(All times ET unless indicated otherwise)

By Omkar Godbole

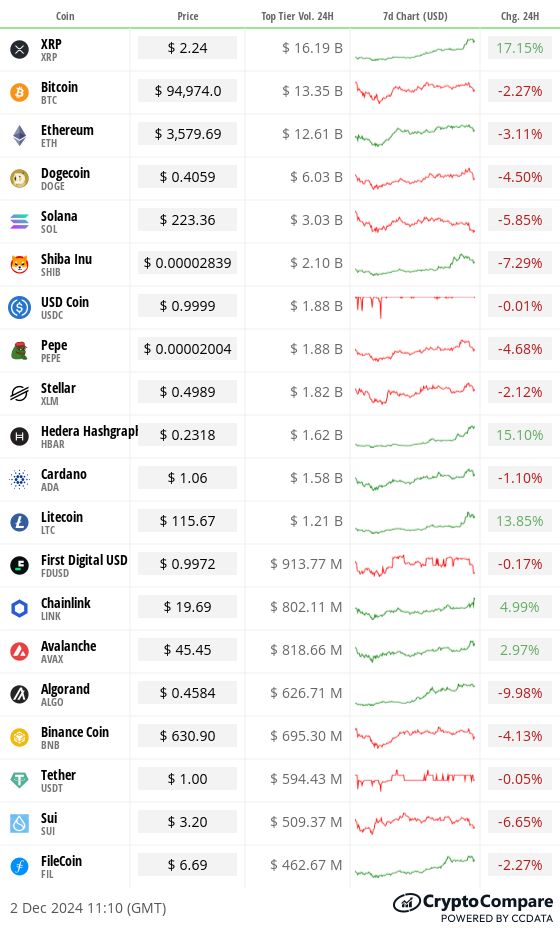

Bitcoin is starting the week connected a despondent note, trading 2% little astatine $95,000 amid risk-off sentiment successful accepted markets. European stocks are falling and the euro is diving against the dollar arsenic interest the French authorities is connected the verge of illness pushes its enslaved yields to levels matching those of debt-ridden Greece.

BTC's diminution follows a failed effort to interruption done the multimillion-dollar <a href="https://www.coindesk.com/markets/2024/12/02/xrp-replaces-tether-as-3rd-largest-cryptocurrency-while-btc-faces-384-m-sell-wall" target="_blank">wall of merchantability orders</a> adjacent $100,000 implicit the play and MicroStrategy's Michael Saylor's bitcoin <a href="https://x.com/saylor/status/1863323760511627565" target="_blank">presentation</a> to Microsoft.

Still, bulls shouldn't suffer anticipation conscionable yet, due to the fact that the proviso scarcity is real, with astir 75% of bitcoin classified arsenic illiquid and little than 14% successful centralized exchanges, according to Andre Dragosch of Bitwise.

There's chatter astir countries adopting BTC arsenic a strategical reserve, with a Middle Eastern federation perchance unveiling thing large astatine the Abu Dhabi Finance Week that runs Dec. 9-12. The sound could get louder arsenic the lawsuit draws close.

Ether's method investigation is <a href="https://www.coindesk.com/markets/2024/12/02/ethers-price-chart-now-mirrors-a-pattern-that-foretold-bitcoins-record-rally" target="_blank">particularly bullish</a>, reminiscent of BTC's positioning successful mid-October, which was signaling a monolithic rally adjacent earlier the U.S. elected crypto-friendly Donald Trump arsenic president.

Market flows are connected the aforesaid page. On Friday, nett inflows into 9 ether ETFs listed successful the U.S. deed astir $333 million. That's adjacent much than the BTC funds' $320 million. Talk astir the alteration successful marketplace leadership. In addition, ETH whales person snapped up ETH worthy $5.7 cardinal successful 20 days, according to IntoTheBlock.

