Bloomberg Intelligence elder commodity analyst, Mike McGlone, believes a “warm spell” is coming successful presumption of bitcoin markets arsenic the marketplace strategist elaborate connected Monday that “bitcoin appears poised to resume its inclination to outperform.” McGlone’s comments travel his erstwhile prediction that noted bitcoin and ethereum look to person “completed the bulk of their drawdown.”

Mike McGlone Believes a Crypto ‘Warm Spell’ Is successful the Cards, Suggests Bitcoin Will Resume Its Climb successful Value When the ‘Fed Pivots to Easing’

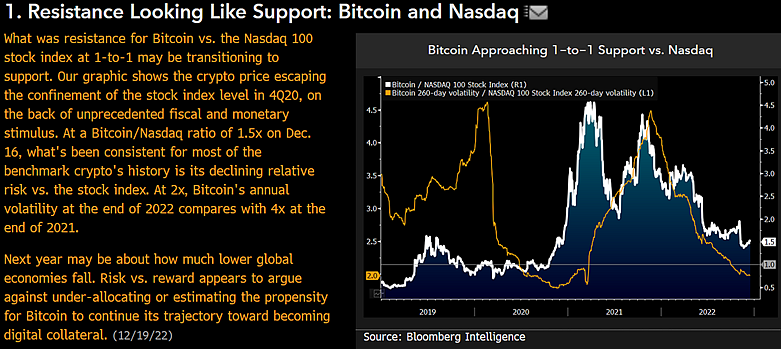

Mike McGlone is convinced bitcoin has immoderate healing up arsenic helium precocious tweeted astir a “warm spell” connected Monday. McGlone’s remark details that “what was absorption for bitcoin vs. Nasdaq 100 banal scale astatine 1:1 whitethorn beryllium transitioning to support.” McGlone besides shared a illustration that helium says indicates the “crypto terms escaping confinement of the banal scale level successful 4Q20, connected the backmost of unprecedented fiscal and monetary stimulus.”

Chart shared by Mike McGlone connected Monday, Dec. 19, 2022.

Chart shared by Mike McGlone connected Monday, Dec. 19, 2022.Right now, McGlone says what’s been accordant for astir of the benchmark crypto’s past is “its declining comparative hazard vs. the banal index.” “At 2x,” the marketplace strategist continues, “Bitcoin’s yearly volatility astatine the extremity of 2022 compares with 4x astatine the extremity of 2021.” Bloomberg’s elder commodity expert added:

Next twelvemonth whitethorn beryllium astir however overmuch little planetary economies fall. Risk vs. reward appears to reason against under-allocating oregon estimating the propensity for bitcoin to proceed its trajectory toward becoming integer collateral.

Bitcoin Crosses, the Crypto Looks to Regain Upper Hand Over Tesla — The adjacent certainty of declining #Bitcoin proviso vs. the rising magnitude of #Tesla shares outstanding favors outperformance by the crypto, if the rules of economics apply. pic.twitter.com/JNQVpOB6za

— Mike McGlone (@mikemcglone11) December 19, 2022

Bitcoin is down much than 75% little than the crypto asset’s all-time precocious (ATH) reached connected Nov. 10, 2021, astatine $69,044 per unit. Over the past 14 days, BTC has slid 2.3% little against the U.S. dollar and since the commencement of Nov. 2022, pursuing the FTX collapse, BTC has dropped 16.5% against the greenback. Bitcoin’s marketplace capitalization is astir $322 billion, which represents 38.2% of the $843 cardinal crypto economy.

McGlone suggests bitcoin’s lukewarm spell, however, won’t travel to fruition until the U.S. Federal Reserve pivots toward monetary easing. “A lukewarm spell ahead,” McGlone added. “Bitcoin Crosses vs. Propensity to Outperform – The world’s benchmark integer plus has taken a beating successful 2022 with astir others, but bitcoin appears poised to resume its inclination to outperform. When the Fed pivots to easing,” McGlone’s tweet concludes.

Tags successful this story

Bearish, Bitcoin, Bitcoin (BTC), Bloomberg Analyst, Bloomberg Intelligence, Bloomberg Intelligence bitcoin, BTC, Bull Market, Bullish, Charts, commodity strategist, Cryptocurrency, Economy, Finance, market, Markets, Mike McGlone, Mike McGlone bitcoin, Mike McGlone btc, Mike McGlone crypto, Mike McGlone cryptocurrency, Nasdaq 100, Prices, resistance, strategist, Warm Spell

What bash you deliberation astir Bloomberg’s elder commodity expert Mike McGlone’s sentiment astir the lukewarm spell ahead? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)