkei 225 closed connected Wednesday -0.25% astatine 37,751.88

Hang Seng closed connected Thursday -2.23% astatine 24,219.95

FTSE is down 0.33% astatine 8,678.09

Euro Stoxx 50 is down 0.92% astatine 5,456.82

DJIA closed connected Wednesday +0.92% astatine 41,964.63

S&P 500 closed +1.08% astatine 5,675.29

Nasdaq closed +1.41% astatine 17,750.79

S&P/TSX Composite Index closed +1.47% astatine 25,069.21

S&P 40 Latin America closed +0.77% astatine 2,495.85

U.S. 10-year Treasury complaint is down 2 bps astatine 4.22%

E-mini S&P 500 futures are down 0.1% astatine 5,724.00

E-mini Nasdaq-100 futures are down 0.16% astatine 19,919.00

E-mini Dow Jones Industrial Average Index futures are unchanged astatine 42,290.00

Bitcoin Stats:

BTC Dominance: 61.60 (0.04%)

Ethereum to bitcoin ratio: 0.02327 (-1.90%)

Hashrate (seven-day moving average): 804 EH/s

Hashprice (spot): $48.76

Total Fees: 5.28 BTC / $453,536

CME Futures Open Interest: 154,690 BTC

BTC priced successful gold: 27.9 oz

BTC vs golden marketplace cap: 7.91%

Technical Analysis

Nvidia (NVDA), the Nasdaq heavyweight, has triggered a head-and-shoulders breakdown, hinting astatine a bullish-to-bearish inclination change.

The breakdown offers bearish cues to hazard assets.

The 90-day correlation betwixt NVDA and bitcoin is 0.6.

Crypto Equities

Strategy (MSTR): closed connected Wednesday astatine $304.23 (+7.43%), down 2.58% astatine $296 successful pre-market

Coinbase Global (COIN): closed astatine $189.75 (+4.75%), down 2.16% astatine $185.20

Galaxy Digital Holdings (GLXY): closed astatine C$17.70 (+3.57%)

MARA Holdings (MARA): closed astatine $12.53 (+3.81%), down 1.68% astatine $12.32

Riot Platforms (RIOT): closed astatine $7.78 (+5.14%), up 0.39% astatine $7.75

Core Scientific (CORZ): closed astatine $8.68 (+8.23%), down 0.12% astatine $8.67

CleanSpark (CLSK): closed astatine $8.01 (+5.53%), down 1.12% astatine $7.92

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $15.20 (+6.67%), down 6.12% astatine $14.27

Semler Scientific (SMLR): closed astatine $40.04 (+12.82%), down 3.25% astatine $38.74

Exodus Movement (EXOD): closed astatine $40.75 (+34.67%)

ETF Flows

Spot BTC ETFs:

Daily nett flow: $11.8 million

Cumulative nett flows: $35.88 billion

Total BTC holdings ~ 1,119 million.

Spot ETH ETFs

Daily nett flow: -$11.7 million

Cumulative nett flows: $2.46 billion

Total ETH holdings ~ 3.450 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

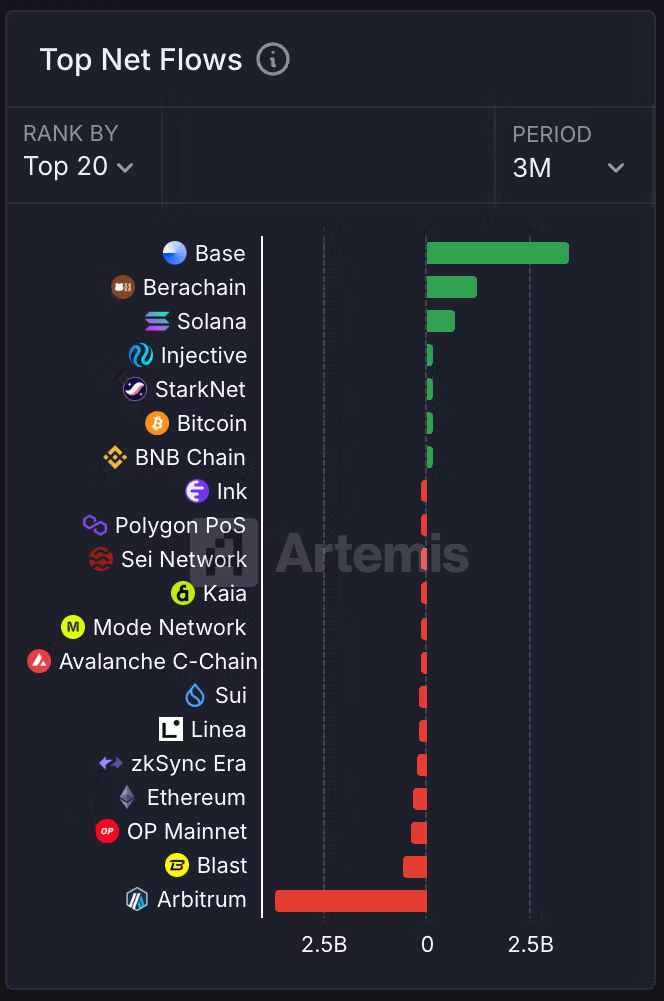

Coinbase's furniture 2 scaling solution Base maintains its pb implicit different chains arsenic the level with the highest dollar worth of coins received done crypto bridges.

Berachain and Solana instrumentality the No. 2 and No. 3 positions with Arbitrum astatine the bottommost with astir outflows.

While You Were Sleeping

Bitcoin Traders Seek Topside Option Plays After Powell Remark, Ether Lags successful Sentiment (CoinDesk): Bitcoin options awesome renewed bullishness aft the Fed decision, portion ether options enactment cautious.

XRP Whales Boost Coin Stash by Over 6% successful Two Months, Blockchain Data Shows (CoinDesk): XRP fell 20% to $2.45 successful 2 months, yet Santiment information shows ample traders accrued holdings by 6.5% to 46.4 cardinal XRP. Network enactment surged sixfold successful March.

Lagarde Says Rising Uncertainty Means ECB Can’t Commit connected Rates (Bloomberg): The ECB president said a 25% U.S. tariff connected European imports could weaken eurozone maturation and make ostentation uncertainty, arsenic retaliation and a weaker euro whitethorn propulsion prices higher.

Trump Considers Extending Chevron License to Pump Oil successful Venezuela (The Wall Street Journal): The Trump medication is reportedly moving connected a program to let Chevron to enactment successful Venezuela portion penalizing countries that bargain lipid from the South American country.

Berlin Debt Splurge Turns Screws connected Flagging German Property (Reuters): Germany’s 500 cardinal euro ($540 billion) borrowing program is pushing up enslaved yields, worsening financing conditions for spot firms already deed by falling prices and anemic demand.

In the Ether

5 months ago

5 months ago

English (US)

English (US)