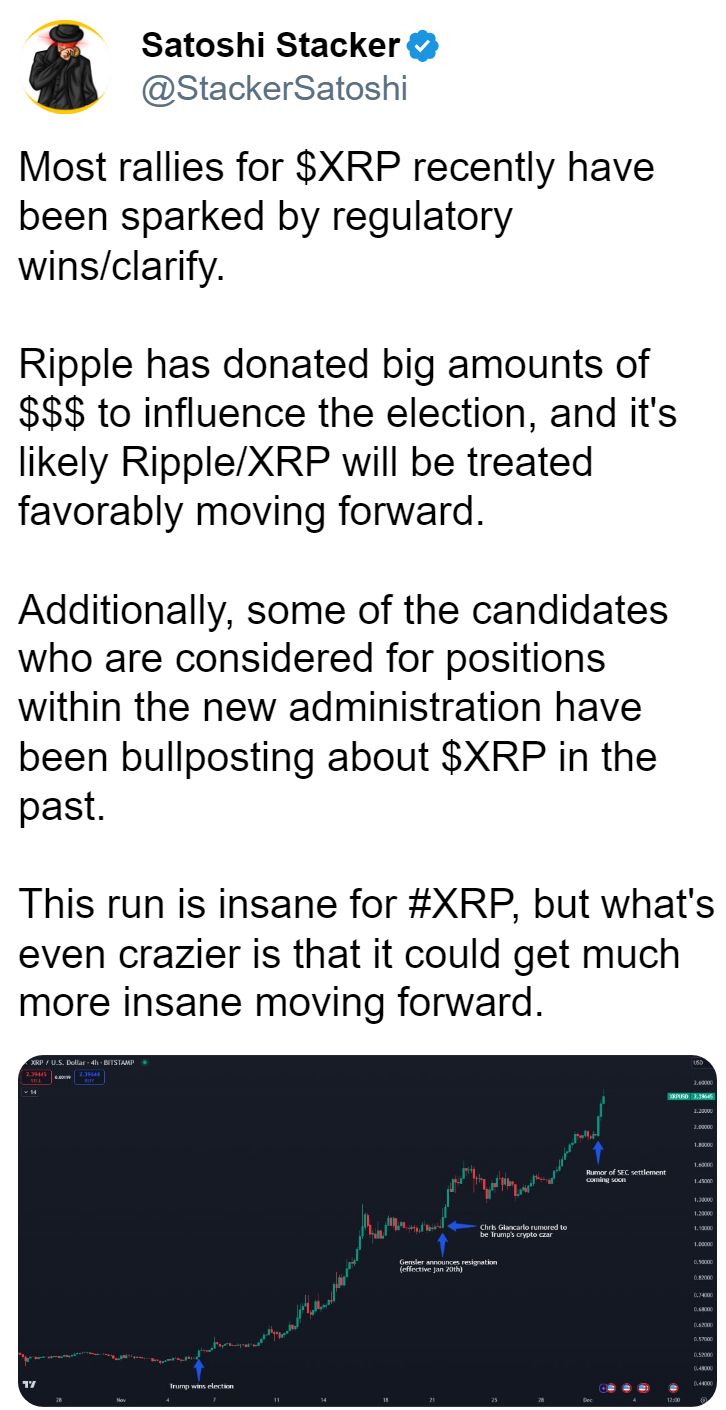

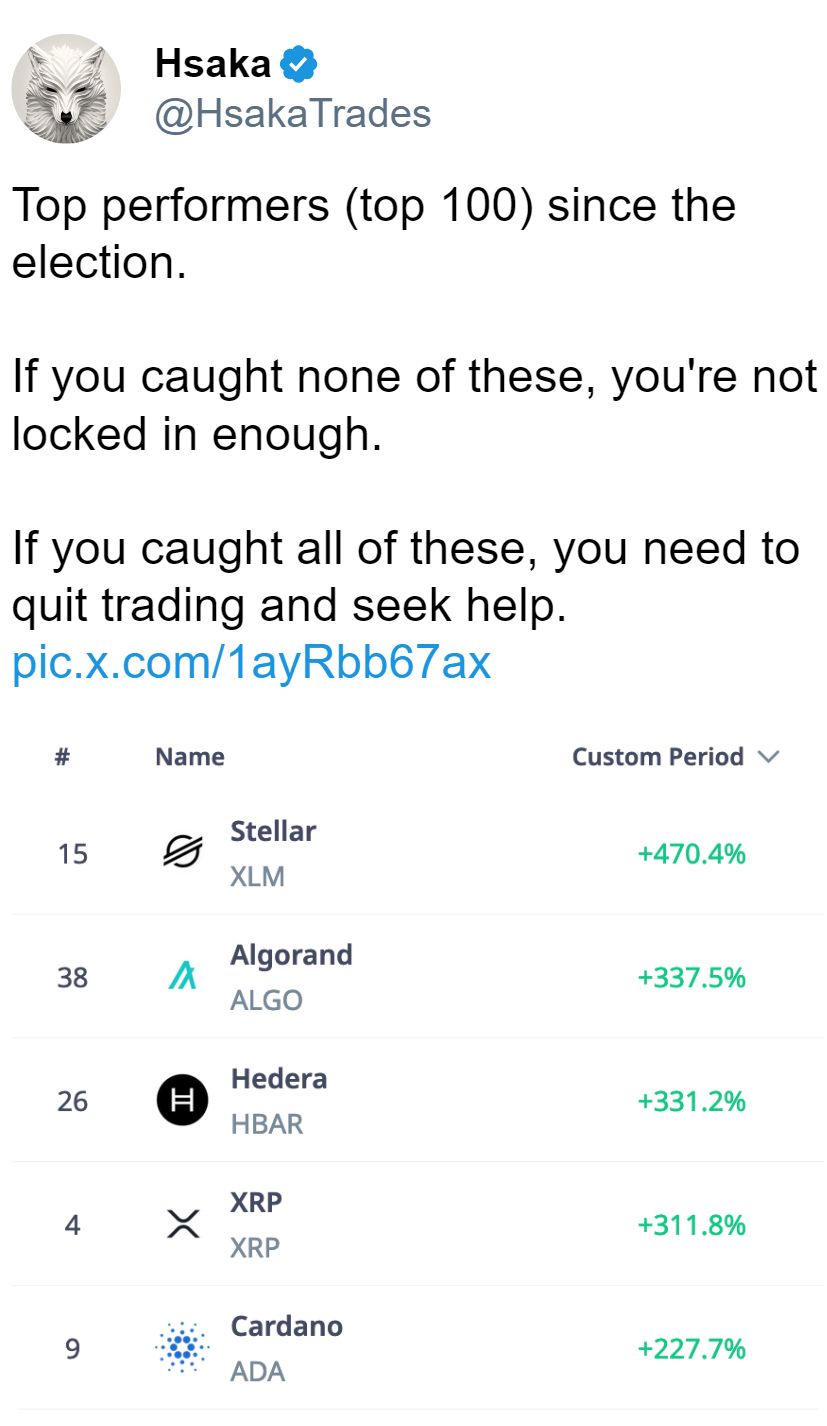

Meanwhile, XRP has surged implicit 27% successful conscionable 24 hours, making it the third-largest cryptocurrency by marketplace worth and pushing Tether's USDT to 4th place. The rally was accompanied by grounds volumes successful South Korea, indicating beardown retail participation. While a surge of 350% successful 4 weeks whitethorn look overstretched, that's not needfully the case. XRP's marketplace value-to-realized worth (MVRV) ratio, a fashionable metric modeled alongside the price-to-book ratio successful equities and tracked by Santiment, has bounced lone to its beingness average, meaning prices request to emergence much earlier we tin commencement talking astir overvaluation.

On the macro front, this week's absorption is the U.S. ISM non-manufacturing PMI connected Wednesday, on with Friday's payrolls and mean hourly net report. If the employment constituent and wage maturation transcend expectations, the dollar could get a assistance portion trimming Fed rate-cut bets. Additionally, there's speech of much easing from China, though the interaction of earlier measures has been downplayed. Stay alert!

