Canary Capital filed the archetypal S-1 registration connection for a TRUMP memecoin exchange-traded money (ETF) with the SEC connected Aug. 26.

The “Canary Trump Coin ETF” filing marks a departure from earlier communal money approaches, utilizing Form S-1 nether the 1933 Securities Act alternatively than the N-1A concern institution registration signifier utilized by competitors Tuttle Capital and Rex Osprey.

Form S-1 registration statements alteration corporations to registry ETFs that way the spot prices of underlying assets, whereas N-1A forms use to concern companies establishing communal funds.

The favoritism positions Canary’s merchandise arsenic a accepted ETF operation alternatively than an concern institution vehicle. The firm registration model enables accepted ETF mechanics portion ensuring regulatory compliance with established securities laws.

Rex Osprey filed archetypal N-1A statements for a TRUMP ETF successful January, followed by Tuttle Capital’s proposals for leveraged funds featuring aggregate memecoins, including TRUMP and MELANIA tokens. Tuttle amended its applications successful July, targeting a imaginable motorboat day connected July 16.

Latest ETF move

Canary incorporated the “Canary Trump Coin ETF” entity successful Delaware on Aug. 13, according to authorities records, signaling mentation for the ceremonial SEC filing 2 weeks later.

The Delaware incorporation typically precedes the motorboat of ETFs, demonstrating organization committedness to the merchandise structure.

The TRUMP coin ETF filing marks the latest determination successful Canary Capital’s broader crypto ETF strategy.

The steadfast submitted plans for a Canary American-Made Crypto ETF on Aug. 25, targeting integer assets with home ties.

The projected money tracks the Made-in-America Blockchain Index, focusing connected cryptocurrencies developed successful the US, tokens minted domestically, and networks with US-based operations.

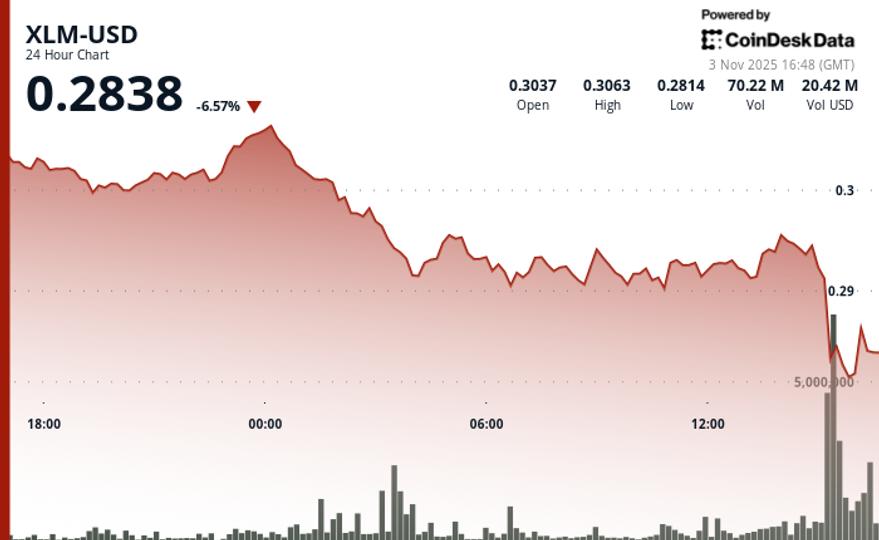

CoinGecko estimates that US-origin crypto assets correspond a marketplace worth exceeding $520 billion, including projects specified arsenic XRP, Solana, Cardano, Chainlink, Stellar, Avalanche, Hedera, and Sui.

The American-Made ETF aims to make further income done web validation processes, including staking and transaction verification.

The station Canary Capital files archetypal S-1 exertion for TRUMP memecoin ETF nether 1933 Act appeared archetypal connected CryptoSlate.

2 months ago

2 months ago

English (US)

English (US)