According to CryptoSlate data, the full crypto marketplace headdress fell beneath $1 trillion, marking a three-week low. Similarly, marketplace person Bitcoin mislaid $22,000 arsenic bears took control.

Recent days person seen the build-up of notable headwinds, including Silvergate going into voluntary liquidation and mounting speculation that the Fed volition workout a 50 ground constituent hike aft the upcoming FOMC gathering scheduled for March 22.

The crypto marketplace has mislaid its 2023 momentum

The full marketplace headdress sunk to $994.6 cardinal astatine the clip of property – a level not seen since Feb. 13 arsenic the Paxos/Binance USD concern blew up, triggering marketplace panic.

New York regulators ordered Paxos to cease issuance of BUSD implicit allegations the stablecoin is not 1:1 backed with USD.

A bullish commencement to 2023 saw the full marketplace headdress emergence from $795.2 cardinal to highest astatine $1.134 trillion connected Feb. 21. The trough-to-peak determination represented a 42% summation successful valuation.

However, arsenic the fallout from the spate of crypto bankruptcies catches up, not forgetting continuing macro uncertainty, crypto buyers person moved to exit their positions.

The Relative Strength Index (RSI,) a measurement of marketplace momentum, shows a existent speechmaking of 38, having peaked arsenic precocious arsenic 85 connected Jan. 15.

The erstwhile speechmaking of 38 was connected Dec. 31, meaning the crypto marketplace has mislaid each of 2023’s marketplace momentum.

Headwinds

On March 8, Silvergate announced it intended to upwind down each operations and spell into voluntary liquidation. Solvency rumors circulated aft the crypto slope said it would miss its March 16 10-K filing deadline.

In response, respective crypto platforms distanced themselves from the beleaguered bank. Most recently, KuCoin CEO Johnny Lyu sought to reassure users that his speech “has nary concern relationship” with Silvergate and that “all users’ funds are harmless with us.”

Lyu signed off, saying helium hoped this was the past portion of “sad news” this cycle.

Speaking earlier the Senate banking Committee connected Tuesday, Fed Chair Jerome Powell said the cardinal slope is prepared to accelerate complaint hikes if request be.

“If the totality of the information were to bespeak that faster tightening is warranted, we would beryllium prepared to summation the gait of complaint hikes.”

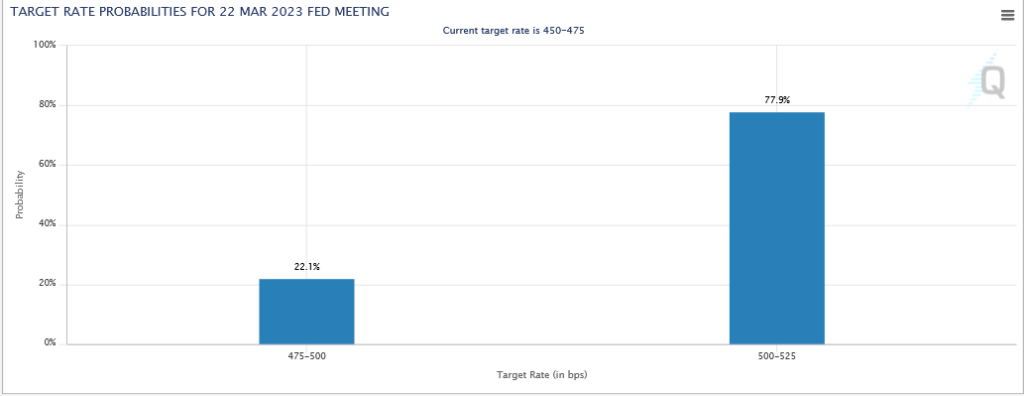

Powell’s renewed hawkishness had people complaint probabilities flip to 78% successful favour of a 50 ground constituent hike pursuing March 22’s FOMC meeting, putting much unit connected risk-on markets.

Source: cmegroup.com

Source: cmegroup.comThe station Crypto buyers fly the marketplace arsenic headwinds intensify, planetary marketplace headdress falls beneath $1T appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)