What to Watch

Crypto:

Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

Macro

Dec. 2, 3:15 p.m.: Fed politician Christopher J. Waller gives a <a href="https://watch.civl.com/programs/live-from-dc-christopher-waller-federal-reserve" target="_blank">speech</a> ("Economic Outlook") astatine the American Institute for Economic Research (AIER) Monetary Conference, successful Washington, D.C.

Dec. 4, 4:00 a.m.: The Organisation for Economic Co-operation and Development (OECD) is acceptable to merchandise its latest <a href="https://www.oecd.org/en/topics/economic-outlook.html" target="_blank">Economic Outlook</a>. Secretary-General Mathias Cormann and Chief Economist Álvaro Pereira contiguous the findings during an <a href="https://oecdtv.webtv-solution.com/82fd95cba31bb793658607a114db81ac/or/hybrid_launch_of_the_oecd_economic_outlook_2024.html" target="_blank">event disposable online</a>.

Dec. 4, 10:00 a.m.: The Institute for Supply Management (ISM) <a href="https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/" target="_blank">releases</a> its Services Purchasing Managers Index (PMI) for November. Est. 55.5 vs Prev. 56.0.

Dec. 4, 1:45 p.m.: Fed Chair Jerome H. Powell takes portion successful a moderated treatment astatine <a href="https://www.nytimes.com/events/dealbook" target="_blank">The New York Times DealBook Summit</a> successful New York City.

Dec. 4, 2:00 p.m.: The Fed <a href="https://www.federalreserve.gov/monetarypolicy/publications/beige-book-default.htm" target="_blank">releases</a> the Beige Book, an economical summary utilized up of FOMC meetings.

Dec. 6, 8:30 a.m.: The U.S. Bureau of Labor Statistics <a href="https://www.bls.gov/news.release/empsit.toc.htm" target="_blank">releases</a> the October Employment Report.

Nonfarm Payrolls (NFP) Prev. 12K.

Unemployment Rate Prev. 4.1%.

Token Events

Token unlocks

Ethena (ENA) to unlock 0.44% of circulating proviso worthy $10.75 cardinal connected Dec. 3.

Cardano (ADA) to unlock 0.05% of circulating proviso worthy $20.18 cardinal connected Dec .4.

Jito (JTO) to unlock 102.7% of circulating proviso worthy $464.1 cardinal connected Dec. 7.

Governance votes

SafeDAO opened preliminary discussions connected allocating $50,000 toward creating a modular treasury absorption system. The treatment opened connected Dec. 1.

Arbitrum is voting connected allocating $20,000 to probe idiosyncratic behaviour and consequent improvement direction. The ballot closes Dec. 5.

Conferences:

Dec. 2: <a href="https://ethvenice.com/" target="_blank">ETHVenice 2024</a> (Venice)

Dec. 2 - 3: <a href="https://digiassetsconnect.wbresearch.com/" target="_blank">DigiAssets Connect 2024</a> (Geneva)

Dec. 2 - 3: <a href="https://digitaltransformationkuwait.com/" target="_blank">Digital Transformation Kuwait Conference 2024</a> (Kuwait)

Dec. 2 - 6: <a href="https://tcc.iacr.org/2024/" target="_blank">Theory of Cryptography Conference 2024</a> (Milan)

Dec. 3 - 4: FT’s <a href="https://banking.live.ft.com/" target="_blank">Global Banking Summit</a> (London)

Token Talk

By Oliver Knight

HyperLiquid’s autochthonal token, HYPE, deed the marketplace past week to go 1 of the astir profitable airdrops of the year. It tripled successful terms implicit the play aft debuting astatine a $1 cardinal marketplace cap. The token is present trading astatine $8.57 aft touching a grounds precocious of $9.79.

Unlike galore different generic autochthonal tokens that connection inferior done governance votes, HYPE tin beryllium staked to unafraid HyperBFT, the proof-of-stake statement algorithm that powers the HyperLiquid exchange. It is besides being utilized arsenic the superior token for paying transaction fees connected the network.

True to its ticker, the token garnered notable attraction among crypto enthusiasts connected X (the alleged Crypto Twitter community) with astir each of the well-known influencers mentioning, recommending and occasionally scrutinizing it.

