Ethereum has surged much than 70% since mid-June, marking 1 of its astir awesome rallies of the year. The determination has been driven by beardown momentum, with bulls firmly successful power arsenic ETH precocious reclaimed the captious $3,500 level. Notably, the uptrend has shown small to nary retracement since the archetypal breakout, signaling sustained buying involvement and assurance among investors.

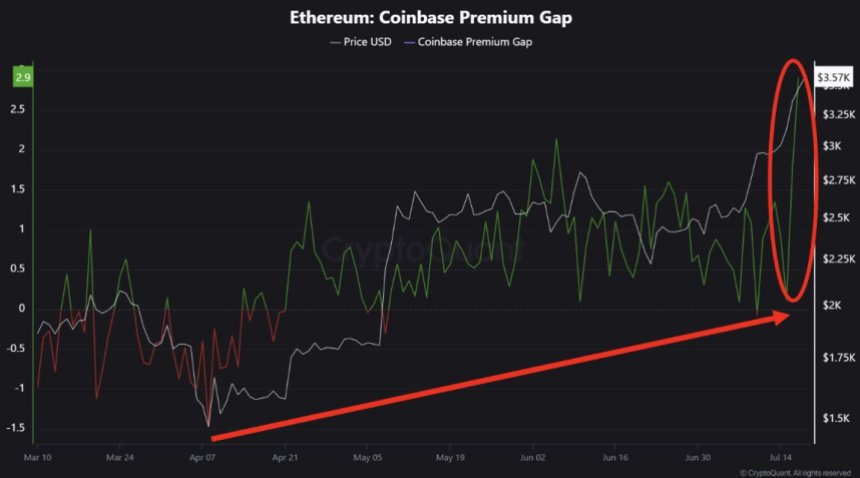

One of the astir striking developments supporting this determination comes from CryptoQuant, which highlights the emergence of a important premium connected Ethereum traded done Coinbase. This is peculiarly noteworthy due to the fact that Coinbase is simply a level predominantly utilized by US institutions and high-net-worth individuals. The premium suggests assertive spot buying by whales, indicating renewed organization involvement successful Ethereum.

This renewed request comes arsenic the broader crypto marketplace sees clearer regulatory signals and expanding ETF flows into ETH-related products. As Ethereum continues to outperform and attract capital, traders are watching intimately to spot if this momentum volition transportation into a broader altcoin rally—or adjacent awesome the commencement of a long-awaited altseason.

US Whales Lead the Charge arsenic Ethereum Buying Activity Accelerates

According to a caller report by CryptoQuant expert Crypto Dan, Ethereum is seeing a notable summation successful buying activity, peculiarly from US-based whales. The dependable emergence successful accumulation, combined with a wide premium connected Coinbase, suggests that high-net-worth players are positioning themselves up of further upside.

Ethereum Coinbase Premium Gap | Source: CryptoQuant

Ethereum Coinbase Premium Gap | Source: CryptoQuantSupporting this trend, regular inflows into Ethereum spot ETFs person surged to caller all-time highs. This crisp spike reflects increasing organization assurance successful ETH arsenic a halfway integer asset, particularly pursuing caller regulatory clarity successful the US. With Ethereum present trading supra $3,600, request continues to outpace proviso crossed aggregate channels.

What makes this rally particularly absorbing is the existent marketplace environment. On-chain metrics amusement that Ethereum is not yet importantly overheated. Indicators specified arsenic NUPL (Net Unrealized Profit/Loss) suggest country for further enlargement earlier excessive euphoria sets in. This creates favorable conditions for ETH to consolidate astatine higher levels earlier perchance breaking retired again.

However, the coming weeks volition beryllium crucial. If beardown inflows and bullish momentum persist into precocious Q3 2025, analysts pass it could trigger signs of overheating. While we are not determination yet, repeated vertical moves without retracement should punctual caution. Investors whitethorn request to reassess hazard levels if the signifier continues.

5 months ago

5 months ago

English (US)

English (US)