Bitcoin's (BTC) terms rally whitethorn person stalled lately, but bullish condemnation surely hasn't, arsenic whales proceed to stake millions connected an extended marketplace rally.

Recently, 1 specified whale executed a important bullish options play targeting $200,000 by the year's end. The strategy progressive the simultaneous acquisition of 3,500 contracts of the Deribit-listed $140,000 December telephone enactment and the abbreviated merchantability (or writing) of 3,500 contracts of the $200,000 December telephone option.

This analyzable trade, a bull telephone spread, resulted successful an archetypal nett debit of $23.7 million. As Deribit Insights noted, "The Dec 140-200k Call dispersed dominates, buying debased Dec 140k IV, funded by higher IV 200k Calls."

The strategy volition execute maximum nett if BTC settles astatine oregon supra the higher onslaught price, $200,000 successful this case, by the expiration date.

This strategy generates a nett debit due to the fact that the premium paid for the little onslaught telephone enactment (the purchase) exceeds the premium received from selling the higher onslaught call. The dispersed offers constricted gains for a constricted risk, capping upside astatine $200,000 portion ensuring the maximum imaginable nonaccomplishment is contained to the archetypal debit.

Options are derivatives utilized for speculation oregon hedging against terms movements. A telephone enactment gives the purchaser the right, but not the obligation, to bargain the underlying plus astatine a predetermined terms connected oregon earlier a specified aboriginal date. A telephone purchaser is implicitly bullish connected the market, portion a enactment purchaser is bearish.

Bitcoin's spot terms reached a grounds precocious of implicit $123,000 connected July 14 and has since consolidated successful a constrictive scope betwixt $116,000 and $120,000.

Record options activity

BTC's terms rally and increasing organization involvement successful structured products, which impact volatility selling, person boosted enactment successful the options market.

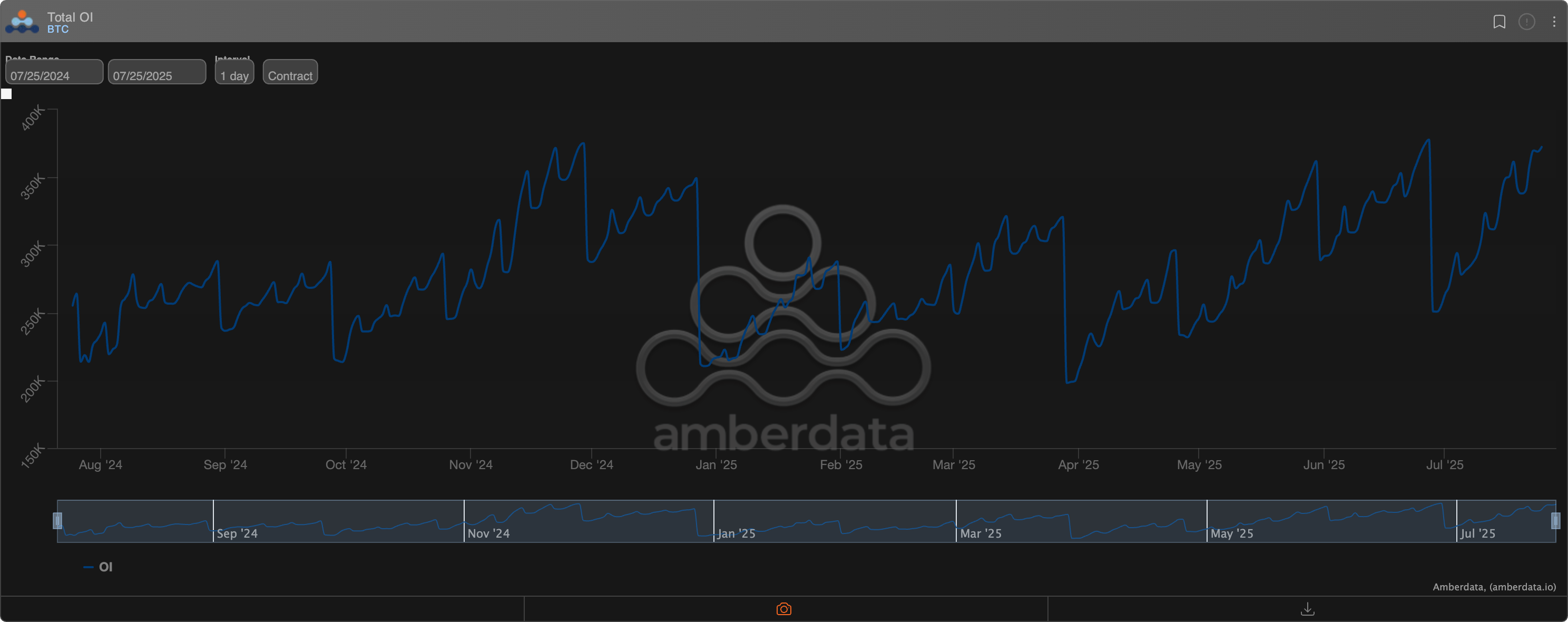

On Deribit, which accounts for implicit 80% of the planetary options activity, the BTC options unfastened interest, oregon the fig of unfastened options contracts, was 372,490 BTC arsenic of penning – conscionable shy of the grounds precocious of 377,892 acceptable successful June.

Meanwhile, unfastened involvement successful ether options has deed a grounds precocious of 2,851,577 ETH, according to information root Amberdata. On Deribit, 1 options declaration represents 1 BTC oregon ETH.

22 hours ago

22 hours ago

English (US)

English (US)