The bull lawsuit for HYPE is successful the tokenomics due to the fact that proviso is skewed toward the assemblage arsenic opposed to task capitalists and aboriginal investors. As a result, it is trading much similar a meme coin with a viral pursuing without the hazard of proviso suppression by anyone who bought successful a backing circular astatine a cheaper price.

Quant trader Flood, who goes nether the X relationship <a href="https://x.com/ThinkingUSD/status/1862428808084648232" target="_blank">@ThinkingUSD</a>, wrote that they were “adding huge” nether $4 connected the time of release. Since past trading terminal Insilico <a href="https://x.com/InsilicoTrading/status/1862967518798729443" target="_blank">announced</a> it was strategically accumulating a HYPE reserve, allocating 25% of play revenue.

Derivatives Positioning

The three-month ground successful BTC and ETH futures connected offshore exchanges has softened from play highs, suggesting a moderation successful bullish sentiment.

Perpetual backing rates crossed the broader marketplace are normalizing, which could pave the mode for a much sustained terms rally.

In the options market, calls for BTC and ETH are inactive trading astatine a premium to puts. However, ETH calls are much costly than BTC calls, indicating bullish expectations for ether comparative to bitcoin.

IBIT and MSTR's precocious implied volatility has sparked involvement successful covered telephone strategies.

Market Movements:

BTC is down 2.6% from 4 p.m. ET Friday to $94,939.66 (24hrs: -2%)

ETH is down 0.5% astatine $3,579.86 (24hrs: -3%)

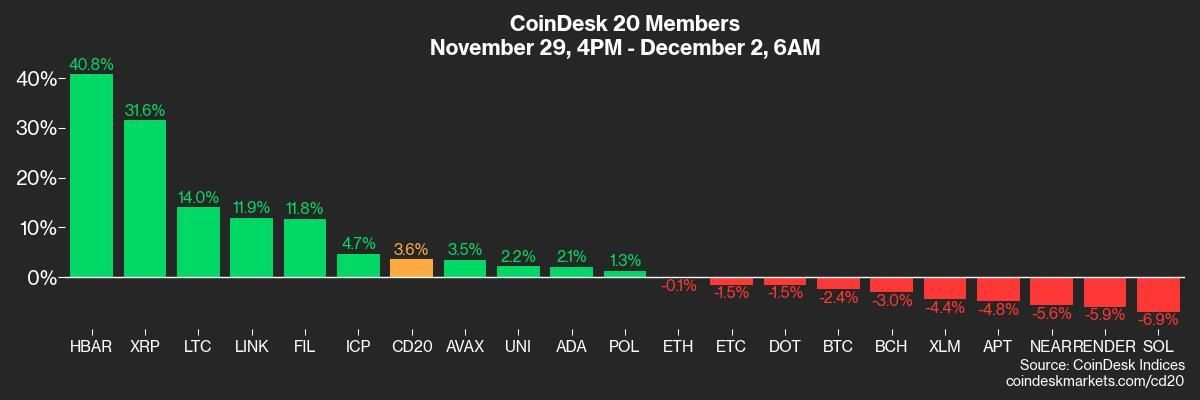

CoinDesk 20 is up 3.6% to 3,641.28 (24hrs: 6+2.13%)

Ether staking output is unchanged astatine 3.07%

BTC backing complaint is astatine 0.017% (18.8% annualized) connected Binance

DXY is up 0.4% astatine 106.2

Gold is down 0.6% astatine $2,635.20/oz

Silver is up 1.2% to $30.26/oz

Nikkei 225 closed +0.8% astatine 38,513.02

Hang Seng closed 0.65% astatine 19,550.29

FTSE is up 0.14% astatine 8,273.78

Euro Stoxx 50 is 0.20% astatine 4,813.85

DJIA closed connected Friday +0.42% to 44,910.65

S&P 500 closed +0.56% astatine 6,032.38

Nasdaq closed +0.83% astatine 19,218.17

S&P/TSX Composite Index closed +0.41% 25,648

S&P 40 Latin America closed -1.58% astatine 2,328.18

U.S. 10-year Treasury was unchanged astatine 4.2%

E-mini S&P 500 futures are down 0.2% to 6039.50

E-mini Nasdaq-100 futures are down 0.21% to 20949

E-mini Dow Jones Industrial Average Index futures are down 0.12% astatine 44999

Bitcoin Stats:

