Crypto markets saw implicit $1 cardinal successful leveraged positions wiped retired successful the past 24 hours aft hotter-than-expected U.S. Producer Price Index (PPI) information fueled fears of persistent ostentation and delayed Federal Reserve rate-cut expectations.

The sell-off came hours aft bitcoin deed a caller all-time precocious supra $123,500, with traders unwinding hazard crossed the board. Major memecoin dogecoin (DOGE) fell 9% to pb losses among majors, with Solana's SOL, XRP, and BNB Chain's BNB dropping betwixt 3-7%.

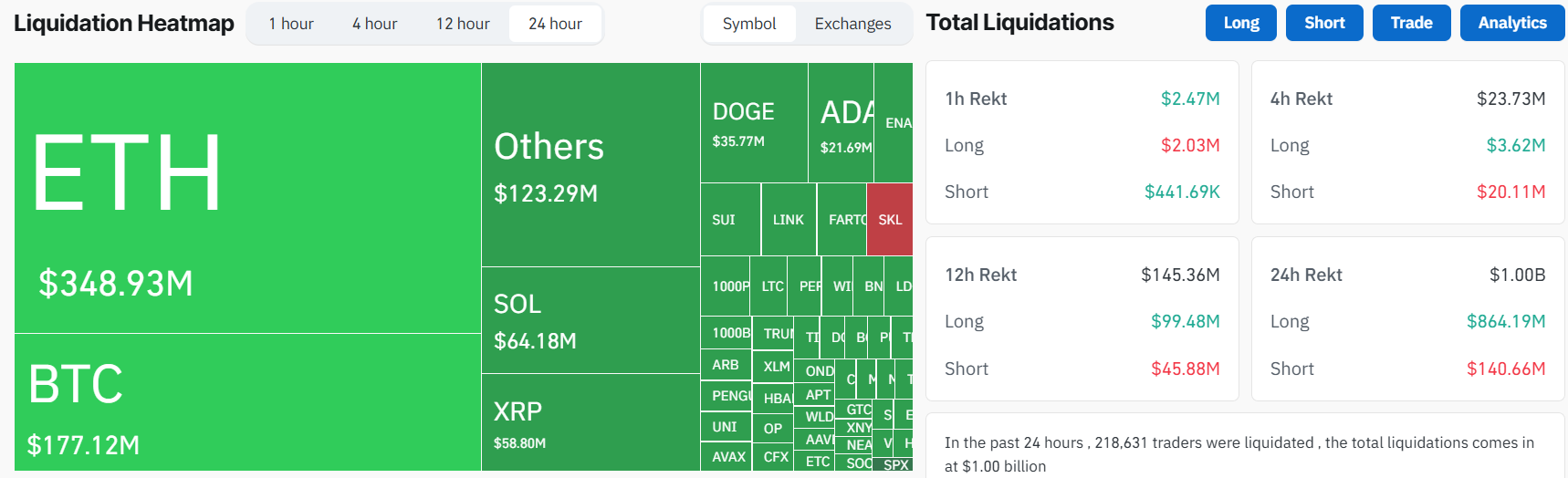

Liquidation information shows $866 cardinal successful agelong positions were erased — much than six times the $140 cardinal successful shorts — arsenic prices reversed sharply from caller highs.

Ether traders took the biggest hit, with $348.9 cardinal liquidated, followed by Bitcoin astatine $177.1 million. Solana, XRP, and Dogecoin saw $64.2 million, $58.8 million, and $35.8 cardinal successful liquidations, respectively.

Bybit accounted for the largest stock of the wipeout, astatine $421.9 million, with much than 92% of those losses stemming from overleveraged agelong positions. Binance followed with $249.9 cardinal successful liquidations, portion OKX saw $125.1 million.

The largest azygous liquidation was an ETH-USDT perpetual swap worthy $6.25 cardinal connected OKX.

Jeff Mei, COO astatine BTSE, said the ostentation astonishment “put the brakes connected an unthinkable crypto rally this past week,” adding that markets are apt to “hover astir their existent levels until much affirmative guidance comes from the Fed.” He noted the ongoing “threat of ostentation continues to persist and could interaction the likelihood of complaint cuts successful September.”

Nick Ruck, manager astatine LVRG Research, pointed to the broader macro unit connected crypto’s caller gains.

“This week successful crypto saw BTC reaching a caller all-time precocious but aboriginal impacted by macroeconomic tremors,” helium said successful a Telegram message. “Inflation surged overmuch higher than expected, reinforcing fears of sticky ostentation and delaying Fed rate-cut expectations."

"The sell-off underscores crypto’s increasing sensitivity to macro liquidity shifts, with traders present eyeing labour metrics successful aboriginal September for clues connected the Fed’s adjacent move. We’re optimistic that the marketplace volition rebound arsenic the cardinal values of crypto driving the bull tally stay successful place," Ruck added.

Traders are present watching U.S. economical information releases and Fed commentary closely, with September shaping up arsenic the adjacent large inflection constituent for monetary policy.

2 months ago

2 months ago

English (US)

English (US)