BTC Dominance: 56.78% (-0.04%)

Ethereum to bitcoin ratio: 0.0379 (-0.37%)

Hashrate (seven-day moving average): 744 EH/s

Hashprice (spot): $62.14

Total Fees: 20.1 BTC/ $1.9 million

CME Futures Open Interest: 181,105 BTC

BTC priced successful gold: 36.2 oz

BTC vs golden marketplace cap: 10.32%

Bitcoin sitting successful over-the-counter table balances: 421,809

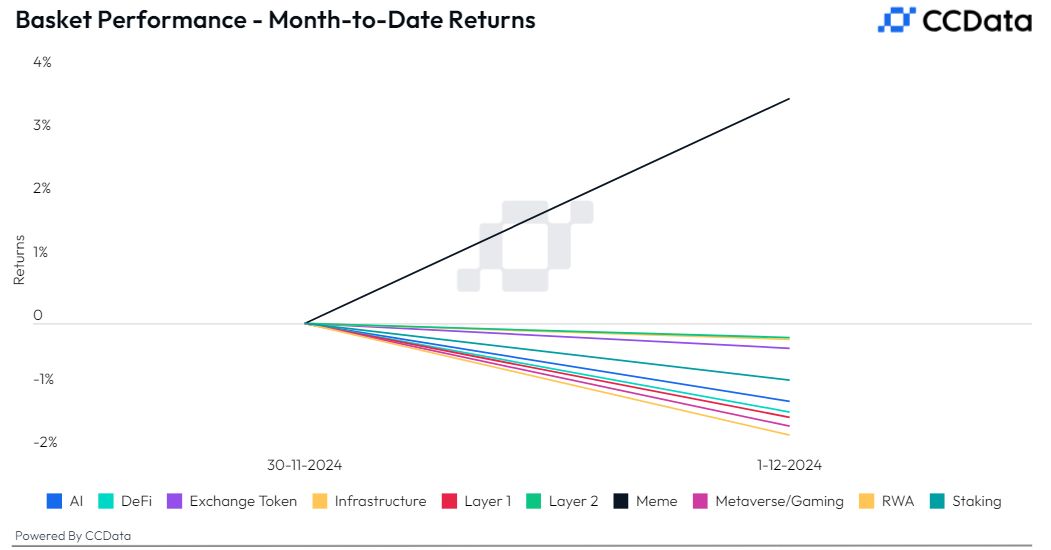

Basket Performance

Technical Analysis

BTC's dominance complaint has slipped beneath an ascending trendline that tracks its year-to-date rise. The breakdown points to a continued capitalist penchant for altcoins implicit bitcoin.

TradFi Assets

MicroStrategy (MSTR): closed connected Friday astatine $387.47 (-0.35%), down 2.17 % astatine $379.05 successful pre-market.

Coinbase Global (COIN): closed astatine $296.20 (-4.75%), up 0.22% astatine $296.84 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$25.61 (+1.83%)

MARA Holdings (MARA): closed astatine $27.42 (+1.86%), down 1.42% astatine $27.03 successful pre-market.

Riot Platforms (RIOT): closed astatine $12.65 (+2.26%), down 1.03% astatine $12.52 successful pre-market.

Core Scientific (CORZ): closed astatine $17.88 (+0.96%), down 1.17% astatine $17.67 successful pre-market.

CleanSpark (CLSK): closed astatine $14.35 (+3.54%), up 0.14% astatine $14.37 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $29.14 (+4.18%).

Semler Scientific (SMLR): closed astatine $57.02 (-6.6%), up 0.63% astatine $57.38 successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett inflow: $320 million

Cumulative nett inflows: $30.67 billion

Total BTC holdings ~ 1.076 million.

Spot ETH ETFs

Daily nett inflow: $332.9 million

Cumulative nett inflows: $576.8 million

Total ETH holdings ~ 3.047 million.

Source:<a href="https://farside.co.uk/" target="_blank"> Farside Investors</a>

Overnight Flows

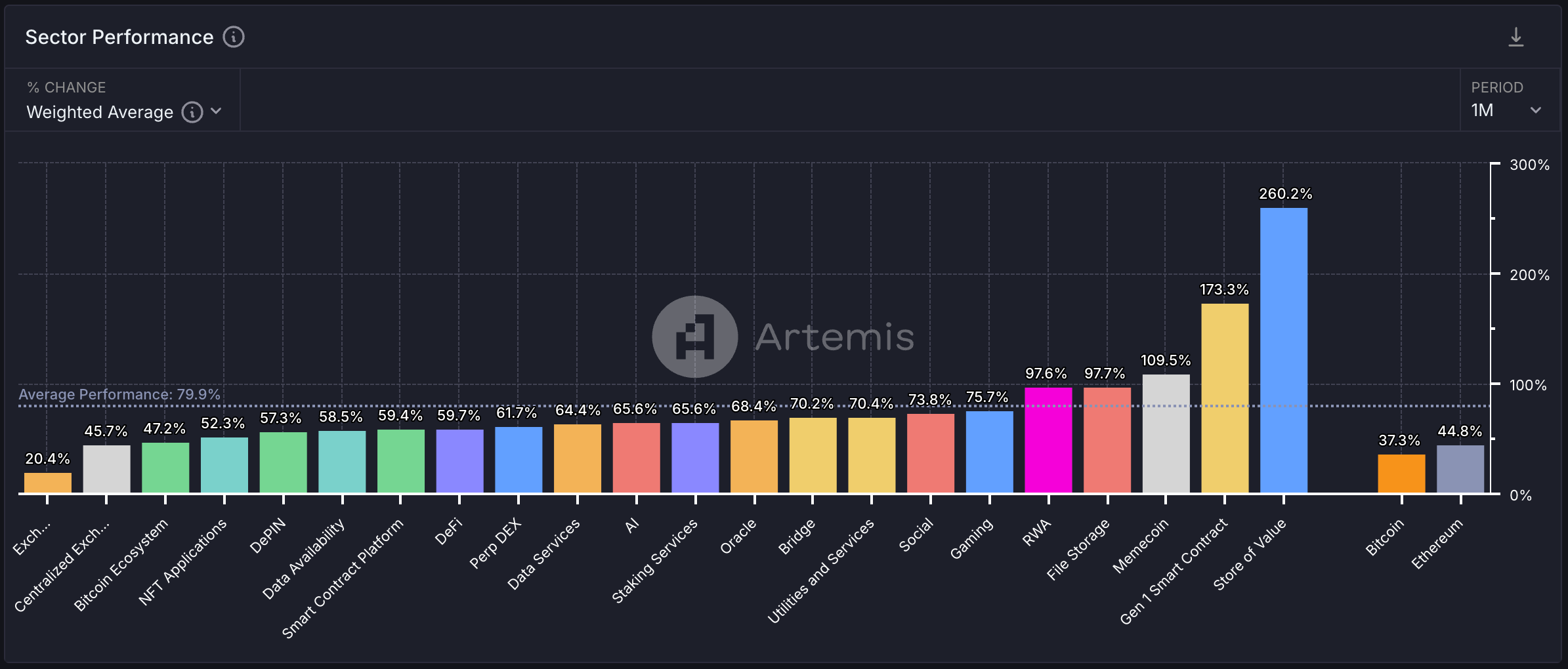

Chart of the Day

The illustration shows the 30-day alteration successful the afloat diluted marketplace capitalizations of tokens grouped by category.

The store-of-value sector, comprising cryptocurrencies with BTC-like appeal, has seen an industry-beating 262% surge successful 4 weeks.

DeFi, meanwhile, has enactment successful a below-average performance.

While You Were Sleeping

<a href="https://www.coindesk.com/markets/2024/12/02/xrp-replaces-tether-as-3rd-largest-cryptocurrency-while-btc-faces-384-m-sell-wall" target="_blank">XRP Replaces Tether arsenic 3rd-Largest Cryptocurrency While BTC Faces $384M Sell Wall</a> (CoinDesk): XRP has surged 375% successful 30 days to $2.40, becoming the third-largest cryptocurrency by marketplace cap. TikTok trends, speculation connected a Ripple stablecoin and ETF hopes are fueling interest. Bitcoin, meantime, faces absorption adjacent $100,000, with a $384 cardinal partition of merchantability orders.

<a href="https://www.coindesk.com/markets/2024/12/02/ethers-price-chart-now-mirrors-a-pattern-that-foretold-bitcoins-record-rally" target="_blank">Ether's Price Chart Now Mirrors a Pattern That Foretold Bitcoin's Record Rally</a> (CoinDesk): Ethereum's terms illustration shows a bullish breakout, ending an eight-month corrective inclination and resuming its October 2023 uptrend from $1,500. Similar to Bitcoin's October rally, it whitethorn trigger cascading gains. Supporting this are rising web enactment and $332.9 cardinal successful nett inflows to U.S. spot ether ETFs past Friday.

<a href="https://www.coindesk.com/markets/2024/12/01/ethereum-etfs-see-record-333-m-inflows-outpacing-bitcoin-funds-as-catch-up-trade-gains-momentum" target="_blank">Ethereum ETFs See Record $333M Inflows, Outpacing Bitcoin Funds arsenic Catch-Up Trade Gains Momentum</a> (CoinDesk): Ethereum ETFs successful the U.S. saw grounds inflows Friday, totaling $332.9 million, led by BlackRock and Fidelity funds. Last week, ether outpaced bitcoin successful ETF flows and terms gains, hitting $3,700. Analysts property the resurgence to improving DeFi sentiment, anticipation of regulatory clarity and imaginable bottoming successful the ETH-BTC ratio aft 3 years.

<a href="https://www.bloomberg.com/news/articles/2024-12-01/the-establishment-takeover-of-bitcoin-creates-new-list-of-risks" target="_blank">Establishment’s Takeover of Bitcoin Creates a New List of Risks</a> (Bloomberg): Spot bitcoin ETFs clasp implicit 1 cardinal tokens, oregon 5% of the supply, rivaling Satoshi Nakamoto's stash. Rising organization demand, imaginable U.S. authorities stockpiles and proviso constraints substance terms forecasts of precocious arsenic $1 cardinal per BTC. However, concentrated ownership and argumentation risks could make marketplace vulnerabilities contempt ongoing terms surges.

<a href="https://www.ft.com/content/68814d56-794f-4dc5-85a6-8631ab95b62f" target="_blank">Yen Strengthens Past 150 per Dollar connected BoJ Rate Rise Expectations</a> (Financial Times): The yen has strengthened past 150 per dollar aft stronger Tokyo ostentation information fueled speculation of a December Bank of Japan interest-rate increase. Core CPI roseate 2.2% year-on-year, driven by higher atom costs. Despite caller yen declines and $100 cardinal successful interventions, a accelerated yen appreciation could deter the slope from raising rates.

<a href="https://www.themoscowtimes.com/2024/11/29/russias-central-bank-acknowledges-short-term-impact-on-ruble-exchange-rate-a87177" target="_blank">Russia’s Central Bank Acknowledges ‘Short-Term’ Impact connected Ruble Exchange Rate</a> (The Moscow Times): On Friday, Russia’s Central Bank attributed the ruble’s driblet to U.S. sanctions connected Gazprombank portion expressing assurance successful its ain actions, including halting overseas currency purchases and maintaining a 21% involvement rate. Friday’s authoritative complaint was 109.57 per dollar and 116.14 per euro, with officials optimistic astir currency stabilization.

In the Ether

11 months ago

11 months ago

English (US)

English (US)